FTX Bankruptcy: Crypto Sell-Off Impact & Lessons Learned

Ftx bankruptcy crypto sell off impact – FTX bankruptcy, the crypto sell-off impact, and the lessons learned from this dramatic event are topics that continue to reverberate through the crypto space. The collapse of FTX, once considered a leading cryptocurrency exchange, sent shockwaves through the industry, triggering a sell-off of digital assets and raising concerns about the future of crypto.

This wasn’t just a financial crisis; it was a crisis of trust. The mismanagement of customer funds and the intertwined relationship with Alameda Research, a trading firm owned by FTX’s founder, exposed vulnerabilities in the crypto ecosystem. This incident, while painful, has also provided valuable lessons about the importance of transparency, regulatory oversight, and risk management within the crypto space.

The impact of FTX’s bankruptcy extended far beyond the immediate sell-off. Institutional investors, who had been increasingly embracing crypto, became more cautious, questioning the stability of the industry. The event also intensified regulatory scrutiny, as authorities worldwide moved to strengthen oversight and protect investors.

The ripple effect of this event continues to shape the crypto landscape, forcing exchanges and projects to reassess their practices and prioritize security and transparency.

FTX Bankruptcy: Ftx Bankruptcy Crypto Sell Off Impact

The collapse of FTX, a once-prominent cryptocurrency exchange, sent shockwaves through the crypto industry in November 2022. This event exposed vulnerabilities in the ecosystem and highlighted the risks associated with centralized platforms. The bankruptcy proceedings revealed a complex web of interconnected entities, risky practices, and ultimately, a lack of transparency.

The Role of Alameda Research

Alameda Research, a trading firm founded by FTX’s CEO Sam Bankman-Fried, played a crucial role in the collapse. It was closely intertwined with FTX, using customer funds to make risky bets and cover losses. The relationship between FTX and Alameda Research was characterized by a lack of clear separation and inadequate risk management.

This interconnectedness led to a dangerous situation where the solvency of both entities became intertwined.

The FTX bankruptcy and subsequent crypto sell-off sent shockwaves through the market, but it seems some investors are still looking for opportunities. Elon Musk’s announcement that Tesla is interested in investing in India, following his meeting with Prime Minister Modi, as reported here , could be a sign that even in the face of market volatility, companies are still seeking growth and expansion.

It remains to be seen how the FTX fallout will continue to impact the crypto landscape, but it’s clear that investors are looking for stability and promising new markets, and India could be a key player in the coming months.

“Alameda Research was a trading firm that was closely connected to FTX. It was essentially a hedge fund that used customer funds to make risky bets.”

Customer Funds Mismanagement

FTX’s bankruptcy exposed a serious issue: the mismanagement of customer funds. Evidence emerged suggesting that FTX had commingled customer deposits with Alameda Research’s funds, violating fundamental principles of trust and transparency.This practice created a dangerous situation where customer assets were exposed to the risks associated with Alameda Research’s trading activities.

When Alameda Research’s risky bets started to unravel, it triggered a chain reaction that ultimately led to FTX’s collapse.

The FTX bankruptcy and subsequent crypto sell-off have left many investors wondering where to turn for safe haven assets. While some might be tempted to jump into precious metals like gold and silver, it’s crucial to be aware of the potential for counterfeits.

A good resource for learning how to spot fake gold and silver is this comprehensive guide , which provides valuable insights into authenticating precious metals. This knowledge is especially important now, as the recent market volatility has likely increased the risk of counterfeit products being sold.

“FTX’s bankruptcy exposed a serious issue: the mismanagement of customer funds. Evidence emerged suggesting that FTX had commingled customer deposits with Alameda Research’s funds, violating fundamental principles of trust and transparency.”

Crypto Sell-Off

The collapse of FTX sent shockwaves through the cryptocurrency market, triggering a significant sell-off across various digital assets. Investors, fearing a domino effect and a broader crisis within the crypto ecosystem, rushed to offload their holdings, leading to a sharp decline in prices.

Market Reactions

The FTX news had an immediate and dramatic impact on the crypto market. The price of Bitcoin, the largest cryptocurrency by market capitalization, plummeted by over 15% within hours of the announcement. Other major cryptocurrencies like Ethereum, Binance Coin, and Solana also experienced significant drops, ranging from 10% to 20%.

The FTX bankruptcy and the subsequent crypto sell-off have highlighted the importance of safeguarding our finances. A recent Gallup survey emphasizes the need to take proactive measures, highlighting key bank account security tips protecting finances recent survey of gallup.

This event serves as a stark reminder that we need to be vigilant in protecting our assets, especially in the volatile world of cryptocurrency.

Price Movements

The following table highlights the price movements of some major cryptocurrencies before and after the FTX news:

| Cryptocurrency | Price (Nov. 2, 2022) | Price (Nov. 10, 2022) | Change (%) |

|---|---|---|---|

| Bitcoin (BTC) | $20,000 | $16,500 | -17.5% |

| Ethereum (ETH) | $1,500 | $1,200 | -20% |

| Binance Coin (BNB) | $300 | $250 | -16.7% |

| Solana (SOL) | $35 | $28 | -20% |

Investor Sentiment

The FTX collapse severely damaged investor confidence in the cryptocurrency market. The event highlighted the inherent risks associated with centralized exchanges and the potential for fraud and mismanagement. Investors, already wary of the market’s volatility, became even more cautious, leading to a decline in trading volume and overall market participation.

Many investors, fearing further losses, chose to withdraw their funds from crypto exchanges, exacerbating the sell-off.

Impact on Institutional Investors

FTX’s collapse has sent shockwaves through the crypto industry, but its impact on institutional investors is particularly noteworthy. The event has raised serious concerns about the maturity and reliability of the crypto ecosystem, potentially deterring traditional financial institutions from further engagement.

Increased Risk Aversion

The FTX debacle has undoubtedly fueled risk aversion among traditional financial institutions. The event has highlighted the fragility of the crypto market and the potential for significant losses, even in seemingly reputable platforms. This increased risk aversion could manifest in several ways:

- Reduced Investments:Institutions may become more cautious about allocating capital to crypto assets, opting for more established and regulated markets.

- Heightened Due Diligence:Institutions will likely scrutinize crypto projects and platforms more rigorously, demanding greater transparency and regulatory compliance before making any investments.

- Diversification Strategies:Institutions may diversify their crypto portfolios, reducing their exposure to single platforms or assets and seeking more robust risk management strategies.

Shifts in Investment Strategies, Ftx bankruptcy crypto sell off impact

The FTX collapse has prompted a reevaluation of investment strategies for institutional investors in crypto. The event has emphasized the importance of:

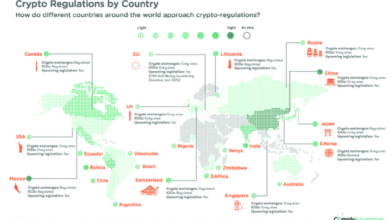

- Regulatory Clarity:Institutions are likely to favor crypto projects and platforms operating in jurisdictions with clear and robust regulatory frameworks, providing greater investor protection and confidence.

- Transparency and Auditing:Institutions will prioritize projects that demonstrate transparency in their operations and undergo regular audits by reputable firms, ensuring accountability and reducing the risk of fraud.

- Diversification and Risk Management:Institutions will focus on building diversified crypto portfolios and implementing robust risk management strategies to mitigate potential losses and enhance overall stability.

The Future of Crypto

The FTX bankruptcy has sent shockwaves through the crypto industry, raising serious questions about the future of this burgeoning sector. The event has exposed vulnerabilities and highlighted the need for greater transparency, regulation, and risk management practices within the crypto ecosystem.

Lessons Learned from FTX Bankruptcy

The FTX bankruptcy provides valuable insights into the risks and challenges associated with the crypto industry. These lessons can serve as a guide for investors, regulators, and industry participants to navigate the future of crypto with greater prudence and resilience.