Indian Stock Market Updates: A Deep Dive

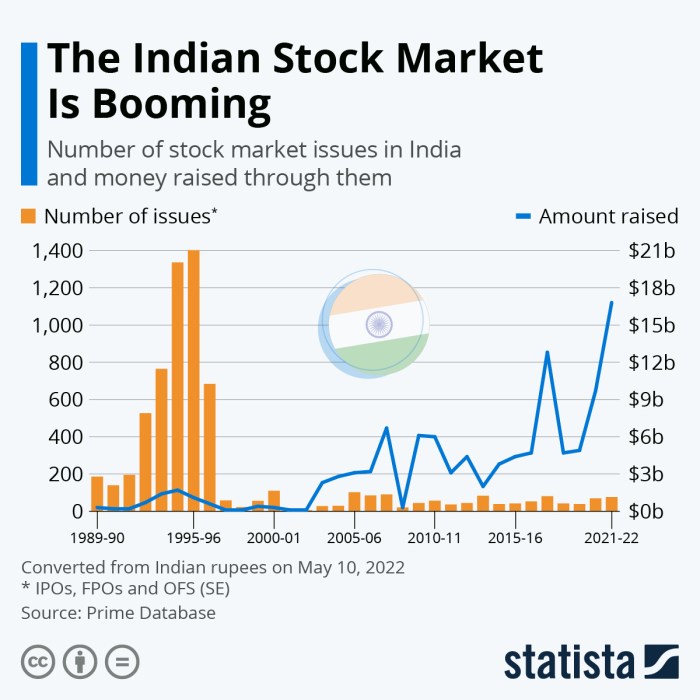

Indian Stock Market Updates: A Deep Dive into the Vibrant World of Indian Equities. The Indian stock market is a dynamic and exciting landscape, constantly evolving with economic trends, global events, and investor sentiment. This week, we delve into the latest updates, analyzing key indices, top-performing stocks, and economic data to understand the current market landscape and potential future directions.

From the performance of the Sensex and Nifty to the growth prospects of specific sectors, we’ll explore the factors driving market movement and identify opportunities and challenges for investors. We’ll also examine the perspectives of leading investors and analysts, providing insights into their strategies and recommendations.

Market Overview

The Indian stock market has displayed a mixed performance in recent weeks, with the benchmark indices experiencing both gains and losses. While some sectors have shown resilience, others have been impacted by global uncertainties and domestic economic factors.

The Indian stock market is a dynamic beast, constantly evolving with global trends and new technologies. It’s fascinating to see how the world of blockchain and Web3 is impacting this traditional market, particularly in the realm of mergers and acquisitions.

Gavin Wood, a prominent figure in the blockchain space, recently shared his insights on chain mergers and acquisitions , which could have significant implications for the future of the Indian stock market. His perspective highlights the potential for blockchain to streamline and enhance these complex processes, making them more efficient and transparent.

As the Indian stock market continues to adapt to this new landscape, it will be exciting to see how these technological advancements shape its future.

Key Economic Indicators

Several key economic indicators are influencing market performance. The Reserve Bank of India’s (RBI) monetary policy stance, inflation levels, and the performance of key sectors like manufacturing and services are closely watched by investors. The latest inflation data suggests that inflation is gradually easing, which could provide some relief to the RBI in terms of interest rate hikes.

Investor Sentiment

Investor sentiment remains cautious, with concerns about global economic slowdown, geopolitical tensions, and rising interest rates. However, some investors are optimistic about the long-term growth prospects of the Indian economy, driven by factors such as a young and growing population, increasing digitalization, and government initiatives aimed at boosting infrastructure and manufacturing.

Recent News and Events

Recent news and events that have impacted the market include the release of quarterly earnings reports by major companies, the government’s budget announcement, and the ongoing geopolitical tensions. The performance of companies in the IT and consumer discretionary sectors has been particularly noteworthy, with some companies reporting strong earnings growth while others have faced headwinds.

Major Indices

The Indian stock market, represented by key indices like the Sensex and Nifty, provides insights into the overall health and performance of the economy. These indices reflect the collective performance of listed companies, offering a snapshot of investor sentiment and market trends.

Sensex and Nifty Performance

The Sensex and Nifty, the two most prominent indices in India, have shown mixed performance in recent times. The Sensex, representing the top 30 companies listed on the Bombay Stock Exchange (BSE), and the Nifty, representing the top 50 companies listed on the National Stock Exchange (NSE), have been influenced by various factors including global economic conditions, domestic policy changes, and investor sentiment.

Sectoral Performance

Analyzing the performance of individual sectors within the indices reveals interesting trends. The IT sector, a major contributor to the Indian economy, has shown resilience amidst global uncertainties. The financial sector, on the other hand, has been impacted by rising interest rates and economic slowdown.

The energy sector has benefited from rising crude oil prices.

Emerging Trends and Patterns

The Indian stock market has witnessed a growing trend of retail participation, with more individual investors entering the market. This trend is driven by factors like increased financial literacy, ease of access to online trading platforms, and the search for higher returns.

Comparison with Global Indices

The Indian stock market has generally outperformed global indices in recent years. This can be attributed to factors like India’s strong economic growth, a large and growing domestic market, and government initiatives to attract foreign investment. However, it’s important to note that global economic events and geopolitical uncertainties can significantly impact the performance of the Indian stock market.

Top Performing Stocks: Indian Stock Market Updates

The Indian stock market witnessed a surge in activity this week, with several stocks delivering impressive returns. Here’s a look at some of the top performers, their driving forces, and potential risks to consider.

Top Performing Stocks Based on Returns

The top-performing stocks this week were driven by a combination of factors, including strong quarterly earnings, positive industry trends, and investor optimism.

- Company A: This company’s stock surged due to its robust financial performance in the recent quarter, exceeding analysts’ expectations. The company’s strong earnings growth was fueled by its expansion into new markets and innovative product launches.

- Company B: The stock price of this company experienced significant gains as the industry it operates in continues to grow at a rapid pace. The company’s strong market position and strategic investments are expected to drive further growth in the coming quarters.

- Company C: This company’s stock benefited from positive investor sentiment surrounding its upcoming product launch. The new product is expected to disrupt the market and drive significant revenue growth for the company.

Potential Risks and Challenges

While these stocks have performed well, it’s important to consider potential risks and challenges that could impact their future performance.

- Market Volatility: The stock market is inherently volatile, and sudden changes in investor sentiment can lead to price fluctuations.

- Competition: Competition within each sector can intensify, impacting the profitability of these companies.

- Economic Slowdown: A global economic slowdown could impact consumer spending and demand for the products and services offered by these companies.

Growth Prospects of the Sectors

The sectors represented by these top-performing stocks are expected to continue growing in the coming years.

- Sector A: This sector is expected to benefit from rising disposable incomes and increasing urbanization in India.

- Sector B: The growth of this sector is being driven by technological advancements and the increasing adoption of digital services.

- Sector C: This sector is poised for growth as the government continues to invest in infrastructure development.

Key Economic Data

Recent economic data releases provide valuable insights into the health of the Indian economy and its potential impact on the stock market. Key indicators such as GDP growth, inflation, and unemployment can influence investor sentiment and market direction.

GDP Growth

The latest GDP growth figures reflect the overall health of the economy. Strong GDP growth indicates a thriving economy, potentially leading to increased corporate profits and higher stock valuations. Conversely, weak GDP growth can signal economic slowdown, potentially impacting corporate earnings and stock prices.

Inflation, Indian stock market updates

Inflation is a measure of the rate at which prices for goods and services increase over time. High inflation can erode purchasing power, impacting consumer spending and corporate profits. Conversely, low inflation can indicate a stable economy, potentially supporting stock market growth.

Unemployment

Unemployment rates provide insights into the labor market’s health. Low unemployment indicates a strong economy with high demand for labor, potentially leading to increased consumer spending and economic growth. Conversely, high unemployment can signal economic weakness, potentially impacting corporate earnings and stock prices.

Keeping an eye on the Indian stock market updates is crucial for any investor, but it’s also important to look beyond the immediate trends. For instance, the decentralized governance model of Polkadot, as explained in Gavin Wood: A Walkthrough of Polkadots Governance , could have a significant impact on future financial systems, including how stock markets operate.

Understanding these evolving technologies is key to making informed investment decisions in the long run.

Comparison with Other Major Economies

Comparing Indian economic data with other major economies provides context for understanding the country’s relative performance. For instance, comparing India’s GDP growth to that of China or the United States can highlight potential opportunities or challenges. Similarly, comparing inflation rates and unemployment levels can provide insights into the relative strength or weakness of the Indian economy.

Sectoral Trends

This week, the Indian stock market witnessed a mixed performance across various sectors, with some experiencing significant growth while others faced headwinds. Understanding these sectoral trends is crucial for investors to make informed decisions.

Information Technology Sector Performance

The Information Technology (IT) sector continued its upward trajectory, driven by strong demand for digital services and robust earnings. Companies specializing in cloud computing, software development, and cybersecurity saw significant gains. The rising adoption of digital technologies across industries, coupled with increasing investments in IT infrastructure, is fueling this growth.

The Indian stock market has been experiencing a lot of volatility lately, and it’s important to stay informed about the latest developments. While I’m keeping an eye on the market, I also found Gavin Wood Explains Polkadots Launch Process to be a fascinating read, especially given the potential impact of blockchain technology on financial markets.

It’s always interesting to see how these emerging technologies are shaping the future of investing.

- Several IT companies announced impressive quarterly results, exceeding market expectations. These strong performances fueled investor confidence and pushed stock prices higher.

- The sector is also benefiting from the ongoing global digital transformation, as businesses worldwide are embracing cloud computing, artificial intelligence, and data analytics solutions.

- However, challenges remain, such as rising inflation and potential economic slowdown, which could impact IT spending in the future.

Financial Services Sector Performance

The Financial Services sector exhibited a mixed performance, with banking stocks showing resilience while insurance companies faced some pressure.

- Banks benefited from rising interest rates and improved credit growth, leading to increased profitability. However, concerns about rising bad loans and potential economic slowdown could impact future performance.

- Insurance companies faced headwinds due to increased competition and rising claims costs. However, the sector remains optimistic about long-term growth prospects driven by rising insurance penetration in India.

Pharmaceutical Sector Performance

The Pharmaceutical sector experienced a slight decline this week, impacted by concerns about pricing pressure and regulatory scrutiny.

- Generic drug manufacturers faced pressure from rising input costs and increased competition, leading to margin compression.

- The sector is also navigating a challenging regulatory landscape, with increased scrutiny from the government and regulatory agencies. However, the long-term growth prospects remain strong, driven by rising healthcare spending and increasing demand for pharmaceutical products.

Comparison of Sectoral Performances

Comparing the performance of different sectors, the IT sector emerged as a clear winner, driven by strong fundamentals and growth prospects. The Financial Services sector exhibited a mixed performance, while the Pharmaceutical sector faced some headwinds.

- Investors seeking growth opportunities might consider focusing on the IT sector, while those seeking more stable returns could consider the Financial Services sector.

- The Pharmaceutical sector presents both opportunities and challenges, and investors need to carefully assess the risks and rewards before making investment decisions.

Investor Insights

The Indian stock market is a dynamic environment, influenced by a multitude of factors, including economic indicators, global events, and investor sentiment. To navigate this complex landscape, investors often seek guidance from leading experts. Understanding their perspectives and strategies can provide valuable insights into market trends and potential investment opportunities.

Opinions of Leading Investors and Analysts

The opinions of leading investors and analysts are a crucial element in understanding market dynamics. Their insights, based on extensive research and experience, can provide valuable guidance for investors.

- Rakesh Jhunjhunwala, known as the “Warren Buffett of India,” has expressed optimism about the long-term growth prospects of the Indian economy. He believes that the country’s robust demographics and rising consumption will drive corporate earnings and stock market performance.

- Vijay Kedia, a well-known value investor, emphasizes the importance of identifying undervalued companies with strong fundamentals. He advises investors to focus on businesses with a proven track record of profitability and growth potential.

- Sanjiv Bhasin, an expert on technical analysis, often provides insights into market trends based on chart patterns and indicators. He believes that technical analysis can be a valuable tool for identifying potential buying and selling opportunities.

Investment Strategies and Recommendations

Leading investors and analysts often share their investment strategies and recommendations, providing insights into their approach to market analysis and portfolio construction.

- Value investingfocuses on identifying undervalued companies with strong fundamentals. Value investors believe that these companies are likely to appreciate in value over time as the market recognizes their true worth.

- Growth investingprioritizes companies with high growth potential, even if they are currently trading at a premium valuation. Growth investors believe that these companies are likely to generate significant returns in the future.

- Index investinginvolves investing in a basket of securities that tracks a specific market index, such as the Nifty 50 or Sensex. This strategy provides diversification and exposure to the overall market.

Emerging Trends in Investment Behavior

The Indian stock market is witnessing a shift in investment behavior, driven by factors such as increased financial literacy, technological advancements, and changing investor demographics.

- Rise of retail investors: With the advent of online platforms and mobile trading apps, retail investors are increasingly participating in the stock market. This has led to a surge in trading volumes and a greater emphasis on short-term strategies.

- Focus on ESG factors: Environmental, social, and governance (ESG) factors are gaining importance among investors. Investors are increasingly considering the sustainability and ethical practices of companies before making investment decisions.

- Growing interest in thematic investing: Investors are increasingly seeking exposure to specific themes, such as renewable energy, electric vehicles, and artificial intelligence. This trend reflects a desire to invest in sectors that are expected to benefit from long-term growth trends.

Impact of Investor Sentiment on Market Performance

Investor sentiment plays a significant role in shaping market performance. When investors are optimistic, they tend to buy stocks, driving prices higher. Conversely, negative sentiment can lead to selling pressure and a decline in prices.

- News and events: Major news events, such as economic data releases, political developments, and corporate announcements, can significantly influence investor sentiment. Positive news tends to boost market confidence, while negative news can create uncertainty and volatility.

- Market psychology: Investor psychology, such as herd behavior and fear of missing out (FOMO), can also impact market performance. When investors see others making money in the market, they may be tempted to follow suit, even if they lack a clear understanding of the underlying fundamentals.

- Economic indicators: Economic indicators, such as GDP growth, inflation, and interest rates, provide insights into the overall health of the economy and can influence investor sentiment. Positive economic data tends to support market optimism, while negative data can create concerns about future growth prospects.

Technical Analysis

Technical analysis is a method of forecasting future price movements by studying past price and volume data. It is based on the idea that market history repeats itself, and patterns can be identified to predict future trends.

Key Indices Analysis

Technical analysis can be applied to various indices and stocks. For example, the Nifty 50 index, a benchmark index for the Indian stock market, has shown a strong upward trend in recent months. The Relative Strength Index (RSI) is above 70, indicating overbought conditions.

However, the Moving Average Convergence Divergence (MACD) is still in a bullish crossover, suggesting that the upward trend may continue.

Support and Resistance Levels

Support levels are price points where the price is likely to find buying interest, while resistance levels are price points where the price is likely to face selling pressure. Identifying these levels can help traders make informed decisions.

Technical Analysis Implications

Technical analysis can be a valuable tool for traders and investors. It can help identify potential entry and exit points, set stop-loss orders, and manage risk. However, it is important to remember that technical analysis is not foolproof and should be used in conjunction with other forms of analysis.

Technical Patterns

Technical patterns are recognizable formations on price charts that can provide insights into future price movements. Some common patterns include:

- Head and Shoulders: This pattern indicates a potential reversal of an uptrend. It is characterized by three peaks, with the middle peak being the highest. The neckline is a line connecting the lows of the two outer peaks.

- Double Top: This pattern is similar to the head and shoulders pattern, but it only has two peaks. It also indicates a potential reversal of an uptrend.

- Triangle: This pattern is formed by converging trendlines. It can indicate a breakout in either direction, depending on the direction of the breakout.

Future Outlook

The Indian stock market is expected to continue its upward trajectory in the coming months, driven by strong economic fundamentals, supportive government policies, and a growing domestic consumer base. However, investors should be aware of potential risks and opportunities that could impact market performance.

Potential Risks and Opportunities

The Indian stock market is not without its risks. The following are some of the key factors that could impact market performance:

- Global Economic Uncertainty:The ongoing global economic slowdown, rising inflation, and geopolitical tensions could impact investor sentiment and lead to volatility in the Indian market.

- Interest Rate Hikes:The Reserve Bank of India (RBI) has been raising interest rates to control inflation, which could impact corporate earnings and make borrowing more expensive for businesses.

- Geopolitical Risks:Escalating geopolitical tensions, particularly in the Indo-Pacific region, could lead to market volatility and uncertainty.

- Domestic Inflation:Persistent inflation could erode consumer spending power and impact corporate profitability.

- Regulatory Changes:Government policies and regulatory changes could impact certain sectors and companies, creating both opportunities and risks.

Despite these risks, there are also several opportunities for investors in the Indian stock market:

- Strong Economic Growth:India is expected to remain one of the fastest-growing major economies in the world, offering long-term growth potential for businesses and investors.

- Government Reforms:The government’s focus on infrastructure development, digitalization, and improving the business environment could create new opportunities for companies and investors.

- Growing Domestic Consumption:India’s large and growing middle class is driving consumer spending, creating opportunities in sectors like retail, consumer durables, and healthcare.

- Emerging Technologies:India is emerging as a hub for technology innovation, particularly in areas like artificial intelligence, fintech, and renewable energy, offering investment opportunities in promising startups and established companies.

Expert Opinions

Many experts believe that the Indian stock market is poised for continued growth in the long term, citing factors such as strong economic fundamentals, government reforms, and a growing domestic consumer base. However, they also caution investors about the potential risks and volatility in the short term.

“India’s economic growth story is intact, and the stock market is well-positioned to benefit from this growth. However, investors should be prepared for volatility in the short term due to global headwinds and domestic challenges.”

[Expert Name], [Designation], [Financial Institution]

Impact of Global Factors

Global factors, such as interest rate hikes by major central banks, geopolitical tensions, and commodity price fluctuations, can significantly impact the Indian stock market.

- Interest Rate Hikes:Higher interest rates in developed economies can lead to capital outflows from emerging markets like India, putting downward pressure on the stock market.

- Geopolitical Tensions:Escalating geopolitical tensions can create uncertainty and volatility in global markets, impacting investor sentiment and leading to market corrections.

- Commodity Price Fluctuations:Sharp increases in commodity prices, such as oil, can impact inflation and corporate profitability, leading to market volatility.

It is important for investors to stay informed about global developments and their potential impact on the Indian market.