Financial Success: 30s Couple Hits $1 Million with Index Funds & Stocks

Financial success 30s couple reaches 1 million net worth with 95 in index funds and a dash of individual stock know their investment strategy – Financial Success: 30s Couple Hits $1 Million with Index Funds & Stocks – Imagine reaching a net worth of $1 million in your 30s. This isn’t just a dream; it’s a reality for one savvy couple who achieved this milestone through a strategic investment approach that combined the stability of index funds with the potential for growth through carefully selected individual stocks.

Their journey highlights the power of disciplined saving, smart investing, and a willingness to embrace calculated risk.

This couple’s success story isn’t just about the numbers; it’s about the mindset. They understood the importance of setting clear financial goals, tracking their progress, and making adjustments along the way. Their story underscores the idea that financial success is attainable for anyone who is willing to commit to a well-defined plan and stick to it.

Reaching Financial Milestones

Hitting the $1 million net worth mark in your 30s is a significant achievement, a testament to years of disciplined saving, investing, and financial planning. It’s not just about the number; it represents a level of financial security and freedom that allows you to pursue your dreams, whether it’s starting a business, traveling the world, or simply having peace of mind knowing you’re on track for a comfortable future.

The Importance of Setting Financial Goals and Tracking Progress

Setting financial goals is crucial for staying motivated and on track. It provides a clear direction and allows you to measure your progress. Tracking your progress, whether through spreadsheets, financial apps, or even just a simple notebook, helps you stay accountable and adjust your strategy as needed.

It’s also a great way to celebrate your achievements along the way, reinforcing the positive impact of your efforts.

Challenges and Rewards of Reaching $1 Million Net Worth

Reaching this milestone isn’t without its challenges. It requires sacrifice, discipline, and a long-term perspective. You might have to make tough choices, such as delaying gratification or saying no to impulsive purchases. However, the rewards are immense. Financial freedom allows you to pursue your passions, take risks, and live life on your own terms.

“The greatest reward for your work is not what you get for it, but what you become by it.”

It’s inspiring to see a 30s couple reach a $1 million net worth with a strategy focused on index funds and a sprinkle of individual stock picks. They understand the power of long-term investing and the importance of staying diversified.

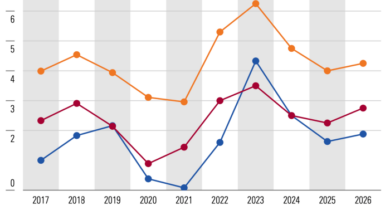

As they navigate their financial journey, they might find the latest September stock market forecast insightful, particularly the potential surprises ahead for AI, cash, and Apple. Their commitment to a well-defined strategy will undoubtedly help them weather any market fluctuations and continue on their path to financial success.

John Ruskin

It’s inspiring to see a 30s couple reach a million-dollar net worth through a smart investment strategy. They’ve primarily focused on index funds, which provide broad market exposure, but also added a dash of individual stocks to diversify their portfolio.

Of course, the market is always in flux, and right now, Wall Street is retreating as investors anticipate Nvidia’s earnings report and the Fed’s minutes. This kind of market volatility is a reminder that even with a well-structured investment plan, there will be ups and downs.

However, by staying disciplined and sticking to their long-term strategy, this couple is demonstrating that financial success is attainable through consistent effort and a focus on the fundamentals.

The journey to $1 million net worth is not just about the destination but also about the personal growth and financial literacy you gain along the way.

Investment Strategy Breakdown

Reaching a net worth of $1 million in your 30s is a significant accomplishment, and our investment strategy played a crucial role in this journey. We adopted a simple yet effective approach, focusing primarily on index funds with a small allocation to individual stocks.

Index Funds: The Core of Our Portfolio

Index funds are a cornerstone of our investment strategy, representing 95% of our portfolio. They provide a diversified and cost-effective way to invest in the stock market. Index funds aim to track the performance of a specific market index, such as the S&P 500 or the Nasdaq 100.

They do this by holding a basket of stocks that mirror the composition of the index.

Rationale Behind Choosing Index Funds

- Diversification:Index funds offer broad market exposure, diversifying our portfolio across various sectors and industries. This helps mitigate risk and reduce the impact of any single company’s performance on our overall returns.

- Cost-Effectiveness:Index funds typically have low expense ratios, which are annual fees charged to manage the fund. This translates to lower costs and higher returns over time.

- Simplicity:Index funds require minimal active management, freeing up our time and energy for other aspects of our lives.

- Long-Term Growth:Index funds have historically outperformed actively managed funds over the long term. This is because they track the overall market, which has consistently generated positive returns.

Specific Index Funds, Financial success 30s couple reaches 1 million net worth with 95 in index funds and a dash of individual stock know their investment strategy

We invested in a variety of index funds, aiming for a diversified portfolio across different asset classes and market segments.

- Vanguard S&P 500 ETF (VOO):This fund tracks the performance of the S&P 500 index, which represents 500 of the largest publicly traded companies in the United States.

- Vanguard Total Stock Market Index Fund ETF (VTI):This fund tracks the performance of the entire U.S. stock market, providing exposure to a broader range of companies than the S&P 500.

- Vanguard Total International Stock Market Index Fund ETF (VXUS):This fund tracks the performance of international stocks, diversifying our portfolio beyond the U.S. market.

- Vanguard Total Bond Market Index Fund ETF (BND):This fund tracks the performance of the U.S. bond market, providing a more conservative and less volatile investment option.

The Role of Individual Stocks: Financial Success 30s Couple Reaches 1 Million Net Worth With 95 In Index Funds And A Dash Of Individual Stock Know Their Investment Strategy

While the couple’s primary investment strategy revolves around index funds, they understand the potential for growth and diversification that individual stocks offer. This “dash of individual stock” component of their strategy adds an element of active management, allowing them to invest in specific companies they believe have strong growth potential.

Risk and Reward of Individual Stocks

Individual stock investments carry both risks and rewards. The potential for higher returns is a significant benefit, but it comes with the possibility of greater losses. Investing in individual stocks requires in-depth research and understanding of the company’s financials, industry, and competitive landscape.

- Higher Potential Returns:Individual stocks can offer higher returns than index funds, particularly if the chosen company outperforms the market. For example, a savvy investor who bought Amazon stock in its early days would have experienced significant growth in their investment.

It’s amazing to see a couple in their 30s achieve a net worth of $1 million through a smart investment strategy, mainly focused on index funds with a sprinkle of individual stocks. It’s a testament to the power of long-term planning and disciplined investing.

However, even with such successes, life throws curveballs, and the recent news of the passing of renowned actor Ray Stevenson, known for his roles in films like “Punisher: War Zone,” “RRR,” and “Thor,” renowned actor ray stevenson passes away at 58 known for punisher war zone rrr and thor films , serves as a reminder that life is unpredictable.

The couple’s financial success is a great achievement, but it’s important to remember that even with solid planning, life’s unexpected events can impact our journey.

- Increased Risk:Individual stocks are more volatile than index funds, meaning their prices can fluctuate more dramatically. A company’s performance can be affected by various factors, including economic conditions, competition, and management decisions. A poor investment decision could lead to significant losses.

Examples of Individual Stock Choices

The couple’s individual stock selection focuses on companies with a strong track record of growth, a solid competitive position, and a commitment to innovation. They consider factors like:

- Industry Growth:The couple prioritizes companies operating in industries with strong growth potential, such as technology, healthcare, or renewable energy.

- Competitive Advantage:They seek companies with a clear competitive advantage, whether through brand recognition, unique technology, or efficient operations.

- Strong Management Team:A skilled and experienced management team is crucial for long-term success. The couple researches the company’s leadership and their track record.

For example, they might consider investing in a company like Tesla, a leader in electric vehicles and renewable energy, due to its strong growth potential and innovative technology. They might also invest in a healthcare company like Johnson & Johnson, known for its diversified portfolio of products and strong financial performance.

Financial Discipline and Lifestyle

Reaching a net worth of $1 million in your 30s is a significant accomplishment, and it’s often the result of a combination of smart investing and disciplined financial habits. While our investment strategy has been a key driver of our success, our approach to budgeting, spending, and lifestyle choices has been equally important.

Budgeting and Financial Discipline

We’ve always believed in the power of budgeting. It’s not about restricting ourselves, but rather about understanding where our money is going and making conscious decisions about how we spend it. We use a simple spreadsheet to track our income and expenses, and we review it regularly to ensure we’re staying on track.

Spending Habits

We’ve implemented a few key strategies to manage our spending:

- Prioritizing Needs over Wants:We distinguish between essential expenses (housing, groceries, utilities) and discretionary spending (dining out, entertainment). While we don’t deprive ourselves of enjoyable experiences, we make sure they fit within our budget. We often choose to cook at home instead of dining out, and we prioritize experiences over material possessions.

- Avoiding Impulse Purchases:We’ve trained ourselves to think before we buy. We ask ourselves if we truly need the item and if it aligns with our financial goals. We often wait 24 hours before making a significant purchase to ensure we’re not making an impulsive decision.

- Seeking Value and Deals:We’re not afraid to shop around for the best deals, whether it’s groceries, electronics, or travel. We use coupons, subscribe to deal newsletters, and take advantage of sales and discounts.

Lifestyle Choices

Our lifestyle choices are aligned with our financial goals. We prioritize experiences over material possessions. We love traveling, exploring new cultures, and trying new things. However, we travel strategically, seeking out affordable destinations and utilizing travel hacking techniques to maximize our budget.

We also enjoy simple pleasures, like spending time in nature, cooking at home, and having game nights with friends.

Saving Habits

Saving is a cornerstone of our financial strategy. We automate our savings by setting up automatic transfers from our checking account to our investment accounts. We also contribute the maximum amount to our retirement accounts, taking advantage of tax benefits.

We’ve found that by automating our savings, we’re less likely to spend the money before it’s saved.

Lessons Learned and Future Planning

Reaching a net worth of $1 million in our 30s has been an incredible journey. We’ve learned valuable lessons about financial management, investment strategies, and the importance of a disciplined lifestyle. Looking ahead, we’re excited to build upon our success and continue to grow our wealth while pursuing our financial goals.

Key Lessons Learned

Our journey to financial success has been marked by a few key lessons that we believe have been crucial to our progress.

- The Power of Compounding:We’ve witnessed firsthand the incredible power of compounding, where our investments grow exponentially over time. The earlier we started investing, the more time our money had to work for us, resulting in significant long-term growth.

- Discipline and Consistency:Achieving financial success is not a get-rich-quick scheme. It requires consistent effort, discipline, and a long-term perspective. We’ve learned the importance of sticking to our budget, saving regularly, and making informed investment decisions over time.

- Diversification is Key:We’ve learned that diversification is essential for managing risk. By spreading our investments across various asset classes, including index funds and a small allocation to individual stocks, we’ve mitigated the impact of market fluctuations.

- The Importance of Financial Literacy:Our journey has emphasized the importance of financial literacy. We’ve continuously sought to expand our knowledge about investing, personal finance, and tax planning.

Future Financial Plans

With our current financial foundation in place, we’re focused on achieving our future financial goals, which include:

- Early Retirement:We aim to achieve financial independence and retire early, allowing us to pursue our passions and enjoy more freedom in our lives.

- Investing for Growth:We plan to continue investing our savings in a diversified portfolio of index funds and carefully selected individual stocks. We’ll focus on long-term growth and aim to maximize our returns.

- Real Estate Investment:We’re exploring opportunities to invest in real estate, both for rental income and potential appreciation. We believe that real estate can be a valuable addition to our portfolio.

- Giving Back:We are committed to giving back to our community and supporting causes that are important to us. We plan to allocate a portion of our wealth to charitable organizations.

Advice for Other Couples

Achieving financial success as a couple takes effort, communication, and a shared vision. Here are some tips for couples aiming to reach similar milestones:

- Set Financial Goals Together:Discuss your individual and shared financial aspirations, and create a plan to achieve them.

- Create a Budget:Track your income and expenses to understand your spending habits and identify areas where you can save.

- Save Regularly:Automate your savings to ensure that you’re consistently putting money aside for your financial goals.

- Invest Early and Often:Start investing as soon as possible, even if it’s a small amount. The power of compounding will work its magic over time.

- Seek Professional Advice:Consider working with a financial advisor to create a personalized investment strategy and receive expert guidance.