Fitch Downgrades US Credit Rating: Global Markets React

Fitch downgrades us credit rating sparking global stocks and treasury yields decline live market updates sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with personal blog style and brimming with originality from the outset.

The world watched in shock as Fitch Ratings, a leading credit agency, downgraded the United States’ credit rating, sending ripples through global markets. This unprecedented move, fueled by concerns about the US government’s debt trajectory and political gridlock, triggered a wave of uncertainty and volatility.

From plummeting stock markets to declining Treasury yields, the impact was immediate and far-reaching. The downgrade ignited a debate about the future of the US economy and its global influence. As investors scrambled to assess the implications, the world held its breath, wondering what this historic decision would mean for the future.

Fitch Downgrade Announcement: Fitch Downgrades Us Credit Rating Sparking Global Stocks And Treasury Yields Decline Live Market Updates

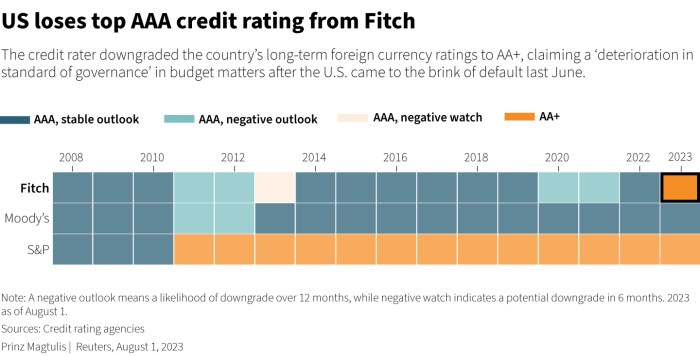

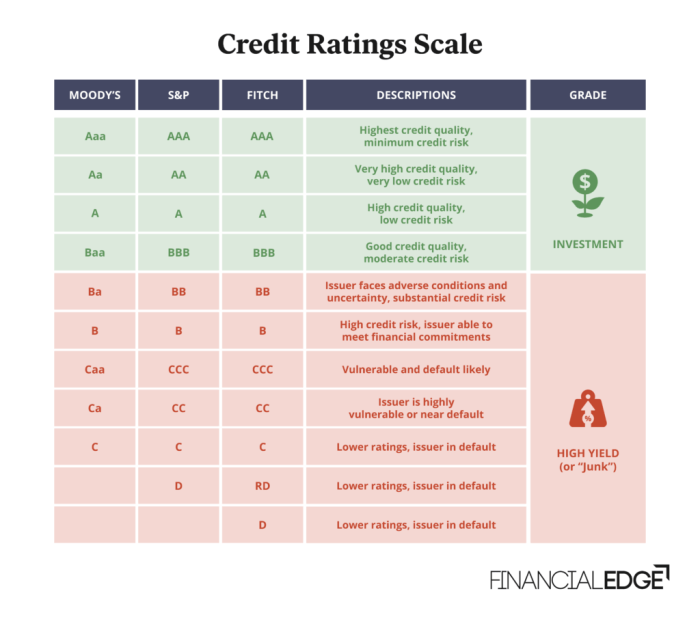

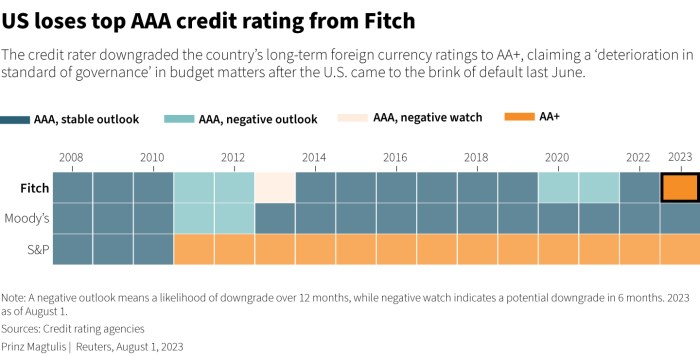

Fitch Ratings, a prominent credit rating agency, announced a downgrade of the US credit rating from AAA to AA+, sending shockwaves through global financial markets. This unexpected move, the first downgrade since 2011, has sparked widespread concern about the US economy’s fiscal health and its implications for global financial stability.

Rationale Behind the Downgrade

Fitch’s decision to downgrade the US credit rating was based on a combination of factors, including the country’s persistent and growing government debt, its projected weakening of public finances over the next three years, and a growing political polarization that hinders the ability to address fiscal challenges.

Factors Contributing to the Downgrade

- Persistent and Growing Government Debt:The US government’s debt has been steadily increasing over the past several years, reaching record levels. This trend is expected to continue, with the debt-to-GDP ratio projected to rise further in the coming years. Fitch highlights that the US has a “high and rising general government debt burden” and that “the government’s fiscal position has weakened.”

- Projected Weakening of Public Finances:Fitch expects the US government’s fiscal position to deteriorate over the next three years. This projection is based on factors such as increasing spending on social programs, rising interest rates, and a slowing economy. The agency points out that “the projected fiscal deterioration is driven by a widening budget deficit and rising interest payments on government debt.”

- Growing Political Polarization:Fitch cites the “erosion of governance standards” in the US, which it attributes to a growing political polarization that makes it difficult for the government to address pressing fiscal issues. This polarization has resulted in repeated debt ceiling crises and stalled efforts to address long-term fiscal challenges.

The news of Fitch downgrading the US credit rating sent shockwaves through the global markets, triggering a decline in stocks and treasury yields. It seems like investors are becoming increasingly wary about the US economy’s stability. Amidst this financial turbulence, peloton recalls 2.2 million bikes over injury and fall concerns , adding another layer of uncertainty to the already volatile market.

It’s interesting to see how these seemingly disparate events are intertwined, reflecting the interconnected nature of our global economy.

Impact of the Downgrade on the US Economy

The Fitch downgrade is expected to have a significant impact on the US economy.

The market’s been on a roller coaster ride lately, with Fitch’s downgrade of the US credit rating sending shockwaves through global stocks and treasury yields. It’s a reminder that economic uncertainty can impact even the most established markets. But while we’re all grappling with the implications of this news, it’s also a good time to think about long-term investments, like deciding between a gas or electric vehicle.

To help you make an informed decision, check out this great article on gas vs electric vehicles which is a better deal know the experts suggestions. Ultimately, navigating these turbulent economic times requires careful planning and a willingness to adapt, and that includes making smart choices about our transportation needs.

- Increased Borrowing Costs:The downgrade could lead to higher borrowing costs for the US government, as investors demand a higher return on their investment in US Treasury bonds. This could put pressure on the federal budget and make it more difficult for the government to finance its operations.

- Reduced Confidence:The downgrade could also erode confidence in the US economy, leading to reduced investment and slower economic growth. This could have a ripple effect on businesses and consumers, leading to job losses and a decline in spending.

- Negative Sentiment:The downgrade could also create a negative sentiment among investors, leading to a sell-off in US assets, including stocks and bonds. This could further weaken the US dollar and increase volatility in financial markets.

Global Implications of the Downgrade

The Fitch downgrade is not just a US issue, but also has global implications.

The Fitch downgrade of the US credit rating has sent shockwaves through global markets, causing stocks and treasury yields to tumble. This uncertainty is compounded by the oil market, which is facing its own set of challenges. The Federal Reserve’s ongoing rate hikes are weighing on demand, while OPEC’s production cuts are tightening supply, creating a complex and volatile landscape.

As the oil market navigates these headwinds , the Fitch downgrade serves as a stark reminder of the interconnectedness of global markets and the potential for cascading effects on the global economy.

- Impact on Global Financial Markets:The downgrade could trigger a wave of risk aversion in global financial markets, leading to a decline in stock prices and a rise in bond yields. This could create volatility and uncertainty in the global economy.

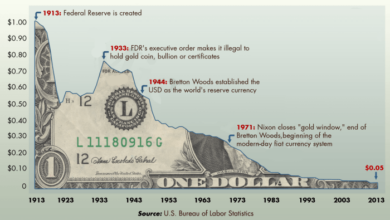

- Dollar Weakness:The downgrade could weaken the US dollar, making it more expensive for US businesses to import goods and services. This could lead to inflation and a decline in consumer purchasing power.

- Impact on Other Sovereign Ratings:The downgrade could also lead to a reassessment of credit ratings for other countries, potentially leading to downgrades for some. This could create a domino effect in global financial markets.

Market Reactions

The Fitch downgrade triggered a wave of negative reactions across global financial markets, with investors expressing concerns about the implications for the US economy and its financial standing. The downgrade sent shockwaves through various asset classes, leading to a decline in stock prices, a drop in US Treasury yields, and fluctuations in currency markets.

Global Stock Market Reactions

The immediate response of global stock markets was a decline, reflecting investor uncertainty and risk aversion. Major stock indices around the world experienced losses, with the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite all registering significant drops.

For instance, the S&P 500 fell by over 1% on the day of the downgrade, signaling a loss of investor confidence in the US economy’s stability. This decline can be attributed to several factors, including:

- Increased risk aversion:The downgrade heightened investor concerns about the US economy’s prospects, prompting them to seek safer investments and reducing their appetite for riskier assets like stocks.

- Potential economic impact:Investors feared that the downgrade could lead to higher borrowing costs for the US government and potentially hinder economic growth, thereby impacting corporate earnings and profitability.

- Uncertainty about the future:The downgrade created uncertainty about the future direction of the US economy, making investors hesitant to commit to long-term investments.

Decline in US Treasury Yields

Contrary to the typical reaction of rising yields during periods of economic uncertainty, US Treasury yields declined following the downgrade. This seemingly counterintuitive response can be attributed to several factors:

- Safe-haven demand:Investors sought the safety and security of US Treasury bonds, perceiving them as a haven in times of market turmoil. This increased demand for Treasuries drove down their yields, reflecting the lower returns investors were willing to accept for the perceived safety of these bonds.

- Reduced borrowing costs:The downgrade could potentially lead to lower borrowing costs for the US government, as investors might be willing to lend money at lower interest rates due to the increased perceived risk of holding US debt.

- Expectations of a less aggressive Fed:The downgrade could also influence the Federal Reserve’s monetary policy decisions, potentially leading to a less aggressive approach to interest rate hikes. This expectation of a less hawkish Fed could contribute to lower Treasury yields.

Market Segment Reactions, Fitch downgrades us credit rating sparking global stocks and treasury yields decline live market updates

The Fitch downgrade impacted different market segments in distinct ways, reflecting the diverse nature of these assets and their sensitivity to economic conditions.

- Equities:As mentioned earlier, equities experienced a decline, reflecting investor concerns about the downgrade’s implications for corporate earnings and economic growth. The decline in equities was particularly pronounced in sectors sensitive to economic conditions, such as consumer discretionary and technology.

- Bonds:While Treasury yields declined, other segments of the bond market, such as corporate bonds, experienced an increase in yields. This divergence can be attributed to the heightened risk aversion among investors, leading them to demand higher returns for holding riskier corporate bonds.

- Currencies:The US dollar initially strengthened against other major currencies, reflecting its safe-haven status during periods of global uncertainty. However, the dollar’s strength was short-lived, and it subsequently weakened as investors began to question the long-term implications of the downgrade on the US economy.

Economic Implications

The Fitch downgrade, while a symbolic blow, carries real economic implications. It signals a diminished view of the US’s creditworthiness, potentially affecting borrowing costs, investor confidence, and the overall economy.

Impact on US Borrowing Costs and Government Spending

A downgrade can lead to higher borrowing costs for the US government. This is because investors may demand a higher return on US Treasury bonds to compensate for the increased risk associated with a lower credit rating. Higher borrowing costs can make it more expensive for the government to finance its debt, potentially forcing it to cut spending in other areas.

For example, if the interest rate on US Treasury bonds rises by even a small amount, the government could face billions of dollars in additional interest payments each year. This could lead to cuts in programs like infrastructure, education, or healthcare.

Effects on Investor Confidence and Economic Growth

A downgrade can also erode investor confidence in the US economy. Investors may become hesitant to invest in US assets, leading to a decline in investment and economic growth. Furthermore, the downgrade could also make it more difficult for US businesses to borrow money, hindering their ability to expand and create jobs.

A study by the Federal Reserve Bank of New York found that a one-notch downgrade in a country’s credit rating can lead to a decline in economic growth of up to 0.5%.

Political Responses

The Fitch downgrade of the US credit rating has triggered a wave of reactions from political leaders across the spectrum. While some expressed concerns about the implications for the economy and financial markets, others criticized the rating agency’s decision, arguing that it was politically motivated.The downgrade has raised questions about the potential political implications, particularly during an election year.

It has become a focal point for partisan debates, with both Democrats and Republicans using the downgrade to bolster their own agendas.

Responses of Different Political Parties

The downgrade has fueled political tensions, highlighting the existing partisan divide in the US. While both Democrats and Republicans have expressed concerns about the downgrade, their responses have differed significantly in terms of emphasis and blame.

- Democrats: Democrats have generally expressed concerns about the downgrade’s impact on the economy and have called for greater fiscal responsibility. They have also criticized the Republican Party’s approach to fiscal policy, arguing that it has contributed to the downgrade.

For example, President Biden stated that the downgrade was “a reminder that we need to work together to get our fiscal house in order.”

- Republicans: Republicans, on the other hand, have been more critical of Fitch’s decision, arguing that it is an overreaction and that the US economy remains strong. They have also used the downgrade to criticize the Biden administration’s policies, arguing that they have weakened the economy and led to the downgrade.

For instance, House Speaker Kevin McCarthy claimed that the downgrade was a “direct result of the Biden administration’s reckless spending.”