Critical Week Ahead: Stocks Brace for Trials

Critical week ahead stocks brace for trials including nvidia earnings and powells speech – Critical week ahead: stocks brace for trials including Nvidia earnings and Powell’s speech. This week promises to be a rollercoaster ride for investors as the market navigates a sea of uncertainty. The tech sector will be under the microscope as Nvidia, a bellwether for the industry, releases its earnings report.

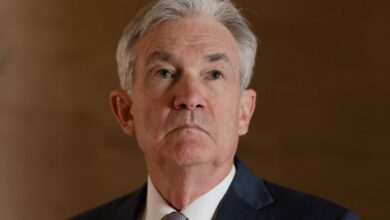

Meanwhile, the Federal Reserve’s Chair Jerome Powell is set to deliver a speech, offering crucial insights into the future of monetary policy. These events, combined with the already volatile market landscape, will undoubtedly shape the trajectory of the stock market in the coming days.

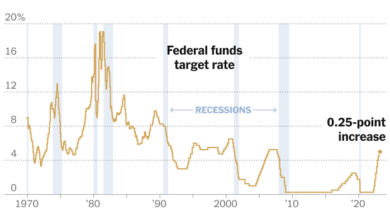

The recent economic data has painted a mixed picture, with inflation showing signs of cooling but the labor market remaining strong. This delicate balance has left investors wondering about the Fed’s next move. Will they continue to raise interest rates to combat inflation, or will they pause and assess the impact of their previous tightening measures?

Powell’s speech will be closely watched for clues about the Fed’s future path, and its implications for the stock market are significant.

Market Outlook: Critical Week Ahead Stocks Brace For Trials Including Nvidia Earnings And Powells Speech

The stock market is poised for a volatile week, with investors bracing for a series of key events that could significantly impact market sentiment. The combination of upcoming earnings reports, a crucial Federal Reserve speech, and ongoing economic uncertainty is creating a heightened sense of anticipation and caution among traders.

Factors Contributing to Volatility

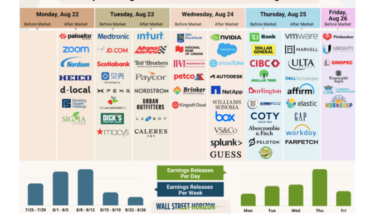

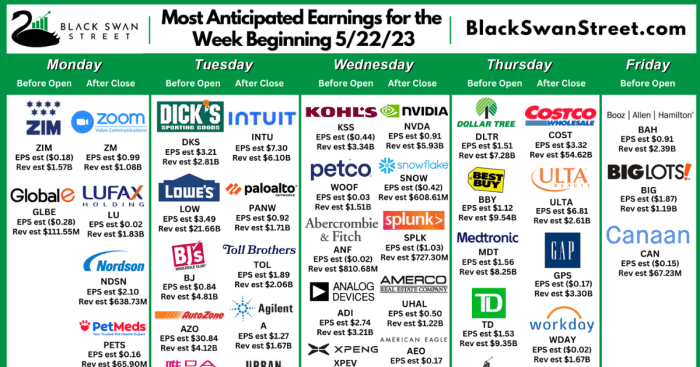

Several factors are converging to create a volatile market environment this week. The release of earnings reports from major companies, particularly Nvidia, will provide insights into the health of key sectors and the overall economic outlook. Additionally, Federal Reserve Chair Jerome Powell’s speech on monetary policy will be closely watched for any hints about future interest rate decisions, which could have a profound impact on asset valuations.

Furthermore, the ongoing geopolitical tensions and inflation concerns continue to weigh on investor confidence, adding to the uncertainty surrounding the market’s direction.

Key Economic Indicators and Events

- Nvidia Earnings Report:Nvidia, a leading semiconductor company, is scheduled to release its quarterly earnings report this week. The results will be closely scrutinized for signs of demand in the artificial intelligence (AI) and gaming sectors, which are key drivers of Nvidia’s growth.

- Federal Reserve Chair Jerome Powell’s Speech:The Federal Reserve Chair is expected to deliver a speech on monetary policy, providing insights into the central bank’s future course of action. Investors will be looking for clues about the timing and magnitude of future interest rate hikes, which could influence the direction of the stock market.

- Economic Data Releases:A number of key economic data releases are scheduled for this week, including inflation data, retail sales figures, and manufacturing indexes. These data points will provide further insights into the health of the US economy and could impact market sentiment.

Potential Risks and Opportunities, Critical week ahead stocks brace for trials including nvidia earnings and powells speech

The volatile market environment presents both risks and opportunities for investors.

- Risks:

- Earnings Disappointments:If companies fail to meet earnings expectations, it could lead to sell-offs in the stock market, particularly in sectors that are heavily reliant on consumer spending.

- Hawkish Fed Stance:If the Federal Reserve signals a more aggressive approach to interest rate hikes, it could lead to a decline in stock prices as investors become concerned about higher borrowing costs and slower economic growth.

- Geopolitical Uncertainty:Ongoing geopolitical tensions, such as the conflict in Ukraine, could continue to weigh on market sentiment and lead to increased volatility.

- Opportunities:

- Earnings Surprises:Companies that exceed earnings expectations could see their stock prices rise as investors become more optimistic about their future prospects.

- Sector Rotation:As investors adjust their portfolios in response to economic conditions, certain sectors may outperform others. For example, if inflation remains high, energy and materials stocks could benefit from rising commodity prices.

- Value Investing:In a volatile market, value stocks, which are often undervalued by the market, may present attractive opportunities for investors seeking long-term growth.

This week is shaping up to be a rollercoaster for the stock market, with investors bracing for crucial events like Nvidia’s earnings report and Powell’s speech. But amidst the market volatility, it’s also a good time to remember the importance of personal financial stability.

Managing credit debt effectively can be a key factor in weathering market storms, and resources like credit debt management tips strategies examples can offer valuable guidance. Ultimately, a well-balanced portfolio and a solid financial foundation can help you navigate the ups and downs of the stock market with confidence.

It’s a critical week ahead for the markets, with investors bracing for trials by fire including Nvidia’s earnings and Powell’s speech. But amidst the volatility, it’s crucial to remember the importance of a balanced life, especially when it comes to your finances and health.

Check out this great article on balancing your finances and health top tips for achieving both for some valuable tips. After all, a healthy mind and body can help you navigate the ups and downs of the market with greater resilience.

This week is shaping up to be a rollercoaster for the markets, with investors bracing for key events like Nvidia’s earnings report and Powell’s speech. The global economic picture isn’t exactly rosy either, as evidenced by the sharp 14.5% drop in Chinese exports in July , reflecting a slowdown in global demand.

These factors will likely influence market sentiment and could make for some volatile trading days ahead.