Credit Rating Agencies: Fitch, Moodys, & S&P for Smart Investing

Know all about credit rating agencies a closer look at fitch moodys and s and p for smart investments – Credit Rating Agencies: Fitch, Moody’s, & S&P for Smart Investing sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with personal blog style and brimming with originality from the outset.

Navigating the complex world of finance can be daunting, but understanding the role of credit rating agencies is crucial for making smart investment decisions. These agencies, like Fitch, Moody’s, and S&P, act as gatekeepers, providing investors with vital insights into the creditworthiness of companies and governments.

Their assessments, expressed through letter grades, influence investor confidence, borrowing costs, and ultimately, the stability of the financial system.

Think of credit rating agencies as the financial detectives of the world. They meticulously analyze companies’ financial health, scrutinizing their debt levels, profitability, and overall risk profile. Their findings are distilled into credit ratings, which are used by investors to gauge the likelihood of a borrower defaulting on their debt obligations.

A high credit rating, like a glowing recommendation, signals a lower risk of default, often translating into lower interest rates for the borrower. Conversely, a low rating, like a cautionary flag, can lead to higher borrowing costs and even difficulty accessing capital.

Introduction to Credit Rating Agencies

Credit rating agencies play a crucial role in the financial market by providing independent assessments of the creditworthiness of borrowers, such as companies and governments. These assessments, known as credit ratings, are crucial for investors, lenders, and other market participants in making informed decisions about allocating capital and managing risk.Credit ratings are essentially opinions on the likelihood that a borrower will repay its debt obligations on time and in full.

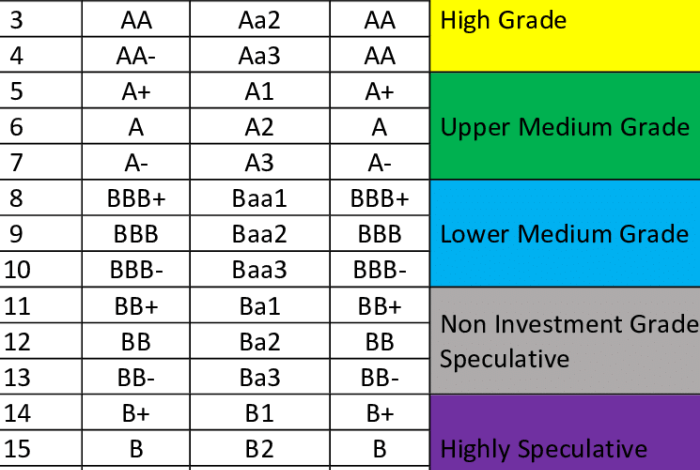

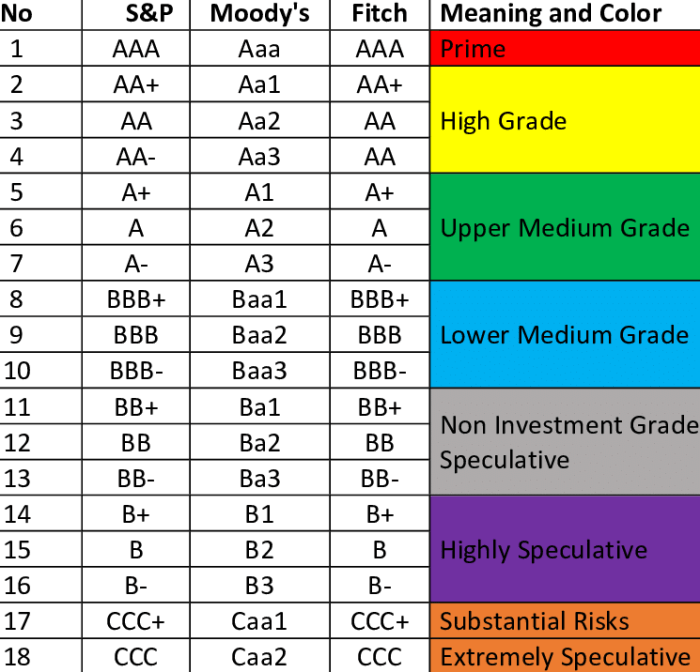

They are expressed using a standardized system of letter grades, with higher grades indicating a lower risk of default and lower grades indicating a higher risk.

Impact of Credit Ratings on Investor Decisions

Credit ratings directly influence investor decisions by providing a common language for assessing risk. Investors use these ratings to evaluate the relative creditworthiness of different borrowers, helping them make informed decisions about which investments to pursue. For example, a bond with a high credit rating is generally considered less risky than a bond with a low credit rating.

As a result, investors may be willing to accept a lower return on a high-rated bond, as they are confident in the borrower’s ability to repay. Conversely, investors may demand a higher return on a low-rated bond to compensate for the increased risk of default.

Understanding credit rating agencies like Fitch, Moody’s, and S&P is crucial for making smart investment decisions. These agencies play a vital role in assessing the creditworthiness of companies and governments, providing investors with valuable insights. However, the recent regulatory scrutiny of the cryptocurrency sector, exemplified by the SEC’s lawsuit against Coinbase , highlights the need for similar transparency and accountability in this rapidly evolving space.

As investors navigate the complex world of finance, understanding the role of both credit rating agencies and regulatory frameworks is essential for making informed choices.

Influence of Credit Ratings on Borrowing Costs

Credit ratings also have a significant impact on borrowing costs for companies and governments. Borrowers with higher credit ratings are typically able to secure loans at lower interest rates. This is because lenders perceive these borrowers as less risky and are therefore willing to accept a lower return on their investment.For example, a company with a high credit rating may be able to borrow money at an interest rate of 5%, while a company with a low credit rating may have to pay an interest rate of 10%.

This difference in interest rates can have a significant impact on the cost of borrowing for companies and can affect their profitability and overall financial health.

The higher the credit rating, the lower the interest rate a borrower can secure, reflecting a lower perceived risk.

A Closer Look at Fitch, Moody’s, and S&P

These three credit rating agencies, Fitch Ratings, Moody’s Investors Service, and Standard & Poor’s (S&P), are the most prominent and influential in the global financial market. They play a crucial role in assessing the creditworthiness of issuers, including governments, corporations, and financial institutions.

Brief History and Overview

- Fitch Ratings: Founded in 1913 as a bond rating agency, Fitch Ratings was acquired by the French media conglomerate Fimalac in 2000. Its key principles include objectivity, independence, and transparency in its rating process. Fitch Ratings uses a complex analytical framework to evaluate the creditworthiness of issuers, taking into account factors such as financial performance, leverage, and regulatory environment.

Understanding credit rating agencies like Fitch, Moody’s, and S&P is crucial for making informed investment decisions. These agencies play a vital role in assessing the creditworthiness of companies and governments, providing investors with valuable insights. While navigating the world of finance, it’s also important to stay abreast of significant developments in the tech world.

For instance, recent news of Elon Musk unveiling dramatic changes to Twitter’s logo and the disappearance of the iconic bird highlights the rapid pace of innovation. Returning to the realm of credit ratings, it’s essential to remember that these agencies provide a valuable tool for investors to make sound financial choices.

- Moody’s Investors Service: Established in 1909, Moody’s Investors Service is a subsidiary of Moody’s Corporation, a global provider of financial information and analytics. Its core principle is to provide investors with reliable and independent credit ratings. Moody’s uses a proprietary methodology, known as the Moody’s Rating Methodology, to assess the creditworthiness of issuers, considering factors such as financial performance, liquidity, and debt structure.

- Standard & Poor’s (S&P): Founded in 1860, S&P Global Ratings is a division of S&P Global, a leading provider of financial information and analytics. Its fundamental principles include objectivity, independence, and transparency in its rating process. S&P employs a comprehensive analytical framework, known as the S&P Global Ratings Methodology, to evaluate the creditworthiness of issuers, incorporating factors such as financial performance, management quality, and industry outlook.

Comparison of Rating Methodologies

The rating methodologies employed by Fitch, Moody’s, and S&P share some similarities but also have distinct differences.

Understanding the nuances of credit rating agencies like Fitch, Moody’s, and S&P is crucial for making smart investment decisions. These agencies provide insights into the financial health of companies and governments, helping investors assess risk. But when the market gets volatile, it’s wise to consider diversifying your portfolio with assets that are less susceptible to economic fluctuations.

This is where understanding the role of gold as a safe investment becomes important. Gold’s historical track record as a safe haven asset can provide a hedge against inflation and market downturns, complementing your investment strategy and potentially mitigating losses during turbulent times.

- Fitch Ratings: Fitch’s rating methodology is based on a five-factor framework, including financial performance, leverage, debt structure, regulatory environment, and management quality. The agency assigns weights to each factor based on its relevance to the specific issuer and industry.

- Moody’s Investors Service: Moody’s rating methodology is based on a four-factor framework, including financial performance, liquidity, debt structure, and regulatory environment. The agency assigns weights to each factor based on its relevance to the specific issuer and industry.

- Standard & Poor’s (S&P): S&P’s rating methodology is based on a seven-factor framework, including financial performance, leverage, debt structure, regulatory environment, management quality, industry outlook, and financial flexibility. The agency assigns weights to each factor based on its relevance to the specific issuer and industry.

Potential Biases and Limitations

Despite their efforts to maintain objectivity and independence, credit rating agencies are not immune to potential biases and limitations.

- Conflicts of Interest: Credit rating agencies are paid by the issuers they rate, which can create a conflict of interest. For example, an agency may be hesitant to downgrade an issuer’s rating if it fears losing future business.

- Model Risk: The complex models used by credit rating agencies can be susceptible to errors or biases. For example, a model may not accurately reflect the impact of unforeseen events, such as a global pandemic.

- Herding Behavior: Credit rating agencies often follow the lead of their peers, which can lead to a herd mentality. For example, if one agency downgrades an issuer’s rating, other agencies may follow suit, even if they have different assessments.

Understanding Credit Ratings and Investment Decisions

Credit ratings are a crucial tool for investors seeking to assess the risk and potential return of investments. These ratings, assigned by credit rating agencies, provide a standardized framework for evaluating the creditworthiness of borrowers, including corporations, governments, and individuals.

Understanding how credit ratings work and their implications for investment decisions is essential for making informed choices.

Credit Rating Categories and Significance for Investors

Credit ratings are typically categorized into investment-grade and non-investment-grade (or speculative) ratings. Investment-grade ratings indicate a lower risk of default and are generally considered suitable for most investors. Non-investment-grade ratings, on the other hand, suggest a higher risk of default and may be more suitable for investors with a higher risk tolerance.

- Investment-grade ratingsare typically assigned to borrowers with a strong financial track record, stable cash flow, and a low probability of default. These ratings are further subdivided into several categories, with higher ratings indicating lower risk and lower ratings indicating higher risk.

For example, Moody’s assigns investment-grade ratings from Aaa to Baa, with Aaa being the highest and Baa being the lowest.

- Non-investment-grade ratings, also known as speculative or junk bonds, are assigned to borrowers with a higher risk of default. These ratings are typically given to companies with a weaker financial track record, volatile cash flow, or a higher probability of default.

These ratings are further subdivided into several categories, with lower ratings indicating higher risk. For example, Moody’s assigns non-investment-grade ratings from Ba to C, with Ba being the highest and C being the lowest.

Relationship Between Credit Ratings and Investment Risk and Return

Credit ratings are directly related to investment risk and return. Generally, investments with higher credit ratings are considered less risky and offer lower returns, while investments with lower credit ratings are considered riskier and offer higher potential returns. This relationship is based on the concept of risk-return trade-off, which suggests that investors must accept higher risk to potentially achieve higher returns.

“Investors typically demand a higher return for investments with higher risk.”

For example, a corporate bond with an investment-grade rating may offer a lower interest rate compared to a corporate bond with a non-investment-grade rating. This is because investors perceive the investment-grade bond as less risky and are willing to accept a lower return.

Conversely, investors require a higher return for the non-investment-grade bond to compensate for the higher risk of default.

Using Credit Ratings for Informed Investment Decisions

Credit ratings play a vital role in helping investors make informed investment decisions. They provide a standardized framework for comparing the creditworthiness of different borrowers and assessing the relative risk of their investments.

- Portfolio Diversification: Investors use credit ratings to diversify their portfolios by investing in a mix of securities with different credit ratings. This strategy helps to reduce overall portfolio risk by spreading investments across different risk categories. For example, an investor might allocate a portion of their portfolio to investment-grade bonds for stability and another portion to non-investment-grade bonds for potential higher returns.

- Investment Selection: Credit ratings help investors choose specific investments based on their risk tolerance and investment objectives. For example, a conservative investor might prefer to invest in investment-grade bonds with lower risk, while a more aggressive investor might consider investing in non-investment-grade bonds for potential higher returns.

- Monitoring Investment Performance: Credit ratings can be used to monitor the performance of existing investments. If a borrower’s credit rating deteriorates, it may indicate an increased risk of default and prompt investors to re-evaluate their investment strategy.

The Impact of Credit Rating Agencies on the Financial System: Know All About Credit Rating Agencies A Closer Look At Fitch Moodys And S And P For Smart Investments

Credit rating agencies play a pivotal role in the global financial system, influencing the flow of capital, investment decisions, and ultimately, economic stability. Their assessments of borrowers’ creditworthiness, known as credit ratings, provide investors with crucial information to gauge risk and make informed decisions.

However, the influence of these agencies extends far beyond their core function, impacting the financial system in multifaceted ways, particularly during periods of economic stress.

The Influence of Credit Rating Agencies During Economic Stress, Know all about credit rating agencies a closer look at fitch moodys and s and p for smart investments

During economic downturns, the importance of credit rating agencies intensifies. Investors, facing heightened uncertainty and risk aversion, rely heavily on these agencies for guidance. A downgrade in a company’s credit rating can trigger a chain reaction, leading to a decrease in investor confidence, a rise in borrowing costs, and potentially, a spiral of defaults.

The 2008 financial crisis provides a stark example of this phenomenon. As the housing bubble burst and the financial system teetered on the brink of collapse, credit rating agencies faced intense scrutiny for their role in assigning inflated ratings to mortgage-backed securities.

The widespread downgrades of these securities, fueled by the agencies’ assessments, contributed to the liquidity crisis and the subsequent economic recession.

Potential Conflicts of Interest and Regulatory Challenges

Credit rating agencies operate in a complex and often controversial environment, facing potential conflicts of interest. The agencies’ revenue models are heavily reliant on fees paid by the very entities they rate. This structure raises concerns about the potential for bias, as agencies may be incentivized to provide favorable ratings to secure lucrative contracts.

Furthermore, the opaque nature of their rating methodologies and the lack of transparency in their decision-making processes add to the challenges of ensuring objectivity and accountability.

Impact of Credit Rating Agency Actions on Financial Markets

Credit rating agency actions can have a significant impact on financial markets. Downgrades can trigger sell-offs, leading to increased market volatility and a decrease in investor confidence. Conversely, upgrades can boost market sentiment, leading to higher stock prices and lower borrowing costs.

The ripple effects of these actions can extend far beyond the specific entities being rated, influencing the overall economic climate. For instance, a downgrade of a major corporation’s credit rating could signal broader economic concerns, leading to a decline in stock markets and a tightening of credit conditions across the board.

Future Trends and Developments in Credit Rating Agencies

The credit rating industry is constantly evolving, facing new challenges and opportunities as the financial landscape transforms. This evolution is driven by factors such as the emergence of new financial instruments, technological advancements, and increased regulatory scrutiny. Understanding these trends is crucial for investors, policymakers, and the financial system as a whole.

The Impact of New Financial Instruments

The emergence of new and complex financial instruments, such as derivatives and structured products, has presented a significant challenge for credit rating agencies. These instruments often involve intricate structures and underlying risks that are difficult to assess accurately. Credit rating agencies have had to adapt their methodologies and expertise to evaluate these instruments effectively.

For instance, the rise of collateralized debt obligations (CDOs) in the lead-up to the 2008 financial crisis highlighted the limitations of traditional rating models in evaluating complex financial instruments.