Disney Posts Robust Earnings Ahead of Iger-Peltz Showdown

Disney posts robust earnings ahead of ceo bob iger showdown with peltz – Disney Posts Robust Earnings Ahead of Iger-Peltz Showdown, a captivating clash between the media giant’s CEO Bob Iger and activist investor Nelson Peltz. This earnings report, showcasing strong financial performance, comes at a critical juncture as the company navigates a complex landscape of streaming wars, theme park attendance, and the ever-evolving media industry.

The spotlight is on Iger’s leadership, his strategic direction for Disney, and the potential impact of Peltz’s proposed changes on the company’s future.

The robust earnings, fueled by a surge in theme park attendance and Disney+ subscriber growth, have undoubtedly provided a temporary reprieve for Iger, who is already facing a formidable challenge in the form of Peltz’s relentless pursuit of board representation.

Peltz, a seasoned investor with a history of shaking up corporate boards, is demanding significant changes at Disney, arguing that the company needs a fresh perspective to address its challenges.

Disney’s Financial Performance

Disney’s recent earnings report has sent shockwaves through the entertainment industry, showcasing the company’s resilience and strong financial position. This robust performance comes at a critical time for Disney, as CEO Bob Iger faces a looming showdown with activist investor Nelson Peltz.

The earnings report serves as a powerful statement, highlighting Disney’s ability to navigate challenges and deliver strong results.

Key Financial Metrics

The earnings report revealed a number of key financial metrics that contributed to Disney’s strong performance. These metrics provide a clear picture of the company’s financial health and its ability to generate revenue and profits.

Disney’s robust earnings are a welcome distraction from the upcoming showdown between CEO Bob Iger and activist investor Nelson Peltz. Meanwhile, the global community is rallying behind Israel, with crypto and Web3 companies stepping up to support Israelis affected by Hamas terrorism.

It’s a stark reminder that even during times of corporate battles, there are bigger issues at play, and a global sense of unity can emerge in the face of tragedy. The Disney-Peltz conflict might seem like a major event, but it pales in comparison to the humanitarian crisis unfolding in Israel.

- Revenue:Disney reported revenue of $21.8 billion for the quarter, exceeding analysts’ expectations and marking a significant increase from the previous quarter. This growth was driven by strong performance across various segments, including theme parks, streaming, and media networks.

- Operating Income:Disney’s operating income for the quarter reached $4.8 billion, demonstrating the company’s ability to control costs and generate profits even in a challenging economic environment. This figure represents a substantial improvement compared to the previous quarter and the same period last year.

- Earnings Per Share:Disney reported earnings per share of $1.06, exceeding analysts’ estimates and showcasing the company’s profitability. This strong performance reflects the company’s efficient operations and its ability to generate value for shareholders.

Comparison with Previous Quarters and the Same Period Last Year

Disney’s recent earnings report represents a significant improvement compared to the previous quarter and the same period last year. The company’s financial performance has been steadily improving, demonstrating its ability to navigate challenges and achieve sustained growth.

- Revenue:Compared to the previous quarter, Disney’s revenue increased by a significant margin, reflecting the company’s strong performance across its various segments. This growth indicates a positive trend and highlights the company’s ability to capitalize on opportunities in the market.

Disney’s robust earnings, released ahead of CEO Bob Iger’s showdown with activist investor Nelson Peltz, highlight the company’s resilience in a changing media landscape. It’s interesting to note that as Disney navigates these challenges, new research reveals the surprising no 1 city for remote jobs defying New York and San Francisco , suggesting a shift in how people are working and where they choose to live.

This changing landscape could potentially influence Disney’s future strategies, particularly in talent acquisition and content production.

- Operating Income:Disney’s operating income for the current quarter exceeded the previous quarter’s performance, showcasing the company’s ability to control costs and generate profits. This improvement demonstrates the company’s commitment to operational efficiency and financial discipline.

- Earnings Per Share:Disney’s earnings per share for the current quarter significantly exceeded the previous quarter’s performance, reflecting the company’s strong profitability. This growth indicates the company’s ability to generate value for shareholders and achieve sustained profitability.

Potential Impact on Disney’s Stock Price

Disney’s robust earnings report is expected to have a positive impact on the company’s stock price. The strong financial performance, coupled with the company’s commitment to growth and shareholder value, is likely to boost investor confidence and drive demand for Disney’s stock.

This could lead to an increase in the stock price, reflecting the market’s positive outlook on the company’s future prospects.

“Disney’s strong earnings report is a clear indication of the company’s resilience and its ability to navigate challenges and deliver strong results. This performance is likely to have a positive impact on the company’s stock price, as investors respond to the company’s strong financial performance and its commitment to growth and shareholder value.”

Analyst Comment

The Bob Iger-Nelson Peltz Showdown: Disney Posts Robust Earnings Ahead Of Ceo Bob Iger Showdown With Peltz

The ongoing conflict between Disney CEO Bob Iger and activist investor Nelson Peltz has captivated the business world, raising questions about the future of the entertainment giant. Peltz, through his investment firm Trian Fund Management, has been pushing for changes at Disney, arguing that the company needs to streamline its operations and improve shareholder value.

Iger, on the other hand, has defended his leadership and the company’s strategic direction.

Key Points of Contention, Disney posts robust earnings ahead of ceo bob iger showdown with peltz

The conflict between Iger and Peltz stems from fundamental disagreements about Disney’s strategy and governance. Peltz’s criticisms primarily center around Disney’s sprawling structure, its high spending on streaming, and its board’s composition. He has argued that Disney should consider selling its ESPN business, reduce its reliance on streaming, and make changes to its board to improve its effectiveness.

Iger, however, has maintained that Disney’s current strategy is sound and that the company is well-positioned for future growth. He has defended the company’s investments in streaming, arguing that it is a critical area for future growth. He has also rejected Peltz’s calls for changes to the board, arguing that the current board is effective and provides strong oversight.

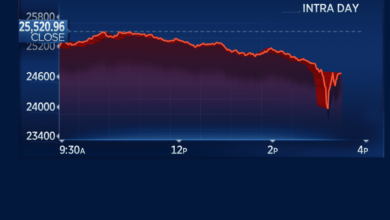

Disney’s robust earnings, a potential counterpoint to the ongoing drama with activist investor Nelson Peltz, come amidst a mixed bag of market news. While the stock market opened lower today, fueled by concerns about China’s economic slowdown, positive US retail sales figures offered some solace.

The performance of Disney, with its robust earnings, will be a key indicator for investors watching for the potential impact of Peltz’s demands on the company’s future strategy.

Potential Outcomes of the Conflict

The outcome of the conflict between Iger and Peltz remains uncertain. There are several potential scenarios:

- Peltz’s demands are met:If Peltz succeeds in pressuring Disney to make significant changes, such as selling ESPN or restructuring its board, it could have a significant impact on the company’s future.

- A compromise is reached:Both sides could agree to some concessions, leading to a more moderate outcome. This could involve Disney making some changes to its operations or board composition while maintaining its overall strategic direction.

- The status quo prevails:If Iger successfully defends his strategy and the board resists Peltz’s demands, the company could continue on its current path.

Impact on Disney’s Business Operations and Strategic Direction

The conflict between Iger and Peltz could have a significant impact on Disney’s business operations and strategic direction.

- Strategic shifts:If Peltz’s demands are met, Disney could be forced to make significant changes to its strategy, such as selling ESPN or reducing its investment in streaming. This could have a major impact on the company’s revenue streams and its competitive position in the entertainment industry.

- Operational changes:Peltz’s calls for streamlining could lead to changes in Disney’s organizational structure and cost-cutting measures. This could impact the company’s workforce and its ability to invest in new products and services.

- Governance changes:Changes to Disney’s board could lead to a shift in the company’s governance structure. This could have implications for how the company is managed and how it responds to shareholder demands.

Disney’s Strategic Direction

Bob Iger’s return as CEO has brought a renewed focus on Disney’s core strengths, emphasizing a return to the traditional entertainment business model. This strategy involves a careful balance between maximizing existing assets, streamlining operations, and investing in growth opportunities.

Iger’s Current Approach Compared to His Previous Tenure

Iger’s current approach is marked by a strong emphasis on cost-cutting and efficiency, reflecting the challenging economic climate and the need to address the company’s recent financial performance. In contrast, his previous tenure was characterized by a more aggressive expansion strategy, marked by large acquisitions and a focus on growth.

However, Iger’s current strategy also includes a focus on innovation and technological advancements, particularly in streaming and immersive experiences, demonstrating a continued commitment to future growth.

Potential Impact of Peltz’s Proposed Changes

Nelson Peltz, an activist investor, has advocated for a strategic shift at Disney, focusing on cost reduction, shareholder value enhancement, and a more streamlined corporate structure. Peltz’s proposed changes, if implemented, could potentially lead to a more focused and efficient Disney, potentially leading to improved profitability and shareholder returns.

However, the potential impact of Peltz’s proposals remains to be seen, as they may require significant adjustments to Disney’s current strategy and operations.

Key Challenges and Opportunities Facing Disney

Disney faces a number of challenges in the current market environment, including increased competition in the streaming market, the ongoing impact of the COVID-19 pandemic, and evolving consumer preferences. Despite these challenges, Disney also has significant opportunities for growth, including the expansion of its streaming services into new markets, the development of new content and experiences, and the continued monetization of its vast intellectual property portfolio.

The Future of Disney

Disney’s future is a tapestry woven with threads of innovation, evolving consumer preferences, and the ongoing battle for market share in a rapidly changing media landscape. While the company faces significant challenges, its iconic brand, vast intellectual property portfolio, and strategic investments in new technologies position it for continued success.

Disney’s Business Segments and Growth Prospects

Disney’s business segments, each with its own growth trajectory, contribute to the company’s overall performance.

| Segment | Growth Prospects | Key Factors |

|---|---|---|

| Theme Parks & Experiences | Strong | Growing global tourism, pent-up demand, new park openings, and immersive experiences |

| Media Networks | Moderate | Declining cable TV subscriptions, but growth in streaming and ESPN+ |

| Studio Entertainment | Stable | Box office performance, licensing, and streaming revenue |

| Direct-to-Consumer & International | High | Growth in Disney+, Hulu, and ESPN+, expanding international reach |

Potential Scenarios for Disney’s Future

The outcome of the Iger-Peltz conflict, coupled with broader industry trends, will shape Disney’s future.

- Scenario 1: Iger prevails, focusing on streaming and cost optimization.Disney’s future might see a renewed emphasis on growing its streaming platforms, potentially including acquisitions or partnerships to enhance its content library. Cost optimization could involve streamlining operations and potentially divesting non-core assets. This scenario suggests a continued focus on digital transformation and maximizing shareholder value.

- Scenario 2: Peltz gains influence, pushing for greater shareholder returns and divestitures.This scenario might lead to a more aggressive approach to shareholder returns, potentially through increased dividends or share buybacks. Disney might also consider divesting some of its non-core assets, such as ESPN or certain media networks, to unlock value. This approach could prioritize short-term financial gains over long-term strategic growth.

- Scenario 3: A negotiated compromise between Iger and Peltz.This scenario might involve a combination of elements from both previous scenarios, with a focus on both shareholder value and strategic growth. Disney could pursue a balanced approach, investing in streaming while also exploring potential divestitures to enhance profitability.

The Impact of Emerging Technologies on Disney’s Business

Emerging technologies, such as AI and VR, hold significant potential for Disney’s future.

- AI:AI can enhance content creation, personalization, and customer service. Disney can leverage AI for automated scriptwriting, character design, and dynamic storytelling. AI-powered chatbots and virtual assistants can provide personalized recommendations and improve customer interactions.

- VR:VR can create immersive theme park experiences, interactive storytelling, and new forms of entertainment. Disney can develop VR attractions that transport guests to fantastical worlds, offer behind-the-scenes glimpses of filmmaking, and create interactive games based on popular franchises.

Key Stakeholders and Their Interests

Disney’s success depends on the alignment of interests among its key stakeholders.

- Shareholders:Seek high returns on their investments through dividends, share price appreciation, and long-term growth.

- Employees:Desire competitive salaries, benefits, and career advancement opportunities within a positive work environment.

- Customers:Expect high-quality entertainment experiences, innovative products and services, and value for their money.

- Government & Regulators:Ensure fair competition, consumer protection, and compliance with regulations.

- Communities:Benefit from economic development, job creation, and responsible environmental practices.