Indian Rupee Expected to Strengthen on Positive GDP Surprise and Fed Pause Speculations

Indian rupee expected to strengthen on positive gdp surprise and fed pause speculations – The Indian Rupee is poised for a surge, buoyed by a positive GDP surprise and the Federal Reserve’s recent pause on interest rate hikes. This unexpected economic strength, coupled with the Fed’s shift in monetary policy, has sparked optimism for the Indian currency.

The rupee’s recent performance, driven by a confluence of factors, signals a potential shift in market sentiment towards a stronger Indian economy.

The recent GDP growth figures have surpassed expectations, showcasing the resilience of the Indian economy. This positive performance has bolstered investor confidence and is a key driver behind the anticipated rupee appreciation. Meanwhile, the Fed’s decision to hold interest rates steady, after a series of aggressive hikes, has created a favorable environment for emerging market currencies, including the Indian Rupee.

This pause in tightening provides breathing room for economies like India to navigate their own monetary policies without facing excessive pressure from the US dollar.

Indian Rupee Strength

The Indian Rupee (INR) has been displaying a notable strengthening trend against major currencies in recent months, bucking the global trend of weakening currencies. This surge in the rupee’s value is driven by a confluence of factors, including robust economic fundamentals, positive investor sentiment, and a cautious stance by the Federal Reserve.

Economic Indicators Contributing to Rupee Strength

Several key economic indicators have contributed to the rupee’s recent strengthening. These indicators reflect the resilience and growth potential of the Indian economy.

- Stronger-than-expected GDP growth:The Indian economy has consistently outperformed expectations, with the latest GDP figures exceeding forecasts. This robust growth has boosted investor confidence in the Indian economy, driving demand for the rupee.

- Stable Inflation:Inflation in India has remained relatively stable, staying within the Reserve Bank of India’s (RBI) target range. This stability has provided a conducive environment for businesses and consumers, contributing to economic growth and supporting the rupee.

- Healthy Current Account Deficit:The current account deficit, which represents the difference between a country’s exports and imports, has been narrowing in recent months. This narrowing deficit indicates that India’s trade balance is improving, reducing pressure on the rupee.

- Strong Foreign Exchange Reserves:India’s foreign exchange reserves have remained robust, providing a buffer against external shocks and supporting the rupee’s value. These reserves provide the RBI with ample firepower to intervene in the foreign exchange market if needed.

Impact of Positive GDP Surprise

The positive GDP surprise has significantly bolstered the rupee’s performance. This unexpected surge in economic growth has further cemented India’s position as a robust and growing economy.

“The positive GDP surprise has acted as a catalyst for the rupee’s appreciation. Investors are increasingly confident in India’s growth prospects, leading to a surge in demand for the rupee.”

Market Analyst

This surge in demand has pushed the rupee higher against major currencies, reinforcing its strengthening trend.

The Role of the Federal Reserve

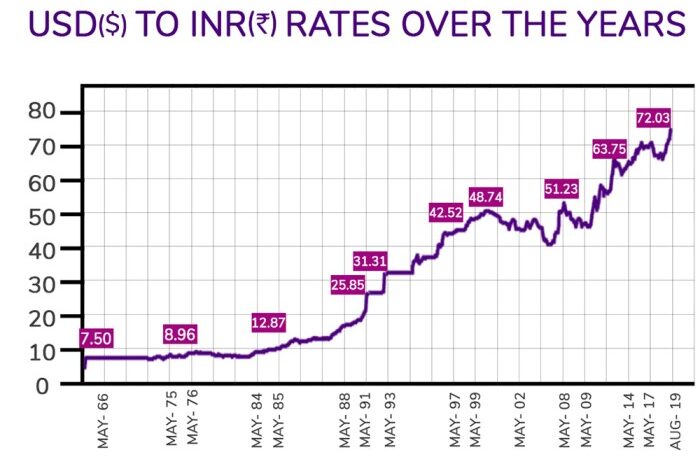

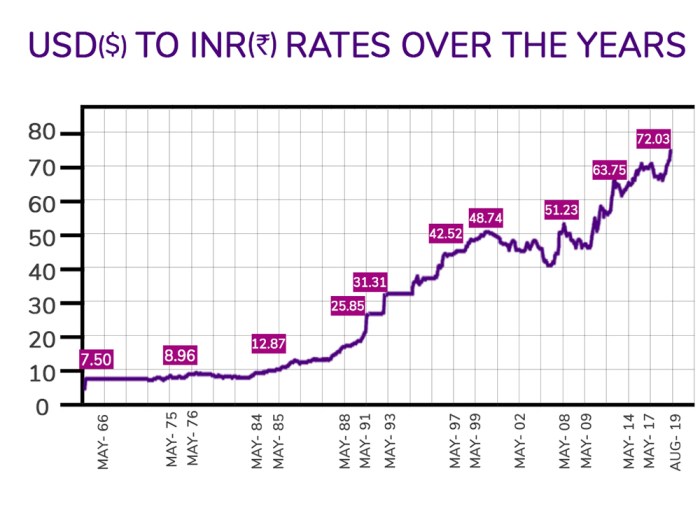

The recent pause in interest rate hikes by the Federal Reserve has generated significant interest, particularly in its potential impact on emerging market currencies like the Indian Rupee. Understanding the Fed’s role and its historical impact on the Indian Rupee is crucial for investors and market analysts alike.

The Fed’s Recent Pause and its Implications for the Indian Rupee

The Fed’s decision to pause interest rate hikes, after a series of aggressive increases, reflects a cautious approach towards inflation and the broader economic outlook. This pause, coupled with the recent softening of inflation data, has raised expectations of a potential pivot towards rate cuts in the near future.

The Indian rupee is poised for a strengthening run, fueled by a positive GDP surprise and speculation of a Fed pause. This bullish sentiment is echoed in the tech sector, where Nvidia’s latest AI supercomputers and services have sent their stock soaring to new heights, as reported in this article.

With global markets responding to these developments, the Indian rupee is expected to benefit from this positive momentum, solidifying its position as a potential investment haven.

This scenario could positively impact the Indian Rupee.

The Indian rupee is expected to strengthen on the back of a positive GDP surprise and speculation surrounding a Fed pause. It’s a good time to be optimistic about the Indian economy, even as we mourn the loss of renowned actor Ray Stevenson, who passed away at 58.

Stevenson was known for his roles in films like Punisher: War Zone, RRR, and the Thorfilms. His talent will be sorely missed, but the positive economic news might offer a glimmer of hope during this difficult time.

A weakening US dollar, often a consequence of a less hawkish Fed, can make the Indian Rupee relatively more attractive to investors.

A weaker dollar typically encourages capital inflows into emerging markets, as investors seek higher returns in currencies that are expected to appreciate against the dollar. This inflow of foreign capital can strengthen the Indian Rupee, boosting its value.

Economic Outlook and Market Sentiment

The recent positive GDP surprise and speculations surrounding a Fed pause have boosted the Indian rupee’s strength. However, understanding the broader economic outlook for India and the market sentiment surrounding the rupee is crucial to assess its future trajectory.

Economic Outlook for India, Indian rupee expected to strengthen on positive gdp surprise and fed pause speculations

India’s economic outlook remains positive, driven by robust domestic demand and government initiatives. The recent GDP data indicates strong growth momentum, fueled by robust consumption and investment. The government’s focus on infrastructure development and digitalization is expected to further stimulate economic activity.

The Indian rupee is poised for a strengthening trajectory, fueled by a positive GDP surprise and speculations surrounding a pause in Fed rate hikes. While global markets grapple with these economic shifts, the news of Warren Buffett’s Berkshire Hathaway finalizing the divestment of TSMC holdings adds another layer of intrigue.

This strategic move by the renowned investor could potentially impact global semiconductor markets, which in turn could influence the Indian rupee’s performance.

However, external factors like global inflation and geopolitical tensions pose challenges.

Market Sentiment and the Rupee’s Strength

The market sentiment surrounding the Indian rupee is currently positive, with investors anticipating further strengthening. The recent GDP data and the possibility of a Fed pause have fueled optimism. The rupee’s strength is also attributed to the country’s strong fundamentals, including its healthy foreign exchange reserves and a growing economy.

Expert Perspectives on the Rupee’s Future Trajectory

Leading economists and analysts hold diverse views on the rupee’s future trajectory. Some believe that the rupee is likely to appreciate further, citing the strong economic fundamentals and the potential for a Fed pause. Others remain cautious, pointing to global uncertainties and the potential for inflation to remain elevated.

“The rupee’s strength is a positive sign for the Indian economy, indicating investor confidence in the country’s growth prospects.”

[Name of Economist/Analyst], [Designation]

“While the rupee is likely to appreciate in the short term, it’s important to consider the global economic outlook and potential headwinds.”

[Name of Economist/Analyst], [Designation]

Potential Risks and Challenges: Indian Rupee Expected To Strengthen On Positive Gdp Surprise And Fed Pause Speculations

While the Indian rupee appears poised for strengthening, it’s crucial to acknowledge the potential risks and challenges that could impact its trajectory. The rupee’s performance is susceptible to a multitude of factors, both domestic and global, and these factors can introduce volatility and uncertainty.

Global Economic Uncertainties

Global economic uncertainties can significantly impact the Indian rupee. The current geopolitical landscape, marked by heightened tensions and conflicts, has led to increased market volatility and risk aversion. For instance, the ongoing Russia-Ukraine war has disrupted global supply chains, fueled inflationary pressures, and heightened uncertainty about future economic growth.

These factors can influence investor sentiment and lead to capital outflows from emerging markets, including India.

Impact on Businesses and Individuals

A strengthening rupee can significantly impact both Indian businesses and individuals, affecting their financial decisions and overall economic well-being. The ripple effects of a stronger rupee are multifaceted, influencing various sectors and individual financial activities.

Impact on Businesses

A strengthening rupee can be both a boon and a bane for Indian businesses, particularly those involved in exports and imports.

- Exports:A stronger rupee makes Indian exports more expensive in foreign markets, potentially reducing demand and impacting export-oriented businesses. This could lead to decreased revenues, reduced competitiveness, and potentially job losses in export-related sectors.

- Imports:Conversely, a stronger rupee makes imported goods cheaper in India, potentially benefiting businesses that rely on imported raw materials or finished products. This can lead to lower input costs, increased profitability, and potentially lower prices for consumers.

Impact on Individuals

A stronger rupee can have several implications for Indian individuals, influencing their spending, savings, and investment decisions.

- Travel Abroad:A stronger rupee makes international travel more affordable for Indians, allowing them to spend less on foreign currencies. This can lead to increased tourism and spending abroad.

- Sending Money Overseas:Individuals sending money overseas, such as to family or for education, benefit from a stronger rupee as they need to exchange fewer rupees for foreign currency. This can reduce the overall cost of remittances.

- Investing in Foreign Assets:A stronger rupee can make investing in foreign assets, such as stocks or bonds, less attractive. This is because the returns from foreign investments, when converted back to rupees, will be lower due to the appreciation of the rupee.

Impact on Different Sectors of the Indian Economy

The impact of a stronger rupee on different sectors of the Indian economy can be summarized as follows: