Israel Shekel Rebounds, $8 Billion Supports Recent Conflict

Israel shekel rebounds 8 billion support recent conflict – Israel Shekel Rebounds, $8 Billion Supports Recent Conflict – this headline might surprise you, given the recent geopolitical tensions in the region. While conflict often leads to economic instability, the Israeli Shekel has defied expectations, showing remarkable resilience. This rebound isn’t just a coincidence; it’s a testament to the country’s economic strength and the support it has received from international allies.

The Israeli Shekel has been bucking the trend, strengthening against major currencies despite the conflict. This unexpected resilience is fueled by a combination of factors. Foreign investment, particularly in the tech sector, has remained strong. Additionally, the Israeli economy has shown remarkable adaptability, with businesses quickly pivoting to meet new challenges.

Furthermore, the significant financial support from international allies, totaling $8 billion, has provided a critical buffer against potential economic fallout.

Economic Outlook for Israel: Israel Shekel Rebounds 8 Billion Support Recent Conflict

The recent conflict in Israel has had a significant impact on the country’s economy. However, the substantial international support received has provided a buffer against immediate economic collapse. The short-term outlook is mixed, with both challenges and opportunities emerging. In the long term, the economic recovery and future growth trajectory will depend on various factors, including the resolution of the conflict, government policies, and the ability to attract foreign investment.

Economic Sector Impact

The impact of the conflict and the support received can be categorized across different economic sectors.

| Economic Sector | Impact of Conflict | Impact of Support | Outlook |

|---|---|---|---|

| Tourism | Significant decline in tourist arrivals due to security concerns and travel advisories. | Increased aid for tourism businesses and marketing campaigns to revive tourism. | Recovery will be gradual, dependent on security situation and international confidence. |

| Technology | Potential disruption to operations and supply chains due to conflict-related events. | Strengthened investment in technology sector as a key growth driver. | Long-term potential remains strong, with Israel’s tech industry attracting global talent and investment. |

| Agriculture | Disruptions to agricultural production and supply chains due to conflict-related events. | Aid to farmers and agricultural businesses to mitigate losses and support production. | Agriculture remains a vital sector, with potential for growth through innovation and export diversification. |

| Real Estate | Reduced investment and construction activity due to uncertainty and potential damage. | Support for infrastructure development and housing projects to stimulate growth. | Recovery depends on investor confidence and the government’s ability to address housing affordability challenges. |

Opportunities and Challenges, Israel shekel rebounds 8 billion support recent conflict

The Israeli economy faces both opportunities and challenges in the aftermath of the conflict.

- Opportunity: Increased International Support:The substantial financial aid and investment commitments from various countries can be leveraged to rebuild infrastructure, stimulate economic growth, and support key sectors.

- Opportunity: Technological Innovation:Israel’s renowned technology sector can play a key role in driving economic recovery and creating new job opportunities.

- Opportunity: Diversification of Exports:Expanding exports to new markets and diversifying product offerings can reduce reliance on specific sectors and enhance economic resilience.

- Challenge: Security Concerns:The ongoing conflict creates uncertainty and discourages investment, impacting tourism, business confidence, and economic growth.

- Challenge: Inflation and Rising Costs:The conflict and international support can lead to increased inflation and higher costs, impacting consumer spending and business profitability.

- Challenge: Social Inequality:The conflict and economic recovery efforts can exacerbate social inequality, requiring targeted interventions to address disparities.

The Israeli shekel’s recent rebound, fueled by an $8 billion support package, reflects the nation’s resilience in the face of conflict. This economic strength comes at a time when global tensions are rising, as evidenced by China’s decision to impose export controls on gallium and germanium, escalating the chip war and further straining international relations.

The shekel’s stability suggests that Israel’s economy is weathering these turbulent times, demonstrating a strong foundation amidst global uncertainty.

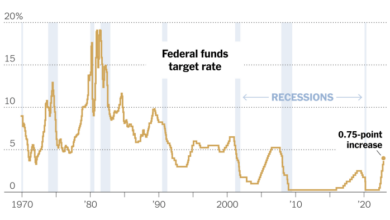

The Israeli Shekel’s recent rebound, bolstered by an $8 billion injection of support in the wake of the recent conflict, paints a picture of resilience. While the Shekel’s strength is a testament to the country’s financial fortitude, it’s interesting to note the stability of the US Dollar, which has held its ground in the forex market amid expectations of a Fed rate hike and growing optimism surrounding the debt ceiling.

This suggests a complex interplay of global economic factors, where the strength of one currency doesn’t necessarily translate to weakness in another. Ultimately, the Shekel’s performance will continue to be influenced by a combination of regional geopolitical events and broader economic trends.

The Israeli shekel’s rebound, bolstered by an $8 billion support package, reflects the country’s resilience in the face of recent conflict. This economic strength, however, is also influenced by global trends, such as the growing impact of cryptocurrencies like Bitcoin.

Understanding the intricate relationship between traditional finance and the digital realm is crucial, especially as we witness the rise of cryptocurrencies and their potential to disrupt global markets. bitcoins impact on the global economy dissecting the influence of cryptocurrency This dynamic interplay underscores the interconnectedness of our financial systems, making it essential to navigate the evolving landscape of finance with both foresight and adaptability.