Economic Outlook Dampens S&P 500s Recent Rally

Economic outlook dampens sp 500s recent rally – Economic Outlook Dampens S&P 500’s Recent Rally, a headline that has become increasingly familiar in recent weeks, reflects a shift in market sentiment. While the S&P 500 enjoyed a significant rally earlier this year, driven by factors like investor optimism and strong corporate earnings, the current economic landscape is casting a shadow over this upward trajectory.

The recent rise in inflation, coupled with the Federal Reserve’s aggressive interest rate hikes, has fueled concerns about a potential economic slowdown, leading to a more cautious approach from investors.

This cautiousness is evident in the recent pullback of the S&P 500, as investors grapple with the uncertainties of the economic outlook. The market is now closely watching key economic indicators, such as inflation data, consumer spending patterns, and corporate earnings reports, to gauge the potential impact on the trajectory of the economy and the stock market.

Recent Rally in the S&P 500

The S&P 500 has experienced a significant rally in recent months, driven by a combination of factors including improving economic data, easing inflation concerns, and a shift in investor sentiment. This rally has pushed the index to new highs, erasing much of the losses experienced in 2022.

Factors Contributing to the Rally

The recent rally in the S&P 500 can be attributed to a confluence of factors that have boosted investor confidence and fueled a risk-on appetite.

- Easing Inflation Concerns:Inflation has shown signs of cooling, with key indicators like the Consumer Price Index (CPI) and Producer Price Index (PPI) coming in below expectations. This has led to a decrease in expectations for aggressive interest rate hikes by the Federal Reserve, which has boosted investor sentiment.

- Strong Corporate Earnings:Despite concerns about a potential recession, many companies have reported strong earnings, exceeding analysts’ expectations. This has provided evidence of resilience in the economy and has reassured investors about the growth potential of US businesses.

- Improving Economic Data:Key economic indicators like unemployment rates, consumer spending, and manufacturing output have shown signs of improvement, suggesting that the US economy may be more resilient than previously anticipated. This has contributed to a more optimistic outlook for corporate profits and economic growth.

- Shift in Investor Sentiment:Investors have become increasingly optimistic about the future, driven by factors like easing inflation, strong corporate earnings, and a potential slowdown in interest rate hikes. This shift in sentiment has led to a surge in demand for stocks, fueling the recent rally.

Impact on Different Sectors

The recent rally has had a mixed impact on different sectors within the S&P 500. Some sectors have benefited more than others, reflecting the specific drivers of the rally and the underlying fundamentals of individual industries.

- Technology:The technology sector has been a major beneficiary of the recent rally, driven by strong earnings reports from major tech companies and a shift in investor sentiment towards growth stocks. This sector has been particularly sensitive to changes in interest rates, and the easing of inflation concerns has boosted investor confidence in technology companies.

- Consumer Discretionary:The consumer discretionary sector has also seen strong gains, fueled by a rebound in consumer spending and a return to pre-pandemic spending patterns. The easing of inflation and the reopening of the economy have contributed to increased demand for discretionary goods and services.

- Energy:The energy sector has benefited from high oil and gas prices, driven by supply chain disruptions and geopolitical tensions. However, the recent rally in the S&P 500 has not translated into significant gains for the energy sector, as investors remain cautious about the long-term outlook for oil prices.

The recent rally in the S&P 500 has been met with cautious optimism, as investors grapple with a murky economic outlook. While inflation has shown signs of cooling, the Federal Reserve’s hawkish stance on interest rates continues to weigh on sentiment.

The fallout from the FTX bankruptcy and subsequent crypto sell-off has further exacerbated market volatility , adding another layer of uncertainty to an already complex environment. The economic outlook, coupled with lingering concerns about crypto’s future, suggest that the S&P 500’s recent gains may be short-lived.

- Financials:The financial sector has seen mixed performance, with some banks benefiting from rising interest rates and others facing headwinds from slowing economic growth. The sector’s performance is likely to be influenced by the trajectory of interest rates and the overall health of the economy.

Economic Outlook and Its Impact

The recent rally in the S&P 500 has been fueled by optimism about a potential economic slowdown, but a closer look at the economic outlook reveals a more nuanced picture. While some indicators suggest a possible easing of inflationary pressures, other factors, such as persistent geopolitical tensions and supply chain disruptions, continue to pose risks to the economic trajectory.

The recent rally in the S&P 500 has been dampened by a gloomy economic outlook, and it’s not just the US economy that’s causing concern. China’s real estate market, a key driver of global growth, is facing a serious challenge with a growing number of empty homes, as reported in this article.

This suggests a potential slowdown in Chinese economic activity, which could further impact global markets and contribute to the bearish sentiment surrounding the S&P 500.

Inflation and Interest Rates

Inflation remains a significant concern for investors and policymakers alike. While the headline inflation rate has moderated in recent months, core inflation, which excludes volatile food and energy prices, has remained stubbornly high. The Federal Reserve has been aggressively raising interest rates to combat inflation, and further rate hikes are expected in the coming months.

The recent rally in the S&P 500 has been met with cautious optimism, as the economic outlook remains uncertain. While investors are eager to see signs of a turnaround, the market is still grappling with inflation and rising interest rates.

Amidst all this, it’s hard to ignore the news that Elon Musk unveils dramatic changes to Twitter logo and birds to vanish , leaving many wondering about the future of the platform. It’s a reminder that even amidst economic turmoil, the tech world continues to evolve at a rapid pace, presenting both opportunities and challenges for investors.

The impact of these rate hikes on economic growth and corporate earnings is a key factor to watch.

The Federal Reserve’s target inflation rate is 2%, and the current rate is well above that.

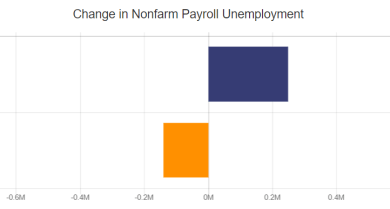

Unemployment and Labor Market

The labor market remains strong, with unemployment rates at historically low levels. This suggests that the economy is still generating jobs and that consumers have a degree of confidence in the job market. However, rising interest rates could eventually lead to job losses, as businesses become more hesitant to hire and invest.

Geopolitical Tensions and Supply Chain Disruptions

The ongoing war in Ukraine and heightened tensions between the United States and China continue to disrupt global supply chains and create uncertainty in the global economy. These disruptions have contributed to higher energy prices and inflationary pressures. The resolution of these geopolitical tensions is crucial for a more stable economic outlook.

Consumer Spending

Consumer spending is a major driver of economic growth, and recent data suggests that consumers are starting to feel the pinch of inflation. Rising interest rates and high inflation are putting pressure on household budgets, and consumer spending could slow in the coming months.

Impact on Corporate Earnings and Investor Confidence

The economic outlook has a significant impact on corporate earnings and investor confidence. Rising interest rates increase the cost of borrowing for businesses, which can impact their profitability. Furthermore, a weakening economic outlook can lead to lower consumer demand, which can hurt corporate earnings.

This can lead to lower stock prices and reduced investor confidence.

Factors Dampening the Rally

The recent rally in the S&P 500, driven by optimism surrounding potential Federal Reserve rate cuts and a decline in inflation, has been met with some resistance. A confluence of factors is now weighing on the market, raising concerns about the sustainability of the current upward trend.

Persistent Inflation

While inflation has shown signs of cooling, it remains stubbornly elevated. The Consumer Price Index (CPI) rose 4.9% year-over-year in April, exceeding expectations and demonstrating that inflation is still a significant concern. This persistent inflationary pressure suggests that the Federal Reserve might be less inclined to aggressively cut interest rates, potentially limiting further upside for the S&P 500.

Economic Uncertainty

The global economic outlook remains uncertain. The International Monetary Fund (IMF) has downgraded its growth projections for 2023, citing ongoing geopolitical tensions, persistent inflation, and tighter monetary policies. The US economy has shown signs of resilience, but concerns remain about a potential recession later in the year.

This economic uncertainty is creating volatility in the market and dampening investor sentiment.

Geopolitical Risks

Geopolitical risks continue to weigh on the market. The war in Ukraine has disrupted global supply chains and contributed to inflation. The ongoing tensions between the United States and China, particularly in the technology sector, add to the uncertainty. These geopolitical risks create a sense of unease among investors, potentially limiting their willingness to take on risk.

Corporate Earnings

Corporate earnings are coming under pressure as companies grapple with rising costs and weakening demand. Some companies have reported disappointing earnings, raising concerns about the overall health of the economy. These earnings reports are closely watched by investors, and weak performance can lead to stock price declines.

Interest Rate Expectations, Economic outlook dampens sp 500s recent rally

While the Federal Reserve has signaled a potential pause in rate hikes, expectations for interest rate cuts have moderated. Some market participants believe that the Fed might need to keep rates higher for longer to tame inflation. This shift in expectations has led to a rise in bond yields, making equities less attractive to investors.

Valuations

The S&P 500 has experienced a significant rally in recent months, pushing valuations to relatively high levels. This raises concerns about a potential correction, as historically high valuations have often been followed by market pullbacks.

Investor Sentiment and Market Volatility: Economic Outlook Dampens Sp 500s Recent Rally

Investor sentiment, a gauge of market psychology, plays a crucial role in shaping the stock market’s trajectory. It reflects the collective mood of investors, encompassing their risk appetite, expectations about future market performance, and overall confidence in the economy.

Impact of Investor Sentiment on Market Volatility

Investor sentiment exerts a significant influence on market volatility, often leading to price fluctuations and market swings. When optimism prevails, investors tend to be more willing to take on risk, driving up demand for stocks and pushing prices higher. Conversely, when pessimism sets in, investors become risk-averse, leading to selling pressure and potential market declines.

“Investor sentiment is a powerful force in the stock market. It can amplify gains during bull markets and exacerbate losses during bear markets.”

- Increased Risk Appetite:During periods of high investor confidence, investors tend to be more willing to take on risk. This leads to increased demand for stocks, pushing prices higher and contributing to market rallies.

- Market Expectations:Investor sentiment is closely tied to market expectations. When investors are optimistic about the economy and corporate earnings, they tend to buy stocks, fueling market gains. Conversely, pessimistic expectations can lead to selling pressure and market declines.

- Trading Activity:Investor sentiment can also influence trading activity. High levels of optimism often lead to increased trading volume, as investors actively seek to capitalize on perceived market opportunities. Conversely, low sentiment can result in reduced trading volume as investors adopt a wait-and-see approach.

Potential for Short-Term Corrections

Given the current economic outlook and investor sentiment, the possibility of short-term corrections or pullbacks in the S&P 500 cannot be discounted. The recent rally has been fueled by factors such as declining inflation, easing interest rate concerns, and a resilient economy.

However, these positive developments are not without their challenges.

- Inflation Concerns:While inflation has moderated, it remains elevated compared to historical levels. Persistent inflation could erode corporate profits and consumer spending, potentially impacting stock prices.

- Interest Rate Uncertainty:The Federal Reserve’s stance on interest rates remains uncertain. Further interest rate hikes could impact corporate borrowing costs and slow economic growth, leading to market volatility.

- Geopolitical Risks:Ongoing geopolitical tensions, such as the Russia-Ukraine war, pose risks to global economic stability and could trigger market sell-offs.