Federal Reserve Rate Hikes: Inflation Concerns Drive Policy

Federal Reserve set to continue rate hike cycle amid inflation concerns. The US economy is facing a complex landscape, with inflation remaining stubbornly high despite the Federal Reserve’s aggressive efforts to curb it. The Fed’s rate hikes, aimed at cooling down the economy and taming inflation, are a hot topic, raising questions about their effectiveness and potential consequences.

This article delves into the current economic situation, examining the Federal Reserve’s role, the impact of rate hikes, and alternative perspectives on the path forward.

The current inflation situation is unlike anything we’ve seen in decades, with consumer prices rising at a rapid pace, eroding purchasing power and causing economic uncertainty. The Federal Reserve, tasked with maintaining price stability and maximizing employment, has responded by raising interest rates, hoping to slow down economic activity and bring inflation under control.

However, this strategy is not without its risks, and the potential consequences of aggressive rate hikes are a subject of intense debate among economists.

The Current Economic Landscape

The US economy is navigating a challenging landscape marked by persistent inflation, which continues to erode purchasing power and weigh on consumer confidence. While the Federal Reserve has aggressively raised interest rates to combat inflation, the path to a soft landing remains uncertain.

Inflation Trends and Impact

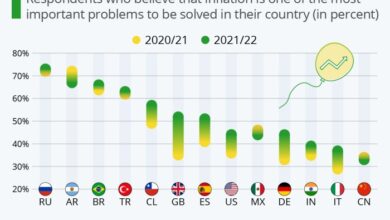

Inflation has remained stubbornly high, significantly impacting the US economy. The Consumer Price Index (CPI), a widely used measure of inflation, rose by 4.9% in April 2023 compared to the previous year, demonstrating a slowing pace of inflation but still well above the Federal Reserve’s target of 2%.

The Federal Reserve’s continued rate hike cycle is a direct response to the persistent inflation concerns that are plaguing our economy. While the Fed aims to curb inflation, it’s crucial to remember that managing our finances effectively during these times is just as important.

Check out the inflation guide tips to understand and manage rising prices for some helpful strategies to navigate this challenging period. By being proactive and informed, we can mitigate the impact of rising prices and maintain financial stability, even as the Fed continues its efforts to combat inflation.

This persistent inflation has led to a decline in real wages, as the increase in prices outpaces wage growth. The purchasing power of consumers has been eroded, impacting consumer spending, a crucial driver of economic growth.

Inflation Data and Implications

The latest inflation data paints a mixed picture. While headline inflation has shown signs of moderation, core inflation, which excludes volatile food and energy prices, remains elevated, suggesting that underlying inflationary pressures persist. This suggests that the Federal Reserve may need to continue its rate hike cycle to bring inflation under control.

The implications of this persistent inflation are far-reaching, impacting everything from business investment to consumer confidence.

Historical Perspective on Inflation

The current inflation situation is unprecedented in recent history. Inflation rates have not been this high since the early 1980s, when the US economy experienced a period of stagflation, characterized by high inflation and stagnant economic growth. This historical context highlights the challenges policymakers face in addressing the current inflation surge, as the experience of the past suggests that bringing inflation under control can be a long and arduous process.

The Federal Reserve’s decision to continue its rate hike cycle is a direct response to the persistent inflation concerns plaguing the economy. While we grapple with the economic implications of these decisions, it’s important to remember that life goes on, and sometimes a little bit of fun is needed.

If you’re looking for a chance to win big, perhaps you should check out understanding mega millions tips to increase your chances of winning. Of course, winning the lottery is a long shot, but it’s a fun distraction from the current economic climate, and who knows, maybe you’ll be the lucky one! Regardless of the outcome, the Fed’s actions will continue to impact our wallets and the overall economy, making it a topic worth staying informed about.

Economic Factors Driving Inflation

Several factors have contributed to the current inflationary environment. The global supply chain disruptions caused by the COVID-19 pandemic have led to shortages of goods and materials, driving up prices. The war in Ukraine has further exacerbated these supply chain issues, particularly for energy and agricultural commodities.

Additionally, strong consumer demand, fueled by government stimulus measures and pent-up demand, has contributed to upward pressure on prices.

The Federal Reserve’s Role

The Federal Reserve, often referred to as the Fed, plays a crucial role in the US economy. As the central bank, it has the responsibility of maintaining a stable financial system and promoting economic growth. One of its primary objectives is to control inflation, which is a sustained increase in the general price level of goods and services.

To achieve this goal, the Fed utilizes various monetary policy tools.The Federal Reserve’s mandate is to promote a stable financial system, moderate long-term interest rates, and promote maximum employment. To achieve these objectives, the Fed has several tools at its disposal.

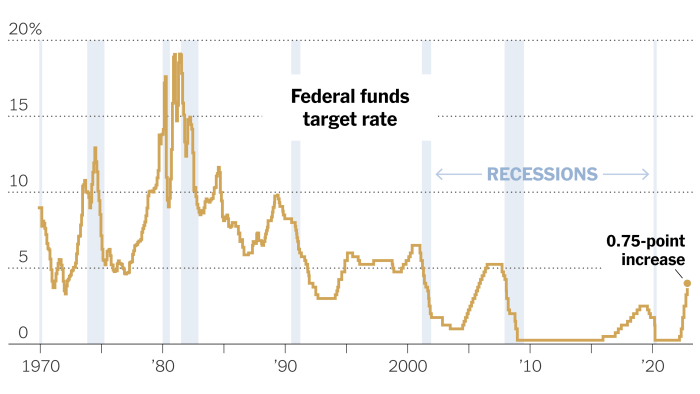

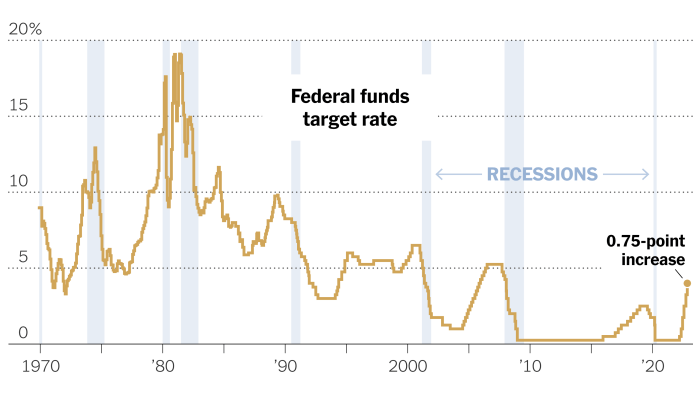

The most prominent of these is setting the federal funds rate, which is the target interest rate that banks charge each other for overnight loans. By adjusting the federal funds rate, the Fed can influence the cost of borrowing for businesses and consumers, ultimately impacting economic activity.

The Federal Reserve’s Rate Hike Cycles

The Federal Reserve has a history of using rate hikes to combat inflation. The decision to raise interest rates is a complex one, and it involves careful consideration of various economic indicators, including inflation, unemployment, and economic growth. The goal of rate hikes is to cool down the economy by making borrowing more expensive, which can slow down spending and inflation.

Recent Rate Hikes and Their Impact, Federal reserve set to continue rate hike cycle amid inflation concerns

The Federal Reserve has been raising interest rates since March 2022 in response to rising inflation. This has been the most aggressive tightening cycle since the early 1980s. The Fed has raised rates by a total of 500 basis points (5%) since March 2022, and it has signaled that it will continue to raise rates in the coming months.

- March 2022:The Fed raised the federal funds rate by 25 basis points to a range of 0.25% to 0.50%. This was the first rate hike since 2018.

- May 2022:The Fed raised the federal funds rate by 50 basis points to a range of 0.75% to 1.00%.

- June 2022:The Fed raised the federal funds rate by 75 basis points to a range of 1.50% to 1.75%.

- July 2022:The Fed raised the federal funds rate by 75 basis points to a range of 2.25% to 2.50%.

- September 2022:The Fed raised the federal funds rate by 75 basis points to a range of 3.00% to 3.25%.

- November 2022:The Fed raised the federal funds rate by 50 basis points to a range of 3.75% to 4.00%.

- December 2022:The Fed raised the federal funds rate by 50 basis points to a range of 4.25% to 4.50%.

- February 2023:The Fed raised the federal funds rate by 25 basis points to a range of 4.50% to 4.75%.

- March 2023:The Fed raised the federal funds rate by 25 basis points to a range of 4.75% to 5.00%.

- May 2023:The Fed raised the federal funds rate by 25 basis points to a range of 5.00% to 5.25%.

The impact of these rate hikes has been felt across the economy. Businesses have faced higher borrowing costs, which has slowed down investment and hiring. Consumers have also seen higher interest rates on mortgages, auto loans, and credit cards, which has reduced their purchasing power.

Comparing the Current Rate Hike Cycle to Previous Ones

The current rate hike cycle is significantly faster than previous cycles. The Fed has raised rates by a total of 500 basis points since March 2022, which is more than double the rate increases seen during the previous tightening cycle in 2015-2018.

This aggressive approach is due to the high level of inflation, which has been driven by supply chain disruptions, strong consumer demand, and the war in Ukraine.The Fed’s aggressive rate hikes have raised concerns about a potential recession. The rapid increase in borrowing costs could slow down economic growth too much, leading to a decline in output and employment.

However, the Fed has stated that it is committed to bringing inflation down to its 2% target, even if it means slowing down the economy.

The Impact of Rate Hikes

The Federal Reserve’s decision to raise interest rates has far-reaching consequences for the economy. These hikes aim to curb inflation by making borrowing more expensive and slowing down economic activity. However, the effects of rate hikes are complex and can impact various aspects of the economy, from consumer spending to the stock market.

Impact on Interest Rates and Borrowing Costs

Rate hikes directly influence interest rates. When the Fed raises rates, banks typically follow suit, increasing the interest rates they charge on loans. This makes borrowing more expensive for individuals and businesses, potentially discouraging them from taking on new debt.

This can have a ripple effect, slowing down economic growth as businesses invest less and consumers spend less. For instance, higher mortgage rates make it more expensive to buy a house, potentially cooling down the housing market. Similarly, businesses may delay investments due to the increased cost of borrowing.

Impact on Consumer Spending

Higher interest rates can impact consumer spending in several ways. As borrowing becomes more expensive, consumers may be less likely to take out loans for large purchases like cars or appliances. This can lead to a decrease in demand for these goods, potentially impacting industries that rely heavily on consumer spending.

Additionally, increased interest rates can make it more expensive to carry credit card debt, potentially reducing discretionary spending as consumers allocate more of their income towards debt repayment.

The Federal Reserve’s continued rate hike cycle, driven by persistent inflation concerns, is creating a complex economic landscape. It’s a time when many are re-evaluating their financial plans, including retirement strategies. It’s fascinating to see how these trends are playing out in the US, as explored in this insightful article: unveiling the surprising retirement patterns in the us know where do you stand.

Understanding these patterns can help individuals make informed decisions about their own financial futures, especially in the face of rising interest rates and economic uncertainty.

Impact on Specific Sectors

Rate hikes can disproportionately affect certain sectors of the economy. Industries that rely heavily on debt financing, such as real estate and construction, are particularly vulnerable. Higher interest rates can make it more expensive to develop new properties, potentially slowing down construction activity and impacting the housing market.

Similarly, industries that rely on consumer spending, such as retail and hospitality, may experience a slowdown in demand as consumers tighten their budgets in response to higher borrowing costs.

Impact on the Stock Market

The stock market can react negatively to rate hikes, as higher interest rates can make it less attractive for investors to invest in stocks. This is because higher interest rates increase the opportunity cost of investing in stocks, meaning investors can earn a higher return by investing in less risky assets like bonds.

As a result, stock prices may decline, potentially impacting the overall value of the stock market.

Impact on the Housing Market

Rate hikes can have a significant impact on the housing market. Higher mortgage rates make it more expensive to buy a house, potentially reducing demand and leading to slower price growth or even price declines. This can particularly affect first-time homebuyers, who are often more sensitive to changes in interest rates.

Additionally, rate hikes can make it more expensive for homeowners to refinance their mortgages, potentially leading to increased mortgage payments and a decrease in housing affordability.

Potential Positive and Negative Effects of Rate Hikes

| Effect | Positive | Negative ||—|—|—|| Inflation| Helps curb inflation by slowing down economic activity. | Can lead to deflation if economic growth slows down too much. || Borrowing Costs| Encourages saving and discourages excessive borrowing. | Makes it more expensive for businesses and individuals to borrow money.

|| Consumer Spending| Can help moderate consumer spending and prevent overheating of the economy. | Can lead to a decrease in consumer demand and economic slowdown. || Stock Market| Can help stabilize the stock market by reducing speculation and encouraging long-term investment.

| Can lead to a decline in stock prices and volatility. || Housing Market| Can help cool down a hot housing market and make homes more affordable. | Can lead to a decrease in home values and a slowdown in construction activity.

|

Alternative Perspectives

While the Federal Reserve’s rate hike strategy is widely accepted as a tool to combat inflation, it’s not without its critics and alternative viewpoints. These perspectives raise important questions about the effectiveness, risks, and potential alternatives to the current approach.

Potential Risks of Aggressive Rate Hikes

Aggressive rate hikes, while aiming to curb inflation, can carry significant risks. These risks stem from the potential for unintended consequences on the economy, particularly in a delicate economic environment.

- Recessionary Pressure:Rapidly increasing interest rates can slow economic growth by making borrowing more expensive for businesses and consumers, potentially leading to a recession.

- Financial Market Instability:Sudden and significant rate hikes can create volatility in financial markets, impacting asset prices and potentially leading to a financial crisis.

- Job Losses:Slower economic growth due to rate hikes can lead to job losses, particularly in sectors sensitive to interest rates, like housing and construction.

- Exacerbated Inequality:Rate hikes can disproportionately impact lower-income households and those with higher debt burdens, potentially widening income inequality.

Alternative Strategies for Addressing Inflation

Beyond rate hikes, other strategies can be considered to address inflation. These alternatives focus on addressing supply-side constraints and promoting long-term economic stability.

- Supply Chain Management:Addressing supply chain bottlenecks and disruptions through government intervention and private sector collaboration can help alleviate inflationary pressures stemming from supply shortages.

- Wage and Price Controls:While controversial, some economists argue that temporary wage and price controls can help curb inflationary expectations and stabilize the economy. However, such measures can lead to distortions in the market and unintended consequences.

- Fiscal Policy:Government spending and tax policies can play a role in managing inflation. For example, targeted tax cuts for low-income households can stimulate demand and address income inequality, while infrastructure investments can boost productivity and reduce supply-side constraints.

- Monetary Policy Mix:Instead of relying solely on rate hikes, the Federal Reserve could explore a combination of monetary policy tools, such as quantitative easing or targeted lending programs, to address specific inflationary pressures.

Different Economic Schools of Thought on Inflation and Rate Hikes

| School of Thought | View on Inflation | View on Rate Hikes |

|---|---|---|

| Keynesian Economics | Focuses on demand-pull inflation, where excessive demand outpaces supply. | Supports rate hikes as a tool to reduce demand and control inflation. |

| Monetarist Economics | Emphasizes the role of money supply in inflation. | Advocates for strict control of money supply growth to combat inflation, often through rate hikes. |

| Supply-Side Economics | Highlights the importance of supply-side factors, such as productivity and resource availability, in inflation. | May favor policies that promote economic growth and productivity over rate hikes, arguing that rate hikes can stifle economic activity. |

| Austrian Economics | Attributes inflation to government intervention in the economy, such as excessive money printing. | Generally opposes rate hikes, arguing that they distort market signals and create economic instability. |

Looking Ahead: Federal Reserve Set To Continue Rate Hike Cycle Amid Inflation Concerns

The Federal Reserve’s decision to continue its rate hike cycle raises several crucial questions about the future of the economy. What will the trajectory of future rate hikes be? How will inflation evolve? What are the potential long-term consequences of this policy?

These are critical considerations as we navigate the complex economic landscape.

Future Rate Hike Trajectory

The Federal Reserve’s future rate hike trajectory will depend on several factors, including the evolution of inflation, the strength of the labor market, and the overall health of the economy. The Fed has indicated that it will continue to raise rates until inflation is under control.

However, the pace and magnitude of future rate hikes remain uncertain. Some experts predict that the Fed will raise rates by 0.25% at its next meeting, while others believe that a more aggressive 0.5% increase is possible. The ultimate decision will be based on the latest economic data and the Fed’s assessment of the inflation outlook.

Future of Inflation

The future of inflation is a subject of much debate among economists. Some experts believe that inflation will continue to decline in the coming months as supply chain disruptions ease and demand cools. Others, however, are more pessimistic, arguing that inflation could remain elevated for a longer period due to persistent supply chain issues, strong consumer demand, and geopolitical uncertainty.

“Inflation is a complex issue with no easy solutions. The Federal Reserve’s actions will play a significant role in shaping the future of inflation, but other factors, such as global supply chain disruptions and geopolitical tensions, will also have a major impact.”

Potential Long-Term Consequences

The current rate hike cycle could have several long-term consequences for the economy. Increased borrowing costs could lead to slower economic growth and potentially trigger a recession. However, it could also help to stabilize inflation and prevent an uncontrolled rise in prices.

The ultimate impact will depend on the pace and magnitude of rate hikes, as well as the overall health of the economy.

Potential Future Scenarios

The future of the economy is uncertain, and several potential scenarios are possible.

- Scenario 1: Soft Landing– The Fed successfully manages to control inflation without triggering a recession. This scenario would involve a gradual slowdown in economic growth, with inflation gradually returning to the Fed’s target of 2%.

- Scenario 2: Recession– The Fed’s aggressive rate hikes lead to a recession, characterized by a significant decline in economic activity and rising unemployment. This scenario would be characterized by a sharp drop in consumer spending, business investment, and overall economic growth.

- Scenario 3: Stagflation– The economy experiences both high inflation and slow growth, leading to a period of economic stagnation. This scenario would be characterized by a combination of high inflation, slow economic growth, and rising unemployment.