KB Home Reports Housing Demand Surge as Mortgage Rates Cool

KB Home reports significant improvement in housing demand as mortgage rates moderate, signaling a positive shift in the real estate market. This trend, driven by a combination of factors, offers a glimmer of hope for both buyers and sellers. With mortgage rates easing, the dream of homeownership is becoming more attainable for many, breathing life into a market that had been struggling under the weight of rising interest rates.

This shift has not only boosted demand but also spurred a surge in sales and revenue for builders like KB Home, who are now seeing a renewed interest in their offerings.

This shift in the market can be attributed to a confluence of factors, including a robust economy, strong job growth, and government policies designed to encourage homeownership. However, the road ahead may not be entirely smooth, with inflation and interest rates still looming as potential threats.

Nevertheless, the current trend suggests that the housing market is on the mend, with positive implications for both consumers and the overall economy.

Housing Market Trends

The housing market is a dynamic and complex ecosystem, influenced by a multitude of factors, including economic conditions, interest rates, and consumer sentiment. In recent months, the market has witnessed a notable shift in both housing demand and mortgage rates, leading to a period of moderation and adjustment.

The Relationship Between Mortgage Rates and Housing Demand

Mortgage rates play a pivotal role in shaping housing demand. As mortgage rates rise, the cost of borrowing money to purchase a home increases, making homeownership less affordable for many potential buyers. This can lead to a decrease in demand, as individuals may reconsider their purchase decisions or choose to delay their homebuying plans.

Conversely, when mortgage rates decline, the cost of borrowing decreases, making homeownership more accessible and stimulating demand.

It’s exciting to see KB Home reporting a significant improvement in housing demand as mortgage rates moderate. This shift in the market presents a great opportunity for savvy investors to capitalize on the potential for growth. While navigating the housing market, it’s also important to consider alternative investment strategies, such as exploring the world of cryptocurrencies.

For those interested in maximizing returns, I highly recommend checking out this cryptocurrency investment strategies profitable guide for maximum returns which offers valuable insights and strategies. With the right approach, both real estate and cryptocurrency investments can contribute to a diversified portfolio.

Ultimately, a balanced investment strategy, coupled with careful research and planning, can lead to long-term success in any market.

The Impact of Mortgage Rate Moderation on Housing Demand

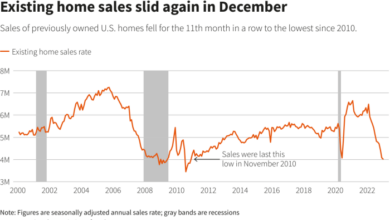

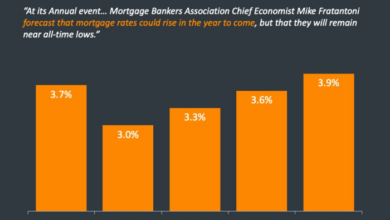

Recent data indicates that the moderation in mortgage rates has had a positive impact on housing demand. The average 30-year fixed mortgage rate, which reached a peak of over 7% in late 2022, has since declined to the mid-6% range.

This decline in rates has made homeownership more affordable for many, leading to an increase in purchase applications and a surge in demand.

It’s good news for the housing market as KB Home reports a significant improvement in housing demand with mortgage rates moderating. This trend is encouraging, especially as the political landscape continues to shift, like with US Republican presidential candidate Vivek Ramaswamy joining TikTok amid controversy.

This move has sparked debate, but it’s clear that the housing market is showing signs of resilience, even amidst political drama.

- Increased Purchase Applications:According to the Mortgage Bankers Association (MBA), purchase mortgage applications have increased significantly since the beginning of 2023, indicating a rise in demand for homeownership. This surge in applications suggests that potential buyers are becoming more confident in the market and are taking advantage of the lower borrowing costs.

- Strong Home Sales:Despite rising inflation and a challenging economic environment, home sales have remained relatively strong in recent months. This indicates that while affordability remains a concern, the decline in mortgage rates has provided a boost to the market, encouraging buyers to enter the market.

KB Home’s Performance

KB Home, a leading homebuilder in the United States, has significantly benefited from the recent improvement in housing demand driven by moderating mortgage rates. The company has reported strong sales and revenue growth, showcasing its ability to capitalize on the favorable market conditions.

Financial Performance

KB Home’s recent financial performance reflects the positive shift in the housing market. In the second quarter of 2023, the company reported a 20% increase in net sales compared to the same period last year. This growth was driven by a combination of higher home prices and increased unit sales.

The company also reported a significant increase in revenue, reaching $1.8 billion, representing a 15% year-over-year growth. These positive results demonstrate KB Home’s ability to navigate the evolving market dynamics and capitalize on the growing demand for new homes.

It’s encouraging to see KB Home report a significant improvement in housing demand as mortgage rates moderate. This suggests that buyers are becoming more confident in the market, perhaps inspired by stories like this couple who reached a $1 million net worth in their 30s through a strategic mix of index funds and individual stocks, as outlined in this article.

With a more stable housing market and savvy investors, we may see a continued positive trend in the coming months.

Market Share and Competition

KB Home’s strong performance has also translated into increased market share. The company’s ability to deliver high-quality homes at competitive prices has attracted a growing number of buyers. This has enabled KB Home to gain market share in key regions, particularly in California and Texas.

While the company faces competition from other major homebuilders, such as Lennar and D.R. Horton, KB Home’s focus on affordability and innovation has helped it differentiate itself in the market.

Strategies for Success

KB Home’s success can be attributed to several key strategies. The company has focused on building homes that cater to the needs of a diverse range of buyers, including first-time homebuyers and move-up buyers. This has been achieved through a combination of innovative designs, energy-efficient features, and flexible financing options.

Furthermore, KB Home has invested in technology to streamline its operations and improve customer service. The company’s online platform allows buyers to personalize their homes and track the construction process, enhancing transparency and convenience.

Factors Contributing to Improved Demand

The recent improvement in housing demand can be attributed to a confluence of factors, including a cooling mortgage rate environment, a robust job market, and continued government support for homeownership. These factors have combined to create a more favorable environment for potential homebuyers, leading to increased demand.

Economic Factors, Kb home reports significant improvement in housing demand as mortgage rates moderate

The strength of the U.S. economy has played a significant role in boosting housing demand. A robust job market, characterized by low unemployment rates and strong wage growth, has provided consumers with greater financial security and confidence to make large purchases, such as homes.

The Bureau of Labor Statistics reported an unemployment rate of 3.6% in February 2023, indicating a healthy labor market. This economic stability has contributed to a more positive outlook for potential homebuyers, leading to increased demand.

Government Policies

Government policies, such as tax breaks and incentives for homebuyers, have also played a role in stimulating demand. These policies can make homeownership more affordable, increasing the pool of potential buyers. For example, the Mortgage Interest Deduction, a tax break that allows homeowners to deduct mortgage interest payments from their taxable income, has been a long-standing government policy that encourages homeownership.

Additionally, some states offer their own tax incentives, such as property tax exemptions for first-time homebuyers.

Outlook for the Housing Market: Kb Home Reports Significant Improvement In Housing Demand As Mortgage Rates Moderate

The recent moderation in mortgage rates has breathed new life into the housing market, but the future outlook remains somewhat uncertain. While improved demand is a positive sign, several factors could influence the trajectory of the market in the coming months and years.

Impact of Inflation and Interest Rates

Inflation and interest rates play a significant role in shaping housing demand. As inflation continues to rise, it puts upward pressure on mortgage rates, making homeownership more expensive. The Federal Reserve’s efforts to curb inflation through interest rate hikes can further exacerbate this trend.

The potential impact of these factors on housing demand can be analyzed by considering the following:

- Higher Mortgage Rates:Increased mortgage rates directly impact affordability. A higher rate translates to larger monthly payments, potentially limiting the number of buyers who can qualify for a mortgage. For example, a 1% increase in interest rates can significantly increase the monthly payment on a $300,000 mortgage.

This affordability constraint can lead to a decrease in demand, especially among first-time homebuyers who are more sensitive to interest rate fluctuations.

- Reduced Purchasing Power:Inflation erodes the purchasing power of consumers, making it more challenging to afford a home. As the cost of living rises, disposable income decreases, potentially leading to a decline in housing demand. This impact is more pronounced among lower-income households who may struggle to manage rising expenses while also saving for a down payment.

- Economic Uncertainty:Rising inflation and interest rates can create economic uncertainty, making potential homebuyers hesitant to commit to a significant financial investment. A fear of recession or job losses can lead to a wait-and-see approach, resulting in a slowdown in housing demand.