High Mortgage Rates Put Homebuilders in a Tight Spot

High Mortgage Rates Put Homebuilders in a Tight Spot as high mortgage rates impact new construction, and it’s creating a challenging landscape for those in the housing market. The recent surge in mortgage rates has significantly impacted affordability, leading to a decrease in demand for new homes.

This trend has created a ripple effect throughout the industry, forcing homebuilders to navigate a complex set of challenges.

The combination of rising mortgage rates and increased costs for materials and labor has squeezed profit margins for homebuilders. Many are finding it difficult to compete in a market where buyers are increasingly hesitant to commit to a large financial investment.

The shift in consumer sentiment is evident in the declining numbers of new home sales and construction starts. This has led to a slowdown in the housing market, forcing builders to adapt their strategies to stay afloat.

Rising Mortgage Rates and Their Impact: Homebuilders In A Tight Spot As High Mortgage Rates Impact New Construction

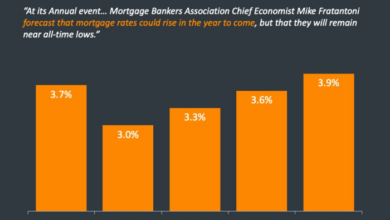

The recent surge in mortgage rates has cast a shadow over the housing market, particularly for new home construction. This shift in the financial landscape has significantly impacted affordability, leading to a slowdown in demand and a decline in new home sales and construction starts.

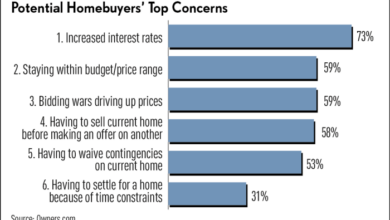

Impact on Affordability

Rising mortgage rates have directly impacted affordability, making it more expensive to finance a new home. As rates climb, monthly mortgage payments increase, reducing the amount of money potential homebuyers can afford to spend on a property. This affordability squeeze has become a major concern for those seeking to enter the housing market, especially first-time buyers.

For example, a 30-year fixed-rate mortgage with a 5% interest rate on a $300,000 loan would result in a monthly payment of $1,610. However, if the interest rate rises to 7%, the monthly payment jumps to $2,012, representing a significant increase of $402 per month.

This increase in monthly payments can significantly impact a household’s budget and limit the purchase price of a home within their affordability range.

Impact on Demand for New Homes

The rise in mortgage rates has led to a decrease in demand for new homes. As affordability challenges grow, potential homebuyers are becoming more hesitant to take on large mortgage loans, especially with rising interest rates. This decline in demand has impacted the new home construction industry, leading to a slowdown in sales and a decrease in construction starts.

Decline in New Home Sales and Construction Starts, Homebuilders in a tight spot as high mortgage rates impact new construction

Data from the National Association of Home Builders (NAHB) reveals a significant decline in new home sales and construction starts. In 2022, new home sales plummeted by 16.4% compared to the previous year, marking the sharpest decline since 2009.

Similarly, housing starts, which represent the number of new homes that are being built, also experienced a significant drop, falling by 10.5% in 2022. These figures underscore the impact of rising mortgage rates on the new home construction market. As rates continue to climb, the affordability challenges for potential homebuyers are likely to persist, potentially leading to further declines in demand and construction activity.

Homebuilders are facing a double whammy right now: high mortgage rates are already making new construction less appealing to buyers, and the fallout from the FTX bankruptcy crypto sell-off impact is adding another layer of uncertainty to the market. With investors pulling back from riskier assets, including real estate, it’s a tough time to be in the business of building new homes.

It’s a tough time to be a homebuilder. High mortgage rates are making it difficult for people to afford new homes, and the construction industry is feeling the pinch. Meanwhile, amazon invests 120 million in satellite processing hub at nasas kennedy space center in florida , showing a commitment to innovation and expansion that stands in stark contrast to the current housing market.

This kind of investment signals confidence in the future, which is a welcome change of pace for those who are struggling to find buyers in the current climate.

It’s tough out there for homebuilders right now. High mortgage rates are making it harder for people to afford new homes, which is putting a real dent in construction activity. To understand the bigger picture, I recommend checking out federal reserve focus a weekly update on economic developments for insights on the broader economic forces at play.

The Fed’s actions are directly impacting interest rates, which in turn influence the housing market. It’s a complex situation, but staying informed is key to navigating these turbulent times for homebuilders.