India Consumer Tech Stocks Outshine Chinese Peers: Widening Gap

India consumer tech stocks outshine chinese peers signaling widening gap – India’s consumer tech sector is on fire, with its stocks outperforming their Chinese counterparts, signaling a widening gap. This dynamic shift is driven by India’s robust economic growth, government initiatives fostering a favorable business environment, and a rapidly evolving consumer landscape.

As the Indian market blossoms with innovation, Chinese tech giants face challenges, including regulatory hurdles and a cooling economy. This trend paints a compelling picture of the future of tech in Asia, with India poised to become a global leader.

The rise of Indian consumer tech stocks is not just a blip on the radar. It’s a reflection of the country’s economic transformation and its growing middle class. With a burgeoning population and increasing smartphone penetration, the demand for digital services and products is skyrocketing.

This has fueled the growth of Indian tech giants like Paytm, Flipkart, and Swiggy, who are challenging established players and disrupting traditional industries.

Widening Gap

The Indian consumer tech market is experiencing a surge in growth, outpacing its Chinese counterpart, creating a widening gap between the two tech giants. This trend is driven by a combination of factors, including India’s rapidly growing middle class, increasing smartphone penetration, and a burgeoning digital economy.

Meanwhile, China’s consumer tech sector faces headwinds due to slowing economic growth, regulatory scrutiny, and geopolitical tensions.

The surge in India’s consumer tech stocks, outpacing their Chinese counterparts, points to a growing gap in economic confidence and innovation. This stark contrast is further emphasized by the recent federal reserve report on SVB collapse , which highlights serious mismanagement and supervisory failures.

While India’s tech sector is demonstrating resilience, these events serve as a reminder of the fragility of the global financial system and the importance of robust regulatory frameworks.

Growth and Innovation

The Indian consumer tech market is characterized by robust growth, fueled by a large and rapidly growing population, rising disposable incomes, and increasing smartphone penetration. This has attracted significant investments from global tech giants and domestic startups, leading to a surge in innovation and new product launches.

In contrast, China’s consumer tech market has experienced a slowdown in recent years, with growth hampered by factors such as slowing economic growth, a saturated smartphone market, and increased regulatory scrutiny.

The surge in Indian consumer tech stocks, outpacing their Chinese counterparts, signals a growing gap in innovation and market potential. This exciting development is a testament to the country’s burgeoning tech ecosystem. While we’re witnessing this shift, it’s also crucial to consider how individuals can maximize their financial well-being, like maximizing home loan repayment exploring the pros and cons of various approaches.

By strategically managing debt, individuals can free up resources to invest in the burgeoning Indian tech sector, potentially reaping the rewards of this exciting growth trajectory.

Investor Sentiment

Investor sentiment towards Indian consumer tech companies is positive, driven by the market’s growth potential and the government’s focus on digitalization. This is reflected in the high valuations of Indian tech startups and the increasing number of initial public offerings (IPOs) in the sector.

Conversely, investor sentiment towards Chinese consumer tech companies has been dampened by concerns over regulatory uncertainty, geopolitical tensions, and slowing growth.

The recent surge in Indian consumer tech stocks, outpacing their Chinese counterparts, signals a widening gap in the tech landscape. This trend underscores the increasing prominence of India as a key market, a fact further cemented by Apple’s continued prosperity in China and the promising future it sees in Asian markets, as highlighted in this insightful article.

With India’s burgeoning middle class and growing digital adoption, the nation is poised to become a major player in the global tech scene, offering exciting opportunities for both domestic and international players.

Challenges Faced by Chinese Consumer Tech Companies

Chinese consumer tech companies face a multitude of challenges that contribute to the widening gap with their Indian counterparts. These challenges include:

- Slowing Economic Growth:China’s economic growth has slowed in recent years, impacting consumer spending and demand for tech products.

- Regulatory Scrutiny:Chinese authorities have increased regulatory scrutiny of the tech sector, imposing restrictions on data collection, antitrust enforcement, and content moderation.

- Geopolitical Tensions:Geopolitical tensions between the US and China have created uncertainty for Chinese tech companies, leading to restrictions on access to key technologies and markets.

- Saturated Smartphone Market:The Chinese smartphone market is largely saturated, with limited growth potential for new players.

Long-Term Implications

The widening gap between India and China’s consumer tech sectors has significant long-term implications for both countries. India’s burgeoning tech sector has the potential to become a global leader, attracting investments and creating jobs. However, China’s tech sector faces challenges that could hinder its growth and competitiveness in the long run.

The continued growth of India’s consumer tech market could also lead to a shift in the global tech landscape, with India emerging as a key player in the future.

Key Players and Opportunities

The Indian consumer tech sector is experiencing rapid growth, driven by a young and tech-savvy population, increasing smartphone penetration, and a robust digital infrastructure. This has attracted significant investments and created opportunities for both established and emerging players.

Leading Indian Consumer Tech Companies

A number of Indian consumer tech companies are leading the charge in this sector, showcasing innovative solutions and disrupting traditional industries. These companies are attracting global attention and are becoming increasingly influential in the global tech landscape.

- Paytm: A leading digital payments platform, Paytm has become synonymous with mobile payments in India. Its diverse range of services, including financial services, e-commerce, and entertainment, has positioned it as a major player in the Indian consumer tech space.

- Flipkart: One of the largest e-commerce platforms in India, Flipkart has revolutionized online shopping in the country. Its extensive product catalog, competitive pricing, and robust logistics network have made it a dominant force in the e-commerce market.

- Zomato: A leading food delivery platform, Zomato has become an integral part of the Indian food tech ecosystem. Its user-friendly interface, wide selection of restaurants, and convenient delivery options have made it a popular choice for food ordering.

- Ola: A ride-hailing platform, Ola has transformed urban transportation in India. Its extensive network of drivers, affordable fares, and innovative features, such as Ola Money, have made it a leading player in the ride-hailing market.

- Swiggy: Another prominent food delivery platform, Swiggy has gained significant traction in the Indian market. Its focus on speed, quality, and customer service has made it a preferred choice for food delivery.

Growth Opportunities in the Indian Consumer Tech Market

The Indian consumer tech market presents numerous growth opportunities across various segments, driven by the country’s large and growing population, increasing digital literacy, and rising disposable incomes.

- E-commerce: The Indian e-commerce market is expected to grow significantly in the coming years, driven by increasing internet penetration, rising disposable incomes, and the growing preference for online shopping.

- Mobile Payments: The Indian mobile payments market is witnessing rapid growth, driven by the widespread adoption of smartphones and the government’s push for digital transactions.

- Digital Entertainment: The Indian digital entertainment market is experiencing rapid growth, driven by the increasing demand for streaming services, online gaming, and other forms of digital entertainment.

- Fintech: The Indian fintech sector is witnessing significant growth, driven by the increasing demand for financial services, such as digital lending, payments, and insurance.

- Edtech: The Indian edtech market is experiencing rapid growth, driven by the increasing demand for online education and the government’s focus on digital learning.

Foreign Investment in Indian Consumer Tech

The Indian consumer tech sector is attracting significant foreign investment, driven by the country’s large and growing market, favorable demographics, and the government’s supportive policies.

“India is becoming a global hub for consumer tech innovation, attracting significant foreign investment and creating opportunities for both established and emerging players.”

- Venture Capital: Venture capitalists are increasingly investing in Indian consumer tech startups, recognizing the immense potential of the market.

- Private Equity: Private equity firms are also making significant investments in Indian consumer tech companies, seeking to capitalize on the sector’s growth trajectory.

- Strategic Acquisitions: Global tech giants are acquiring Indian consumer tech companies to gain access to the country’s growing market and talent pool.

Challenges and Risks: India Consumer Tech Stocks Outshine Chinese Peers Signaling Widening Gap

While the Indian consumer tech sector is flourishing, it’s not without its share of challenges and risks. These factors could potentially impact the sector’s growth trajectory and future prospects.

Competition

The Indian consumer tech market is fiercely competitive, with both domestic and international players vying for market share. This competition is likely to intensify as more players enter the market and existing players expand their product and service offerings.

The rise of homegrown startups like Paytm, Swiggy, and Ola has created a dynamic ecosystem, while established global players like Amazon, Google, and Facebook continue to invest heavily in India. This intense competition can lead to price wars, increased marketing expenses, and a focus on innovation to differentiate products and services.

Regulatory Hurdles

The Indian government has implemented various regulations to govern the consumer tech sector, aimed at protecting consumer rights and promoting fair competition. These regulations can be complex and evolving, posing challenges for businesses to comply with and navigate. For example, the government has introduced regulations regarding data privacy, e-commerce, and digital payments.

These regulations can impact business operations, increase compliance costs, and create uncertainty for companies operating in the sector.

Economic Volatility

India’s economy is subject to global macroeconomic trends and domestic factors that can influence consumer spending and overall economic growth. Economic volatility can lead to a decline in consumer confidence, reduced disposable income, and a slowdown in demand for consumer tech products and services.

For example, the COVID-19 pandemic had a significant impact on the Indian economy, leading to disruptions in supply chains, lockdowns, and a decline in consumer spending. These economic fluctuations can pose challenges for businesses operating in the consumer tech sector.

Global Macroeconomic Trends

Global macroeconomic trends, such as rising inflation, interest rate hikes, and geopolitical tensions, can have a significant impact on the Indian consumer tech market. These trends can affect consumer spending, investment flows, and overall economic growth. For instance, rising inflation can lead to increased costs for businesses, potentially impacting pricing strategies and profitability.

Similarly, interest rate hikes can make it more expensive for companies to borrow money, potentially slowing down growth and expansion plans.

Emerging Trends and Technologies

The consumer tech sector is constantly evolving, with new technologies and trends emerging rapidly. These advancements can disrupt the market and create new opportunities for some players while posing challenges for others. For example, the rise of artificial intelligence (AI), blockchain, and the metaverse are creating new possibilities for businesses to innovate and create new products and services.

However, these emerging technologies also require significant investments in research and development, and companies need to adapt quickly to stay competitive.

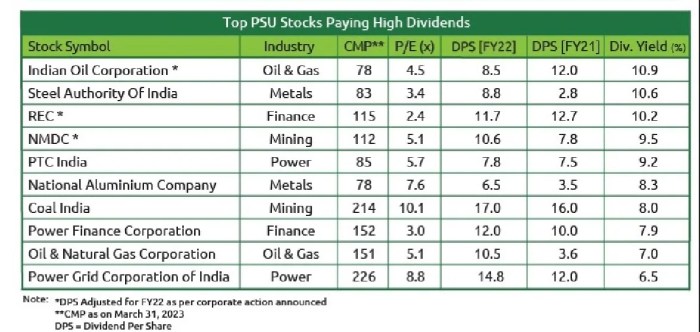

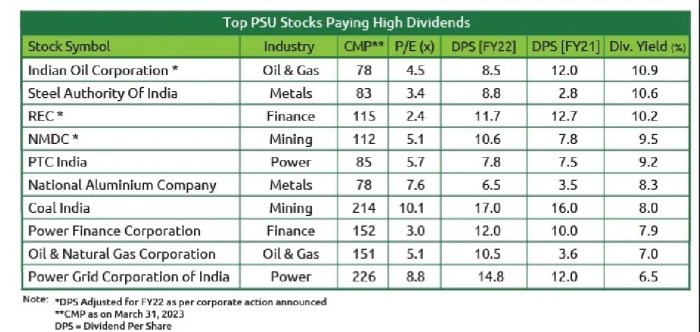

Investment Implications

The outperformance of Indian consumer tech stocks relative to their Chinese counterparts presents a compelling investment opportunity. However, investors must carefully consider the associated risks and opportunities before making any investment decisions. This section delves into the investment case for Indian consumer tech stocks, comparing it with Chinese counterparts, and Artikels a potential portfolio allocation strategy.

Investment Opportunities

The Indian consumer tech sector offers several attractive investment opportunities.

- Large and Growing Market: India has a vast and rapidly growing population, with a young and tech-savvy demographic. This provides a large and expanding market for consumer tech products and services.

- Favorable Government Policies: The Indian government is actively promoting the digital economy through initiatives like “Digital India” and “Startup India,” creating a conducive environment for tech businesses to thrive.

- Rising Disposable Incomes: As India’s economy continues to grow, disposable incomes are rising, enabling consumers to spend more on technology and digital services.

- Innovation and Disruption: Indian consumer tech companies are known for their innovative solutions tailored to the local market, challenging established players and disrupting traditional industries.

Comparison with Chinese Consumer Tech Stocks

While Chinese consumer tech stocks have experienced significant growth in the past, their recent performance has been impacted by regulatory scrutiny and geopolitical tensions. Indian consumer tech stocks, on the other hand, benefit from a less restrictive regulatory environment and a more stable geopolitical landscape.

- Regulatory Environment: China’s regulatory crackdown on tech giants has led to increased uncertainty and volatility in the sector. In contrast, India has a more favorable regulatory environment, encouraging innovation and growth.

- Geopolitical Risks: Chinese tech companies face geopolitical risks, including trade tensions with the US and other countries. Indian tech companies are less exposed to these risks, offering a more stable investment proposition.

- Growth Potential: While China’s consumer tech market is already mature, India’s market remains relatively untapped, offering significant growth potential for Indian tech companies.

Portfolio Allocation Strategy, India consumer tech stocks outshine chinese peers signaling widening gap

Investors interested in the Indian consumer tech sector can consider a diversified portfolio allocation strategy.

- Core Holdings: Investing in established and profitable Indian consumer tech companies with strong market positions and proven track records, like Reliance Industries, Infosys, and Tata Consultancy Services.

- Growth Opportunities: Allocating a portion of the portfolio to promising startups and emerging players in sectors like e-commerce, fintech, and digital payments. Examples include Paytm, Nykaa, and PolicyBazaar.

- Sector Diversification: Investing across different sub-sectors within the Indian consumer tech space to mitigate risk. This could include companies operating in e-commerce, online travel, food delivery, and digital entertainment.

Investment Risks

Despite the attractive opportunities, investors should be aware of the risks associated with Indian consumer tech stocks.

- Competition: The Indian consumer tech market is highly competitive, with both domestic and international players vying for market share.

- Regulatory Uncertainty: While India has a generally favorable regulatory environment, changes in policies or regulations could impact the industry.

- Economic Slowdown: A slowdown in the Indian economy could negatively impact consumer spending and tech adoption, affecting the growth of the sector.

- Valuation: Some Indian consumer tech companies are trading at high valuations, which could lead to a correction if their growth expectations are not met.