Global Markets: Stocks Steady, Dollar Weak Ahead of US Data

Global markets stocks steady dollar holds low ahead of us data – Global Markets: Stocks Steady, Dollar Weak Ahead of US Data sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with personal blog style and brimming with originality from the outset.

The global markets are in a state of flux, with investors cautiously navigating a landscape of economic uncertainty. While stocks have shown surprising resilience, the dollar has been struggling to maintain its strength, holding steady at a relatively low position.

This dynamic is likely to be influenced by upcoming US economic data releases, which could send ripples across the global financial landscape.

The current market stability can be attributed to a confluence of factors, including strong corporate earnings, a resilient consumer sector, and a steady flow of liquidity from central banks. However, the ongoing trade tensions, geopolitical risks, and concerns about slowing global growth continue to cast a shadow over investor sentiment.

The dollar’s weakness is primarily driven by the Federal Reserve’s dovish stance on interest rates and the widening trade deficit. The relationship between the dollar and global market sentiment is complex, with a weaker dollar often boosting demand for emerging market assets and commodities, while a stronger dollar can dampen global economic growth.

Global Market Overview

Global markets are exhibiting a cautious tone, with major indices trading in a narrow range as investors digest recent economic data and await further cues on the path of interest rates. The dollar remains relatively stable, holding near recent lows, reflecting a balance between concerns about the US economy and expectations for a potential pause in interest rate hikes.

While global markets saw stocks steady and the dollar hold low ahead of key US economic data releases, there’s a different kind of economic boom happening in the entertainment industry. The live events sector is thriving, with superstars like Taylor Swift and Beyoncé leading the charge, as fans flock to see their idols in person.

This resurgence in live entertainment is a welcome sign for the economy, injecting a much-needed dose of excitement and revenue, even as investors wait with bated breath for the latest economic indicators.

Major Indices Performance

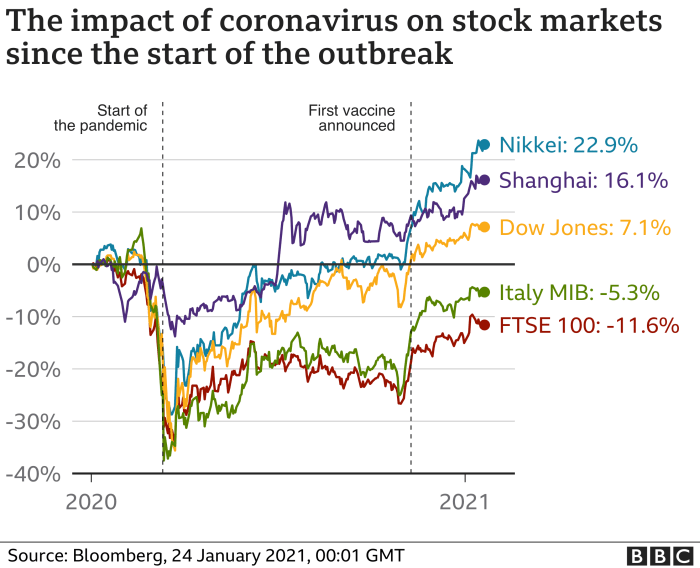

The performance of major indices is mixed, reflecting the cautious sentiment in the market. The S&P 500, a benchmark for US stocks, is trading slightly lower, while the tech-heavy Nasdaq Composite is showing modest gains. European markets are also experiencing mixed performance, with the FTSE 100 in London trading higher, while the DAX in Germany is slightly lower.

Asian markets closed mostly higher, driven by optimism about China’s economic recovery.

Global markets are holding steady today, with the dollar remaining low ahead of the release of crucial US data. This comes as the Senate’s most prominent advocate for cryptocurrency, known as the “Crypto Queen,” has unveiled a far-reaching new bill focused on Bitcoin , which could have a significant impact on the digital asset landscape.

It remains to be seen how this development will influence the broader market sentiment and the direction of the dollar in the coming days.

Investor Sentiment and Market Volatility

Investor sentiment is currently characterized by uncertainty and a wait-and-see approach. Recent economic data, including inflation readings and manufacturing activity, have provided mixed signals about the health of the global economy. This has led to increased volatility in the markets, with investors adjusting their positions based on the latest developments.

Factors Influencing Market Direction

The global market direction is being influenced by several factors, including:

- Interest Rate Expectations:The Federal Reserve’s monetary policy stance remains a key driver of market sentiment. Investors are closely monitoring the Fed’s communication for clues on the future path of interest rates. A potential pause in rate hikes could boost risk appetite, while further increases could weigh on equity markets.

Global markets seem to be holding steady, with stocks trading sideways and the dollar remaining low ahead of crucial US economic data releases. This cautious optimism might be linked to the recent stock market optimism as federal reserve hints at rate hike pause , which could signal a potential shift in monetary policy.

The market’s reaction to the upcoming data will be crucial in determining the next steps for global investors and the direction of the dollar.

- Inflation:Inflation remains a major concern for investors, as central banks continue to battle rising prices. While inflation has shown signs of cooling in some economies, it remains elevated in others, leading to uncertainty about the outlook for economic growth.

- Geopolitical Risks:The ongoing war in Ukraine and tensions between the US and China continue to create geopolitical uncertainty. These risks can impact investor confidence and lead to market volatility.

- Economic Data:Economic data releases, such as inflation readings, manufacturing activity, and employment figures, are closely watched by investors for insights into the health of the global economy. These data points can influence market sentiment and investment decisions.

Stock Market Stability: Global Markets Stocks Steady Dollar Holds Low Ahead Of Us Data

Global stock markets have displayed remarkable resilience in recent times, defying expectations of a significant downturn amidst a challenging economic environment. This stability can be attributed to a confluence of factors, including robust corporate earnings, accommodative monetary policies, and a gradual easing of inflation concerns.

Factors Contributing to Stock Market Stability

Several key factors have contributed to the steady performance of global stocks. These include:

- Strong Corporate Earnings:Many companies have reported strong earnings, driven by factors such as resilient consumer spending, increased business investment, and supply chain improvements. These positive earnings reports have boosted investor confidence and supported stock valuations.

- Accommodative Monetary Policies:Central banks in major economies have maintained accommodative monetary policies, keeping interest rates low and providing ample liquidity in the financial system. This has helped to support borrowing costs for businesses and encourage investment, contributing to stock market stability.

- Easing Inflation Concerns:Inflation rates have begun to moderate in several economies, signaling a potential easing of inflationary pressures. This has alleviated concerns about aggressive interest rate hikes and their potential impact on economic growth, thereby supporting stock market sentiment.

Key Sectors Driving Stock Market Stability

While the overall market has shown resilience, certain sectors have outperformed others, playing a significant role in driving stock market stability. These sectors include:

- Technology:The technology sector has continued to perform well, driven by strong demand for software, cloud computing, and artificial intelligence solutions. The sector’s growth prospects remain robust, supported by ongoing technological advancements and digital transformation initiatives.

- Healthcare:The healthcare sector has benefited from a steady demand for medical services and pharmaceuticals, as well as ongoing innovation in areas such as biotechnology and drug development. The sector’s long-term growth potential is underpinned by an aging global population and increasing healthcare expenditures.

- Consumer Discretionary:The consumer discretionary sector has seen strong growth, driven by pent-up demand for travel, entertainment, and other discretionary goods and services. This sector’s performance reflects the recovery in consumer confidence and spending following the pandemic.

Impact of Economic Indicators and Geopolitical Events

Economic indicators and geopolitical events can have a significant impact on stock prices.

- Economic Indicators:Key economic indicators, such as inflation, unemployment rates, and GDP growth, provide insights into the overall health of the economy. Positive economic data tends to boost investor confidence and support stock market valuations. Conversely, negative economic data can lead to market volatility and declines.

- Geopolitical Events:Geopolitical events, such as wars, trade disputes, and political instability, can create uncertainty and volatility in the market. These events can impact investor sentiment and lead to shifts in capital flows, influencing stock prices.

Dollar Strength and Weakness

The dollar’s relatively low position can be attributed to a combination of factors, including a softening US economy, concerns about rising interest rates, and the relative strength of other major currencies.

Dollar Strength Compared to Historical Trends

The dollar’s current strength can be compared to historical trends to understand its potential implications. For instance, during periods of economic uncertainty, the dollar often appreciates as investors seek safe haven assets. However, prolonged periods of dollar strength can negatively impact US exports and potentially lead to inflation.

Relationship Between the Dollar’s Value and Global Market Sentiment

The value of the dollar is closely tied to global market sentiment. When investors are optimistic about the global economy, they tend to invest in riskier assets, leading to a weaker dollar. Conversely, during periods of risk aversion, investors flock to safe-haven assets like the dollar, driving its value higher.

Anticipation of US Economic Data

The upcoming week is packed with crucial US economic data releases that will provide valuable insights into the health of the US economy and potentially influence market sentiment. Investors and analysts are eagerly awaiting these releases, as they can shed light on inflation, consumer spending, and the Federal Reserve’s future monetary policy decisions.

Impact of Key Economic Data Releases

These data releases can significantly impact market sentiment and investor behavior. Positive economic data, such as a decline in inflation or strong job growth, can boost investor confidence and lead to a rise in stock prices. Conversely, negative data, such as a rise in unemployment or a slowdown in economic growth, can trigger a sell-off in the market.

Key Data Releases to Watch

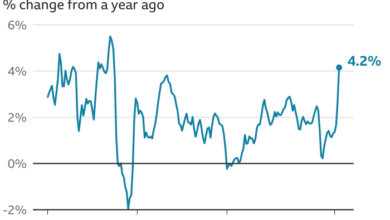

- Consumer Price Index (CPI):This index measures the change in prices paid by urban consumers for a basket of goods and services. A lower-than-expected CPI reading would suggest that inflation is easing, which could lead to a less aggressive stance by the Federal Reserve on interest rate hikes.

- Producer Price Index (PPI):This index measures the change in prices received by domestic producers for their output. A lower-than-expected PPI reading would indicate that inflation is moderating at the wholesale level, which could further support expectations of a less aggressive Fed.

- Retail Sales:This report measures the total value of sales at retail stores. Strong retail sales figures would suggest that consumer spending remains robust, indicating a healthy economy.

- Industrial Production:This report measures the output of factories, mines, and utilities. A rise in industrial production would signal that the manufacturing sector is expanding, which could be positive for the overall economy.

Market Reactions to Data Releases

The market’s reaction to economic data releases is often driven by how the data aligns with expectations. If the data comes in better than expected, it can lead to a positive market reaction, with stock prices rising and the dollar strengthening.

Conversely, if the data comes in worse than expected, it can lead to a negative market reaction, with stock prices falling and the dollar weakening.

Example of Market Reactions

For instance, if the CPI reading comes in lower than expected, indicating that inflation is easing, investors might view this as a positive sign and buy stocks, pushing prices higher. Conversely, if the CPI reading comes in higher than expected, it could signal that inflation is more persistent, leading to concerns about further interest rate hikes by the Fed and potentially causing investors to sell stocks, pushing prices lower.

Global Market Outlook

The global market landscape remains a mixed bag, with a multitude of factors influencing investor sentiment and asset prices. While some sectors show resilience, others face headwinds, making a clear-cut prediction for the near future challenging.

Short-Term Outlook

The global market outlook for the short term is characterized by uncertainty, driven by geopolitical tensions, persistent inflation, and central bank monetary policy tightening. While stock markets have shown some resilience, the potential for further volatility remains high.

- Geopolitical Tensions:The ongoing conflict in Ukraine, escalating tensions between the US and China, and other geopolitical uncertainties create an environment of heightened risk aversion among investors. These factors can lead to market fluctuations and potentially impact global trade and supply chains.

- Inflation and Interest Rates:Persistent inflation remains a significant concern, prompting central banks worldwide to continue raising interest rates to curb price pressures. This tightening monetary policy can slow economic growth and impact corporate earnings, potentially leading to market corrections.

- Economic Slowdown:The global economy is facing headwinds from high inflation, rising interest rates, and supply chain disruptions. These factors could lead to a slowdown in economic growth, impacting corporate earnings and investor sentiment.

Potential Risks and Opportunities, Global markets stocks steady dollar holds low ahead of us data

The current market environment presents both risks and opportunities for investors.

- Risks:

- Market Volatility:The potential for sharp market fluctuations due to geopolitical events, economic data releases, and central bank policy decisions remains high.

- Recession:The risk of a global recession is increasing due to high inflation, rising interest rates, and supply chain disruptions. This could lead to a decline in corporate earnings and asset prices.

- Inflation:Persistent inflation could erode purchasing power and corporate profits, impacting investor sentiment and asset valuations.

- Opportunities:

- Value Stocks:As interest rates rise, value stocks, which are typically undervalued by the market, may become more attractive to investors seeking higher returns.

- Defensive Sectors:Sectors like healthcare and consumer staples, which tend to be less sensitive to economic cycles, may offer some protection during periods of market uncertainty.

- Emerging Markets:Emerging markets may offer attractive growth opportunities as they benefit from global economic expansion and rising consumer demand.

Strategies for Navigating Market Conditions

Given the current market environment, investors should consider the following strategies:

- Diversification:Spreading investments across different asset classes, sectors, and geographies can help reduce portfolio risk and mitigate the impact of market fluctuations.

- Long-Term Perspective:Maintaining a long-term investment horizon can help investors weather short-term market volatility and benefit from the long-term growth potential of the markets.

- Risk Management:Implementing risk management strategies, such as setting stop-loss orders and monitoring portfolio performance, can help protect investments from significant losses.

- Professional Advice:Consulting with a financial advisor can provide personalized investment advice and help develop a comprehensive investment strategy tailored to individual risk tolerance and financial goals.