Key Events Ahead: Strikes, Prices, and Earnings in Focus

Key events ahead strikes prices and earnings in focus – Key Events Ahead: Strikes, Prices, and Earnings in Focus – Navigating the ever-shifting landscape of the market requires a keen eye on upcoming events, economic trends, and corporate performance. This week, a confluence of factors will shape investor sentiment and market movements, from potential strikes disrupting industries to crucial earnings reports revealing company health.

The economic calendar is packed with data releases that could provide insights into inflation, growth, and interest rate expectations. Labor negotiations are reaching critical points in several sectors, with potential strikes looming that could disrupt supply chains and impact consumer spending.

Earnings season is in full swing, with major companies revealing their financial performance and setting the stage for future growth prospects. Understanding these key events and their potential impact is crucial for making informed investment decisions in the coming weeks.

Key Events Ahead: Key Events Ahead Strikes Prices And Earnings In Focus

The coming weeks are packed with key economic releases, corporate earnings reports, and policy announcements that will likely shape market sentiment and investor decisions. These events offer valuable insights into the health of the global economy and the performance of various sectors.

Economic Releases

Economic releases provide crucial data points that reflect the state of the economy and can influence investor expectations.

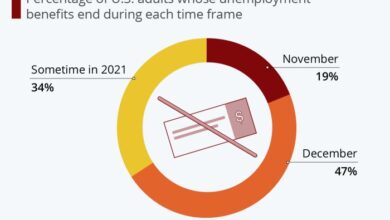

- US Nonfarm Payrolls (July 7):This report provides insights into job creation and unemployment levels, offering a snapshot of the labor market’s health. Strong job growth could bolster confidence in the economy, potentially supporting stock prices. Conversely, a weak report could raise concerns about economic growth and put pressure on stocks.

- US Consumer Price Index (CPI) (July 12):The CPI measures inflation, a key factor influencing interest rate decisions. A rise in inflation could lead to further interest rate hikes, potentially weighing on growth-sensitive sectors like technology. However, a decline in inflation could provide some relief for businesses and consumers, potentially boosting market sentiment.

- Eurozone GDP (July 12):The Eurozone’s GDP growth rate provides insights into the economic performance of the region. A strong GDP reading could boost investor confidence in the euro and European assets. However, a weak reading could raise concerns about the region’s economic outlook and put pressure on European markets.

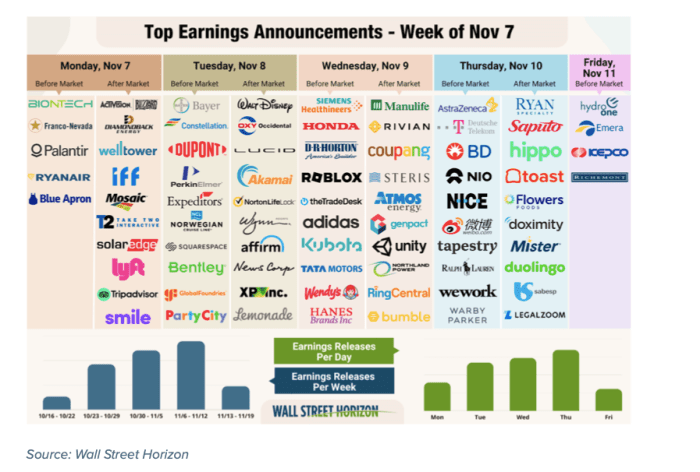

Corporate Earnings

Corporate earnings reports offer valuable insights into the financial performance of companies and can drive stock price movements.

- Technology Giants (July):Tech giants like Apple, Microsoft, Amazon, and Alphabet are expected to report their earnings in July. These reports will be closely watched for signs of growth in key areas like cloud computing, artificial intelligence, and advertising. Strong earnings from these companies could signal continued growth in the tech sector and boost investor confidence.

- Financial Institutions (July):Major banks like JPMorgan Chase, Bank of America, and Wells Fargo are scheduled to report earnings in July. These reports will provide insights into the health of the financial sector and the impact of rising interest rates. Strong earnings could indicate resilience in the face of economic challenges and potentially support the banking sector.

- Retailers (August):Retailers like Walmart, Target, and Home Depot are expected to report earnings in August. These reports will provide insights into consumer spending patterns and the impact of inflation on retail sales. Strong earnings could signal continued consumer demand and a healthy economy.

However, weak earnings could raise concerns about consumer spending and the overall economic outlook.

Policy Announcements

Policy announcements from central banks and governments can significantly impact market sentiment and asset prices.

- US Federal Reserve (July 25-26):The Federal Reserve is expected to make a decision on interest rates at its July meeting. Investors will be closely watching for clues about the future path of monetary policy. Further interest rate hikes could weigh on growth-sensitive sectors, while a pause in rate hikes could provide some relief for markets.

- European Central Bank (July 27):The European Central Bank is also expected to make a decision on interest rates at its July meeting. Similar to the Fed, investors will be looking for signs of the ECB’s future policy direction. A hawkish stance could put pressure on European assets, while a dovish stance could provide some support.

Price Movements and Trends

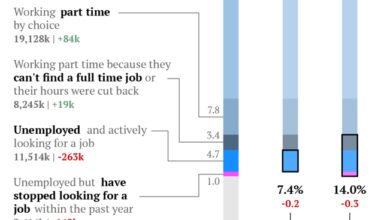

The global financial markets have been experiencing a period of volatility in recent months, driven by a confluence of factors, including inflation, interest rate hikes, and geopolitical tensions. This volatility has affected the performance of various asset classes, including stocks, bonds, commodities, and currencies.

Understanding the forces behind these price movements is crucial for investors seeking to navigate these turbulent markets.

Recent Price Movements in Key Asset Classes, Key events ahead strikes prices and earnings in focus

The recent price movements in key asset classes have been influenced by a number of factors, including:

- Inflation: Persistent inflation has led to concerns about rising prices and eroded purchasing power, prompting central banks to raise interest rates to cool down the economy. This has weighed on asset prices, particularly in the bond market, where yields have risen in anticipation of higher interest rates.

- Interest Rate Hikes: Central banks around the world have been aggressively raising interest rates to combat inflation. This has increased borrowing costs for businesses and consumers, slowing down economic growth and putting pressure on asset prices. For example, the Federal Reserve has raised interest rates by 500 basis points since March 2022, leading to a decline in the stock market.

- Geopolitical Events: The ongoing war in Ukraine, rising tensions between the United States and China, and other geopolitical events have created uncertainty and volatility in global markets. These events have disrupted supply chains, fueled inflation, and led to capital flight from emerging markets.

- Market Sentiment: Investor sentiment has been influenced by these factors, leading to periods of risk aversion and market sell-offs. For example, the recent rise in interest rates has led to a decline in the stock market, as investors become more cautious about the future economic outlook.

With key events ahead like strikes, price changes, and earnings reports, it’s a busy time for investors. But even with the market’s focus on these factors, experts warn homebuyers of red flags beyond climbing interest rates , reminding us that even during economic uncertainty, there are other crucial factors to consider in major financial decisions.

As we navigate this period of volatility, staying informed about all facets of the market, including housing, will be essential for making sound investment choices.

With key events ahead, including strikes, price changes, and earnings reports, the market is buzzing. But amidst the economic storm, Peloton’s recall of 2.2 million bikes over injury and fall concerns, as reported on The Venom Blog , adds another layer of complexity.

This recall could significantly impact Peloton’s already struggling stock, adding another factor to consider as we navigate the coming weeks.

The week ahead is packed with key events, from strike updates to crucial price and earnings reports. Amidst this flurry of economic indicators, a recent University of Michigan survey paints a positive picture: us consumer sentiment soars amid slowing inflation university of michigan survey , suggesting a growing sense of optimism despite persistent inflation.

This positive consumer sentiment could influence upcoming earnings reports and offer valuable insights into the trajectory of the economy.