Forex Dollar Strengthens as US Retail Sales Boost Confidence: Latest Money Market Trends

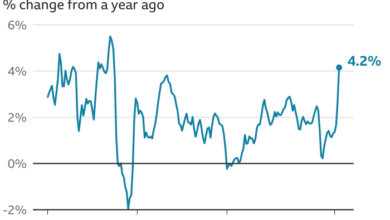

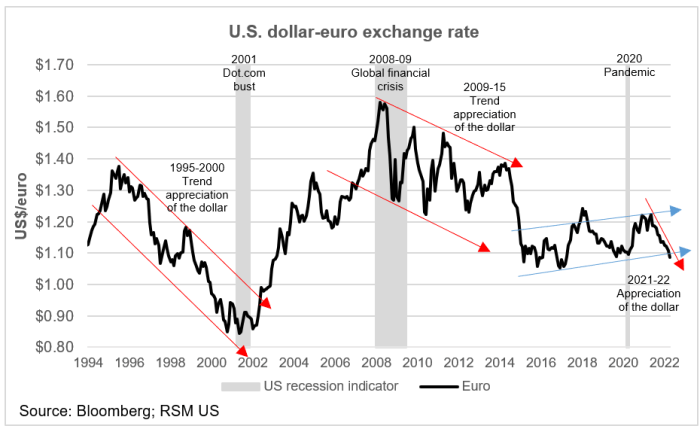

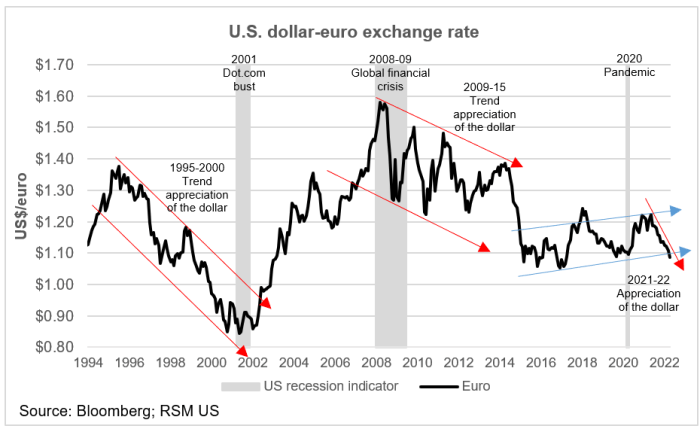

Forex dollar strengthens as US retail sales boost confidence latest money market trends – this headline captures the essence of a recent surge in economic optimism. Strong US retail sales figures have fueled confidence in the American economy, leading to a strengthening of the US dollar and impacting global financial markets.

This trend is not just about a currency; it reflects a shift in investor sentiment and the broader economic landscape.

The recent uptick in retail sales signifies a robust consumer spending environment, a key driver of economic growth. This positive economic outlook has encouraged investors to seek out US dollar-denominated assets, further strengthening the currency. The rising dollar also impacts global trade, making US exports more expensive and imports cheaper, potentially influencing international business dynamics.

Potential Implications for Investors: Forex Dollar Strengthens As Us Retail Sales Boost Confidence Latest Money Market Trends

The strengthening dollar and positive economic outlook create new investment opportunities for savvy investors. While a strong dollar can benefit some sectors and asset classes, it can also pose risks to others. Understanding these implications and adopting appropriate strategies is crucial for navigating the evolving market landscape.

Investment Opportunities, Forex dollar strengthens as us retail sales boost confidence latest money market trends

A strong dollar generally benefits investors in U.S. assets, as it makes them more attractive to foreign buyers.

- U.S. Equities:A strong dollar can boost the value of U.S. stocks for international investors, leading to potential capital gains. Companies with significant international operations or exports stand to benefit from a favorable exchange rate.

- U.S. Bonds:The dollar’s strength can attract foreign investors seeking safe-haven assets, driving up demand for U.S. bonds. This can result in lower interest rates and higher bond prices.

- U.S. Real Estate:A strong dollar can make U.S. real estate more affordable for foreign buyers, potentially increasing demand and property values.

Managing Risks

While a strong dollar offers opportunities, it also presents potential risks.

- Impact on Emerging Markets:A strengthening dollar can make it more expensive for emerging market countries to service their dollar-denominated debt, potentially leading to financial instability. This can negatively impact investments in emerging markets.

- Impact on U.S. Exports:A strong dollar can make U.S. goods and services more expensive for foreign buyers, potentially hindering exports and impacting companies with significant international sales.

- Impact on Commodity Prices:The dollar’s strength can depress commodity prices, as they are often priced in dollars. This can impact investments in commodities and companies involved in commodity production.

Investment Strategies

Investors can consider various strategies to capitalize on the strengthening dollar and manage potential risks.

- Diversification:A well-diversified portfolio across different asset classes and geographies can help mitigate risks associated with a strong dollar. Investing in a mix of U.S. and international assets can provide balance and reduce exposure to specific market fluctuations.

- Currency Hedging:Investors can use currency hedging strategies to mitigate the impact of currency fluctuations on their portfolios. For example, they can use forward contracts or options to lock in exchange rates and protect against potential losses.

- Sector Selection:Investors can focus on sectors that are likely to benefit from a strong dollar, such as companies with significant international operations or exports. Alternatively, they can explore sectors that are less sensitive to currency fluctuations.

The forex dollar is getting a boost from strong US retail sales figures, signaling confidence in the economy. This positive news comes at a time when some Wells Fargo customers are reporting missing deposits, a situation that requires immediate attention.

If you find yourself in this situation, it’s crucial to take action to address the issue and protect your finances. You can find helpful steps and advice on how to handle this situation in this article: wells fargo customers report missing deposits steps to address the issue and protect your finances.

Meanwhile, the strong dollar is likely to continue to be a factor in the money markets as investors look for safe haven assets.

The forex dollar is on a roll, boosted by strong US retail sales figures that signal a resilient economy. This confidence in the US economy is likely to continue to support the dollar, even as some institutions like JP Morgan Chase in the UK are taking a cautious approach to cryptocurrencies.

JP Morgan’s decision to prohibit crypto transactions highlights the ongoing debate surrounding the future of digital assets and their place in traditional finance. This could further impact the broader market, as investors seek safe havens amid uncertainties.

The forex dollar is on the rise, fueled by strong US retail sales figures that boost investor confidence. This positive sentiment is further amplified by the anticipation of the Federal Reserve’s upcoming interest rate decision, which could significantly impact market direction.

As we see in markets anticipate federal reserve decision stocks on the rise , stocks are already on the rise in anticipation. The overall market trend seems to be leaning towards optimism, with the dollar’s strength reflecting a positive outlook on the US economy.