Forex Dollar Strengthens for Second Week as Rate Cut Bets Fade

Forex Dollar Strengthens for Second Week as Rate Cut Bets Fade – The US dollar has been on a roll lately, strengthening for the second consecutive week, defying expectations of a potential rate cut by the Federal Reserve. This unexpected trend is catching the attention of investors and businesses worldwide, prompting a wave of questions about the future direction of the US dollar and its impact on global markets.

The recent surge in the US dollar’s value is attributed to a number of factors, including a resilient US economy, robust inflation data, and a more hawkish stance by the Federal Reserve, which has fueled expectations of continued interest rate hikes.

This unexpected shift in the market sentiment has led to a reassessment of the US dollar’s trajectory, leaving investors and businesses scrambling to adjust their strategies.

The Forex Market and the US Dollar: Forex Dollar Strengthens For Second Week As Rate Cut Bets Fade

The forex market, short for foreign exchange market, is the largest and most liquid financial market globally. It facilitates the buying and selling of currencies, enabling individuals, businesses, and governments to exchange one currency for another. At the heart of this intricate market lies the US dollar, playing a pivotal role as the world’s dominant reserve currency.

The US Dollar’s Role in the Global Forex Market

The US dollar’s dominance in the global forex market stems from its historical significance, economic strength, and political stability. The US dollar is used for international transactions, including trade, investment, and debt settlement. This widespread use has cemented its status as the world’s reserve currency, influencing global economies and financial markets.

Factors Influencing the US Dollar’s Strength

The strength or weakness of the US dollar is determined by a multitude of factors, including:

- Economic Growth and Performance:A robust US economy, characterized by strong GDP growth, low unemployment rates, and high consumer confidence, tends to bolster the dollar’s value. Conversely, economic weakness, such as a recession or high inflation, can weaken the dollar.

- Interest Rate Differentials:The Federal Reserve’s monetary policy, particularly interest rate decisions, significantly impacts the US dollar. When interest rates rise, they attract foreign investors seeking higher returns, increasing demand for the dollar and pushing its value up. Conversely, interest rate cuts tend to weaken the dollar.

The forex dollar is gaining strength for the second week as rate cut bets fade, indicating confidence in the economy’s resilience. This coincides with heightened tensions in the auto industry, where UAW auto workers strike negotiations are intensifying as the Detroit Three face a labor standoff.

The potential impact of a prolonged strike on the US economy could be significant, further influencing the dollar’s trajectory in the coming weeks.

- Government Policies and Political Stability:Government policies, such as trade agreements and fiscal spending, can influence the dollar’s strength. Political stability and sound economic policies contribute to a strong dollar, while uncertainty and instability can weaken it.

- Global Economic Conditions:Global economic events, such as a recession or a financial crisis, can affect the dollar’s value. For example, during a global recession, investors often seek safe-haven assets like the US dollar, driving its value up.

The US Dollar’s Strength: Impact on Global Economies

The US dollar’s strength can have significant implications for global economies:

- Impact on Trade:A strong dollar makes US exports more expensive for foreign buyers, potentially reducing demand and hurting US exporters. Conversely, it makes imports cheaper, potentially boosting consumer spending.

- Impact on Debt:For countries with dollar-denominated debt, a strong dollar can increase the cost of servicing their debt, putting pressure on their finances.

- Impact on Investment:A strong dollar can make US assets more attractive to foreign investors, leading to increased investment in the US economy. However, it can also make it more expensive for US companies to invest abroad.

Recent Trends in the Forex Market

The US dollar has been on a tear in recent weeks, strengthening against most major currencies. This surge has been driven by a combination of factors, including the Federal Reserve’s hawkish stance on interest rates, a strong US economy, and a flight to safety amid global economic uncertainty.

The forex dollar is continuing its winning streak, strengthening for a second week as bets on a rate cut fade. This is likely due to the robust US economy, which continues to defy predictions of a recession. Meanwhile, the financial world is buzzing about the news that KKR is acquiring PayPal’s buy now pay later loans for a whopping $44 billion.

This deal underscores the growing popularity of BNPL options, and could further fuel the dollar’s strength as investors look to invest in sectors perceived as less risky in a time of economic uncertainty.

Performance of the US Dollar, Forex dollar strengthens for second week as rate cut bets fade

The US dollar’s recent strength is evident in its performance against other major currencies. For instance, the euro has fallen to its lowest level against the dollar in over two decades, while the Japanese yen has also weakened significantly. This trend has been consistent across most major currency pairs, highlighting the dollar’s dominance in the current market environment.

Factors Driving US Dollar Strength

Several factors have contributed to the recent strengthening of the US dollar.

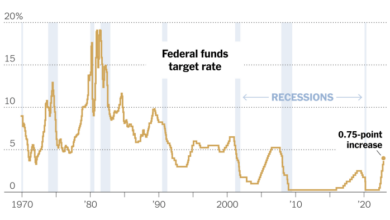

- Federal Reserve’s Monetary Policy:The Federal Reserve’s aggressive stance on interest rate hikes has made the US dollar more attractive to investors seeking higher returns. The Fed has indicated its commitment to raising rates further, which is expected to continue supporting the dollar’s strength.

The forex dollar’s strengthening for the second week in a row, as bets on rate cuts fade, reflects a global shift in economic tides. This trend is amplified by the surge in Russia-China trade, which has led to a shipping container boom and significant economic shifts.

As global trade patterns evolve, the dollar’s strength will likely remain a key factor, as investors seek stability in a world of uncertainty.

- Strong US Economy:The US economy has shown resilience in the face of global economic headwinds. Strong job growth and robust consumer spending have supported the dollar’s appeal as a safe-haven currency.

- Global Economic Uncertainty:Concerns over the global economic outlook, including rising inflation, potential recessions, and geopolitical tensions, have driven investors towards the US dollar as a safe-haven asset.

Comparison with Previous Periods of US Dollar Strength

The current period of US dollar strength is reminiscent of previous periods when the dollar has been a dominant force in the forex market. For example, during the 1980s, the dollar surged due to a combination of high US interest rates and a strong US economy.

Similarly, in the early 2000s, the dollar strengthened following the September 11th attacks, as investors sought safety in US assets. However, it is important to note that the current environment is unique and presents its own set of challenges and opportunities for investors.

The Role of Interest Rate Expectations

Interest rates play a crucial role in determining the value of a currency. When interest rates rise, a country’s currency tends to appreciate, and vice versa. This is because higher interest rates attract foreign investors, who seek to earn a higher return on their investments.

To invest in a country with higher interest rates, investors need to buy that country’s currency, increasing demand and pushing up its value.

Impact of the Federal Reserve’s Interest Rate Decisions on the US Dollar

The Federal Reserve (Fed), the central bank of the United States, has a significant impact on the US dollar through its interest rate decisions. When the Fed raises interest rates, it becomes more attractive for investors to hold US dollar assets, as they can earn a higher return.

This increased demand for the US dollar strengthens its value against other currencies. Conversely, when the Fed lowers interest rates, it makes the US dollar less attractive to investors, leading to a decrease in demand and a weakening of the currency.

Expectations About Future Rate Cuts

The forex market is highly sensitive to expectations about future interest rate changes. When market participants anticipate that the Fed will cut interest rates in the future, it can lead to a weakening of the US dollar. This is because investors may start to sell US dollar assets, anticipating lower returns in the future.

For example, if the market expects the Fed to cut interest rates by 50 basis points in the next meeting, the US dollar may weaken as investors anticipate a lower return on US dollar investments.

Implications for Investors and Businesses

A strengthening US dollar can have significant implications for investors and businesses operating in global markets. While a strong dollar can present opportunities, it also comes with potential risks. Understanding these implications is crucial for navigating the forex market effectively.

Impact on Investors

A strong US dollar generally benefits investors holding US dollar-denominated assets, such as stocks and bonds. This is because the value of their investments increases when converted to other currencies. However, a strong dollar can also create challenges for investors seeking returns from foreign markets.

- Increased Returns on US Dollar-Denominated Assets:A strong dollar can lead to higher returns for investors holding US dollar-denominated assets. For example, if an investor buys a US stock for $100 and the dollar strengthens against the euro by 5%, the stock’s value in euros will increase to €105, resulting in a higher return for the investor.

- Challenges for Foreign Investments:A strong dollar can make it more expensive for US investors to invest in foreign markets. This is because the dollar needs to be converted to the local currency, and the exchange rate will be less favorable when the dollar is strong.

- Currency Hedging Strategies:Investors can mitigate the risks associated with currency fluctuations by employing hedging strategies. These strategies involve using financial instruments, such as forward contracts or options, to lock in a specific exchange rate.

Impact on Businesses

A strong dollar can have both positive and negative impacts on businesses operating in global markets.

- Export Challenges:A strong dollar can make US exports more expensive in foreign markets, potentially leading to reduced demand and lower sales. This is because foreign buyers need to pay more in their local currency for US goods and services.

- Competitive Advantage for Importers:Conversely, a strong dollar can benefit US importers by making imported goods and services cheaper. This can lead to increased competition in the domestic market and potentially lower prices for consumers.

- Currency Risk Management:Businesses can manage currency risk by using hedging strategies, such as forward contracts or options, to lock in a specific exchange rate. This can help mitigate the impact of currency fluctuations on their profitability.

Industries Sensitive to Currency Fluctuations

Several industries are particularly sensitive to currency fluctuations due to their reliance on international trade or their exposure to foreign markets.

- Manufacturing:Manufacturers that export a significant portion of their goods can be negatively impacted by a strong dollar. This is because their products become more expensive in foreign markets, leading to reduced demand.

- Tourism:The tourism industry is highly sensitive to currency fluctuations. A strong dollar can make US destinations more expensive for foreign tourists, potentially reducing visitor numbers.

- Agriculture:Agricultural commodities, such as grains and soybeans, are traded globally. A strong dollar can make US agricultural exports more expensive, impacting demand and potentially leading to lower prices for farmers.

Future Outlook for the US Dollar

The recent strengthening of the US dollar has raised questions about its future trajectory. While several factors currently support the dollar’s rise, potential risks and shifting economic landscapes could impact its performance in the coming months. Understanding these factors and expert opinions is crucial for investors and businesses operating in the global market.

Factors Contributing to Continued US Dollar Strength

The US dollar’s strength is underpinned by several factors, including:

- Strong US Economic Performance:The US economy continues to exhibit resilience, with low unemployment and steady growth. This strong economic performance makes the US dollar an attractive safe haven currency for investors seeking stability.

- Higher Interest Rates:The Federal Reserve’s aggressive interest rate hikes have increased the attractiveness of US dollar assets for global investors, driving demand for the currency. The interest rate differential between the US and other major economies, such as the Eurozone, widens the appeal of US dollar investments.

- Safe Haven Status:During times of global uncertainty, the US dollar is often sought as a safe haven currency. Geopolitical tensions, such as the ongoing war in Ukraine, have contributed to increased demand for the US dollar as investors seek refuge from market volatility.

Potential Risks to US Dollar Strength

Despite the current favorable conditions, several factors could potentially weaken the US dollar:

- Inflationary Pressures:While inflation has begun to moderate in the US, it remains a concern. If inflation proves more persistent than anticipated, the Fed may be forced to continue raising interest rates, potentially slowing economic growth and weakening the dollar.

- Global Economic Slowdown:A global economic slowdown could negatively impact US exports and economic growth, reducing demand for the US dollar. The potential for a recession in major economies, such as Europe, could dampen global trade and weigh on the dollar’s performance.

- Shifting Monetary Policy:The Federal Reserve’s future policy decisions will play a significant role in the US dollar’s trajectory. If the Fed shifts to a more dovish stance and slows down or pauses interest rate hikes, the dollar could weaken as its attractiveness for investors diminishes.

Expert Opinions on the Future Trajectory of the US Dollar

Experts hold varying views on the future of the US dollar:

- Continued Strength:Some analysts believe the US dollar will continue to strengthen in the short term, supported by the strong US economy and interest rate differentials. They argue that the dollar’s safe haven status will remain a key driver of its performance, especially in times of global uncertainty.

- Potential for Correction:Others predict a potential correction in the US dollar’s value. They point to factors like inflation, global economic slowdown, and the possibility of a shift in the Fed’s monetary policy as potential catalysts for a weakening dollar.

- Neutral Outlook:Some experts adopt a more neutral outlook, suggesting that the US dollar could consolidate at current levels or fluctuate within a narrow range. They highlight the balancing act between strong economic fundamentals and potential headwinds, making it difficult to predict a clear direction for the dollar.