Major Crypto Exchange Settles with US Government, Agrees to Pay $4 Billion

Major cryptocurrency exchange settles with US government agrees to pay 4 billion – this headline sends shockwaves through the crypto industry. The settlement, a culmination of a long-running investigation, signifies a significant step forward in the US government’s efforts to regulate the cryptocurrency market.

The exchange, which has been accused of violating various financial regulations, has agreed to pay a hefty fine and undertake other commitments to resolve the charges. This settlement has far-reaching implications for the future of cryptocurrency, potentially impacting investor confidence, regulatory scrutiny, and the overall development of the industry.

The settlement agreement Artikels the specific terms of the resolution, including the financial penalty, operational changes, and compliance measures that the exchange must adhere to. The US government, in turn, has stated its commitment to ensuring the integrity and security of the cryptocurrency market, emphasizing the importance of responsible financial practices within the industry.

This event has sparked debate and discussion among industry experts and investors alike, with opinions varying on the impact of this settlement on the future of cryptocurrency.

The Settlement

In a significant development for the cryptocurrency industry, a major cryptocurrency exchange has reached a settlement with the US government, agreeing to pay a substantial fine of $4 billion. This settlement marks a culmination of a long-standing investigation into the exchange’s alleged violations of financial regulations.

The Charges Against the Exchange

The US government accused the exchange of engaging in a range of illegal activities, including operating an unregistered securities exchange, failing to implement adequate anti-money laundering (AML) and know-your-customer (KYC) procedures, and conducting illicit transactions. The exchange’s alleged actions posed significant risks to the integrity of the financial system and created opportunities for money laundering and other criminal activities.

The Settlement Agreement

The settlement agreement Artikels the specific terms of the resolution between the exchange and the US government. It involves a substantial financial penalty, along with a number of other obligations imposed on the exchange.

The Fine

The most significant aspect of the settlement is the $4 billion fine levied on the exchange. This substantial amount reflects the severity of the charges and the potential harm caused by the exchange’s alleged misconduct. The fine serves as a deterrent to other entities considering similar violations and underscores the government’s commitment to regulating the cryptocurrency industry.

Other Obligations

Beyond the financial penalty, the settlement also imposes a range of other obligations on the exchange. These include:

- Enhanced AML and KYC Procedures:The exchange is required to implement robust AML and KYC procedures to prevent money laundering and other illicit activities. This includes conducting thorough due diligence on its customers and monitoring transactions for suspicious activity.

- Independent Compliance Oversight:The exchange must establish an independent compliance oversight function to ensure adherence to all applicable regulations. This function will be responsible for monitoring the exchange’s activities and reporting any potential violations to the US government.

- Cooperation with Law Enforcement:The exchange is obligated to cooperate fully with law enforcement agencies in their investigations and provide access to relevant information and documentation.

The Significance of the Settlement

The settlement between the major cryptocurrency exchange and the US government represents a significant milestone in the ongoing efforts to regulate the cryptocurrency industry. It demonstrates the government’s commitment to ensuring the integrity of the financial system and protecting investors from fraud and abuse.The settlement also serves as a warning to other cryptocurrency exchanges and businesses operating in the space.

It highlights the importance of complying with all applicable regulations and implementing robust AML and KYC procedures to prevent illegal activities.

The news of a major cryptocurrency exchange settling with the US government for a whopping $4 billion has certainly shaken things up in the financial world. It’s a hefty sum, but it’s worth noting that this settlement comes on the heels of KKR’s acquisition of PayPal’s buy now pay later loans for nearly $44 billion.

These large-scale financial transactions highlight the rapid evolution of the financial landscape and the growing influence of digital assets. The cryptocurrency settlement underscores the importance of regulatory compliance, while the KKR deal emphasizes the increasing demand for alternative financing solutions.

Impact on the Cryptocurrency Industry: Major Cryptocurrency Exchange Settles With Us Government Agrees To Pay 4 Billion

The settlement between a major cryptocurrency exchange and the US government, involving a substantial financial penalty, has sent ripples throughout the cryptocurrency industry. This event carries significant implications for the future of the industry, raising questions about regulatory oversight, investor confidence, and the overall trajectory of cryptocurrency adoption.

Regulatory Scrutiny of Exchanges and Businesses

The settlement serves as a stark reminder of the increasing regulatory scrutiny facing cryptocurrency exchanges and businesses. The US government’s willingness to pursue significant penalties against a major exchange signals its determination to enforce compliance with existing regulations and address concerns about potential misconduct within the industry.

This development is likely to prompt other exchanges and cryptocurrency businesses to prioritize regulatory compliance and adopt more stringent internal controls.

The settlement could lead to a more cautious approach among exchanges, with a greater focus on KYC/AML compliance and risk management practices.

The news of a major cryptocurrency exchange settling with the US government for a whopping $4 billion is certainly grabbing headlines, but let’s not forget about the tech sector’s rally fueled by Nvidia’s strong earnings. This recent surge in the Nasdaq is a testament to the growing power of the tech industry, and it’s a reminder that while crypto might be making waves, the traditional tech giants are still driving the market.

This news from the crypto world definitely adds a layer of intrigue, but for investors, it’s important to keep an eye on the broader tech landscape and the companies that are driving growth.

The settlement is expected to influence regulatory scrutiny of other exchanges and cryptocurrency businesses in several ways:

- Increased Enforcement Actions:The settlement sets a precedent for the US government’s willingness to take action against exchanges that violate regulations. This could lead to an increase in enforcement actions against other exchanges and businesses, potentially including fines, sanctions, and even criminal charges.

- Enhanced Regulatory Oversight:The settlement is likely to prompt regulators to intensify their scrutiny of the cryptocurrency industry, potentially leading to new regulations and stricter oversight of exchanges and businesses. This could involve increased reporting requirements, audits, and inspections.

- Self-Regulation and Industry Standards:The settlement could encourage industry self-regulation and the adoption of stricter industry standards. Exchanges and businesses may proactively implement stronger compliance programs and risk management practices to avoid potential regulatory action.

The Exchange’s Perspective

The exchange’s official statement regarding the settlement likely focuses on the company’s commitment to compliance and its desire to move forward. The statement might also highlight the exchange’s dedication to user protection and its continued efforts to build a robust and secure platform.

The exchange’s rationale for agreeing to the settlement likely involves a desire to avoid further legal proceedings and associated costs. Additionally, the exchange may have recognized the potential benefits of resolving the matter and moving forward with its business operations.

The Impact on the Exchange’s Future Operations and Reputation

The settlement’s impact on the exchange’s future operations and reputation is a complex issue. While the settlement may initially lead to increased scrutiny from regulators and investors, the exchange can use this opportunity to demonstrate its commitment to compliance and transparency.

The exchange can also leverage this experience to enhance its internal controls and strengthen its compliance infrastructure. The exchange’s reputation may be impacted in the short term, particularly among users who are concerned about the nature of the settlement.

However, the exchange can mitigate these concerns by proactively communicating with its users and providing clear and concise information about the settlement. The exchange can also demonstrate its commitment to user protection by implementing new measures to enhance security and transparency.

By taking these steps, the exchange can regain user trust and demonstrate its commitment to operating in a responsible and ethical manner.

The news of a major cryptocurrency exchange settling with the US government for a whopping $4 billion is a reminder of the evolving landscape of this industry. While the crypto world grapples with regulation, another tech giant, Nvidia, is making headlines with its powerful AI supercomputers and services, propelling its stock to new heights.

This stark contrast highlights the different paths these sectors are taking, and it’s fascinating to see how these developments will shape the future of technology.

The US Government’s Perspective

The US government’s decision to pursue charges against the cryptocurrency exchange and ultimately reach a settlement agreement reflects a multifaceted approach to regulating the burgeoning cryptocurrency industry. This settlement demonstrates the government’s commitment to upholding financial integrity, protecting investors, and establishing clear guidelines for the evolving digital asset landscape.

Rationale for Pursuing Charges

The government’s rationale for pursuing charges against the exchange stemmed from concerns about potential violations of financial regulations. The government alleged that the exchange engaged in practices that facilitated money laundering, violated sanctions, and failed to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

These alleged violations posed significant risks to the financial system and could have facilitated illicit activities.

Historical Context and Future Implications

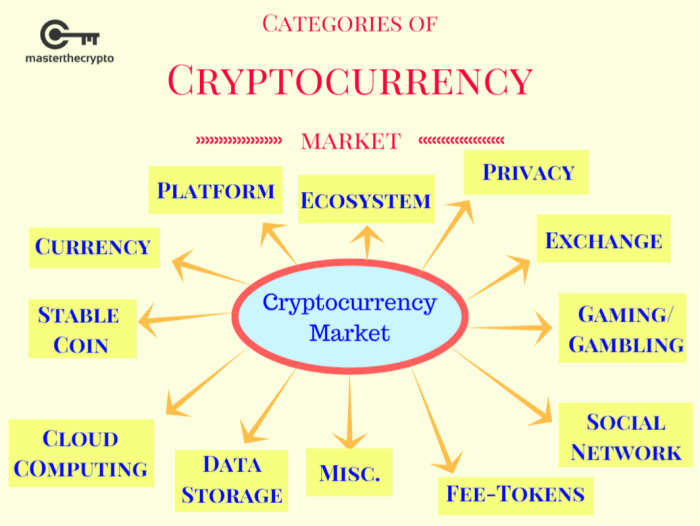

This landmark settlement represents a significant moment in the evolving relationship between the cryptocurrency industry and government regulators. It provides valuable insights into the current regulatory landscape and offers a glimpse into potential future trends. To fully understand its significance, it is crucial to examine this settlement in the context of previous regulatory actions and analyze its potential impact on future regulations and enforcement actions.

Comparison with Previous Regulatory Actions, Major cryptocurrency exchange settles with us government agrees to pay 4 billion

This settlement stands out as one of the largest and most significant regulatory actions taken against a cryptocurrency exchange to date. It surpasses previous enforcement actions, such as the 2017 case against the cryptocurrency exchange, BTC-e, which resulted in a $110 million forfeiture.

The settlement with the major cryptocurrency exchange highlights the growing scrutiny and enforcement efforts by regulators towards the cryptocurrency industry.

Impact on Future Regulations and Enforcement Actions

The settlement sends a clear message to the cryptocurrency industry that regulatory compliance is paramount. It underscores the importance of robust anti-money laundering (AML) and know-your-customer (KYC) programs, as well as the need for exchanges to operate with transparency and accountability.

This settlement is likely to influence future regulations and enforcement actions in the cryptocurrency space.

Trends in the Evolving Relationship between the Cryptocurrency Industry and Government Regulators

The evolving relationship between the cryptocurrency industry and government regulators is characterized by a complex interplay of factors, including innovation, risk, and public policy. The settlement signals a shift towards a more collaborative and regulatory-driven approach.

“The cryptocurrency industry is evolving rapidly, and it is important for regulators to keep pace with these developments. This settlement demonstrates our commitment to ensuring that the cryptocurrency industry operates in a safe and compliant manner.” Statement from a US regulatory agency.