Rising Rates: How Will the Housing Market Be Affected?

How will the housing market be affected by rising federal reserve interest rates – Rising Rates: How Will the Housing Market Be Affected? The Federal Reserve’s recent interest rate hikes have sent ripples through the financial world, and the housing market is no exception. As borrowing costs increase, potential homebuyers face a new reality: higher mortgage payments.

This shift could have a profound impact on affordability, demand, and even the value of homes.

The impact of rising interest rates on the housing market is a complex topic, with implications that extend far beyond the cost of borrowing. This article will explore the potential consequences of these rate hikes, examining how they could influence everything from housing demand and supply to overall economic growth.

Impact on Mortgage Rates

The Federal Reserve’s actions directly impact mortgage rates, as they influence the cost of borrowing for banks and lenders. When the Federal Reserve raises interest rates, it becomes more expensive for banks to borrow money, which in turn leads to higher mortgage rates for borrowers.

Relationship between Federal Reserve Interest Rates and Mortgage Rates

The Federal Reserve’s benchmark interest rate, known as the federal funds rate, serves as a guide for other interest rates in the economy. When the Federal Reserve raises the federal funds rate, banks tend to increase their lending rates, including mortgage rates.

This is because they need to compensate for the higher cost of borrowing money.

The Federal Reserve’s recent interest rate hikes are already impacting the housing market, making mortgages more expensive and potentially slowing down sales. This, combined with the recent bank turmoil, like the bank turmoil results in 72 billion loss of deposits for first republic , could further dampen buyer enthusiasm and lead to a more cautious approach to real estate investments.

The ripple effects of these economic events are still unfolding, but it’s clear that the housing market is in for a bumpy ride.

Comparison with Historical Trends

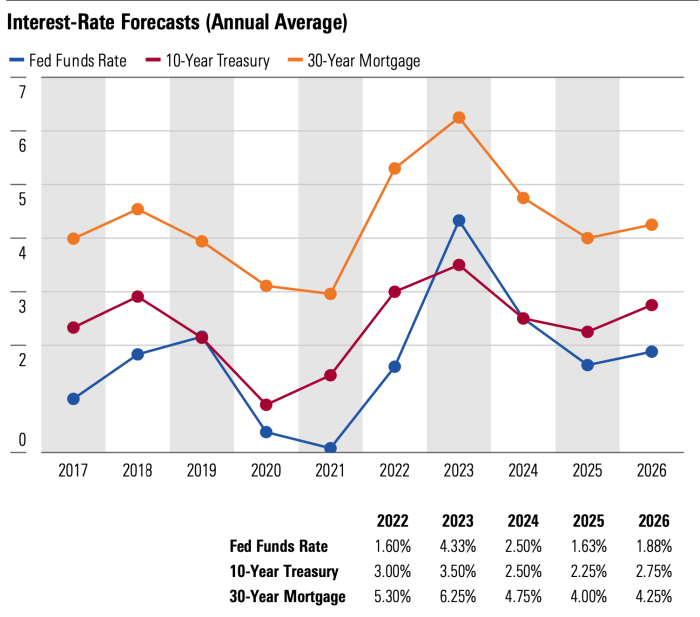

Mortgage rates have fluctuated significantly throughout history, influenced by various factors including economic conditions, inflation, and Federal Reserve policy. In recent years, mortgage rates have been relatively low, but they have risen sharply in 2022 and 2023, following the Federal Reserve’s efforts to combat inflation.

The rising federal reserve interest rates will likely impact the housing market in a significant way, making it more expensive for buyers to obtain mortgages. This could lead to a slowdown in home sales and a decrease in home values.

It’s interesting to see how this plays out against the backdrop of the blockchain space, where figures like Gavin Wood are exploring innovative ways to streamline transactions and enhance efficiency. The potential for blockchain technology to revolutionize the real estate market, particularly in the realm of gavin wood chain mergers and acquisitions , could offer some intriguing solutions for the challenges posed by rising interest rates.

Different Mortgage Types and Their Sensitivity to Interest Rate Changes

Different types of mortgages have varying levels of sensitivity to interest rate changes. For example, fixed-rate mortgages offer borrowers a fixed interest rate for the duration of the loan, providing stability and predictability. In contrast, adjustable-rate mortgages (ARMs) have interest rates that can fluctuate based on a benchmark index, such as the London Interbank Offered Rate (LIBOR).

ARMs can offer lower initial interest rates but may become more expensive if interest rates rise significantly.

Impact on Affordability for Prospective Homebuyers

Rising mortgage rates have a significant impact on affordability for prospective homebuyers. As mortgage rates increase, the monthly mortgage payment for a given loan amount becomes higher. This can make it challenging for some buyers to qualify for a mortgage or afford the desired home.

For example, a 1% increase in the mortgage rate can result in a substantial increase in the monthly payment, potentially making a home purchase less attainable.

Housing Demand and Supply: How Will The Housing Market Be Affected By Rising Federal Reserve Interest Rates

Rising interest rates have a significant impact on the housing market by affecting both demand and supply. As interest rates rise, the cost of borrowing money increases, making it more expensive for potential homebuyers to finance a mortgage. This can lead to a decrease in demand, as buyers become more hesitant to purchase homes due to higher monthly payments.

Impact of Higher Interest Rates on Housing Demand

Higher interest rates directly influence housing demand by increasing the cost of borrowing for mortgages. As a result, potential buyers face higher monthly payments, which can significantly impact their affordability. This can lead to several consequences:

- Reduced purchasing power:Higher interest rates reduce the amount of money buyers can borrow, leading to a decrease in their purchasing power. This can make it challenging for buyers to afford homes within their desired price range, especially in competitive markets.

- Increased borrowing costs:The higher interest rates translate into higher monthly mortgage payments, putting a strain on buyers’ budgets. This can make it difficult for some buyers to qualify for a mortgage or choose to delay their home purchase until rates stabilize.

- Shift in buyer preferences:Higher interest rates can also lead to a shift in buyer preferences. Some buyers may opt for smaller or less expensive homes to manage affordability concerns. Others might consider delaying homeownership altogether, leading to a decrease in demand.

Factors Influencing Housing Supply

The supply of homes available for sale is influenced by several factors, including:

- Construction activity:Rising interest rates can impact the cost of construction materials and labor, making it more expensive for builders to develop new homes. This can lead to a decrease in new construction, limiting the supply of homes in the market.

- Existing home inventory:Higher interest rates can also influence the supply of existing homes. Some homeowners may be reluctant to sell their homes if they believe they can secure a lower interest rate in the future. This can result in a lower inventory of homes available for sale, further contributing to affordability challenges.

- Economic conditions:The overall economic climate can also influence housing supply. During periods of economic uncertainty or recession, builders may be less inclined to start new projects, while homeowners may be hesitant to sell their homes due to concerns about market stability.

Potential Shift in Buyer Preferences

Rising interest rates can lead to a shift in buyer preferences as affordability becomes a primary concern. This shift can manifest in several ways:

- Preference for smaller homes:Buyers may prioritize smaller or less expensive homes to manage affordability concerns. This can lead to increased demand for starter homes or condos, while demand for larger, more expensive homes may decrease.

- Shift towards more affordable locations:Some buyers may consider relocating to more affordable areas outside of major metropolitan areas to find homes within their budget. This can lead to a shift in demand patterns, impacting housing markets in different regions.

- Increased interest in rental properties:As homeownership becomes less affordable, some buyers may opt for renting instead. This can lead to an increase in demand for rental properties, potentially driving up rental costs.

Impact of Rising Rates on the Pace of Home Sales

Higher interest rates can significantly impact the pace of home sales. As affordability becomes a concern, the number of buyers willing to purchase homes can decline, leading to a slowdown in sales activity. This can manifest in several ways:

- Reduced demand:Fewer buyers are willing to purchase homes due to affordability concerns, leading to a decrease in overall demand.

- Longer time on market:Homes may take longer to sell as fewer buyers are actively looking to purchase. This can lead to an increase in inventory and potential price adjustments to attract buyers.

- Increased competition among sellers:With fewer buyers in the market, sellers may face more competition to attract potential buyers. This can lead to price adjustments or more concessions to incentivize sales.

Housing Prices and Market Values

The impact of rising interest rates on housing prices is a complex issue with potential implications for different market segments and the overall housing market value. As interest rates increase, the cost of borrowing money for a mortgage becomes more expensive, which can affect housing demand, affordability, and ultimately, prices.

Impact on Housing Prices in Different Market Segments

The impact of rising rates on housing prices can vary significantly across different market segments. For example, the impact on luxury homes, which are often purchased by cash buyers or individuals with strong credit scores, might be less pronounced than the impact on entry-level homes, which are more susceptible to affordability constraints.

- Luxury Homes:These homes are often less affected by rising rates as they are typically purchased by individuals with substantial financial resources who are less sensitive to interest rate fluctuations. They may be less reliant on mortgage financing, and their purchasing decisions are often driven by factors other than affordability, such as lifestyle choices or investment opportunities.

- Entry-Level Homes:These homes are particularly vulnerable to rising rates as they are typically purchased by first-time homebuyers who rely heavily on mortgage financing. The increased cost of borrowing can significantly impact their affordability and reduce their purchasing power, leading to decreased demand and potentially lower prices.

- Mid-Range Homes:The impact on mid-range homes can vary depending on factors such as location, market conditions, and the specific characteristics of the homes. In some cases, mid-range homes may experience a more moderate impact than entry-level homes, while in other cases, they may be more affected than luxury homes.

Rising interest rates are a double-edged sword for the housing market. While they make borrowing more expensive, slowing demand and potentially causing prices to cool, they also make investing in assets like real estate more attractive. This is a similar dynamic to what we’re seeing with Amazon, where amazons stock falls despite strong revenue as cloud growth slows due to concerns about slowing growth in the cloud computing sector.

Ultimately, the housing market’s trajectory will depend on a complex interplay of factors, including interest rate movements, inflation, and consumer confidence.

Potential Scenarios for Price Appreciation, Depreciation, or Stabilization

The potential impact of rising rates on housing prices can be categorized into three scenarios: price appreciation, depreciation, or stabilization.

- Price Appreciation:In some cases, housing prices may continue to appreciate despite rising interest rates. This could occur if factors such as strong economic growth, limited housing supply, or high demand outweigh the impact of higher borrowing costs. For example, in a market with limited housing inventory and a strong economy, demand may remain robust, potentially supporting price growth even with higher interest rates.

- Price Depreciation:In other cases, housing prices may depreciate due to rising interest rates. This is more likely to occur in markets with oversupply, weak economic conditions, or a decline in demand. For instance, if a market experiences a surge in new construction, resulting in an oversupply of homes, and the economy weakens, leading to job losses and reduced demand, housing prices may decline.

- Stabilization:Housing prices may also stabilize in response to rising interest rates. This scenario suggests that the impact of higher borrowing costs is offset by other factors, such as moderate economic growth, balanced supply and demand, or a combination of these factors.

For example, if a market experiences a period of steady economic growth and a stable supply of housing, the impact of rising interest rates may be muted, resulting in a stabilization of prices.

Impact of Higher Rates on the Overall Housing Market Value, How will the housing market be affected by rising federal reserve interest rates

Rising interest rates can have a significant impact on the overall housing market value. As interest rates increase, the cost of borrowing money for a mortgage becomes more expensive, which can reduce demand and potentially lower prices. This can lead to a decrease in the overall value of the housing market, as homeowners may experience a decline in the value of their properties.

- Reduced Demand:Higher interest rates can make it more expensive for potential homebuyers to qualify for a mortgage or afford the monthly payments. This can lead to a decrease in demand, which can put downward pressure on prices.

- Lower Prices:When demand decreases, sellers may be forced to lower their asking prices to attract buyers. This can lead to a decline in the overall value of the housing market.

- Negative Equity:If the value of a home drops below the amount owed on the mortgage, homeowners may find themselves in a situation of negative equity. This can make it difficult to sell the home or refinance the mortgage.

Historical Trends in Housing Prices During Periods of Rising Interest Rates

Historical trends suggest that rising interest rates can have a significant impact on housing prices.

For example, during the 1970s and early 1980s, interest rates rose to record highs, leading to a decline in housing prices. Similarly, during the 2006-2008 housing crisis, rising interest rates contributed to a significant decline in home values.

Impact on Investors and Real Estate Market

Rising interest rates can significantly impact real estate investment strategies, influencing investor decisions and potentially leading to shifts in market dynamics. Understanding these impacts is crucial for investors to navigate the evolving market landscape effectively.

Impact on Real Estate Investment Strategies

Rising interest rates directly affect the cost of borrowing for real estate investments. Higher rates increase the cost of mortgages, making it more expensive to finance property purchases. This can lead to a decrease in demand for investment properties, particularly for those who rely heavily on financing.

- Reduced Leverage:As interest rates rise, investors may find it challenging to leverage their investments effectively. This can limit their ability to acquire multiple properties or expand their portfolios, potentially impacting their overall returns.

- Shift Towards Value-Oriented Strategies:Rising rates can encourage investors to shift towards value-oriented strategies, focusing on properties with strong cash flow potential and lower acquisition costs. This may involve seeking out properties in more affordable markets or focusing on renovations and improvements to enhance property value.

- Increased Focus on Due Diligence:In a rising rate environment, thorough due diligence becomes even more critical. Investors must carefully analyze property valuations, rental income potential, and potential risks before making any investment decisions.

Potential Shifts in Investment Preferences

Rising interest rates can influence investor preferences towards different asset classes. As the cost of borrowing increases, investors may consider alternatives that offer potentially higher returns or lower risk.

- Shift Towards Equities:Historically, equities have been considered a potentially more attractive investment option during periods of rising interest rates. This is because stock prices tend to be less sensitive to interest rate changes compared to real estate, and equity markets can benefit from economic growth.

- Increased Interest in Fixed Income:Higher interest rates can make fixed income investments, such as bonds, more appealing. This is because investors can earn higher yields on their investments, potentially offsetting some of the impact of inflation.

- Diversification Strategies:Investors may consider diversifying their portfolios across various asset classes to mitigate risk. This could involve allocating a portion of their investments to real estate, equities, and fixed income, aiming to balance potential returns and risks.

Impact on Profitability of Rental Properties

Rising interest rates can impact the profitability of rental properties in several ways.

- Increased Financing Costs:Higher interest rates increase mortgage payments, potentially reducing the cash flow generated by rental properties.

- Potential Rent Increases:Landlords may need to increase rents to offset rising financing costs and maintain profitability. However, this can lead to challenges in attracting and retaining tenants, especially in a competitive rental market.

- Impact on Property Values:Rising rates can potentially lead to a decline in property values, impacting the overall return on investment for rental property owners.

Strategies for Investors to Navigate the Changing Market Conditions

Investors can adopt various strategies to navigate the changing market conditions brought about by rising interest rates.

- Focus on Cash Flow:Prioritizing properties with strong cash flow potential can help investors weather market fluctuations and maintain profitability. This involves carefully evaluating rental income, expenses, and vacancy rates.

- Consider Value-Add Opportunities:Investing in properties that require renovations or improvements can potentially offer higher returns. By adding value to a property, investors can increase its rental income potential and potentially enhance its market value.

- Strategic Debt Management:Managing debt effectively is crucial in a rising rate environment. Investors may consider refinancing existing loans to secure lower interest rates or exploring alternative financing options, such as private loans or hard money loans.

- Diversification:Diversifying investments across different property types, locations, and asset classes can help mitigate risk and potentially enhance returns. This could involve investing in single-family homes, multifamily properties, commercial real estate, or even REITs.

- Long-Term Perspective:It’s essential for investors to maintain a long-term perspective and avoid making impulsive decisions based on short-term market fluctuations. Real estate markets tend to cycle, and investors who remain patient and focused on their long-term goals are better positioned to navigate market challenges.

Economic Implications and Market Outlook

Rising interest rates can have a significant impact on the overall economy, influencing various aspects such as economic growth, employment, and consumer spending. Understanding these implications is crucial for assessing the potential risks and opportunities for the housing market in the short and long term.

Impact on Economic Growth

Rising interest rates can act as a brake on economic growth by increasing the cost of borrowing for businesses and consumers. Higher borrowing costs can lead to reduced investment and spending, slowing down economic activity. This can have a ripple effect across various sectors, potentially impacting employment levels and consumer confidence.

For example, a company planning to expand its operations may reconsider its investment plans if borrowing costs become too high.

Impact on Employment and Consumer Spending

Rising interest rates can impact employment in various ways. Higher borrowing costs for businesses can lead to reduced hiring or even layoffs as companies adjust to the changing economic landscape. Additionally, rising mortgage rates can make it more challenging for individuals to purchase homes, potentially slowing down the housing market and impacting related industries such as construction and real estate.

Consumer spending can also be affected, as individuals may choose to save more and spend less due to higher borrowing costs.

Potential Risks and Opportunities for the Housing Market

Rising interest rates can present both risks and opportunities for the housing market. One potential risk is a decline in housing demand as affordability becomes a greater concern for potential buyers. This could lead to a slowdown in price growth or even price corrections in some areas.

However, rising interest rates can also create opportunities for investors seeking to acquire properties at potentially lower prices. In addition, the increased cost of borrowing could lead to a decrease in new construction, potentially creating a shortage of housing supply in the long term.