Financing Options for First-Time Homebuyers in the United States

Financing options for first time homebuyers in the united states – The dream of homeownership is within reach for many Americans, but navigating the complex world of financing can be daunting, especially for first-time buyers. Financing options for first-time homebuyers in the United States are diverse, offering a range of programs and loans tailored to specific needs and circumstances.

From conventional mortgages to government-backed loans and down payment assistance, there’s a path to homeownership for everyone.

This guide delves into the various financing options available, exploring the benefits and drawbacks of each, helping you make informed decisions. We’ll cover everything from understanding eligibility criteria to managing closing costs, ensuring you’re well-equipped to embark on your home buying journey.

Understanding First-Time Homebuyer Programs: Financing Options For First Time Homebuyers In The United States

Purchasing your first home is a significant milestone, and it’s often accompanied by a whirlwind of emotions and financial considerations. Thankfully, numerous programs are designed to ease the journey for first-time homebuyers, providing valuable support and resources. These programs are specifically crafted to make homeownership more attainable by offering financial assistance, educational resources, and guidance throughout the process.

Purpose and Benefits of First-Time Homebuyer Programs

First-time homebuyer programs aim to make the dream of homeownership a reality for individuals and families who might otherwise find it challenging. These programs offer a range of benefits, including:

- Down Payment Assistance:Many programs provide financial assistance to cover a portion of the down payment, significantly reducing the initial out-of-pocket expenses. This can be particularly beneficial for individuals who are saving for a down payment and might not have accumulated the full amount yet.

- Lower Interest Rates:Some programs offer lower interest rates on mortgages, leading to reduced monthly payments and overall lower borrowing costs. This can make a substantial difference in the long run, saving you money on your mortgage.

- Closing Cost Assistance:Programs may help cover closing costs, which can include various fees associated with the purchase of a home, such as appraisal fees, title insurance, and attorney fees. This reduces the upfront financial burden and makes the transition into homeownership smoother.

- Homebuyer Education:Many programs offer free or low-cost homebuyer education courses. These courses provide valuable information on the homebuying process, from budgeting and credit management to understanding mortgage options and navigating the closing process. This empowers first-time homebuyers with the knowledge they need to make informed decisions.

- Financial Counseling:Some programs offer access to financial counseling services. These services provide personalized guidance on budgeting, debt management, and financial planning, ensuring you’re financially prepared for the responsibilities of homeownership.

Eligibility Criteria for First-Time Homebuyer Programs, Financing options for first time homebuyers in the united states

Eligibility criteria for first-time homebuyer programs vary depending on the specific program and the state or region. However, some common requirements include:

- First-Time Homebuyer Status:Most programs are designed for individuals who have never owned a home before. This means you must be able to demonstrate that you have not owned a home as your primary residence within a specific timeframe, usually the past three years.

- Income Limits:Many programs have income limits, ensuring the assistance benefits those who need it most. These limits vary based on the program and location, and it’s essential to check the specific requirements.

- Credit Score Requirements:Programs often have minimum credit score requirements. These scores are crucial for obtaining a mortgage, and meeting the minimum requirement ensures you are deemed financially responsible and capable of managing a mortgage.

- Homebuyer Education Completion:Some programs require completion of a homebuyer education course before you can qualify for assistance. This ensures you have the necessary knowledge and skills to make informed decisions throughout the homebuying process.

- Location Restrictions:Some programs may have geographic restrictions, limiting the areas where you can purchase a home. This could be based on factors such as the availability of affordable housing or specific community development goals.

Examples of Common First-Time Homebuyer Programs

Here are some examples of widely available first-time homebuyer programs across the United States:

- FHA Loan Program:The Federal Housing Administration (FHA) offers a popular mortgage insurance program that allows borrowers with lower credit scores and down payments to qualify for homeownership. The FHA program requires a minimum down payment of 3.5%, making it more accessible to first-time homebuyers.

- VA Loan Program:The Department of Veterans Affairs (VA) offers a loan program specifically for eligible veterans, active-duty military personnel, and surviving spouses. The VA loan program does not require a down payment and often offers lower interest rates, making it an attractive option for those who qualify.

- USDA Rural Development Loan Program:The U.S. Department of Agriculture (USDA) offers a loan program for homebuyers in eligible rural areas. This program provides financing with no down payment requirement and low interest rates, making it an attractive option for those seeking to purchase a home in a rural community.

Navigating the world of financing options for first-time homebuyers in the United States can feel overwhelming, but it’s a journey worth taking. While securing a mortgage is a major step, it’s also a great time to consider building a financial foundation for the future.

Investing in the stock market can be a smart move, and there are plenty of resources available to help you get started. Check out tips for beginners to invest in the stock market learn the basics of stock market for a solid introduction.

With a bit of planning and research, you can lay the groundwork for a secure financial future, both in your home and beyond.

- State and Local First-Time Homebuyer Programs:Many states and local governments offer their own first-time homebuyer programs, often providing down payment assistance, closing cost assistance, or other financial incentives. These programs can vary significantly in their eligibility requirements and benefits, so it’s essential to research the programs available in your specific area.

Navigating the world of financing options for first-time homebuyers can be daunting, especially when considering the current economic climate. The news today, with Dow futures dipping as Disney reports losses and inflation data looming , certainly adds to the complexity.

However, it’s important to remember that there are still various programs and resources available to help first-time homebuyers achieve their dream of owning a home.

Conventional Mortgages

Conventional mortgages are a popular choice for first-time homebuyers, offering flexibility and competitive interest rates. These loans are not insured or guaranteed by the government, unlike FHA or VA loans, but they often come with lower interest rates and potentially fewer restrictions.

Fixed-Rate Mortgages vs. Adjustable-Rate Mortgages (ARMs)

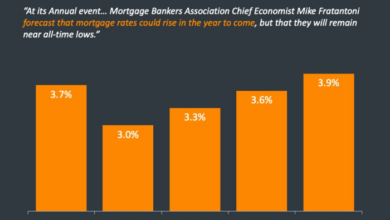

When choosing a conventional mortgage, you’ll encounter two primary options: fixed-rate mortgages and adjustable-rate mortgages (ARMs). Understanding the key differences between these options is crucial for making an informed decision that aligns with your financial goals and risk tolerance.

Fixed-Rate Mortgages

A fixed-rate mortgage offers predictable monthly payments throughout the life of the loan. The interest rate remains constant, providing stability and allowing you to budget accurately.

- Predictable Payments:Fixed-rate mortgages provide peace of mind with consistent monthly payments, simplifying budgeting and financial planning.

- Stability:The unchanging interest rate protects you from fluctuating market rates, ensuring predictable monthly costs over the loan term.

- Long-Term Security:Fixed-rate mortgages offer a sense of security, knowing your payments will remain consistent even if interest rates rise in the future.

Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages (ARMs) start with a lower initial interest rate compared to fixed-rate mortgages. However, the interest rate adjusts periodically based on a specific index, such as the London Interbank Offered Rate (LIBOR).

- Lower Initial Rate:ARMs typically offer lower initial interest rates, making them attractive for those seeking lower monthly payments initially.

- Potential for Savings:If interest rates decline, your monthly payments may decrease, leading to potential savings over the loan term.

- Interest Rate Fluctuations:The adjustable nature of ARMs introduces uncertainty, as your monthly payments can increase if interest rates rise.

Pros and Cons of Conventional Mortgages

Conventional mortgages offer advantages and disadvantages that you should carefully consider before making a decision.

Pros

- Lower Interest Rates:Conventional mortgages often have lower interest rates compared to government-backed loans like FHA or VA loans.

- Flexibility:Conventional mortgages offer various loan terms and options, allowing you to choose the best fit for your financial situation.

- Higher Loan Limits:Conventional mortgages typically have higher loan limits, potentially accommodating larger mortgage amounts.

Cons

- Higher Down Payment:Conventional mortgages typically require a larger down payment, often 20% of the purchase price, compared to government-backed loans.

- Stricter Credit Requirements:Lenders often have stricter credit score and debt-to-income ratio requirements for conventional mortgages.

- Private Mortgage Insurance (PMI):If your down payment is less than 20%, you may be required to pay private mortgage insurance (PMI), adding to your monthly costs.

Government-Backed Loans

Government-backed loans, such as FHA and VA loans, are designed to make homeownership more accessible to a wider range of borrowers, including first-time buyers. These programs offer unique advantages and are worth considering for those who meet the eligibility criteria.

FHA Loans

FHA loans are insured by the Federal Housing Administration, a government agency that helps to reduce the risk for lenders, allowing them to offer more favorable terms to borrowers.

Advantages of FHA Loans

- Lower Down Payment:FHA loans require a minimum down payment of 3.5%, making them more accessible to borrowers with limited savings. This can be a significant advantage for first-time homebuyers who may not have a large down payment readily available.

- More Lenient Credit Requirements:FHA loans have less stringent credit score requirements compared to conventional loans, making them an option for borrowers with less-than-perfect credit histories. However, it is important to note that a higher credit score will generally result in a lower interest rate.

- Flexible Income Guidelines:FHA loans consider a wider range of income sources, including self-employment income and non-traditional employment arrangements, making them more accessible to borrowers who may not meet the income requirements for conventional loans.

Disadvantages of FHA Loans

- Mortgage Insurance Premiums:FHA loans require borrowers to pay an upfront mortgage insurance premium (MIP) and an annual MIP, which can add to the overall cost of the loan. The MIP is typically a percentage of the loan amount and is factored into the monthly mortgage payment.

This premium is meant to protect the lender from losses in case of default.

- Loan Limits:FHA loans have maximum loan limits that vary by county. In high-cost areas, the loan limits may be higher, but they can still be lower than the limits for conventional loans. If the purchase price of the home exceeds the FHA loan limit, borrowers may need to consider other financing options.

- Stricter Appraisal Requirements:FHA loans have stricter appraisal requirements than conventional loans. Appraisers must ensure that the home meets FHA standards for safety, habitability, and structural integrity. This can sometimes result in delays or issues if the property does not meet these requirements.

FHA Loan Eligibility Requirements

- Credit Score:FHA loans generally require a minimum credit score of 580 to qualify for a 3.5% down payment. Borrowers with credit scores below 580 may still be eligible for an FHA loan but will need a larger down payment of 10%.

- Debt-to-Income Ratio (DTI):FHA loans have a maximum DTI of 43%. This means that your total monthly debt payments (including your mortgage payment) cannot exceed 43% of your gross monthly income.

- Employment History:FHA lenders typically require borrowers to have a stable employment history for at least two years. This helps to ensure that borrowers have a consistent income stream to make their mortgage payments.

FHA Loan Down Payment Options

- 3.5% Down Payment:This is the minimum down payment required for borrowers with a credit score of 580 or higher. This can be a significant advantage for first-time homebuyers who may not have a large down payment readily available.

- 10% Down Payment:Borrowers with credit scores below 580 will need a 10% down payment to qualify for an FHA loan. This can be a higher hurdle for some borrowers, but it can still be a more affordable option than a conventional loan.

- Down Payment Assistance Programs:Some states and local governments offer down payment assistance programs to help eligible borrowers with their down payment. These programs can make homeownership more accessible to those who may not have the funds readily available.

VA Loans

VA loans are guaranteed by the Department of Veterans Affairs (VA), which means that the VA guarantees a portion of the loan to the lender, making it less risky for them to lend to veterans.

Key Features and Benefits of VA Loans

- No Down Payment:VA loans do not require a down payment, making them a very attractive option for eligible veterans who may not have a large down payment readily available. This can be a significant advantage for those who are looking to purchase a home with minimal out-of-pocket expenses.

- Lower Interest Rates:VA loans often have lower interest rates than conventional loans, which can result in significant savings over the life of the loan. This is because the VA guarantee reduces the risk for lenders, allowing them to offer more favorable terms to veterans.

Navigating the world of financing options for first-time homebuyers in the US can be overwhelming, but understanding the importance of a strong financial foundation is crucial. While traditional loans are often the go-to, exploring alternative avenues like utilizing a portion of your savings or even considering a small investment in precious metals like gold, as described in this insightful article on the role of gold as a safe investment , can provide a sense of security and potentially bolster your financial position.

This can then lead to more favorable financing options and a smoother journey towards homeownership.

- No Private Mortgage Insurance (PMI):VA loans do not require private mortgage insurance (PMI), which is a common requirement for conventional loans with a down payment of less than 20%. This can save borrowers thousands of dollars over the life of the loan.

- More Lenient Credit Requirements:VA loans have less stringent credit score requirements than conventional loans, making them an option for veterans with less-than-perfect credit histories. However, it is important to note that a higher credit score will generally result in a lower interest rate.

- No Prepayment Penalty:VA loans do not have a prepayment penalty, which means that borrowers can pay off their loan early without any additional fees. This can be a significant advantage for those who want to save money on interest payments.

Down Payment Assistance Programs

Down payment assistance programs (DPAs) are valuable resources for first-time homebuyers who may struggle to save for a substantial down payment. These programs provide financial assistance to help cover a portion of the down payment, making homeownership more accessible.

Down Payment Assistance Programs Comparison

This table compares different down payment assistance programs, highlighting their eligibility criteria, maximum assistance amounts, and application processes:| Program Name | Eligibility Criteria | Maximum Assistance Amount | Application Process ||—|—|—|—|| State Housing Finance Agencies (HFA)| Vary by state, typically for first-time homebuyers, income limits, and specific geographic areas.

| Varies by state, often up to 5% of the purchase price. | Apply directly to the HFA in your state. || Local Down Payment Assistance Programs| Vary by city or county, typically for first-time homebuyers, income limits, and specific geographic areas. | Varies by program, often up to 5% of the purchase price.

| Contact your local government or housing authority. || Employer-Sponsored Down Payment Assistance Programs| Offered by some employers as a benefit to employees. | Varies by employer, often up to 5% of the purchase price. | Contact your employer’s human resources department. || Nonprofit Organizations| Often have specific eligibility requirements, such as first-time homebuyers, low- to moderate-income households, and specific geographic areas.

| Varies by organization, often up to 5% of the purchase price. | Contact the specific nonprofit organization. || Federal Housing Administration (FHA) Down Payment Assistance| Available to first-time homebuyers who meet FHA eligibility requirements. | Up to 3.5% of the purchase price. | Apply through an FHA-approved lender.

|

Impact of Down Payment Assistance on Long-Term Mortgage Costs

Down payment assistance programs can significantly reduce the upfront costs of homeownership, but it’s essential to understand their potential impact on long-term mortgage costs.

Down payment assistance programs often require repayment with interest, which can increase the overall cost of the mortgage.

For example, if a homebuyer receives a $10,000 down payment assistance grant that needs to be repaid over 10 years with a 5% interest rate, they would pay an additional $6,386 in interest over the life of the loan. However, it’s crucial to weigh the potential long-term costs against the benefits of achieving homeownership sooner.

By reducing the down payment, borrowers can potentially qualify for a lower interest rate on their mortgage, which could offset the cost of repaying the assistance.

Budgeting and Financial Planning

Buying a home is a significant financial decision that requires careful budgeting and financial planning. Before you start looking for a home, it’s crucial to understand your financial situation and create a realistic budget that accounts for all the costs associated with homeownership.

Creating a Realistic Budget

Creating a realistic budget involves tracking your income and expenses to understand where your money is going. This helps you identify areas where you can cut back and save for your down payment and closing costs.

- Track your income and expenses:Start by tracking your income from all sources, including your salary, investments, and any other income streams. Then, track your expenses for a few months to get a clear picture of your spending habits. There are many budgeting apps and tools available that can help you with this process.

- Identify areas to cut back:Once you have a good understanding of your spending, identify areas where you can cut back. This might involve reducing your entertainment budget, eating out less, or finding cheaper alternatives for everyday items.

- Create a monthly budget:Based on your income and expenses, create a monthly budget that allocates your income to different categories, such as housing, food, transportation, and entertainment. This will help you stay on track with your finances and avoid overspending.

Pre-Approval and Loan Application Process

Pre-approval is a crucial step for first-time homebuyers, offering numerous advantages that streamline the homebuying process. It allows you to understand your borrowing capacity, making it easier to find homes within your budget. Pre-approval also strengthens your negotiating position with sellers, demonstrating your financial readiness.

The Loan Application Process

The loan application process involves several steps, each contributing to a thorough assessment of your financial situation and creditworthiness. This process ensures you are qualified for a mortgage and helps determine the loan terms that best suit your needs.

- Gather Required Documentation:The lender will request various documents to verify your financial information. These include your income verification (pay stubs, W-2s, tax returns), bank statements, credit reports, and any other relevant financial records.

- Complete the Loan Application:You will be asked to fill out a detailed loan application form, providing information about your personal details, employment history, assets, debts, and desired loan amount.

- Credit and Income Verification:The lender will pull your credit report and verify your income to assess your creditworthiness and ability to repay the loan.

- Property Appraisal:Once you have found a home, the lender will arrange for a professional appraisal to determine the fair market value of the property.

- Loan Underwriting:The lender will review your application, supporting documents, and appraisal to make a final decision on your loan approval.

- Loan Closing:If your loan is approved, you will attend a closing meeting to sign the final loan documents and finalize the purchase of your home.

Tips for Navigating the Loan Application Process Smoothly

- Shop Around for the Best Rates:Compare loan rates and terms from multiple lenders to find the most competitive offer.

- Improve Your Credit Score:A higher credit score generally translates to lower interest rates. Before applying for a loan, take steps to improve your credit score by paying bills on time, reducing credit card balances, and avoiding unnecessary credit inquiries.

- Gather Documentation in Advance:Having all required documentation readily available will expedite the loan application process.

- Communicate with Your Lender:Keep your lender informed of any changes in your financial situation, such as a job change or new debt.

- Ask Questions:Don’t hesitate to ask your lender questions about the loan process or any unclear terms.

Finding the Right Real Estate Agent

Navigating the complex world of buying your first home can feel overwhelming, but having a skilled and experienced real estate agent by your side can make the process smoother and more successful. A real estate agent acts as your advocate, guiding you through every step, from finding the right property to closing the deal.

Choosing a Qualified Agent

Finding a qualified real estate agent is crucial. You want someone who is knowledgeable about the local market, has a proven track record of success, and is dedicated to meeting your needs. Here are some tips for finding a qualified agent:

- Seek Recommendations:Start by asking friends, family, and colleagues for referrals. They can provide valuable insights based on their personal experiences.

- Check Online Reviews:Websites like Zillow, Realtor.com, and Google Reviews can offer insights into an agent’s reputation and client satisfaction.

- Interview Multiple Agents:Schedule consultations with several agents to discuss their experience, expertise, and communication style. This will help you determine if their approach aligns with your preferences.

- Verify Credentials:Ensure the agent is licensed and in good standing with their state’s real estate commission.

Establishing Clear Communication

Once you’ve chosen an agent, establishing clear and consistent communication is vital for a successful home buying journey.

- Define Your Needs:Communicate your specific requirements, including budget, desired location, and property type. This will help your agent narrow down the search and present properties that align with your vision.

- Set Expectations:Discuss your preferred communication methods and frequency. Some agents prefer email, while others favor phone calls or in-person meetings. Clarify your expectations regarding response times and availability.

- Ask Questions:Don’t hesitate to ask questions throughout the process. Your agent is there to guide you and provide answers. Open and honest communication fosters trust and ensures you feel confident and informed.

Home Inspection and Appraisal

Once you’ve found your dream home and your financing is secured, there are two crucial steps left before you can officially call it yours: the home inspection and the appraisal. These processes are essential for protecting your investment and ensuring you’re getting a fair deal.

Home Inspection

A home inspection is a thorough examination of the property’s condition by a qualified professional. The inspector will assess the structural integrity, mechanical systems, electrical wiring, plumbing, roof, and other key components. They will identify any potential issues, defects, or safety hazards that might require repairs or replacements.

The home inspection report is an invaluable tool for negotiating with the seller. It provides you with the information you need to make informed decisions about any necessary repairs or adjustments to the purchase price. It can also help you avoid costly surprises down the road.

Appraisal

An appraisal is an independent assessment of the property’s market value by a licensed appraiser. The appraiser will consider factors such as the size, condition, location, and recent comparable sales in the area. The appraisal report determines the fair market value of the property, which is used by the lender to ensure the loan amount is not exceeding the property’s worth.

Navigating the Home Inspection and Appraisal Process

Here are some tips for navigating the home inspection and appraisal process:

- Schedule the inspection as soon as possible after your offer is accepted. This will give you ample time to review the report and negotiate with the seller if necessary.

- Be present during the inspection. This allows you to ask questions and observe the inspector’s findings firsthand.

- Review the inspection report carefully. Pay attention to any major defects or safety concerns that might require repairs.

- Don’t hesitate to ask for clarificationif you don’t understand anything in the report.

- Negotiate with the sellerabout any necessary repairs or adjustments to the purchase price based on the inspection findings.

- Choose a qualified and experienced appraiser. Ask for referrals from your real estate agent or other trusted sources.

- Be prepared for the appraisal process. Gather any relevant documentation, such as property tax bills, recent comparable sales, and any recent improvements made to the property.

- Understand that the appraisal is just an estimate. The final purchase price may be higher or lower than the appraised value depending on market conditions and other factors.