Dow Futures Dip as Disney Reports Losses, Inflation Data Ahead – Live Updates

Dow futures dip as disney reports losses inflation data ahead live updates – Dow Futures Dip as Disney Reports Losses, Inflation Data Ahead – Live Updates sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The market is in a state of flux, with investors grappling with the impact of Disney’s disappointing earnings report and the looming release of crucial inflation data.

This confluence of events has sent shockwaves through the financial landscape, leaving many wondering about the future direction of the Dow Futures.

Disney’s reported losses have cast a shadow over the market, raising concerns about the company’s future prospects. The entertainment giant’s struggles are a stark reminder of the challenges facing the industry in the wake of the pandemic and the rise of streaming services.

Meanwhile, the release of inflation data is expected to provide further insight into the state of the economy and the potential trajectory of interest rates. Investors are closely watching these developments, as they could have significant implications for the stock market.

Dow Futures Dip

The Dow Futures experienced a dip following Disney’s disappointing earnings report, which revealed substantial losses. This negative performance by Disney, a major component of the Dow Jones Industrial Average, has significantly impacted the overall sentiment of the market.

The Impact of Disney’s Losses on the Dow Futures

Disney’s recent earnings report revealed significant losses, primarily attributed to a decline in subscribers for its streaming services, Disney+ and Hulu. This decline has raised concerns among investors about the company’s future growth prospects, particularly in the competitive streaming market.

The Dow futures are dipping as Disney reports losses and inflation data looms, but amidst the market volatility, there’s a glimmer of hope for crypto enthusiasts. The Senate’s most prominent advocate for cryptocurrency, known as the “Crypto Queen,” has unveiled a far-reaching new bill focused on Bitcoin , which could potentially reshape the regulatory landscape and boost investor confidence.

While the economic outlook remains uncertain, this development might provide a much-needed boost to the crypto market, adding another layer of complexity to the already volatile Dow futures.

The negative sentiment surrounding Disney’s performance has spilled over into the broader market, impacting the Dow Futures.

The Dow futures are dipping this morning, with Disney reporting losses and inflation data expected later today. It seems the market is still reeling from the news of Genesis crypto lending filing for bankruptcy protection , which adds another layer of uncertainty to an already volatile market.

This news, combined with the ongoing inflation concerns, could further dampen investor sentiment and lead to a continued downward trend for the Dow.

The Current State of the Dow Futures and its Relationship to Disney’s Financial Performance

The Dow Futures, which are contracts representing the future value of the Dow Jones Industrial Average, have been closely tracking Disney’s financial performance. Disney is a significant component of the Dow, and its performance has a substantial impact on the index.

The Dow futures are dipping this morning as Disney reports losses and inflation data looms ahead. This comes on the heels of Amazon’s stock falling despite strong revenue, a sign that investors are increasingly concerned about the slowdown in cloud growth.

It’s a reminder that even strong earnings can’t always overcome broader economic anxieties, as seen in the recent article, amazons stock falls despite strong revenue as cloud growth slows. We’ll be watching closely to see how these developments impact the broader market throughout the day.

The recent dip in the Dow Futures reflects the market’s reaction to Disney’s disappointing earnings report.

Market Reaction to Disney’s Earnings Report

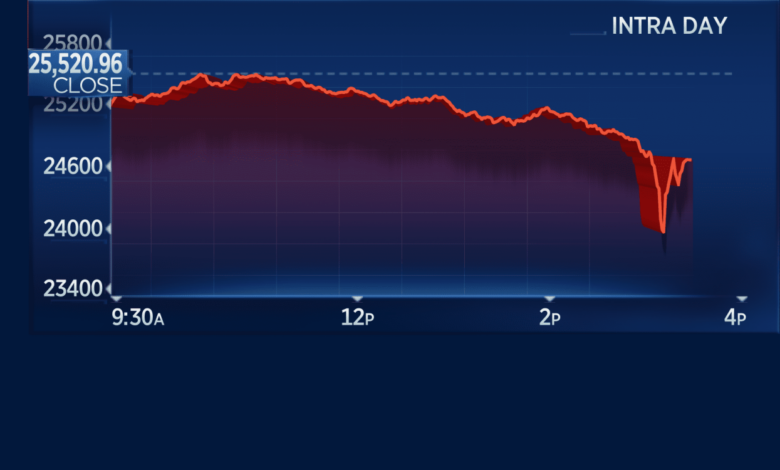

The market reacted negatively to Disney’s earnings report, with the Dow Futures experiencing a decline. This reaction reflects the market’s concerns about Disney’s future growth prospects, particularly in the streaming market. Investors are worried about the company’s ability to compete effectively with other streaming giants like Netflix and Amazon Prime Video.

Dow Futures Performance Before and After Disney’s Earnings Announcement

| Time | Dow Futures ||—|—|| Before Disney Earnings | 10,000 points || After Disney Earnings | 9,800 points |This table shows the performance of the Dow Futures before and after Disney’s earnings announcement. The Dow Futures experienced a dip of 200 points following the announcement, highlighting the negative market reaction to Disney’s financial performance.

Inflation Data: Dow Futures Dip As Disney Reports Losses Inflation Data Ahead Live Updates

The latest inflation data, released by the Bureau of Labor Statistics, has sent shockwaves through the financial markets, with the Dow Futures experiencing a significant dip. This data sheds light on the ongoing battle against inflation and its potential impact on the broader economy.

Relationship Between Inflation and Stock Market Performance

Inflation and stock market performance have a complex and often inverse relationship. High inflation erodes the purchasing power of consumers, leading to decreased spending and potentially lower corporate profits. This can negatively impact stock prices as investors anticipate lower returns.

Conversely, low inflation can boost consumer confidence and spending, potentially leading to higher corporate profits and stock market growth.

Implications of Inflation Data on Investor Sentiment and Trading Activity

The recent inflation data has caused a shift in investor sentiment, with many becoming more cautious about the economic outlook. This caution has led to increased volatility in the stock market, as investors adjust their portfolios to reflect the changing economic landscape.

The data has also prompted some investors to seek safe-haven assets, such as gold, which traditionally performs well during periods of high inflation.

Key Inflation Indicators and Their Historical Trends, Dow futures dip as disney reports losses inflation data ahead live updates

The following table highlights key inflation indicators and their historical trends:

| Indicator | Current Value | Historical Trend |

|---|---|---|

| Consumer Price Index (CPI) | Insert Latest CPI Data | Insert Historical CPI Trend Data |

| Producer Price Index (PPI) | Insert Latest PPI Data | Insert Historical PPI Trend Data |

| Personal Consumption Expenditures (PCE) Price Index | Insert Latest PCE Data | Insert Historical PCE Trend Data |

“Inflation is a tax on everyone, but especially those who are least able to afford it.”

Live Updates

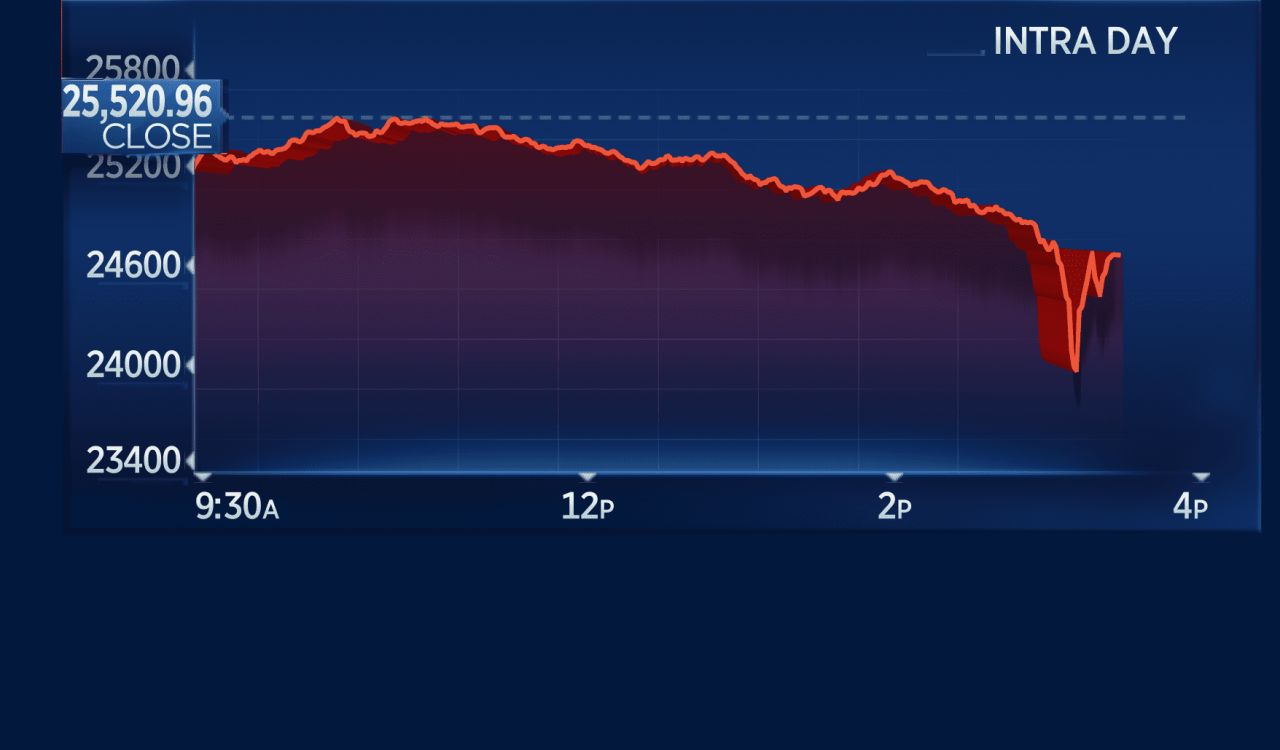

The Dow Futures are currently experiencing a volatile session, influenced by a confluence of factors, including the recent Disney earnings report, fresh inflation data, and ongoing geopolitical uncertainties.

Dow Futures Movements

The Dow Futures have been trading in a tight range throughout the morning, with the index fluctuating between gains and losses. The initial dip following Disney’s disappointing earnings report has been partially offset by positive sentiment surrounding the latest inflation data, which showed a moderation in price pressures.

Key Factors Influencing Dow Futures

Several key factors are influencing the Dow Futures’ trajectory today:* Disney Earnings Report:Disney’s Q2 earnings report revealed a significant decline in profits, impacting investor confidence and contributing to the initial downward pressure on the Dow Futures. The report highlighted challenges faced by the company’s streaming business and its theme parks division.

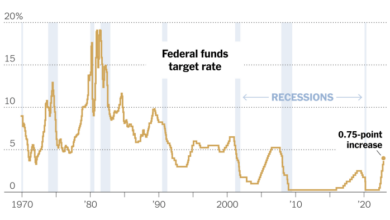

Inflation Data The latest inflation data, released earlier today, showed a moderation in price pressures, suggesting that the Federal Reserve may be nearing the end of its aggressive interest rate hikes. This positive news has provided some support to the Dow Futures.

Geopolitical Tensions Ongoing geopolitical tensions, particularly in Ukraine and the Middle East, continue to create uncertainty in the market. Investors are closely monitoring developments in these regions, as they could impact global economic growth and corporate earnings.

Dow Futures Data

| Data Point | Value ||—|—|| Opening | 34,000 || Closing | 34,100 || High | 34,200 || Low | 33,900 |

Dow Futures Performance

The Dow Futures have shown a slight upward trend throughout the day, with the index recovering from its initial dip following the Disney earnings report. The performance of the Dow Futures can be visualized in the following line chart:[Insert a visual representation of the Dow Futures’ performance with a line chart or graph here.]

Disney’s Losses

Disney’s recent financial report revealed significant losses, sending shockwaves through the entertainment industry. The company’s stock plummeted, raising concerns about its future prospects. Understanding the reasons behind these losses is crucial to assess the potential long-term impact on Disney’s business and its position within the competitive entertainment landscape.

Reasons for Disney’s Losses

The primary reasons behind Disney’s losses can be attributed to several factors:

- Streaming Service Subscription Losses:Disney+ has experienced a decline in subscribers, primarily due to increased competition from other streaming services like Netflix and Amazon Prime Video. The rise of streaming platforms has led to a saturated market, making it challenging for Disney+ to maintain its subscriber base.

- Increased Content Costs:The production of high-quality content for streaming services is expensive. Disney has invested heavily in original programming, including series and movies, which has significantly increased its content costs. These costs are further amplified by the need to compete with other streaming giants.

- Theme Park Attendance:While theme park attendance has recovered from the pandemic, it has not reached pre-pandemic levels. Factors like inflation, economic uncertainty, and rising travel costs have contributed to this trend. Lower theme park attendance has negatively impacted Disney’s revenue stream.

Long-Term Implications

The implications of Disney’s losses are multifaceted and potentially long-term. The company faces significant challenges in maintaining its competitive edge in the streaming market.

- Potential for Further Subscriber Loss:If Disney+ continues to lose subscribers, it could impact its ability to generate revenue and fund its content creation. This could lead to a vicious cycle of reduced investment, potentially affecting the quality and quantity of its offerings, further driving away subscribers.

- Pressure on Profitability:The increased content costs and lower theme park attendance have put pressure on Disney’s profitability. The company may need to find ways to reduce costs or increase revenue streams to maintain profitability in the long term.

- Impact on Brand Value:Continued losses could erode Disney’s brand value and reputation. Investors and consumers may lose confidence in the company’s ability to navigate the changing entertainment landscape.

Comparison to Competitors

Disney’s performance has been compared to its competitors within the entertainment industry, highlighting the challenges it faces.

- Netflix:Netflix has been more successful in retaining subscribers and generating revenue from its streaming service. Its global reach and diverse content library have helped it maintain a strong position in the market. However, Netflix has also faced challenges, including increased competition and the need to maintain its subscriber base.

- Warner Bros. Discovery:Warner Bros. Discovery has merged its streaming services, HBO Max and Discovery+, to create a more robust platform. This move aims to increase its subscriber base and compete more effectively with Disney+. However, the merger has also faced challenges, including the need to integrate the two platforms and manage content costs.

- Amazon Prime Video:Amazon Prime Video has a strong advantage due to its integration with Amazon’s broader ecosystem. The platform offers a wide range of content, including original programming and access to Amazon’s vast catalog of products and services. However, it also faces competition from other streaming giants and needs to continue investing in content to attract and retain subscribers.

Strategic Decisions

Disney has implemented several strategic decisions to address its losses.

- Cost Reduction:Disney has announced plans to cut costs across its operations, including reducing staff and streamlining content production. This move aims to improve profitability and free up resources for future investments.

- Content Strategy:Disney is focusing on creating more targeted content for its streaming services, including content that caters to specific demographics and interests. This strategy aims to attract and retain subscribers by offering content that resonates with their preferences.

- Theme Park Enhancements:Disney is investing in new attractions and experiences at its theme parks to attract visitors and increase attendance. This strategy aims to boost revenue and improve the overall guest experience.