Forex Dollar Soars to 11-Month High Against Yen: Intervention Risk Looms

Forex dollar soars to 11 month high against yen watchful eyes on intervention risk. The US dollar has been on a tear against the Japanese yen, recently reaching its highest point in 11 months. This surge has sparked concerns about potential intervention by the Bank of Japan to stem the yen’s decline.

The yen’s weakness is driven by a confluence of factors, including the widening interest rate differential between the US and Japan, the Bank of Japan’s ultra-loose monetary policy, and a perception of the Japanese economy lagging behind its global peers.

The prospect of intervention adds a layer of uncertainty to the market, as investors grapple with the potential implications for the dollar-yen exchange rate and the global economic landscape.

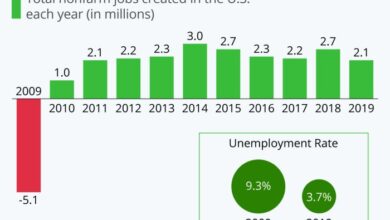

The dollar’s strength is not just a story of yen weakness. The US Federal Reserve’s aggressive interest rate hikes have made the dollar more attractive to investors seeking higher returns. This has fueled a global flight to safety, with investors seeking haven in US assets.

This trend has been exacerbated by the ongoing war in Ukraine, which has added to global economic uncertainty. Meanwhile, the Bank of Japan has maintained its ultra-loose monetary policy, keeping interest rates near zero. This policy divergence has widened the interest rate differential between the US and Japan, further incentivizing investors to sell yen and buy dollars.

The yen’s weakness has raised concerns about its impact on the Japanese economy, particularly for exporters and importers. A weaker yen makes Japanese exports more expensive in overseas markets, potentially impacting their competitiveness. On the other hand, a weaker yen makes imports more expensive for Japanese consumers, potentially leading to inflation and a squeeze on purchasing power.

Global Economic Context

The current global economic landscape is characterized by a confluence of factors, including persistent inflation, tightening monetary policies, and geopolitical tensions, all of which exert significant influence on currency markets. The dollar’s recent surge against the yen reflects these complex dynamics, highlighting the interplay between global economic conditions and currency valuations.

Interest Rate Differentials

Interest rate differentials play a crucial role in influencing exchange rates. When a country’s central bank raises interest rates, it makes its currency more attractive to foreign investors, as they can earn a higher return on their investments. Conversely, lower interest rates can weaken a currency.

The recent divergence in monetary policy stances between the US Federal Reserve and the Bank of Japan has contributed to the dollar’s strength against the yen. The Fed has aggressively raised interest rates to combat inflation, while the Bank of Japan has maintained an ultra-loose monetary policy to support economic growth.

The dollar’s surge against the yen, reaching an 11-month high, has everyone watching for potential intervention. While the US currency’s strength is driven by various factors, the tech sector’s performance is playing a significant role. Nvidia’s recent announcement of AI supercomputers and services, detailed in this article nvidia unleashes ai supercomputers and services propelling stock surge to new heights , has propelled the stock to new heights, boosting investor confidence in the tech sector and indirectly supporting the dollar’s climb.

This dynamic highlights the interconnectedness of global markets, where technological advancements can impact currency fluctuations.

This divergence in interest rate policies has widened the interest rate differential between the US and Japan, making the dollar more appealing to investors.

The forex dollar’s surge to an 11-month high against the yen has everyone on edge, with speculation swirling about potential intervention by the Bank of Japan. It’s a complex situation with global implications, and understanding the dynamics at play is crucial.

In a similar vein, understanding your online privacy is equally important. After all, you wouldn’t want your personal data to be traded like currency on the open market, would you? That’s where a privacy policy comes in, outlining how your information is collected and used.

What is a privacy policy and why is it important is a question worth exploring, especially in today’s digital age. As the forex market fluctuates, so too does the landscape of online privacy, making it essential to stay informed and protect yourself.

Monetary Policy Stances of Major Central Banks

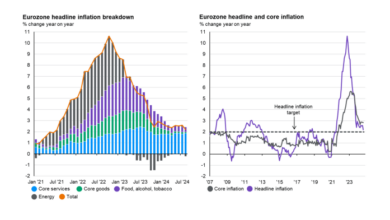

Central banks around the world are navigating a challenging economic environment, with inflation remaining elevated in many countries. The US Federal Reserve, the European Central Bank (ECB), and the Bank of England (BoE) have all raised interest rates to curb inflation, but the pace and magnitude of these hikes vary.

The dollar’s surge to an 11-month high against the yen has sparked speculation about potential intervention by Japanese authorities. Meanwhile, the cryptocurrency market is seeing mixed signals, with Bitcoin slipping slightly while Ethereum inches up. Despite the volatility in Bitcoin, investor confidence remains positive, as evidenced by the continued growth in Ethereum.

You can find a detailed analysis of the current cryptocurrency market situation here. It remains to be seen whether the dollar’s strength will continue, and if so, whether it will prompt Japan to intervene in the currency market.

The Fed has been the most aggressive in tightening monetary policy, followed by the ECB and BoE. In contrast, the Bank of Japan has maintained its accommodative stance, keeping interest rates near zero to stimulate economic growth. These divergent monetary policy stances have created volatility in currency markets, as investors adjust their positions based on their expectations for future interest rate movements.

Geopolitical Events, Forex dollar soars to 11 month high against yen watchful eyes on intervention risk

Geopolitical events can also have a significant impact on the dollar-yen relationship. The ongoing war in Ukraine has created uncertainty in global markets, prompting investors to seek safe-haven assets, such as the US dollar. Additionally, tensions between the US and China, particularly over trade and technology, have also contributed to the dollar’s strength.

These geopolitical risks have increased demand for the dollar as a safe-haven currency, further bolstering its value against the yen.

Market Sentiment and Speculation: Forex Dollar Soars To 11 Month High Against Yen Watchful Eyes On Intervention Risk

The recent surge in the dollar against the yen has been fueled by a confluence of factors, including the divergence in monetary policy between the US Federal Reserve and the Bank of Japan, the robust US economy, and heightened risk aversion in global markets.

Market sentiment towards the dollar-yen pair is currently bullish, with many investors expecting further gains in the greenback.

Speculative Drivers of Currency Movements

Speculation plays a significant role in driving currency movements, particularly in the short term. Traders often use technical analysis to identify trends and potential turning points in the market. Technical indicators provide signals based on historical price data and volume, helping traders make informed decisions.

Technical analysis relies on the idea that history tends to repeat itself, and that past price patterns can predict future movements.

Key Technical Indicators and Implications

Here’s a table outlining some key technical indicators and their potential implications for the dollar-yen pair:| Indicator | Description | Potential Implications ||—|—|—|| Moving Averages| Averages of past prices, used to identify trends and support/resistance levels. | A break above a key moving average can signal a bullish breakout, while a break below can indicate a bearish trend.

|| Relative Strength Index (RSI)| Measures the magnitude of recent price changes to evaluate overbought or oversold conditions. | An RSI reading above 70 suggests the market is overbought, while a reading below 30 indicates an oversold condition. || MACD (Moving Average Convergence Divergence)| A trend-following momentum indicator that shows the relationship between two moving averages.

| A bullish crossover occurs when the MACD line crosses above the signal line, while a bearish crossover occurs when the MACD line crosses below the signal line. || Bollinger Bands| A volatility indicator that shows price fluctuations relative to a moving average.

| A widening of the bands indicates increased volatility, while a narrowing of the bands suggests lower volatility. |

Outlook and Potential Scenarios

The recent surge in the dollar against the yen has raised concerns about the potential for intervention by the Japanese authorities. The Bank of Japan’s commitment to its ultra-loose monetary policy, coupled with the Federal Reserve’s hawkish stance, has created a significant divergence in interest rate differentials, further bolstering the dollar.

However, the potential for intervention by the Japanese government to stem the yen’s decline remains a key factor to watch.

Short-Term Outlook and Potential Scenarios

The short-term outlook for the dollar-yen exchange rate is uncertain, with several factors potentially influencing its trajectory.

- Continued Fed Rate Hikes:If the Fed continues to raise interest rates aggressively, the dollar could continue to strengthen against the yen. This would likely put further pressure on the Bank of Japan to adjust its monetary policy stance, potentially leading to intervention.

- Japanese Intervention:The Japanese government has signaled its willingness to intervene in the currency market to curb excessive yen weakness. If the yen continues to decline sharply, intervention is a possibility, which could potentially lead to a short-term appreciation of the yen.

However, the effectiveness of intervention remains debatable, especially in the face of persistent interest rate differentials.

- Global Economic Slowdown:A slowdown in global economic growth could weaken demand for Japanese exports, potentially leading to yen depreciation. Conversely, if the US economy shows signs of resilience, the dollar could continue to strengthen.

- Geopolitical Tensions:Rising geopolitical tensions, particularly in the Asia-Pacific region, could impact the yen’s performance.

Potential Implications for Businesses, Investors, and Consumers

The direction of the dollar-yen exchange rate has significant implications for businesses, investors, and consumers.

- Businesses:Japanese exporters could face a decline in profitability if the yen weakens further, making their products more expensive in foreign markets. Conversely, importers may benefit from a weaker yen, as imported goods become cheaper.

- Investors:Investors holding Japanese assets could experience losses if the yen continues to depreciate. Conversely, investors holding dollar-denominated assets could benefit from the dollar’s strength.

- Consumers:A weaker yen could lead to higher prices for imported goods, impacting consumer spending. However, Japanese travelers could find foreign travel more affordable.

Key Factors Influencing Future Trajectory

Several key factors could influence the future trajectory of the dollar-yen exchange rate:

- Monetary Policy Divergence:The divergence in monetary policy between the US and Japan remains a key driver of the exchange rate. If the Fed continues to tighten monetary policy while the Bank of Japan maintains its ultra-loose stance, the dollar is likely to remain strong against the yen.

- Economic Growth Differentials:The relative performance of the US and Japanese economies will also play a significant role. If the US economy outperforms Japan, the dollar could continue to appreciate.

- Risk Appetite:Investor risk appetite can also impact the exchange rate. If investors become risk-averse, they may seek safe-haven assets like the yen, leading to yen appreciation.

- Geopolitical Developments:Geopolitical events, such as trade tensions or military conflicts, can also influence the exchange rate.