China Faces Pressure to Boost Economy Amid Rate Cut Skepticism

China faces mounting pressure to boost economy amidst rate cut skepticism – China Faces Pressure to Boost Economy Amid Rate Cut Skepticism: The world’s second-largest economy is grappling with a slowdown, prompting calls for aggressive action. While recent rate cuts have been implemented, skepticism remains regarding their effectiveness in stimulating growth. The pressure on China to revive its economy is mounting, with global stakeholders eager to see a robust recovery.

China’s economic challenges are multifaceted. The global trade war, pandemic-related disruptions, and domestic policy constraints have contributed to a slowdown in GDP growth, rising inflation, and increasing unemployment. The effectiveness of past stimulus measures has been debated, with some questioning their long-term sustainability.

China’s Economic Challenges

China’s economic growth has been a defining feature of the 21st century, propelling the nation to become the world’s second-largest economy. However, recent years have seen a slowdown in this remarkable growth trajectory, prompting concerns about the sustainability of China’s economic model.

Current Economic Indicators

China’s economic performance is characterized by a complex interplay of various indicators. The country’s GDP growth, a key measure of economic activity, has been slowing down, reflecting the challenges facing the economy. In 2022, China’s GDP grew by 3%, marking a significant decline from the double-digit growth rates seen in previous decades.

While this growth rate is still relatively high compared to many other developed economies, it represents a considerable slowdown for China.Inflation, another important indicator, has been relatively stable in recent years, remaining within the government’s target range. However, the recent spike in global commodity prices due to the war in Ukraine has put upward pressure on inflation, raising concerns about potential price increases.Unemployment is a critical social and economic issue, particularly in a country with a large and rapidly growing population.

China’s unemployment rate has been relatively low in recent years, but the rising cost of living and job insecurity have raised concerns about the sustainability of this trend. The youth unemployment rate, in particular, has been a source of concern, highlighting the challenges facing young graduates in finding stable employment.

Factors Contributing to the Slowdown

The slowdown in China’s economic growth is a result of several interconnected factors, both domestic and global. One significant factor is the ongoing trade tensions between China and the United States. The trade war, characterized by tariffs and other trade barriers, has disrupted global supply chains and negatively impacted Chinese exports.Domestic policy constraints also play a role in the economic slowdown.

The Chinese government’s efforts to curb excessive debt levels in the financial sector and to reduce pollution have slowed down investment and economic activity. The government’s “common prosperity” campaign, aimed at reducing income inequality, has also led to uncertainty among businesses and investors.The COVID-19 pandemic has had a significant impact on China’s economy, disrupting supply chains, reducing consumer spending, and causing widespread business closures.

The government’s zero-COVID policy, while successful in containing the spread of the virus, has also led to economic disruptions and slowed down the recovery process.

China’s economic woes continue to deepen, with the recent rate cut failing to inspire confidence. While policymakers grapple with finding the right formula for a revival, news from across the globe highlights the complexities of navigating the modern economic landscape.

The EU’s record-breaking billion-euro fine on Meta for data privacy violations highlights the growing scrutiny of tech giants , reminding us that global markets are subject to ever-evolving regulations. This underscores the challenges China faces in fostering a stable and sustainable economic environment amidst growing international pressure.

Effectiveness of Stimulus Measures

In response to the economic slowdown, the Chinese government has implemented various stimulus measures, including tax cuts, infrastructure spending, and monetary easing. While these measures have provided some short-term support to the economy, their long-term impact is debatable.Previous stimulus measures have been criticized for contributing to excessive debt levels and asset bubbles, which can pose risks to financial stability.

The effectiveness of future stimulus measures will depend on their design and implementation, as well as the overall economic environment.

The Rate Cut Skepticism

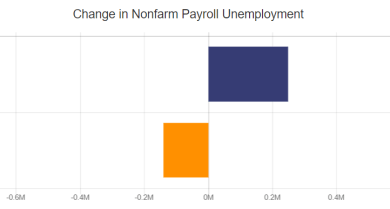

China’s recent rate cuts, aimed at stimulating economic growth, have sparked skepticism among economists and market analysts. While the government seeks to revive the economy, concerns remain regarding the effectiveness of this approach.

China’s economy is facing a tough road ahead, with pressure mounting for a boost despite skepticism surrounding potential rate cuts. While the Chinese government grapples with these challenges, the US dollar remains relatively stable in the forex market, fueled by expectations of further Fed rate hikes and optimism surrounding the debt ceiling resolution.

This stability, as detailed in this article , might actually create further pressure on China to find innovative solutions to jumpstart their economy.

Reasons for Rate Cuts and Their Intended Impact

The rationale behind the rate cuts lies in the government’s efforts to address slowing economic growth and bolster investment. Lower interest rates make it cheaper for businesses to borrow money, encouraging them to invest and expand operations. This, in turn, is expected to create jobs, stimulate consumer spending, and ultimately boost economic activity.

Concerns and Skepticism Regarding Rate Cuts

Despite the intended benefits, several concerns surround the effectiveness of rate cuts in stimulating economic activity. These concerns include:

- Debt Levels:China’s already high corporate and household debt levels may limit the impact of rate cuts. With significant debt burdens, businesses may be hesitant to borrow more, even at lower interest rates.

- Structural Issues:Rate cuts alone may not address underlying structural issues such as overcapacity in certain industries, weak consumer demand, and a slowing property market. These factors may hinder the effectiveness of monetary policy measures.

- Limited Transmission Mechanism:The effectiveness of rate cuts depends on the transmission mechanism, or how lower interest rates translate into increased economic activity. In China, the transmission mechanism may be weak due to factors such as government control over lending and a lack of financial market development.

China’s economic challenges are complex, with mounting pressure to stimulate growth amidst skepticism surrounding recent rate cuts. A potential avenue for investors seeking exposure to the global economy might be through soft commodities trading know the opportunities in coffee cocoa cotton and sugar , as these markets often reflect global demand trends.

However, navigating these markets requires careful consideration of supply and demand dynamics, as well as geopolitical factors that can influence prices.

Potential Benefits and Drawbacks of Rate Cuts

Rate cuts can potentially benefit the economy by stimulating investment, boosting consumer spending, and creating jobs. However, they also come with potential drawbacks, such as:

- Increased Debt:Lower interest rates can encourage excessive borrowing, potentially leading to higher debt levels and financial risks.

- Asset Bubbles:Rate cuts can inflate asset prices, such as real estate, creating asset bubbles that can burst and destabilize the economy.

- Inflation:While the current inflation rate is relatively low, rate cuts could potentially lead to higher inflation in the long run.

Pressure for Economic Boost

China’s economic slowdown has triggered a chorus of concerns, with various stakeholders demanding swift action to revitalize the nation’s growth engine. These pressures stem from a confluence of factors, including the implications for global markets, regional stability, and China’s own internal dynamics.

Domestic Stakeholders’ Concerns

Domestic stakeholders, including businesses, investors, and citizens, are feeling the brunt of China’s economic challenges. The slowdown has led to job losses, reduced investment opportunities, and a decline in consumer confidence. Businesses are struggling to maintain profitability, while investors are wary of the uncertain economic outlook.

Citizens are concerned about the potential impact on their livelihoods and future prospects.

Potential Solutions and Strategies: China Faces Mounting Pressure To Boost Economy Amidst Rate Cut Skepticism

China’s economic challenges require a multi-pronged approach that encompasses both short-term stimulus and long-term structural reforms. While the recent rate cut has raised skepticism, a combination of fiscal and monetary measures, coupled with strategic investments in key sectors, could help revive growth and foster sustainable development.

Fiscal and Monetary Measures

Fiscal and monetary policies are crucial tools for stimulating economic activity. China has several options at its disposal:

- Increased Government Spending:Investing in infrastructure projects, such as high-speed rail, renewable energy, and urban renewal, can create jobs and boost economic activity. This approach has proven effective in the past, but it’s essential to ensure that projects are well-planned and executed efficiently to maximize returns on investment.

- Tax Cuts and Rebates:Reducing taxes for businesses and individuals can increase disposable income, stimulate consumer spending, and encourage investment. Targeted tax breaks for specific sectors, such as innovation or green technology, can further promote economic growth.

- Lower Interest Rates:Lowering interest rates can make borrowing more affordable for businesses and consumers, leading to increased investment and spending. However, the effectiveness of this strategy depends on factors like inflation and the overall health of the financial system. The recent rate cut, while a step in the right direction, may not be sufficient to stimulate borrowing if businesses are hesitant due to economic uncertainty.

- Relaxed Credit Standards:Easing credit requirements for businesses can make it easier for them to access funding for expansion and investment. However, this needs to be carefully balanced to avoid excessive risk-taking and potential financial instability.

Structural Reforms

Addressing structural bottlenecks and promoting long-term growth requires comprehensive reforms:

- Innovation and Entrepreneurship:Fostering innovation and entrepreneurship is crucial for driving economic growth. This can be achieved by creating a more favorable environment for startups, promoting research and development, and protecting intellectual property. Examples include simplifying business registration processes, providing tax incentives for research and development, and establishing technology incubators.

- Market Efficiency:Improving market efficiency by reducing barriers to entry, promoting competition, and ensuring fair market practices can boost economic activity. This involves addressing issues like monopolies, corruption, and regulatory red tape. The government could implement measures like strengthening antitrust enforcement, simplifying regulatory processes, and promoting transparency.

- Human Capital Development:Investing in education, skills training, and healthcare can improve productivity and competitiveness. This involves strengthening the education system, providing access to vocational training, and ensuring affordable healthcare for all citizens.

Sector-Specific Initiatives

Targeted government initiatives can support specific sectors:

- Technology:China’s ambitious goal of becoming a global technology leader requires continued investment in research and development, fostering innovation, and supporting the growth of domestic tech companies. This can be achieved through funding for research institutions, providing tax incentives for tech companies, and promoting collaboration between academia and industry.

- Infrastructure:Continued investment in infrastructure, such as transportation, energy, and communication networks, is essential for economic growth and development. This includes building high-speed rail lines, expanding renewable energy capacity, and upgrading communication infrastructure.

- Consumer Spending:Boosting consumer spending is crucial for driving economic growth. This can be achieved through measures like increasing wages, providing subsidies for essential goods, and promoting domestic tourism. The government could also implement policies to encourage the development of a robust domestic consumer market.

The Future Outlook

China’s economic future is a complex tapestry woven with threads of both optimism and uncertainty. The country’s trajectory will be shaped by a confluence of factors, including domestic policy choices, global economic trends, and geopolitical developments. While navigating the short-term challenges, China’s long-term outlook remains positive, driven by its vast market, technological advancements, and ongoing structural reforms.

Short-Term Outlook

The immediate future for China’s economy is likely to be marked by continued volatility. The recent rate cuts and other stimulus measures are expected to provide some short-term relief, but their effectiveness in stimulating sustained growth remains to be seen.

The global economic slowdown, rising inflation, and geopolitical tensions will continue to weigh on China’s economic performance.

Long-Term Outlook

Despite the short-term challenges, China’s long-term economic prospects remain positive. The country’s vast domestic market, its rapidly growing middle class, and its ongoing investments in technology and infrastructure provide a strong foundation for sustained growth. China’s commitment to innovation and its “dual circulation” strategy, which aims to boost domestic consumption and reduce reliance on external markets, are expected to drive long-term growth.

Impact of Global Economic Trends

The global economic environment will have a significant impact on China’s growth trajectory. The ongoing trade war between the US and China, coupled with rising global inflation and interest rates, could dampen export growth and disrupt supply chains. However, China’s growing domestic market and its increasing economic ties with other countries, particularly in Asia, provide some insulation from these global headwinds.

Geopolitical Developments

Geopolitical developments, particularly those related to the US-China rivalry, will also play a significant role in shaping China’s economic future. The ongoing tensions between the two superpowers could lead to increased trade restrictions, investment barriers, and technological decoupling, which could have a negative impact on China’s growth.

However, China’s increasing global influence and its growing network of strategic partnerships with other countries could help mitigate these risks.

Challenges and Opportunities, China faces mounting pressure to boost economy amidst rate cut skepticism

China faces a number of challenges in navigating its economic path in the coming years. These include:

- Maintaining economic stability amidst global uncertainty.

- Managing the transition to a more sustainable and inclusive growth model.

- Addressing income inequality and regional disparities.

- Strengthening its technological capabilities to compete in the global innovation race.

However, China also has a number of opportunities to capitalize on:

- Its vast domestic market and growing middle class.

- Its increasing technological prowess and innovation capabilities.

- Its strategic partnerships with other countries, particularly in Asia.

- Its commitment to green development and sustainability.