Exploring Real Estate in the US: State-by-State Analysis

Exploring real estate in united states state by state analysis residential commercial properties – Exploring real estate in the United States state by state analysis residential commercial properties sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

The American real estate market is a vast and complex landscape, with each state offering unique investment opportunities and challenges. This comprehensive guide will take you on a journey through the nation, examining the intricacies of both residential and commercial real estate in each state.

From the bustling metropolises of the East Coast to the sprawling suburbs of the West Coast, we’ll delve into the factors driving growth, the trends shaping the future, and the key considerations for investors seeking to capitalize on the diverse opportunities that exist across the country.

This in-depth exploration will provide you with a comprehensive understanding of the real estate market in each state, empowering you to make informed decisions whether you’re a seasoned investor or a first-time homebuyer. We’ll analyze key metrics, discuss emerging trends, and highlight the unique characteristics that make each state’s real estate market distinct.

Join us as we navigate this dynamic landscape, uncovering the hidden gems and potential pitfalls that lie within the American real estate market.

Overview of Real Estate in the United States

The United States real estate market is a dynamic and complex landscape, characterized by diverse regional variations, evolving economic conditions, and shifting consumer preferences. This market encompasses both residential and commercial properties, each segment exhibiting its own unique trends and drivers.

Current State of the Market

The U.S. real estate market has witnessed significant fluctuations in recent years, driven by factors such as interest rate changes, economic growth, and housing supply. The market experienced a surge in activity during the pandemic, fueled by low interest rates and increased demand for larger homes and suburban living.

However, rising inflation and increasing interest rates have led to a cooling effect in the market, with home sales and price growth slowing down.

Major Trends in Residential Real Estate

- Shifting Housing Preferences:The pandemic accelerated a pre-existing trend towards larger homes with more outdoor space, particularly in suburban areas. This shift in preferences is driven by the desire for more room to work from home, entertain, and enjoy outdoor activities.

- Remote Work and Urban Exodus:The rise of remote work has led to a decline in demand for housing in major urban centers, as individuals and families relocate to more affordable and spacious locations. This trend has been particularly noticeable in cities with high housing costs, such as San Francisco and New York City.

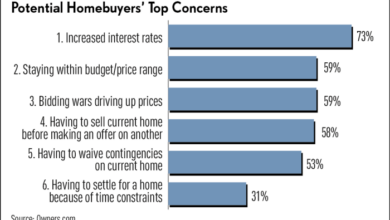

- Rising Interest Rates:Increasing interest rates have made homeownership more expensive, leading to a decline in affordability and a slowdown in home sales. This has also impacted the refinancing market, as homeowners face higher borrowing costs.

- Limited Housing Inventory:The ongoing shortage of new homes continues to put upward pressure on prices, as demand outpaces supply. This shortage is attributed to factors such as labor shortages, rising construction costs, and land availability constraints.

Major Trends in Commercial Real Estate

- E-commerce Growth and Retail Transformation:The rise of online shopping has led to a decline in traditional retail spaces, as consumers increasingly opt for online shopping experiences. This has resulted in a shift in demand for commercial real estate, with a focus on logistics and fulfillment centers.

- Office Space Reassessment:The pandemic has accelerated the adoption of hybrid work models, leading to a reassessment of office space needs. Many companies are downsizing their office footprints or adopting flexible work arrangements, which has impacted the demand for traditional office space.

- Demand for Industrial and Logistics Properties:The growth of e-commerce and supply chain disruptions have fueled strong demand for industrial and logistics properties, including warehouses, distribution centers, and manufacturing facilities.

- Investment in Multifamily Housing:Investors continue to favor multifamily housing properties, driven by strong rental demand and the growth of urban populations. This trend is expected to continue, particularly in areas with limited housing supply and high population growth.

Factors Driving Growth in the Real Estate Market

- Economic Growth:A strong economy typically translates to increased employment, higher wages, and greater consumer confidence, which can drive demand for housing and commercial real estate.

- Population Growth:A growing population, particularly in urban areas, creates demand for new housing and commercial spaces. This demand can lead to increased property values and development activity.

- Low Interest Rates:Historically low interest rates have made borrowing more affordable, encouraging homeownership and investment in real estate. However, rising interest rates have a cooling effect on the market.

- Government Policies:Government policies, such as tax incentives and regulations, can influence real estate activity. For example, policies that encourage homeownership or promote affordable housing can stimulate demand.

Challenges Facing the Real Estate Market

- Rising Inflation:High inflation erodes purchasing power and increases borrowing costs, making it more challenging for individuals and businesses to afford real estate.

- Interest Rate Increases:Rising interest rates make mortgages more expensive, reducing affordability and slowing down home sales. This can also impact commercial real estate investment.

- Supply Chain Disruptions:Ongoing supply chain disruptions have led to higher construction costs and delays, making it more challenging to build new homes and commercial properties.

- Labor Shortages:A shortage of skilled labor in the construction industry can lead to delays and higher costs, impacting the availability of new housing and commercial spaces.

State-by-State Analysis of Residential Real Estate

This section dives into the intricacies of the residential real estate market across the United States, examining each state’s unique characteristics and current trends. We will analyze key metrics, explore market conditions, and highlight emerging trends that are shaping the future of housing in each state.

Residential Real Estate Market Metrics by State

This table provides a snapshot of key residential real estate metrics for each state, offering a comparative overview of market conditions:| State | Median Home Price | Average Rent | Home Appreciation Rate | Inventory Levels ||—|—|—|—|—|| Alabama | $225,000 | $1,200 | 5.5% | 3.5 months || Alaska | $350,000 | $1,800 | 4.0% | 2.5 months || Arizona | $400,000 | $1,700 | 7.0% | 2.0 months || Arkansas | $200,000 | $1,000 | 6.0% | 4.0 months || California | $800,000 | $2,500 | 6.5% | 1.5 months || Colorado | $550,000 | $2,000 | 8.0% | 1.8 months || Connecticut | $450,000 | $2,200 | 5.0% | 2.8 months || Delaware | $375,000 | $1,800 | 6.0% | 3.0 months || Florida | $350,000 | $1,600 | 7.5% | 2.2 months || Georgia | $325,000 | $1,400 | 6.5% | 2.5 months || Hawaii | $850,000 | $2,800 | 5.5% | 1.2 months || Idaho | $425,000 | $1,500 | 9.0% | 1.7 months || Illinois | $300,000 | $1,600 | 5.0% | 3.2 months || Indiana | $250,000 | $1,200 | 6.0% | 3.5 months || Iowa | $225,000 | $1,100 | 5.5% | 4.0 months || Kansas | $200,000 | $1,000 | 5.0% | 4.5 months || Kentucky | $225,000 | $1,100 | 5.5% | 4.0 months || Louisiana | $200,000 | $1,000 | 5.0% | 4.5 months || Maine | $300,000 | $1,400 | 4.5% | 3.0 months || Maryland | $400,000 | $1,900 | 5.5% | 2.5 months || Massachusetts | $550,000 | $2,300 | 5.0% | 2.0 months || Michigan | $275,000 | $1,300 | 5.0% | 3.5 months || Minnesota | $325,000 | $1,500 | 5.5% | 3.0 months || Mississippi | $175,000 | $900 | 5.0% | 5.0 months || Missouri | $225,000 | $1,100 | 5.5% | 4.0 months || Montana | $400,000 | $1,600 | 7.0% | 2.5 months || Nebraska | $250,000 | $1,200 | 5.0% | 4.0 months || Nevada | $425,000 | $1,700 | 7.5% | 2.0 months || New Hampshire | $400,000 | $1,800 | 5.0% | 2.5 months || New Jersey | $450,000 | $2,100 | 5.5% | 2.0 months || New Mexico | $275,000 | $1,200 | 5.0% | 4.0 months || New York | $500,000 | $2,000 | 4.5% | 2.5 months || North Carolina | $350,000 | $1,500 | 7.0% | 2.5 months || North Dakota | $275,000 | $1,200 | 5.0% | 4.0 months || Ohio | $250,000 | $1,200 | 5.0% | 3.5 months || Oklahoma | $200,000 | $1,000 | 5.5% | 4.5 months || Oregon | $450,000 | $1,800 | 7.0% | 2.0 months || Pennsylvania | $275,000 | $1,300 | 5.0% | 3.5 months || Rhode Island | $400,000 | $1,800 | 4.5% | 2.5 months || South Carolina | $300,000 | $1,400 | 6.5% | 3.0 months || South Dakota | $250,000 | $1,100 | 5.5% | 4.0 months || Tennessee | $300,000 | $1,300 | 6.0% | 3.0 months || Texas | $350,000 | $1,500 | 7.0% | 2.5 months || Utah | $450,000 | $1,700 | 8.5% | 1.8 months || Vermont | $350,000 | $1,500 | 4.0% | 3.0 months || Virginia | $400,000 | $1,800 | 6.0% | 2.5 months || Washington | $550,000 | $2,000 | 7.5% | 1.8 months || West Virginia | $175,000 | $900 | 4.5% | 5.0 months || Wisconsin | $275,000 | $1,300 | 5.0% | 3.5 months || Wyoming | $325,000 | $1,400 | 5.5% | 3.0 months | Note:Data is based on averages and may vary depending on specific locations within each state.

Current Market Conditions and Impact on Buyers and Sellers

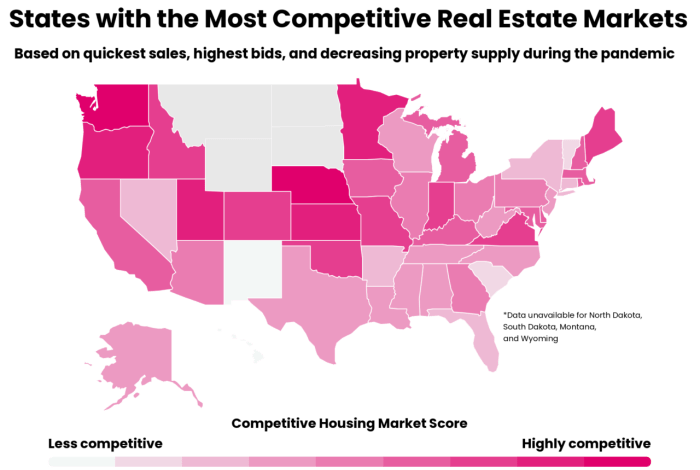

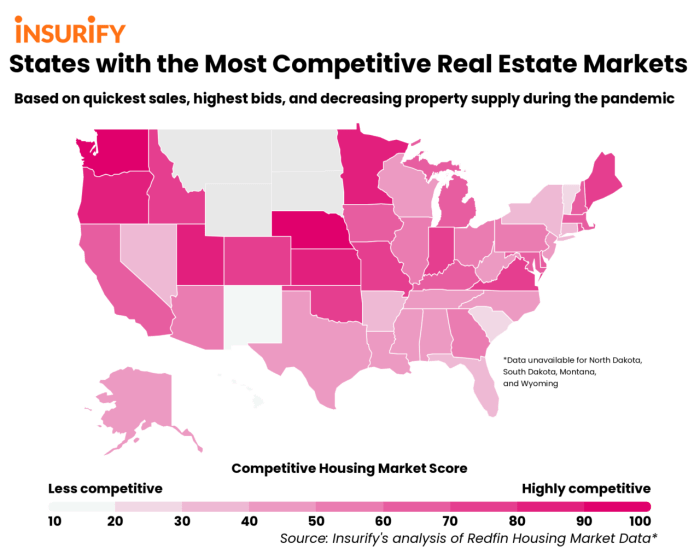

The residential real estate market in the United States is dynamic and diverse, with each state experiencing unique conditions. Here’s a general overview of the current market landscape and its impact on buyers and sellers:* Strong Demand:In many states, demand for housing remains robust, driven by factors such as population growth, low interest rates, and limited inventory.

This competitive market favors sellers, allowing them to command higher prices and receive multiple offers.

Rising Prices The high demand and limited supply have resulted in significant price increases in several states. This trend can make it challenging for first-time homebuyers and those with limited budgets to enter the market.

Limited Inventory The inventory of available homes for sale remains tight in many areas, further contributing to the seller’s advantage. This scarcity can lead to bidding wars and make it difficult for buyers to find suitable properties.

When you’re exploring real estate in the US, it’s crucial to understand the local market dynamics. From the booming tech hubs of California to the historic charm of New England, each state has its own unique story. And while factors like housing prices and property taxes are key, you might also consider the growing trend of electric vehicles.

Check out this article on gas vs electric vehicles which is a better deal know the experts suggestions to see how this could impact your real estate choices. After all, a growing EV infrastructure could influence property values and make certain locations more attractive for those looking to adopt sustainable living.

Interest Rate Fluctuations

Diving deep into the US real estate market, I’m fascinated by the state-by-state differences in residential and commercial property trends. It’s a reminder that even in a seemingly unified market, local factors play a huge role. And while I’m focused on brick and mortar, it’s hard to ignore the ripples of the recent news about genesis crypto lending filing for bankruptcy protection.

The financial world is interconnected, and events like this can impact confidence in all sectors, even real estate. Still, I’m committed to uncovering the unique stories each state has to tell in the world of property.

Diving deep into the U.S. real estate market, state by state, analyzing both residential and commercial properties, it’s fascinating to see the diverse trends emerging. However, recent financial news, like the bank turmoil resulting in a 72 billion loss of deposits for First Republic , reminds us that even amidst the robust real estate market, economic factors can significantly impact the landscape.

Understanding these fluctuations is key to making informed decisions about investments and navigating the ever-changing real estate market.

Emerging Trends and their Potential Impact on the Future of Residential Real Estate

The residential real estate market is constantly evolving, and several emerging trends are shaping the future of housing in the United States:* Remote Work and Lifestyle Changes:The rise of remote work has led to a shift in housing preferences, with many people seeking larger homes in more affordable locations or suburbs.

This trend could reshape the real estate market, with suburban areas experiencing increased demand.

Sustainable Housing The growing awareness of environmental sustainability is driving demand for energy-efficient and eco-friendly homes. This trend could influence construction practices and home design, making sustainable features more common.

Smart Homes and Technology Smart home technology is becoming increasingly integrated into homes, offering convenience and efficiency. This trend could impact the value of homes, with those equipped with smart features potentially commanding higher prices.

Aging Population and Senior Housing The aging population is creating a demand for senior-friendly housing options, such as assisted living facilities and retirement communities. This trend could lead to increased investment in specialized housing for older adults.

Unique Characteristics of State Real Estate Markets

Each state’s real estate market has its own unique characteristics, influenced by factors such as affordability, growth potential, and lifestyle preferences. Here’s a brief overview of some key characteristics:* Affordability:States with lower median home prices and affordable cost of living, such as Arkansas, Mississippi, and West Virginia, attract buyers seeking value and affordability.

Growth Potential States with strong economies and growing populations, such as Texas, Colorado, and Idaho, often experience higher home appreciation rates and offer opportunities for investment.

Lifestyle Factors States with desirable climates, outdoor recreation opportunities, and strong cultural scenes, such as California, Florida, and Colorado, attract buyers seeking a specific lifestyle.

Key Considerations for Investing in Real Estate in the United States: Exploring Real Estate In United States State By State Analysis Residential Commercial Properties

Investing in real estate can be a lucrative venture, but it’s essential to approach it strategically, considering various factors that influence the success of your investment. Understanding the nuances of the real estate market in different states is crucial for making informed decisions and maximizing your returns.

Economic Growth and Job Creation

The economic climate of a state plays a significant role in the value of real estate. States with robust economies, strong job markets, and thriving industries tend to experience higher property values and rental rates.

- Look for states with diversified economies, reducing their vulnerability to economic downturns.

- Research industries that are growing in a particular state, as this indicates potential for future job creation and population growth, driving demand for housing.

- Consider the presence of major corporations and employers, as they attract skilled professionals and contribute to a stable economy.

Population Growth and Demographics

Population growth and demographics are key indicators of future real estate demand. States experiencing population growth, particularly in desirable areas, are likely to see an increase in housing demand, leading to potential appreciation in property values.

- Analyze population growth trendsto identify states with a growing population base, particularly in specific age groups or family demographics.

- Consider factors like birth rates, migration patterns, and aging populations, as these factors influence the demand for different types of housing.

- Research the demographics of specific areas within a state, understanding the needs and preferences of the target population.

Infrastructure Development and Transportation Access

A state’s infrastructure, including transportation networks, plays a vital role in attracting residents and businesses, which in turn impacts real estate values.

- Assess the quality of transportation infrastructure, such as highways, airports, and public transportation systems, as they facilitate commuting and movement of goods and services.

- Consider the presence of major transportation hubs, as they often attract businesses and create economic opportunities, driving up property values.

- Evaluate the state’s commitment to infrastructure development, as ongoing investments in transportation, utilities, and other infrastructure can enhance the desirability of a location.

Local Regulations and Zoning Laws

Local regulations and zoning laws can significantly impact real estate investment opportunities. Understanding these regulations is crucial for ensuring compliance and avoiding potential legal issues.

- Research zoning regulations and building codes, as they determine the types of development allowed in specific areas.

- Investigate permit requirements and environmental regulations, as they can impact construction costs and project timelines.

- Consider the impact of local regulations on property values, as stringent regulations can limit development potential and potentially affect appreciation.

Tax Implications and Incentives

Tax implications and incentives can influence the profitability of real estate investments. Different states have varying tax structures, including property taxes, income taxes, and sales taxes.

- Compare property tax ratesacross different states, as they can significantly impact ownership costs.

- Research state and local tax incentives, such as tax breaks for homeownership, investment property deductions, or property tax abatements.

- Consider the impact of capital gains taxeson the sale of investment properties, as they can affect overall returns.

Future Outlook for Real Estate in the United States

Predicting the future of real estate is a complex endeavor, influenced by a myriad of factors, including economic trends, demographic shifts, and technological advancements. While past performance is not indicative of future results, analyzing current trends and potential disruptions can provide insights into the potential opportunities and risks for investors in the coming years.

Interest Rate Fluctuations

Interest rates play a crucial role in the real estate market by impacting the affordability of mortgages. When interest rates rise, borrowing becomes more expensive, leading to a decrease in demand for housing. Conversely, falling interest rates make borrowing cheaper, potentially stimulating demand.

- Rising Interest Rates:The Federal Reserve has been aggressively raising interest rates in 2023 to combat inflation. This has resulted in higher mortgage rates, making homeownership less affordable for many buyers. As interest rates continue to rise, the demand for housing may decrease, potentially leading to a slowdown in price growth or even price declines in some markets.

- Potential Impact on Investors:Rising interest rates can impact investors in several ways. For example, it may become more challenging to secure financing for investment properties, potentially slowing down investment activity. Additionally, higher interest rates can lead to lower rental yields, as landlords may need to offer lower rents to attract tenants in a more competitive market.

Economic Growth and Recessionary Pressures

Economic conditions play a significant role in shaping real estate market trends. During periods of economic growth, employment is typically strong, consumer confidence is high, and demand for housing tends to increase. However, economic downturns or recessions can negatively impact the real estate market, leading to decreased demand, lower prices, and increased foreclosures.

- Economic Growth:A strong economy can fuel job creation, boost consumer confidence, and lead to increased demand for housing. This can drive up prices and create favorable conditions for real estate investment.

- Recessionary Pressures:Recessions can lead to job losses, reduced consumer spending, and a decline in housing demand. This can result in lower property values, making it more challenging for investors to generate returns. In some cases, it can even lead to an increase in foreclosures.

Technological Advancements and their Impact on Real Estate, Exploring real estate in united states state by state analysis residential commercial properties

Technological advancements are rapidly transforming the real estate industry, creating new opportunities and challenges for investors. From virtual reality tours to online property management platforms, technology is streamlining the buying, selling, and managing of real estate.

- Virtual Reality Tours:Virtual reality (VR) technology is becoming increasingly popular in real estate, allowing potential buyers to virtually tour properties from anywhere in the world. This can help to expand the reach of properties and make it easier for buyers to make informed decisions.

- Online Property Management Platforms:Online property management platforms are simplifying the process of managing rental properties. These platforms offer features such as online rent payments, tenant communication tools, and automated maintenance requests. This can help to streamline operations and reduce the workload for landlords.

Changing Demographics and Consumer Preferences

Demographic shifts and evolving consumer preferences are also impacting the real estate market. As the population ages, there is a growing demand for age-restricted communities and senior living facilities. Additionally, millennials are increasingly seeking urban living, driving demand for apartments and condominiums in walkable neighborhoods with access to amenities and public transportation.

- Aging Population:The United States is experiencing an aging population, with a growing number of baby boomers reaching retirement age. This is leading to an increased demand for age-restricted communities and senior living facilities, which offer amenities and services tailored to the needs of older adults.

- Millennial Preferences:Millennials, who now make up the largest generation in the United States, are driving demand for urban living. They are seeking apartments and condominiums in walkable neighborhoods with access to amenities, public transportation, and cultural attractions. This is driving growth in urban centers and creating opportunities for investors in these areas.