Dollar Strengthens on Fed Rate Hike Signal, Yuan and Kiwi Decline in Asia

Dollar strengthens on feds signal of rate hikes yuan and kiwi experience declines in asian markets – Dollar Strengthens on Fed Rate Hike Signal, Yuan and Kiwi Decline in Asia sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The US Federal Reserve’s recent signal of impending interest rate hikes has sent ripples across global markets, bolstering the US dollar while pushing down currencies in Asia, particularly the yuan and the New Zealand dollar.

This intricate dance of currencies reflects the interconnected nature of the global economy and the powerful influence of central bank decisions.

The Fed’s move to raise interest rates is intended to curb inflation, but it can have a significant impact on global markets. Higher interest rates in the US make the dollar more attractive to investors, leading to an increase in demand and a strengthening of the currency.

This, in turn, can put pressure on other currencies, particularly those in emerging markets like China and New Zealand. The yuan and the kiwi have been experiencing declines in recent weeks, reflecting concerns about their respective economies and the potential impact of the stronger dollar on their exports and investments.

Federal Reserve’s Influence on the Dollar

The Federal Reserve’s recent signal of rate hikes has sent ripples through the global financial markets, with the US dollar strengthening against its major counterparts. This move reflects the central bank’s commitment to combatting inflation, which has been at its highest levels in decades.

The dollar’s strength is making waves across the globe, as the Federal Reserve’s signals of rate hikes continue to influence currency markets. The yuan and kiwi are experiencing declines in Asian markets, a trend that reflects the global economic landscape.

This news comes as a stark contrast to the sad news of the passing of renowned actor Ray Stevenson at 58 , known for his roles in films like “Punisher: War Zone,” “RRR,” and the “Thor” franchise. His loss is a reminder of the fragility of life, even amidst the fluctuating tides of the global economy.

The dollar’s strength, while a significant factor in the current market, is ultimately overshadowed by the human element, and the impact of a life well-lived.

Impact of Rate Hikes on the Dollar

The connection between the Federal Reserve’s rate hikes and the strengthening dollar lies in the principle of interest rate differentials. When the Federal Reserve raises interest rates, it makes US assets, such as bonds, more attractive to foreign investors. This increased demand for US assets drives up the dollar’s value, as investors need to exchange their currencies for dollars to purchase these assets.

Impact of Increased Interest Rates on the US Economy, Dollar strengthens on feds signal of rate hikes yuan and kiwi experience declines in asian markets

Higher interest rates can have a mixed impact on the US economy. While they help curb inflation by making borrowing more expensive and slowing down economic activity, they can also stifle investment and growth. The Federal Reserve carefully monitors the economy and adjusts interest rates accordingly to achieve its dual mandate of price stability and maximum employment.

Historical Examples of Rate Hikes Affecting the Dollar’s Value

Throughout history, the Federal Reserve’s rate hike decisions have consistently influenced the dollar’s value. For example, during the 1980s, under then-Chair Paul Volcker, the Fed aggressively raised interest rates to combat rampant inflation. This policy resulted in a significant appreciation of the dollar, although it also led to a recession.

In more recent times, the Federal Reserve’s gradual rate hikes between 2015 and 2018 contributed to a period of dollar strength.

Yuan and Kiwi Declines in Asian Markets

The recent strengthening of the US dollar has led to declines in the Chinese yuan and the New Zealand dollar in Asian markets. These currency movements reflect the diverging economic conditions between the United States and these two Asian economies.

Reasons for Yuan and Kiwi Declines

The declines in the yuan and the kiwi can be attributed to a number of factors. The US Federal Reserve’s aggressive rate hikes have made the dollar more attractive to investors, leading to capital outflows from emerging markets, including China and New Zealand.

The dollar’s strength, fueled by the Fed’s hints of further rate hikes, is creating ripples across Asian markets. The yuan and kiwi are experiencing declines, while the Indian market remains relatively flat. For live updates on the share market movement, including the Nifty crossing 17650 and a focus on HCL Tech and Tata Motors, check out this insightful article: live updates share market movement flat nifty crosses 17650 focus on hcl tech and tata motors.

It’s fascinating to see how global monetary policies influence regional markets, and it’s a reminder to stay informed about the latest developments.

Additionally, China’s economic growth has slowed in recent months, due in part to the ongoing COVID-19 pandemic and strict zero-COVID policies. The country’s real estate sector has also been experiencing difficulties. These factors have weighed on the yuan’s value.

New Zealand’s economy has also been impacted by global inflation and rising interest rates. The country’s central bank has raised interest rates to combat inflation, but this has also slowed economic growth. These factors have contributed to the decline in the kiwi.

Comparison of Economic Conditions

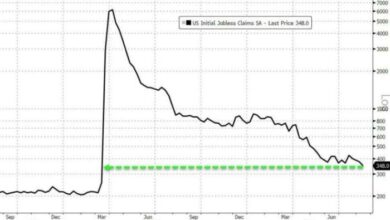

The US economy is currently outperforming both China and New Zealand. The US unemployment rate is low, and consumer spending remains strong. The Federal Reserve’s rate hikes are intended to cool the US economy and curb inflation, but the economy is still expected to grow in the coming months.

China’s economy, on the other hand, is facing headwinds from the pandemic, strict COVID-19 policies, and a slowing real estate sector. The country’s growth rate is expected to slow in the coming months. New Zealand’s economy is also facing challenges from global inflation and rising interest rates.

The dollar’s surge on the Fed’s signal of rate hikes is shaking up Asian markets, with the yuan and kiwi experiencing notable declines. This kind of economic volatility often prompts investors to seek out safer havens, and it’s interesting to see how this plays out in the tech world.

For example, the recent news that daniel baldwin joins ishook 202879 could be a sign of a shift in investment strategies as businesses brace for potential economic headwinds. Only time will tell how these global market trends will ultimately impact the tech industry, but it’s definitely something to keep an eye on.

The country’s central bank has raised interest rates to combat inflation, but this has also slowed economic growth.

Impact on Trade and Investment

The declines in the yuan and the kiwi could have a significant impact on trade and investment in the region. A weaker yuan could make Chinese exports more competitive, but it could also make imports more expensive. This could lead to higher inflation in China.

A weaker kiwi could also make New Zealand exports more competitive, but it could also make imports more expensive.The declines in these currencies could also make it more expensive for Chinese and New Zealand companies to borrow money in foreign currencies.

This could make it more difficult for these companies to invest and expand their businesses.

Global Market Dynamics

The strengthening dollar has far-reaching implications for global markets, influencing everything from trade flows to investment decisions. Its impact is particularly pronounced in emerging economies and developing countries, where businesses and individuals are more vulnerable to currency fluctuations.

Impact on Emerging Economies and Developing Countries

The dollar’s strength poses both challenges and opportunities for emerging economies and developing countries. While a strong dollar can make imports cheaper, it can also make exports more expensive, potentially hurting these economies’ growth prospects.

- Increased Debt Burden:Many emerging market countries have borrowed heavily in dollars, and a stronger dollar increases the real value of their debt, making it more difficult to repay. This can lead to financial instability and slow economic growth.

- Reduced Investment:A strong dollar can discourage foreign investment in emerging markets, as investors may seek higher returns in dollar-denominated assets. This can lead to lower investment levels and slower economic growth.

- Inflationary Pressures:A stronger dollar can lead to imported inflation, as the prices of imported goods rise. This can erode purchasing power and make it more difficult for central banks to control inflation.

Current Exchange Rates

The table below shows the current exchange rates of major currencies against the US dollar:

| Currency | Exchange Rate (USD/Unit) |

|---|---|

| Euro (EUR) | 1.08 |

| Japanese Yen (JPY) | 140.00 |

| British Pound (GBP) | 0.80 |

| Canadian Dollar (CAD) | 1.35 |

| Australian Dollar (AUD) | 1.45 |

| Swiss Franc (CHF) | 0.90 |

Note: These exchange rates are subject to change and are for illustrative purposes only.

Future Outlook: Dollar Strengthens On Feds Signal Of Rate Hikes Yuan And Kiwi Experience Declines In Asian Markets

Predicting currency movements is a complex endeavor, influenced by a multitude of factors. However, based on current trends and economic indicators, we can speculate on the potential trajectory of the dollar, yuan, and kiwi in the coming months.

Factors Influencing Future Currency Movements

The following factors are likely to influence currency movements in the future:

- Monetary Policy:The Federal Reserve’s continued rate hikes are expected to strengthen the dollar, while the People’s Bank of China’s (PBOC) easing monetary policy could weaken the yuan. The Reserve Bank of New Zealand (RBNZ) is also expected to continue raising interest rates, which could support the kiwi.

- Economic Growth:The US economy is expected to slow down in the coming months, while China’s economy is projected to recover. New Zealand’s economy is also expected to grow, albeit at a slower pace. These growth differentials could influence currency movements.

- Geopolitical Events:Geopolitical events, such as the ongoing war in Ukraine, trade tensions between the US and China, and global energy crises, can have significant impacts on currency markets.

- Risk Appetite:Investor sentiment towards emerging markets can influence currency movements. If investors are risk-averse, they may sell emerging market currencies, including the yuan and kiwi.

- Commodity Prices:Commodity prices, particularly oil and gas, can have a significant impact on currency movements. For example, rising oil prices could benefit the kiwi, which is closely tied to commodity exports.

Potential Timeline of Events

The following is a potential timeline of events that could impact exchange rates:

- Q2 2023:The Federal Reserve is expected to continue raising interest rates, which could further strengthen the dollar. The PBOC may continue to ease monetary policy to support economic growth, which could weaken the yuan. The RBNZ is also expected to raise interest rates, which could support the kiwi.

- Q3 2023:The US economy is expected to slow down, which could put downward pressure on the dollar. China’s economy is projected to recover, which could support the yuan. New Zealand’s economy is also expected to grow, which could support the kiwi.

- Q4 2023:The Federal Reserve may begin to slow down its rate hikes, which could weaken the dollar. The PBOC may continue to support economic growth, which could strengthen the yuan. The RBNZ may also start to slow down its rate hikes, which could weaken the kiwi.