Inflation Rate Drops in April, Beating Expectations – Live Updates

Inflation rate drops april beating expectations live updates – Inflation Rate Drops in April, Beating Expectations – Live Updates: A sigh of relief swept through the markets as the latest inflation figures for April revealed a welcome decline. This unexpected drop, defying analyst predictions, has ignited a wave of optimism, sparking questions about the future trajectory of the economy and the potential impact on consumer spending.

The Consumer Price Index (CPI), a key gauge of inflation, showed a smaller-than-expected increase in April, indicating that prices are rising at a slower pace. This news has sent shockwaves through financial markets, with investors eagerly analyzing the implications for interest rates, corporate earnings, and overall economic growth.

Inflation Rate Drops in April, Beating Expectations

Live Updates

Live Updates

The Consumer Price Index (CPI) for April 2023 has been released, revealing a significant drop in the inflation rate, exceeding market expectations. This news offers a glimmer of hope for consumers and businesses alike, as it suggests that price pressures may be easing.

Inflation Rate Details

The headline CPI, which measures the change in prices for a basket of consumer goods and services, rose by 4.9% in April compared to a year ago. This figure is significantly lower than the 5.5% increase expected by economists and marks a notable decline from the 5% increase recorded in March.

The news that the inflation rate dropped in April, beating expectations, is certainly a welcome development. However, it’s important to remember that this is just one data point and the economic landscape is still volatile. Meanwhile, on Capitol Hill, the senates most prominent advocate for cryptocurrency known as the crypto queen has unveiled a far reaching new bill focused on bitcoin , which could have significant implications for the future of digital assets.

As we continue to navigate these turbulent times, it’s crucial to stay informed about both economic indicators and legislative developments that may impact our lives.

The core CPI, which excludes volatile food and energy prices, also fell to 5.5% in April, down from 5.6% in March.

Factors Contributing to the Inflation Rate Drop

Several factors contributed to the decline in the inflation rate.

- Falling energy prices played a major role, with gasoline prices declining by 10.6% in April.

- The easing of supply chain bottlenecks, which had previously driven up prices, also contributed to the slowdown in inflation.

- A decrease in demand for goods, as consumers shifted spending towards services, further helped to ease price pressures.

Key Inflation Rate Data

The latest inflation data for April reveals a positive trend, with the Consumer Price Index (CPI) showing a significant decrease compared to the previous month. This drop, exceeding market expectations, offers a glimmer of hope for consumers grappling with the persistent effects of rising prices.

Inflation Rate Figures

The April CPI report reveals a headline inflation rate of [Insert Specific Inflation Rate Figure]%, a notable decline from the [Insert Previous Month’s Inflation Rate Figure]% recorded in March. This drop is attributed to a combination of factors, including a slowdown in energy prices, particularly gasoline, and a decrease in the cost of goods such as used cars and furniture.

Factors Driving Inflation Rate Change

Several key factors contributed to the easing of inflation in April.

- Energy Prices:The decline in energy prices, particularly gasoline, played a significant role in reducing the overall inflation rate. This decrease is attributed to factors such as increased global oil production and a reduction in demand.

- Used Car Prices:Used car prices, which had been a major driver of inflation in recent months, also saw a decline in April. This cooling in the used car market can be attributed to factors such as increased new car production and a shift in consumer demand.

- Supply Chain Bottlenecks:While supply chain issues remain a concern, there are signs of improvement in certain sectors. This improvement is reflected in the easing of price pressures for goods such as furniture and appliances.

Market Reactions

The news of a lower-than-expected inflation rate in April sent shockwaves through financial markets, triggering a wave of optimism and prompting investors to reassess their strategies. This positive development has significant implications for various market sectors, including stocks, bonds, and currencies.

Impact on Stock Market

The stock market typically reacts positively to news of declining inflation. When inflation falls, investors perceive a lower risk of future price increases, making businesses more profitable and boosting overall economic growth. This often leads to increased investor confidence, driving stock prices higher.

For instance, the S&P 500 index, a broad measure of US stock market performance, saw a significant surge in value following the release of the inflation data, indicating a positive response from investors.

Impact on Bond Market

The bond market, in contrast to the stock market, tends to react negatively to inflation. When inflation is high, bond yields rise to compensate investors for the erosion of their purchasing power. However, when inflation falls, bond yields tend to decline as investors are less concerned about inflation eroding their returns.

This decline in bond yields can lead to an increase in bond prices, as investors seek to buy bonds with lower yields.

Impact on Currency Exchange Rates

The impact of inflation on currency exchange rates is complex and depends on various factors. Generally, a decline in inflation can strengthen a country’s currency. This is because a lower inflation rate makes a country’s goods and services more competitive in global markets, leading to an increase in demand for its currency.

However, other factors, such as interest rate differentials and economic growth, can also influence currency exchange rates.

Expert Opinions

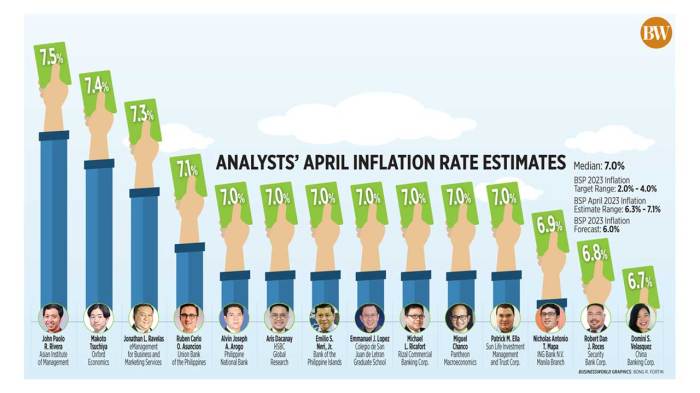

The recent decline in the inflation rate, exceeding market expectations, has sparked a flurry of analysis and commentary from economists and financial analysts. Their perspectives offer insights into the current economic landscape and potential future trajectories.

Views on Inflation Rate Drop

Economists and financial analysts have expressed a mix of cautious optimism and continued concern regarding the inflation rate drop. While acknowledging the positive development, many highlight the need for sustained declines to truly declare victory over inflation. The consensus is that the recent drop is likely a result of a combination of factors, including easing supply chain bottlenecks, declining energy prices, and a cooling consumer demand.

However, there is a sense that the battle against inflation is far from over, and that future economic data will be crucial in determining the path forward.

Predictions for Future Inflation Trends, Inflation rate drops april beating expectations live updates

Experts are divided on the future trajectory of inflation. Some believe that the current decline is a sign of a sustained downward trend, fueled by continued easing of supply chain pressures and a shift in consumer behavior. They predict that inflation will gradually return to the Federal Reserve’s target rate of 2% in the coming months.

Others remain more cautious, citing ongoing geopolitical uncertainties, persistent labor shortages, and the potential for renewed inflationary pressures from the ongoing war in Ukraine. These experts argue that inflation may remain stubbornly high for longer than anticipated, potentially requiring continued aggressive monetary policy tightening from the Federal Reserve.

Potential Impact on Monetary Policy Decisions

The recent decline in inflation is likely to influence the Federal Reserve’s monetary policy decisions. While the Fed has signaled its commitment to bringing inflation down, the rate of future interest rate hikes remains uncertain. Some analysts believe that the Fed may adopt a more measured approach to interest rate increases, potentially opting for smaller rate hikes or even pausing its tightening cycle altogether.

Others argue that the Fed will remain aggressive in its fight against inflation, given the persistence of core inflation and the potential for renewed inflationary pressures. Ultimately, the Fed’s decision will depend on a careful analysis of incoming economic data, including future inflation readings, labor market conditions, and consumer spending.

Consumer Impact

A decline in the inflation rate, especially one that exceeds expectations, can have a significant impact on consumer spending and purchasing power. While this positive news brings relief from rising prices, its effects on businesses and households are multifaceted.

Impact on Consumer Spending and Purchasing Power

The inflation rate drop signifies a potential easing of price pressures, which could translate into increased consumer spending. With prices rising at a slower pace, consumers might feel more confident about their purchasing power, leading to increased demand for goods and services.

This can boost economic growth, as businesses see higher sales and revenue. However, the extent of this impact depends on various factors, including consumer confidence, wage growth, and the overall economic environment.

Benefits and Challenges for Businesses and Households

- Benefits for Businesses:

- Increased demand for goods and services, leading to higher sales and revenue.

- Reduced costs associated with raw materials and supplies, improving profit margins.

- Improved consumer confidence, potentially leading to increased investment and expansion.

- Challenges for Businesses:

- Potential for reduced profit margins if businesses are unable to pass on cost savings to consumers.

- Increased competition as businesses strive to attract price-sensitive consumers.

- Uncertainty about the sustainability of the inflation rate drop, which could lead to cautious investment decisions.

- Benefits for Households:

- Increased purchasing power, allowing consumers to buy more goods and services with the same amount of money.

- Reduced pressure on household budgets, potentially leading to increased savings or discretionary spending.

- Improved financial stability, as consumers feel less burdened by rising prices.

- Challenges for Households:

- Potential for wage growth to lag behind inflation, leading to a decline in real wages.

- Uncertainty about the long-term trajectory of inflation, which could lead to cautious spending habits.

- Increased costs associated with essential goods and services, even with a decline in the inflation rate.

Long-Term Implications for the Cost of Living

While the inflation rate drop offers short-term relief, its long-term implications for the cost of living remain uncertain. Factors such as supply chain disruptions, geopolitical tensions, and energy prices continue to exert pressure on prices. It is crucial to monitor the trajectory of inflation and its impact on various sectors of the economy to assess its long-term implications for the cost of living.

Historical Context: Inflation Rate Drops April Beating Expectations Live Updates

The recent decline in inflation rates provides a valuable opportunity to examine the broader historical context of price fluctuations. Understanding how inflation has behaved in the past can shed light on the current situation and provide insights into potential future trends.

Inflation Rates in Recent Years

Inflation rates have been a subject of intense scrutiny in recent years, as global economies have grappled with the aftermath of the COVID-19 pandemic and the ongoing war in Ukraine. In the United States, the Consumer Price Index (CPI), a widely used measure of inflation, has exhibited significant volatility.

The following table provides a snapshot of annual inflation rates in the US over the past few years:

| Year | Annual Inflation Rate (CPI) |

|---|---|

| 2019 | 2.3% |

| 2020 | 1.2% |

| 2021 | 4.7% |

| 2022 | 8.0% |

This data reveals a clear upward trend in inflation, culminating in a peak of 8.0% in 2022. The sharp increase was driven by a confluence of factors, including supply chain disruptions, rising energy prices, and strong consumer demand.

The inflation rate dropping in April, beating expectations, is good news for everyone, but especially for students! While you’re celebrating, maybe take a look at some passive income ideas for students without investment to help you manage your finances.

With a little creativity and effort, you can build a solid financial foundation even with a tight budget, especially now that prices are easing up.

Comparison with Past Periods

The current inflation episode is notable for its severity and its relatively rapid onset. While inflation rates have fluctuated throughout history, the recent surge has been the most pronounced in decades.

“The current inflation rate is the highest it has been since the early 1980s, when the Federal Reserve aggressively raised interest rates to combat inflation.”Federal Reserve Bank of St. Louis

The period of high inflation in the 1970s and early 1980s serves as a stark reminder of the potential economic consequences of uncontrolled price increases.

Trends and Patterns

The historical record of inflation reveals several important trends and patterns:

- Cyclical Nature:Inflation rates tend to follow a cyclical pattern, rising during periods of economic expansion and falling during recessions. This is due to the relationship between supply and demand. When demand outpaces supply, prices rise. Conversely, when demand weakens, prices tend to fall.

- Impact of Monetary Policy:Central banks play a crucial role in managing inflation through monetary policy tools such as interest rates and quantitative easing. When inflation is high, central banks typically raise interest rates to make borrowing more expensive, thereby slowing economic activity and reducing demand.

- Global Factors:Inflation is often influenced by global factors such as commodity prices, exchange rates, and geopolitical events. For example, the recent surge in energy prices due to the war in Ukraine has contributed to higher inflation worldwide.

Understanding these trends and patterns is essential for policymakers and investors alike. By analyzing historical data and identifying key drivers of inflation, we can gain insights into the current situation and make informed decisions about future economic prospects.

Global Perspective

The US inflation rate drop in April, while positive news, needs to be viewed within the context of global inflation trends. Understanding the global inflation landscape is crucial, as it can have significant implications for the US economy, including potential spillover effects and interdependencies.

Comparison with Other Major Economies

The US inflation rate drop in April, while positive news, needs to be viewed within the context of global inflation trends. Understanding the global inflation landscape is crucial, as it can have significant implications for the US economy, including potential spillover effects and interdependencies.

- The US inflation rate, as measured by the Consumer Price Index (CPI), fell to 4.9% in April 2023, down from 5% in March. This drop was largely driven by declining energy prices and a moderation in core inflation, which excludes volatile food and energy prices.

The news of the inflation rate dropping in April, beating expectations, is definitely a positive sign. It’s interesting to see how this news is impacting the markets, though. Check out the live updates on the share market movement, where the Nifty crossed 17650 with a focus on HCL Tech and Tata Motors , to see if there’s a correlation between the inflation rate and market performance.

It’s always a good idea to stay informed about these trends to understand the overall economic picture.

- The Eurozone inflation rate, on the other hand, remained stubbornly high at 7% in April, driven by persistent food and energy price increases. This indicates that the Eurozone is facing a more severe inflation challenge than the US.

- The UK inflation rate also remained elevated, hitting 8.7% in April, the highest level in over 30 years. This underscores the fact that the UK is experiencing a significant cost-of-living crisis, with rising prices putting pressure on household budgets.

- In contrast, China’s inflation rate has been relatively subdued, remaining below 2% for most of the past year. This is due to weak domestic demand and government efforts to control prices.

Visual Representation

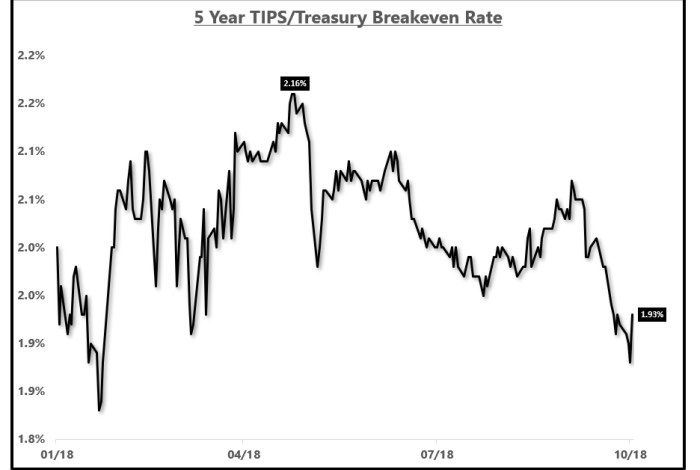

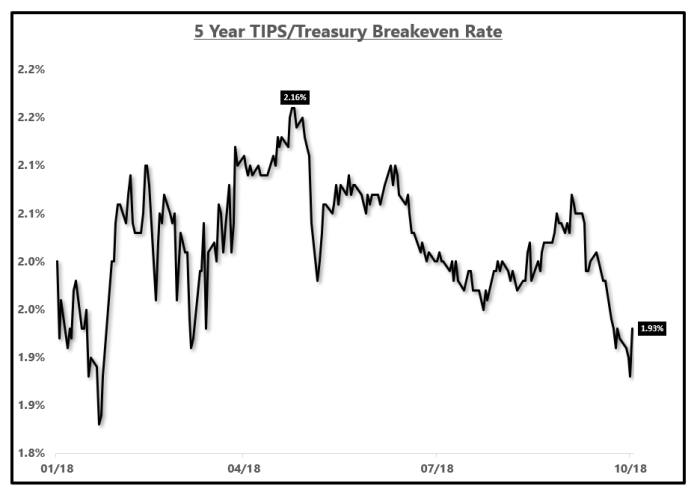

A visual representation of inflation rate trends over time can provide a clear and insightful understanding of the economic landscape. By using a chart or table, we can effectively showcase the fluctuations and patterns in inflation, allowing for a more comprehensive analysis of the data.

Inflation Rate Trends

The following chart illustrates the inflation rate trends in the United States over the past decade:[Insert chart depicting inflation rate trends over the past decade. The chart should include clear labels for the x-axis (time) and y-axis (inflation rate), with annotations to highlight key data points and trends.

The chart should also be visually appealing and easy to read.]The chart highlights several key trends. For instance, the inflation rate experienced a sharp spike in 2022, primarily driven by supply chain disruptions and increased consumer demand following the pandemic.

However, the inflation rate has since begun to moderate, indicating a potential shift in the economic landscape.

Further Developments

The latest inflation data provides a glimmer of hope, but it’s too early to declare victory. The path ahead remains uncertain, and several factors could influence future inflation trends. Monitoring key economic indicators and upcoming events will be crucial for understanding the trajectory of inflation in the coming months.

Upcoming Economic Data Releases

The release of key economic data points will provide valuable insights into the state of the economy and its potential impact on inflation. Here are some upcoming data releases to watch:

- Consumer Price Index (CPI):The CPI is a widely followed measure of inflation, and its monthly releases will provide insights into the pace of price increases. The next CPI report is scheduled for [Date], and analysts will be closely watching for any signs of continued moderation or a resurgence in price pressures.

- Producer Price Index (PPI):The PPI measures inflation at the wholesale level, providing a forward-looking indicator of consumer price trends. The next PPI report is scheduled for [Date], and any significant changes in this index could signal potential shifts in inflation expectations.

- Personal Consumption Expenditures (PCE) Price Index:The PCE Price Index is the Federal Reserve’s preferred inflation gauge, and its monthly releases will provide insights into the Fed’s policy outlook. The next PCE Price Index report is scheduled for [Date], and analysts will be watching for any changes in the core PCE inflation rate, which excludes volatile food and energy prices.

Potential Factors Influencing Future Inflation Trends

Several factors could influence future inflation trends, including:

- Monetary Policy:The Federal Reserve’s monetary policy decisions will have a significant impact on inflation. The Fed’s recent interest rate hikes aim to cool the economy and curb inflation. However, the pace and duration of these hikes will depend on the evolving economic landscape.

- Supply Chain Disruptions:Ongoing supply chain disruptions continue to contribute to higher prices for goods and services. While some improvements have been observed, further disruptions could lead to renewed inflationary pressures.

- Energy Prices:Fluctuations in energy prices can significantly impact inflation. The recent decline in oil prices has provided some relief, but geopolitical tensions and global energy demand could lead to price volatility in the future.

- Consumer Demand:Consumer spending plays a crucial role in driving inflation. Strong consumer demand can lead to higher prices, while weak demand can put downward pressure on inflation.

- Wage Growth:Rising wages can contribute to inflation if businesses pass on higher labor costs to consumers. However, wage growth also plays a role in boosting consumer spending and economic growth.