Experts Warn Homebuyers of Red Flags Beyond Climbing Interest Rates

Experts warn homebuyers of red flags beyond climbing interest rates, and it’s a message that deserves our attention. While rising interest rates are undoubtedly a significant factor impacting the housing market, there are other crucial considerations that could make or break your dream home purchase.

This isn’t just about the numbers; it’s about understanding the hidden pitfalls that can lead to costly headaches down the line.

Beyond the obvious financial hurdles, the current market presents a unique set of challenges for homebuyers. It’s a landscape where hidden issues, neighborhood quirks, and seller tactics can easily overshadow the allure of a beautiful property. This guide aims to equip you with the knowledge to navigate these potential red flags and make a smart, informed decision.

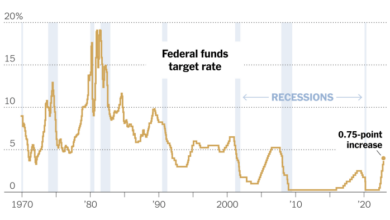

Rising Interest Rates and Their Impact

The Federal Reserve has been aggressively raising interest rates in an effort to combat inflation, and this has had a significant impact on the housing market. Mortgage rates have climbed to their highest levels in decades, making it more expensive for potential homebuyers to finance a purchase.

This has led to a slowdown in home sales and a decrease in home prices in some areas.

The Current State of Interest Rates and Their Effect on Mortgage Affordability, Experts warn homebuyers of red flags beyond climbing interest rates

The average 30-year fixed mortgage rate has more than doubled since the beginning of 2022, rising from around 3% to over 7%. This means that the monthly mortgage payment on a $300,000 home has increased by hundreds of dollars. This increase in mortgage rates has made homeownership less affordable for many potential buyers, particularly first-time homebuyers who are already facing challenges with saving for a down payment.

The higher the interest rate, the more expensive the mortgage becomes.

For example, a $300,000 mortgage at a 3% interest rate would have a monthly payment of around $1,265. However, at a 7% interest rate, the monthly payment would be around $2,000. This is a significant difference, and it can make the difference between being able to afford a home and not.

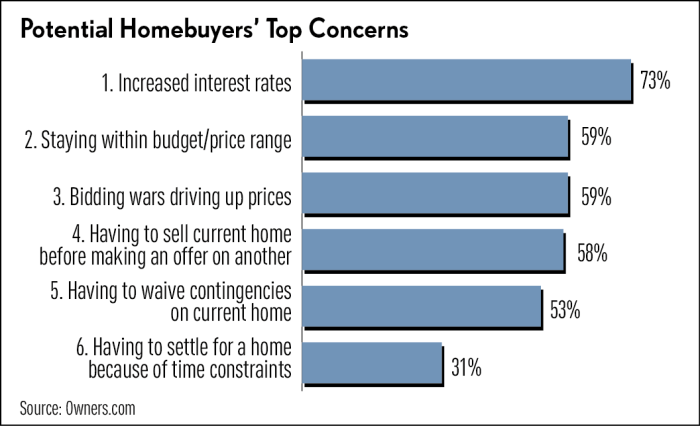

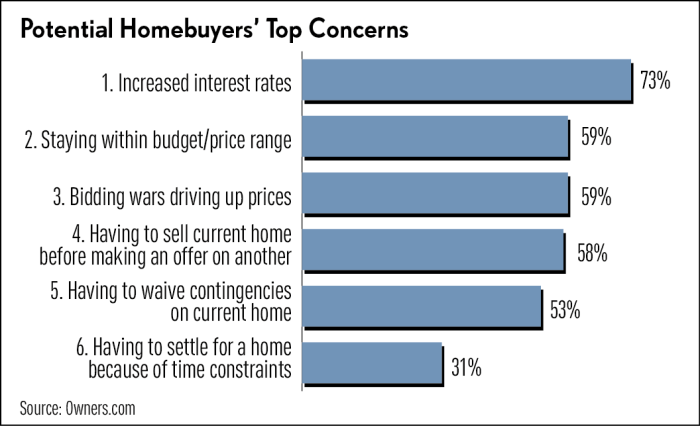

The Psychological Impact of Rising Rates on Potential Homebuyers

Rising interest rates have also had a psychological impact on potential homebuyers. Many people are feeling anxious about the future of the housing market and are hesitant to make a major purchase. They are worried that interest rates could continue to rise, making their mortgage payments even more expensive.

This uncertainty is causing some buyers to delay their home purchase decisions or to look for more affordable options.

The psychological impact of rising interest rates can be significant, leading to hesitation and anxiety among potential homebuyers.

Real-World Examples of How Rising Rates Have Changed the Housing Market Landscape

The impact of rising interest rates on the housing market is already being felt across the country. In some areas, home sales have slowed significantly, and home prices have begun to decline. For example, in the San Francisco Bay Area, home prices have fallen by over 10% since their peak in early 2022.

This decline is attributed to a combination of factors, including rising interest rates, a cooling economy, and increased inventory.

Rising interest rates have contributed to a slowdown in home sales and a decline in home prices in some areas.

Red Flags Beyond Interest Rates

While rising interest rates are a major concern for homebuyers, they’re not the only red flags to watch out for. A thorough inspection and careful consideration of various factors beyond financing can save you from potential headaches and financial burdens down the line.

Experts are warning homebuyers about red flags beyond climbing interest rates, reminding us that the housing market isn’t always as straightforward as it seems. For example, understanding the complexities of blockchain technology and its potential for disrupting traditional finance is crucial, especially when considering the insights of industry leaders like Gavin Wood, whose thoughts on chain mergers and acquisitions can be found here.

These insights highlight the need for informed decision-making, ensuring buyers are well-equipped to navigate the evolving landscape of the real estate market.

Structural Issues

Structural issues can be costly to repair and may even render a home uninhabitable. It’s crucial to have a professional home inspection conducted before making an offer.

- Foundation Cracks:Large, widening cracks in the foundation could indicate structural instability, especially if they are accompanied by uneven floors or doors that stick.

- Roof Problems:A leaking roof, missing shingles, or signs of water damage can lead to significant repair costs and mold growth.

- Termite Infestation:Termites can cause extensive damage to wood framing, leading to structural compromises and costly repairs.

- Electrical Issues:Outdated wiring, flickering lights, and frequent power outages can be safety hazards and costly to fix.

- Plumbing Problems:Leaky pipes, clogged drains, and low water pressure can indicate underlying plumbing issues that may require extensive repairs.

Neighborhood Concerns

The neighborhood environment can significantly impact your quality of life and property value.

- High Crime Rates:Check local crime statistics and neighborhood watch programs to assess the safety of the area.

- Noise Pollution:Consider proximity to busy roads, airports, industrial areas, or other sources of noise that could disrupt your peace and quiet.

- Schools and Amenities:If you have children, research the quality of nearby schools and their proximity to your potential home. Also, assess the availability of essential amenities such as grocery stores, parks, and healthcare facilities.

- Property Values:Research recent home sales in the neighborhood to get an idea of property values and their trend. This can help you determine if the area is likely to appreciate in value.

Seller Behavior

The seller’s behavior can reveal valuable insights about the property and their motivations for selling.

- Unwillingness to Negotiate:If the seller is unwilling to negotiate on price or closing costs, it could indicate they are desperate to sell and may be hiding something.

- Unresponsive to Questions:A seller who avoids answering questions about the property or its history may be trying to conceal issues.

- Pressuring You to Make a Quick Decision:If the seller is pressuring you to make an offer without giving you enough time to inspect the property and research the neighborhood, it’s a red flag.

- Lack of Disclosure:Sellers are legally obligated to disclose known defects in the property. If they are reluctant to provide information or appear evasive, it could be a sign of hidden problems.

Structural Red Flags: Experts Warn Homebuyers Of Red Flags Beyond Climbing Interest Rates

A home inspection is a crucial step in the home buying process. It allows you to uncover potential issues that could cost you dearly in the future. While rising interest rates are a major concern, don’t overlook the importance of a thorough inspection to identify structural red flags that could significantly impact your investment.

Common Structural Issues and Repair Costs

A home inspection can reveal a range of structural issues, some of which can be costly to repair. The following table provides a glimpse into common structural problems and their associated repair costs. It’s important to remember that these are estimates and actual costs may vary depending on the severity of the issue, location, and other factors.

| Structural Issue | Repair Cost (Estimated) |

|---|---|

| Foundation Cracks | $1,000

|

| Roof Leaks | $500

|

| Termite Damage | $1,000

Experts are warning homebuyers to look beyond just rising interest rates for red flags. While those rates are a major concern, it’s also crucial to consider the broader economic landscape, including the potential for consolidation in the real estate market. Gavin Wood, a prominent figure in the blockchain space, has been making headlines for his involvement in chain mergers and acquisitions , which could have a ripple effect on various industries, including real estate. As these trends unfold, buyers need to be extra vigilant in their due diligence, ensuring they understand the long-term implications of any purchase they make.

|

| Water Damage | $500

|

| Mold Growth | $1,000

|

Questions to Ask a Home Inspector

It’s essential to be proactive during the inspection process and ask the right questions. This can help you gain a better understanding of the home’s condition and potential risks.

- What are the most significant structural issues you have identified?

- What are the potential repair costs for these issues?

- Are there any safety concerns related to the structural issues?

- How urgent are these repairs?

- Are there any signs of past structural repairs that may need further attention?

Neighborhood Concerns

Beyond interest rates and structural issues, the neighborhood itself plays a crucial role in determining a home’s value and desirability. A thorough assessment of the neighborhood can reveal red flags that may impact your long-term investment.

Neighborhood Dynamics and Amenities

Understanding the local community’s dynamics and amenities is essential for gauging a neighborhood’s appeal and future potential.

- High Crime Rates:A neighborhood with a high crime rate can significantly impact property values and homeowner safety. Research local crime statistics and consider the neighborhood’s overall safety perception.

- Schools and Education:The quality of local schools is a major factor for families with children. Research school ratings, test scores, and the availability of educational resources.

- Community Events and Activities:A vibrant community with regular events, festivals, and social gatherings can contribute to a strong sense of belonging and enhance the overall lifestyle. Look for community centers, parks, and recreational facilities.

- Accessibility and Infrastructure:Easy access to transportation, shopping centers, healthcare facilities, and other essential services is crucial for daily convenience. Evaluate the neighborhood’s proximity to major roads, public transportation, and essential amenities.

Seller Behavior and Red Flags

A seller’s behavior can offer valuable insights into the condition of a property and their motivation for selling. While a friendly and cooperative seller might seem positive, certain behaviors can signal potential problems that you should be aware of. It’s crucial to remain objective and observant during interactions with a seller, paying close attention to their responses, actions, and overall demeanor.

This can help you uncover potential red flags that may not be apparent in the property’s documentation or during a home inspection.

Recognizing and Interpreting Warning Signs

A seller’s behavior can reveal a lot about their motivations and the potential issues with a property. Here are some warning signs to watch out for:

- Avoidance or Hesitation:A seller who is evasive about questions or reluctant to provide information about the property’s history or any repairs made could be hiding something.

- Exaggerated Claims:Be cautious of sellers who make overly enthusiastic claims about the property’s condition or market value, especially if they lack supporting documentation.

- Pressure Tactics:Sellers who try to rush you into making an offer or pressure you to waive inspections or contingencies could be trying to conceal problems.

- Unrealistic Expectations:A seller who sets an asking price that is significantly higher than comparable properties in the area could be overestimating the property’s value or attempting to hide underlying issues.

- Sudden Urgency:If a seller is unexpectedly eager to sell quickly, especially if they have not listed the property on the market for a reasonable period, it could indicate a need for a quick sale due to financial difficulties or undisclosed problems.

Verifying Information Through Independent Research

While a seller’s words can be insightful, it’s crucial to verify their claims through independent research. This includes:

- Public Records:Review property records and tax assessments to confirm the property’s size, age, and any liens or encumbrances.

- Neighborhood Comparisons:Compare the property to similar homes in the area to gauge its market value and assess its condition relative to other properties.

- Home Inspector’s Report:A thorough home inspection can uncover hidden problems that the seller may not have disclosed.

By observing a seller’s behavior and conducting independent research, you can gain a more comprehensive understanding of a property’s condition and the seller’s motivations. This can help you make an informed decision about whether to proceed with a purchase.

It’s not just rising interest rates that should have homebuyers on high alert. Experts are also urging caution about hidden issues like foundation problems, outdated wiring, and even the impact of climate change on a property’s future value. It’s a reminder that even with the insights of tech giants like Vitalik Buterin, who recently discussed the future of blockchain on Bloomberg Studio 10, bloombergs studio 10 ethereum co founder vitalik buterin , it’s crucial to be thorough in your research before making such a significant investment.

Mitigating Red Flags

Discovering red flags during the home buying process can be unsettling, but it’s crucial to remember that you have options. By taking proactive steps, you can mitigate risks and make informed decisions. Here’s a breakdown of strategies to address red flags in different areas:

Negotiation

Negotiation is a powerful tool for addressing red flags, especially when dealing with issues that can be addressed through adjustments or concessions. It’s an opportunity to leverage your knowledge of the market and your financial position to reach a mutually agreeable outcome.

- Price Reduction:If you uncover issues that impact the home’s value, negotiate a price reduction to reflect the necessary repairs or the diminished desirability of the property. For example, if a structural inspection reveals foundation problems, you can negotiate a lower price to cover the anticipated repair costs.

- Seller-Paid Repairs:In some cases, you can negotiate for the seller to handle specific repairs before closing. This can be particularly beneficial for addressing minor issues that don’t significantly impact the home’s value but require immediate attention. For example, if the roof needs minor repairs, you might request the seller to address them before closing.

- Contingency Clauses:Include contingency clauses in your offer, making the purchase conditional on certain events, such as the successful completion of inspections or the approval of financing. This gives you leverage to back out of the deal if the red flags aren’t addressed to your satisfaction.

Further Investigation

Sometimes, a red flag might not be immediately clear-cut. Further investigation can help you gather more information and make a more informed decision. This involves going beyond the initial surface level and delving deeper into the specifics.

- Second Opinions:If you’re unsure about an inspector’s findings or have concerns about a specific issue, consider seeking a second opinion from another qualified professional. This can provide an independent perspective and help you make a more informed decision.

- Research and Documentation:Gather additional information about the property, the neighborhood, and any potential issues you’ve identified. Research online resources, consult local authorities, and review historical records to gain a comprehensive understanding.

- Consult Legal Counsel:If you’re dealing with complex issues or have concerns about legal implications, seek legal advice from a real estate attorney. They can provide guidance on your rights and obligations and help you navigate the complexities of the transaction.

Alternative Options

If red flags are significant or cannot be mitigated through negotiation or further investigation, consider exploring alternative options. This might involve reconsidering the property or exploring different avenues to meet your housing needs.

- Walk Away:If the red flags are too severe or cannot be addressed to your satisfaction, don’t be afraid to walk away from the deal. It’s better to avoid a potentially problematic purchase than to be stuck with a property that causes you significant financial or emotional stress.

- Offer a Lower Price:If you’re willing to accept the red flags but want to compensate for the risks, offer a lower price than the asking price. This reflects the potential issues and allows you to purchase the property at a price that aligns with its true value.

- Seek Other Properties:If you’re not comfortable with the red flags, continue your search for other properties that better align with your needs and expectations. Don’t settle for a property that doesn’t meet your standards or presents significant risks.

The Importance of Professional Guidance

Navigating the complexities of the real estate market, especially in the face of rising interest rates and other challenges, can be daunting. This is where professional guidance becomes invaluable. Having a team of experts on your side can significantly enhance your chances of securing a desirable home while minimizing risks.

Working with a real estate agent and other professionals, such as mortgage lenders and home inspectors, provides a wealth of benefits that go beyond simply finding a property. These experts possess specialized knowledge and experience that can help you make informed decisions and navigate the intricacies of the home buying process.

Real Estate Agent Expertise

A qualified real estate agent serves as your advocate throughout the home buying journey. They are familiar with the local market, current trends, and pricing strategies, enabling them to identify potential red flags and negotiate favorable terms on your behalf.

Asking the right questions to a potential real estate agent is crucial to ensure you find someone who aligns with your needs and goals. Here are some key questions to consider:

- How long have you been a real estate agent, and what is your experience in the local market?

- What is your approach to negotiating with sellers, and how do you handle red flags during the home buying process?

- Can you provide examples of successful transactions you have handled, and what strategies did you employ to achieve those outcomes?

- How familiar are you with the types of properties I am interested in, and what resources do you have to help me find suitable options?

- What is your availability and communication style, and how often will you provide updates on my search?

A skilled real estate agent can proactively identify and address red flags, acting as your eyes and ears during the process. They can:

- Conduct thorough property inspections and research to uncover potential issues, such as structural defects or neighborhood concerns.

- Analyze comparable sales data to ensure you are paying a fair price for the property.

- Negotiate effectively with sellers to secure favorable terms, including closing costs and contingencies.

- Guide you through the paperwork and legal aspects of the transaction, ensuring all necessary documentation is completed accurately.

- Provide support and guidance throughout the entire process, answering your questions and addressing your concerns.