Market Volatility Persists as Investors Anticipate Fed Rate Decision

Market volatility persists as s investors anticipate feds rate decision – Market volatility persists as investors anticipate the Fed’s rate decision, a pivotal moment that could shape the course of the markets for months to come. The current economic landscape is a complex tapestry woven with threads of inflation, geopolitical tensions, and shifting investor sentiment.

The Fed’s actions will undoubtedly have a profound impact on asset classes, influencing everything from stock prices to bond yields.

The upcoming rate decision is a focal point for investors, as they grapple with the potential implications for their portfolios. The Fed’s communication and its ability to navigate the delicate balance between controlling inflation and supporting economic growth will be closely scrutinized.

Current Market Conditions

The current market landscape is characterized by heightened volatility, driven by a complex interplay of economic, geopolitical, and investor sentiment factors. Recent trends indicate a fragile market, with significant fluctuations in asset prices and investor anxieties.

Factors Contributing to Market Volatility

Several factors contribute to the current market volatility, creating a dynamic and uncertain environment for investors. These include:

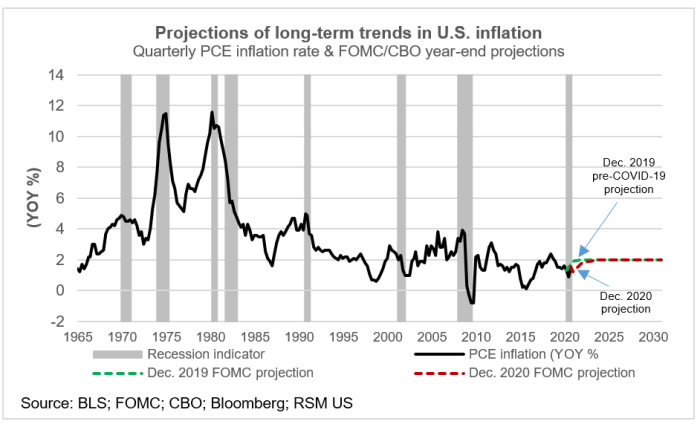

- Economic Data:Fluctuations in key economic indicators, such as inflation, unemployment, and interest rates, impact investor confidence and market sentiment. For instance, recent data showing persistent inflation has fueled concerns about aggressive monetary tightening by central banks, potentially leading to slower economic growth.

- Geopolitical Events:Geopolitical tensions, such as the ongoing conflict in Ukraine and escalating trade disputes, introduce uncertainty and risk aversion in the market. These events can disrupt global supply chains, impact energy prices, and trigger volatility in financial markets.

- Investor Sentiment:Investor sentiment plays a crucial role in driving market trends. Fear and uncertainty can lead to sell-offs, while optimism and confidence can fuel rallies. Recent market volatility reflects a combination of both bearish and bullish sentiment, as investors grapple with conflicting economic signals and geopolitical risks.

Impact of Rising Inflation

Rising inflation has emerged as a significant factor influencing market behavior. The erosion of purchasing power and the prospect of higher interest rates have led to concerns about economic growth and corporate profitability. Investors are closely monitoring inflation data and central bank policy announcements, as these factors can significantly impact asset valuations and market performance.

The market’s been a roller coaster lately, with everyone glued to their screens waiting for the Fed’s rate decision. It’s a reminder that while we can’t control external factors, we can control our own financial well-being. That’s why it’s crucial to prioritize balancing your finances and health , ensuring a solid foundation for weathering any market storm.

Ultimately, a strong financial position gives you the freedom to make informed decisions, regardless of what the Fed does.

For example, the recent surge in inflation has prompted the Federal Reserve to aggressively raise interest rates, leading to increased borrowing costs for businesses and consumers and potentially slowing economic growth.

Federal Reserve Rate Decision: Market Volatility Persists As S Investors Anticipate Feds Rate Decision

The Federal Reserve’s upcoming rate decision is a significant event for financial markets, with the potential to influence everything from interest rates and inflation to economic growth and investment strategies. Investors are keenly watching for clues about the Fed’s future path for monetary policy, which will likely shape the market’s direction in the coming months.

Anticipated Rate Hike and Its Implications, Market volatility persists as s investors anticipate feds rate decision

The Federal Open Market Committee (FOMC), the policymaking body of the Federal Reserve, is widely expected to raise interest rates by 25 basis points at its upcoming meeting. This move would continue the Fed’s gradual tightening of monetary policy, aimed at curbing inflation and bringing it back to its 2% target.

The size of the rate hike, however, is subject to debate, with some analysts predicting a larger 50 basis point increase depending on the latest economic data and inflation readings.A rate hike would likely have a mixed impact on different asset classes.

The market’s been a roller coaster lately, with investors holding their breath for the Fed’s next move. It’s a good time to consider long-term investments, like whether to go for a gas or electric vehicle. Check out this insightful article on gas vs electric vehicles which is a better deal know the experts suggestions to make a smart decision.

Ultimately, the Fed’s decision will likely have a ripple effect across all sectors, including the auto industry, so staying informed is key.

Higher interest rates tend to benefit bonds, as their fixed coupon payments become more attractive relative to riskier assets. However, rising interest rates can put downward pressure on equities, as they increase the cost of borrowing for businesses and reduce the present value of future earnings.

The impact on the real estate market is more complex, as higher mortgage rates could dampen demand, while strong economic growth could support prices.

Fed’s Communication and Its Influence on Investor Expectations

Beyond the actual rate decision, the Fed’s communication will be closely scrutinized by investors for insights into its future plans. The FOMC statement and Chair Jerome Powell’s press conference will be analyzed for clues about the Fed’s outlook for inflation, economic growth, and future rate hikes.Investors will be particularly interested in the Fed’s assessment of the “terminal rate,” the level at which it expects to stop raising rates.

This will provide a key indicator of the Fed’s commitment to controlling inflation and the potential for future rate cuts. The Fed’s communication can have a significant impact on investor expectations and market sentiment, influencing asset prices and investment decisions.

Investor Sentiment and Behavior

Investor sentiment is a crucial driver of market movements, especially during periods of heightened uncertainty like the current one. As investors grapple with the anticipation of the Fed’s rate decision, their sentiment is shaping market reactions, influencing asset prices, and dictating trading strategies.

Investor Sentiment and Market Reactions

The current market landscape is characterized by a mix of anxiety and anticipation. Investors are cautiously optimistic about the potential for economic growth, but concerns remain about inflation, geopolitical tensions, and the potential for a recession. The Fed’s decision on interest rates is seen as a pivotal event that could significantly impact investor sentiment and, consequently, market direction.

A hawkish stance by the Fed, signaling a larger-than-expected rate hike, could trigger a sell-off in risk assets, such as stocks and bonds, as investors become more risk-averse. Conversely, a dovish stance, suggesting a smaller rate hike or a pause in the tightening cycle, could lead to a rally in risk assets as investors become more optimistic about the economic outlook.

Investor Strategies

Different investor groups are adopting diverse strategies in response to the anticipated Fed decision:* Institutional Investors:These investors, including pension funds, mutual funds, and hedge funds, are generally more sophisticated and have access to vast resources and expertise. They tend to take a long-term perspective and are often more prepared to weather short-term market volatility.

They may adjust their portfolios based on their assessment of the Fed’s decision and its potential impact on their investment thesis.* Retail Investors:These investors, typically individuals who manage their own investments, often react more emotionally to market events. They may be more susceptible to herd behavior, driven by news headlines and social media chatter.

The market’s jittery dance continues as investors anxiously await the Fed’s rate decision, hoping for a sign of stability. Amidst the uncertainty, some see a beacon of optimism in the Tesla Cybertruck’s potential for mainstream success, comparable to the Model Y.

Whether this futuristic vehicle can truly weather the storm remains to be seen, but its potential impact on the market is undeniable.

During periods of uncertainty, retail investors might be more inclined to sell off assets, particularly if they perceive a heightened risk of losses.* Hedge Funds:These funds are known for their aggressive and often complex investment strategies. They may use leverage and derivatives to amplify returns or hedge against market risks.

Hedge funds often try to capitalize on market volatility by taking short positions in assets they expect to decline or by going long on assets they believe will rise.

Market Swings and Investor Expectations

The potential for market swings in the aftermath of the Fed’s announcement is significant. Investors’ expectations, often fueled by speculation and rumors, can create a self-fulfilling prophecy, leading to sharp price movements. If investors anticipate a hawkish Fed decision, they may sell off assets in advance, driving down prices.

Conversely, if they anticipate a dovish decision, they may buy assets in anticipation of a rally, pushing prices higher.The magnitude of these swings will depend on several factors, including the size of the Fed’s rate hike, the clarity of its communication, and the overall market sentiment.

The more unexpected or surprising the Fed’s decision, the more likely it is to trigger significant market volatility.

Potential Market Outcomes

The Federal Reserve’s rate decision will undoubtedly have a significant impact on market sentiment and asset prices. Investors are eagerly awaiting the Fed’s announcement, as it will provide crucial insights into the future direction of monetary policy and its implications for economic growth and inflation.

To understand the potential market outcomes, it’s essential to analyze different rate hike scenarios and their likely consequences.

Scenario Analysis of Potential Market Outcomes

The market’s reaction to the Fed’s rate decision will depend on several factors, including the magnitude of the rate hike, the Fed’s communication regarding future policy moves, and the overall economic backdrop. Here’s a scenario analysis outlining potential market outcomes based on different Fed rate decisions:

Scenario 1: Aggressive Rate Hike (75 bps or More)

An aggressive rate hike could signal the Fed’s determination to combat inflation, even at the risk of slowing economic growth. This scenario could lead to:

- Increased Volatility:The market could experience heightened volatility as investors adjust their positions in response to the aggressive stance. Equity markets might experience a sell-off, while safe-haven assets like bonds and gold could see an increase in demand.

- Higher Bond Yields:Bond yields are likely to rise as investors anticipate higher interest rates in the future. This could put pressure on companies with high debt levels and potentially slow down economic activity.

- Stronger Dollar:A stronger dollar could make US exports more expensive and impact multinational companies with significant overseas operations.

Scenario 2: Moderate Rate Hike (50 bps)

A moderate rate hike could be viewed as a balanced approach, reflecting the Fed’s commitment to controlling inflation while acknowledging the risks to economic growth. This scenario could lead to:

- Stable Markets:The market could react relatively calmly, as investors perceive the Fed’s actions as measured and appropriate. Equity markets might experience some short-term fluctuations but could ultimately trend upward.

- Gradual Rise in Bond Yields:Bond yields might rise gradually, reflecting the expectation of continued interest rate increases in the future.

- Neutral Dollar Impact:The dollar could remain relatively stable, as the market balances the potential for higher interest rates with concerns about economic growth.

Scenario 3: No Rate Hike or Smaller Rate Hike (25 bps)

A decision to hold rates steady or a smaller rate hike could be interpreted as a sign of the Fed’s willingness to prioritize economic growth over inflation control. This scenario could lead to:

- Market Rally:Equity markets could rally on the perception that the Fed is easing its hawkish stance. Investors might view this as a positive signal for economic growth and corporate earnings.

- Lower Bond Yields:Bond yields might decline as investors anticipate lower interest rates in the future. This could benefit companies with high debt levels and potentially boost economic activity.

- Weaker Dollar:A weaker dollar could make US exports more competitive and benefit multinational companies with significant overseas operations.

Key Factors Influencing Market Response

The market’s response to the Fed’s rate decision will be influenced by several key factors, including:

- Inflation Data:Recent inflation data will provide insights into the Fed’s assessment of the inflation outlook. Stronger-than-expected inflation data could lead to a more aggressive rate hike, while weaker data might suggest a more dovish stance.

- Economic Growth:The Fed’s decision will also be influenced by its assessment of economic growth. Concerns about a potential recession could lead to a more cautious approach to rate hikes.

- Job Market Conditions:The strength of the labor market will be a key factor in the Fed’s decision-making process. A strong job market could support a more aggressive rate hike, while signs of weakness might lead to a more cautious approach.

- Fed Communication:The Fed’s communication accompanying its rate decision will be closely scrutinized by investors. Clear and concise communication regarding future policy moves can help to reduce uncertainty and minimize market volatility.

Strategies for Navigating Volatility

The current market landscape, characterized by persistent volatility and the looming shadow of the Fed’s rate decision, demands a strategic approach from investors. Navigating this turbulent terrain requires a multi-pronged strategy that encompasses risk management, portfolio diversification, and proactive adjustments.

This section will delve into practical strategies that can help investors weather the storm and potentially capitalize on opportunities.

Risk Management

Risk management is paramount in volatile markets. It involves understanding and mitigating potential losses while pursuing growth opportunities.

- Define Your Risk Tolerance:The first step is to clearly define your risk tolerance. This involves understanding your financial goals, time horizon, and emotional capacity to withstand market fluctuations.

- Diversify Your Portfolio:Diversification is a cornerstone of risk management. Spreading your investments across different asset classes, sectors, and geographies helps reduce the impact of any single asset’s performance on your overall portfolio.

- Employ Stop-Loss Orders:Stop-loss orders can help limit potential losses by automatically selling an asset if it falls below a predetermined price. While not foolproof, they can provide a safety net during market downturns.

- Consider Hedging Strategies:Hedging involves using financial instruments to offset potential losses from adverse market movements. This can include options, futures, or other derivatives that can provide downside protection.

Asset Allocation Strategies

Asset allocation refers to the distribution of your investment portfolio across different asset classes. In a volatile market, adjusting your asset allocation can be crucial.

- Shift Towards More Conservative Assets:If you anticipate increased market volatility, you might consider shifting a portion of your portfolio towards more conservative assets like bonds or cash. This can provide stability and downside protection.

- Rebalance Regularly:Regular portfolio rebalancing ensures that your asset allocation aligns with your risk tolerance and investment goals. It involves selling overperforming assets and buying underperforming assets to maintain the desired balance.

- Explore Alternative Investments:Consider diversifying your portfolio beyond traditional stocks and bonds by exploring alternative investments like real estate, commodities, or private equity. These investments can offer diversification benefits and potentially outperform traditional assets in certain market conditions.

Portfolio Adjustments Based on Fed Decision

The Fed’s rate decision can have a significant impact on market sentiment and asset prices. Anticipating the Fed’s move and adjusting your portfolio accordingly can be beneficial.

- Rate Hike Scenario:If the Fed is expected to raise interest rates, consider shifting towards sectors that tend to perform well in a rising rate environment. This might include sectors like financials, energy, or healthcare.

- Rate Cut Scenario:If the Fed is expected to cut interest rates, consider increasing your exposure to sectors that benefit from lower interest rates, such as technology, consumer discretionary, or real estate.

- Stay Informed:Monitor economic data, market news, and Fed statements to stay informed about the potential direction of interest rates.