Global Market Update: Inflation Worries & Earnings Season Impact

Global market update inflation worries and earnings season impact – The global market is in a state of flux, with inflation worries and the recent earnings season taking center stage. This combination of factors is creating a complex and dynamic landscape for investors and businesses alike. Inflation, fueled by supply chain disruptions and robust consumer demand, is eroding purchasing power and forcing companies to grapple with rising costs.

Meanwhile, the recent earnings season has provided a glimpse into how businesses are navigating these challenging conditions, offering insights into their resilience and future prospects.

This article delves into the current state of the global market, examining the impact of inflation worries and the latest earnings season. We’ll explore how these factors are influencing investor sentiment, business strategies, and the overall economic outlook. Join me as we unpack these key developments and their implications for the future.

Global Market Overview

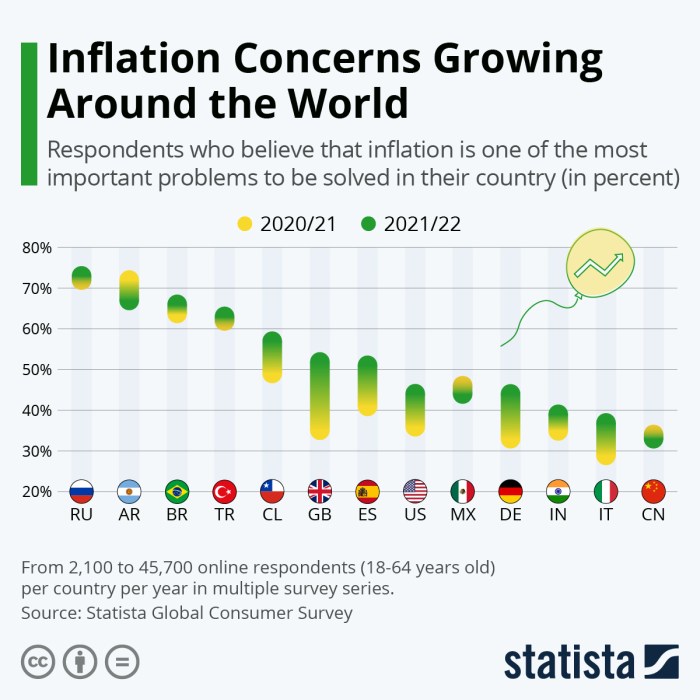

Global markets are currently navigating a complex landscape, marked by persistent inflation concerns, fluctuating economic growth prospects, and ongoing geopolitical tensions. While recent data suggests a possible peak in inflation, concerns remain about its stickiness and the potential for central banks to tighten monetary policy further.

Economic growth forecasts are being revised downwards as the global economy faces headwinds from rising interest rates, supply chain disruptions, and the war in Ukraine. Geopolitical risks, particularly the ongoing conflict in Ukraine and its implications for energy and food security, continue to add volatility to markets.

The global market update continues to be a rollercoaster ride, with inflation worries and earnings season impact keeping investors on edge. It’s fascinating to hear perspectives from leading voices in the tech world, like Vitalik Buterin, Ethereum’s co-founder, who recently discussed the future of crypto on Bloomberg’s Studio 10 bloombergs studio 10 ethereum co founder vitalik buterin.

His insights offer a valuable lens through which to analyze the broader economic landscape, reminding us that innovation and adaptation are crucial for navigating these turbulent times.

Key Factors Influencing Market Sentiment

The current market sentiment is shaped by a confluence of factors, each contributing to a volatile and uncertain environment.

The global market is still grappling with inflation worries and the impact of earnings season, making it a tough time for many. But amidst the economic uncertainty, there’s a looming deadline that many have been waiting for: the resumption of federal student loan payments.

If you’re one of the millions affected, check out this helpful federal student loan payments resuming guide for guidance on the process. With the return of payments, it’s even more important to stay informed about economic trends and how they might impact your financial situation.

- Inflation: Inflation remains a primary concern for investors, as central banks worldwide grapple with rising prices. While inflation has shown signs of easing in some regions, the persistence of price pressures and the potential for further interest rate hikes are causing anxiety.

- Economic Growth: Global economic growth prospects have dimmed in recent months, with concerns about a potential recession in some major economies. Rising interest rates, persistent supply chain disruptions, and the war in Ukraine are weighing on economic activity.

- Geopolitical Tensions: Geopolitical risks, particularly the war in Ukraine and its implications for energy and food security, are adding to market volatility.

The conflict has disrupted global supply chains, driven up energy prices, and fueled uncertainty about the global economic outlook.

Inflation Worries and Their Impact: Global Market Update Inflation Worries And Earnings Season Impact

Inflation remains a significant concern for global markets, driven by a complex interplay of factors. This ongoing rise in prices is impacting businesses and consumers alike, leading to adjustments in strategies and behaviors.

Impact on Businesses

Rising input costs, including raw materials, energy, and labor, are putting pressure on businesses’ profit margins. Many companies are struggling to absorb these increased expenses, leading to several coping mechanisms.

- Price Increases:Passing on higher costs to consumers through price increases is a common strategy. However, this can lead to decreased demand, especially if consumers are already feeling the pinch of inflation.

- Cost Optimization:Businesses are exploring ways to reduce costs, such as streamlining operations, negotiating better deals with suppliers, and investing in automation to improve efficiency.

- Product and Service Adjustments:Some businesses are adjusting their product offerings to reduce costs. This might involve offering smaller package sizes, substituting cheaper ingredients, or focusing on higher-margin products.

Impact on Consumers

Consumers are facing a challenging economic environment with rising prices for essential goods and services. This has led to several changes in consumer behavior.

- Reduced Spending:Many consumers are cutting back on discretionary spending to manage their budgets. This is particularly evident in sectors like travel, entertainment, and dining.

- Shifting Spending Patterns:Consumers are prioritizing essential items and seeking out value-for-money alternatives. This has led to an increase in demand for private label brands and discount retailers.

- Increased Savings:Some consumers are saving more to prepare for potential economic uncertainties or to offset the impact of inflation on their finances.

Earnings Season Analysis

The recent earnings season provided insights into the resilience and adaptability of businesses amidst persistent inflation and economic uncertainty. While some sectors demonstrated strength and outperformance, others faced challenges, reflecting the diverse impact of macroeconomic factors on different industries.

Performance Across Sectors

The earnings season revealed a mixed bag of results across various sectors. While some sectors, like technology and consumer discretionary, showcased strong growth driven by innovation and pent-up demand, others, such as energy and materials, faced headwinds from slowing global growth and commodity price fluctuations.

- Technology: The tech sector continued to impress, with companies like Apple and Microsoft reporting strong revenue growth driven by cloud computing, software subscriptions, and robust demand for consumer electronics. This sector benefited from its ability to adapt to changing consumer behavior and capitalize on emerging technologies.

- Consumer Discretionary: Companies in the consumer discretionary sector, including retailers and automakers, also witnessed strong earnings growth, fueled by pent-up demand and consumer spending. However, rising inflation and supply chain disruptions posed challenges for these businesses.

- Energy: The energy sector faced a more complex landscape, with volatile oil and gas prices impacting profitability. While high energy prices boosted earnings for some companies, others faced challenges due to increased production costs and uncertainties in global energy markets.

- Materials: The materials sector, encompassing companies involved in mining, chemicals, and building materials, experienced mixed results. While some companies benefited from strong demand for commodities, others faced headwinds from rising input costs and slowing global construction activity.

Challenges and Opportunities

Companies navigating the current economic environment face several challenges and opportunities.

The global market is navigating a tricky landscape with inflation worries still lingering and the earnings season in full swing. Investors are keeping a close eye on how companies are managing rising costs and what it means for future growth.

Despite the headwinds, the stock market has shown surprising resilience, as seen in the recent stock market shows resilience in the face of ppi surge. This suggests that investors might be cautiously optimistic about the future, although the overall outlook remains uncertain.

- Inflation and Supply Chain Disruptions: Persistent inflation and ongoing supply chain disruptions continue to impact businesses, leading to increased input costs, reduced profit margins, and operational inefficiencies. Companies are actively seeking ways to mitigate these challenges, such as implementing cost-cutting measures, raising prices, and diversifying supply chains.

- Labor Market Dynamics: The tight labor market presents both challenges and opportunities for companies. While attracting and retaining skilled workers is crucial for growth, businesses also face pressure to increase wages to remain competitive. Companies are adapting by investing in employee training and development, offering flexible work arrangements, and focusing on employee well-being to attract and retain talent.

- Technological Advancements: Rapid technological advancements continue to reshape industries, creating both opportunities and challenges for companies. Businesses need to embrace innovation and invest in emerging technologies to remain competitive and enhance their offerings. This includes areas like artificial intelligence, automation, and data analytics, which can improve efficiency, enhance customer experiences, and unlock new revenue streams.

Impact on Investors and Businesses

Inflation worries and the performance of companies during earnings season are key factors shaping investor sentiment and investment strategies. Businesses, too, are adapting their operations and strategies to navigate the current economic landscape.

Investor Sentiment and Investment Strategies

The current economic environment has led investors to adopt a cautious approach. Inflation concerns have pushed investors to re-evaluate their portfolios and prioritize investments that can potentially offer protection against inflation. For example, some investors are shifting towards value stocks, which are companies that are undervalued relative to their earnings and assets, or investing in commodities, such as gold, as a hedge against inflation.

“Investors are increasingly seeking out companies with strong pricing power and resilient earnings streams, which are better positioned to navigate inflationary pressures,” said a leading financial analyst.

Here are some specific strategies investors are employing:

- Diversification:Investors are spreading their investments across different asset classes, including stocks, bonds, real estate, and commodities, to reduce risk and enhance portfolio resilience.

- Value Investing:Investors are focusing on companies with strong fundamentals and undervalued assets, anticipating potential growth in the future.

- Inflation-Hedged Investments:Investors are seeking investments that can potentially protect their portfolio value from inflation, such as commodities, real estate, and inflation-linked bonds.

Business Operations and Strategies, Global market update inflation worries and earnings season impact

Businesses are responding to inflation and earnings season pressures by implementing various operational and strategic adjustments. These adjustments aim to improve efficiency, mitigate cost increases, and maintain profitability.

- Cost Management:Businesses are scrutinizing their expenses, seeking opportunities for cost reduction, and exploring alternative suppliers to minimize price increases.

- Price Optimization:Companies are carefully evaluating price increases to balance maintaining profitability and avoiding customer dissatisfaction.

- Innovation and Diversification:Businesses are investing in research and development to introduce new products and services that can meet evolving customer needs and generate new revenue streams.

Outlook for the Future

Predicting the future of the global market is always a complex task, but considering current trends and economic indicators, we can make some informed observations about the potential trajectory in the coming months. The global market will likely be shaped by a combination of factors, including inflation, interest rates, geopolitical tensions, and corporate earnings.

Factors Influencing Market Performance

The interplay of these factors will determine the overall direction of the market.

- Inflation and Interest Rates:Central banks around the world are actively trying to tame inflation by raising interest rates. The effectiveness of these measures in curbing inflation without causing a recession remains to be seen. If inflation remains stubbornly high, central banks might have to raise rates further, potentially leading to slower economic growth and market volatility.

- Geopolitical Tensions:The ongoing war in Ukraine, tensions between the US and China, and other geopolitical conflicts continue to create uncertainty and volatility in the global market. These conflicts disrupt supply chains, increase energy prices, and create a risk-averse environment for investors.

- Corporate Earnings:The upcoming earnings season will be crucial for understanding the health of the global economy. Companies are expected to face challenges from inflation and rising costs, and their ability to maintain profitability will be a key factor influencing investor sentiment.

Potential Risks and Opportunities

While the future is uncertain, there are both potential risks and opportunities for investors to consider.

- Risks:

- Recession:As central banks continue to raise rates, there is a growing risk of a recession, which could significantly impact market performance.

- Inflation:Persistent inflation could erode consumer spending and corporate profits, leading to a decline in market valuations.

- Geopolitical Instability:Escalating geopolitical tensions could further disrupt global markets and create uncertainty for investors.

- Opportunities:

- Value Stocks:As interest rates rise, value stocks, which are companies with strong fundamentals and low valuations, may become more attractive to investors.

- Emerging Markets:Some emerging markets, particularly those with strong economic growth potential, could offer attractive investment opportunities, especially as the US dollar weakens.

- Technology:Despite the economic headwinds, the long-term growth potential of the technology sector remains strong, particularly in areas like artificial intelligence, cloud computing, and cybersecurity.