Bullish Options Trading Fuels Stock Market Rally Amid FOMO

Bullish options trading fuels stock market rally amid FOMO sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The stock market is a dynamic beast, driven by a complex interplay of factors, and bullish options trading is often cited as a significant force behind market rallies, particularly when fueled by the pervasive fear of missing out (FOMO).

This article delves into the fascinating world of options trading, exploring how bullish strategies can propel market momentum and the potential impact of FOMO on investment decisions.

Imagine a scenario where investors are convinced that a particular stock is on the verge of a breakout. The anticipation is palpable, and the fear of being left behind in the potential surge in value is a powerful motivator. Enter bullish options trading, a strategy that allows investors to leverage their belief in a rising market by purchasing call options, which grant them the right, but not the obligation, to buy shares at a predetermined price.

This strategy can amplify potential gains, but it also carries significant risks, including the potential for substantial losses. As we delve deeper into the intricacies of bullish options trading, we’ll uncover the complex relationship between investor sentiment, market volatility, and the role of options in driving market rallies.

Bullish Options Trading

Bullish options trading is a strategy employed by investors who believe a particular asset’s price will rise in the future. This strategy leverages the potential for significant gains, making it a popular choice during periods of market optimism and heightened FOMO (Fear Of Missing Out).

Understanding the mechanics of options trading and the various strategies available is crucial for navigating this complex yet potentially lucrative investment approach.

Call Options

Call options grant the holder the right, but not the obligation, to buy an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). The premium paid for the option represents the cost of this right.

A call option is “in the money” when the underlying asset’s price is higher than the strike price, “out of the money” when the underlying asset’s price is lower than the strike price, and “at the money” when the underlying asset’s price is equal to the strike price.

Bullish Options Strategies

Investors employ various strategies to capitalize on their bullish outlook. Two common examples are:

- Covered Calls:This strategy involves selling a call option on an asset the investor already owns. The investor receives a premium for selling the call, which is a form of income. However, if the asset’s price rises above the strike price, the investor is obligated to sell the asset at the strike price, limiting potential upside gains.

- Long Calls:In this strategy, investors purchase call options, hoping the underlying asset’s price will rise above the strike price before the expiration date. This strategy allows for significant leverage, as the potential profit can be much larger than the initial investment.

However, the investor also faces the risk of losing the entire premium paid for the option if the asset’s price fails to rise above the strike price.

FOMO and Market Volatility

Fear of missing out (FOMO) is a psychological phenomenon that can have a significant impact on trading decisions, especially in volatile markets. It describes the feeling of anxiety and pressure that arises from the perception that others are experiencing something positive or advantageous that you are missing out on.

The stock market is on a tear, fueled by bullish options trading and a healthy dose of FOMO. This upward momentum is likely being further bolstered by recent news of significant price declines in gasoline, natural gas, and other energy sources, as reported in this article.

Lower energy costs could mean more disposable income for consumers, potentially leading to increased spending and further fueling the stock market rally.

This often leads to impulsive and irrational decisions, as individuals try to “catch up” or avoid feeling left behind.

The Impact of FOMO on Trading Decisions

FOMO can amplify market volatility and lead to price bubbles by influencing investor behavior in several ways.

- Increased Demand:When FOMO takes hold, investors may rush to buy assets, driving up prices. This can create a self-fulfilling prophecy, as rising prices further fuel the perception that others are “missing out,” leading to even more buying.

- Reduced Risk Aversion:FOMO can lead to a decrease in risk aversion, as investors become more willing to take on greater risks in the hope of achieving quick gains. This can result in overpaying for assets and investing in risky ventures that may not be justified by fundamentals.

- Herding Behavior:FOMO can contribute to herding behavior, where investors mimic the actions of others, often without fully understanding the underlying rationale. This can lead to a cascade effect, as more and more investors jump on the bandwagon, further inflating prices.

The Relationship Between FOMO and Bullish Options Trading, Bullish options trading fuels stock market rally amid fomo

Bullish options trading, where investors purchase call options to bet on rising asset prices, can be particularly susceptible to FOMO. This is because options provide leverage, meaning that small price movements in the underlying asset can result in large gains for the options holder.

- Amplified Returns:The potential for large gains from options trading can exacerbate FOMO, as investors chase the possibility of “hitting it big.” This can lead to excessive speculation and risky trading strategies.

- Time Decay:Options have a limited lifespan and lose value over time, a phenomenon known as time decay. This can create a sense of urgency among options traders, as they feel the pressure to make a profit before the options expire.

- Short-Term Focus:FOMO often encourages a short-term focus, as investors prioritize quick gains over long-term value. This can lead to trading strategies that are based on momentum and speculation rather than fundamental analysis.

The Role of Options Trading in Market Rallies: Bullish Options Trading Fuels Stock Market Rally Amid Fomo

Options trading plays a significant role in shaping market trends, especially during periods of heightened volatility and investor sentiment. While it’s often associated with risk, options trading can also act as a catalyst for market rallies, particularly when bullish sentiment prevails.

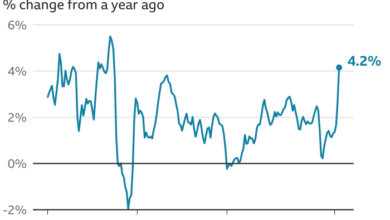

The recent stock market rally, fueled by bullish options trading and FOMO, might be taking a breather as investors digest economic data and react to the leadership changes at GameStop, as reported by The Venom Blog. However, the underlying sentiment remains optimistic, and we could see renewed momentum in the market as investors continue to seek out growth opportunities in the face of rising inflation.

The Correlation Between Bullish Options Trading and Market Rallies

The relationship between bullish options trading activity and stock market rallies is multifaceted and often observed in periods of strong market momentum.

- Increased Demand for Calls:When investors anticipate a rise in stock prices, they tend to buy call options. This increased demand for call options drives up their prices, creating a positive feedback loop.

- Gamma Squeeze:As call option prices rise, market makers who have sold these options are forced to buy the underlying stock to hedge their positions. This buying pressure further pushes up stock prices, creating a self-fulfilling prophecy.

- Momentum Trading:Bullish options trading attracts momentum traders who capitalize on the upward price trend. This further amplifies the rally, attracting more investors and driving prices higher.

How Options Trading Fuels Market Momentum and Creates Self-Fulfilling Prophecies

Bullish options trading can create a self-fulfilling prophecy by amplifying market momentum and driving prices higher.

The recent stock market rally, fueled by bullish options trading and a hefty dose of FOMO, is a testament to the optimism swirling around global growth. A big part of that optimism stems from the burgeoning Asian markets, with Apple’s success in China serving as a prime example of the potential these markets hold.

Apple’s prosperity in China and the promising future in Asian markets is a clear signal that these markets are ripe for investment, further driving the bullish sentiment and feeding the frenzy of options trading.

- Increased Volatility:The increased demand for options, particularly call options, contributes to higher implied volatility. This heightened volatility makes options more expensive, attracting even more investors seeking potential profits.

- Short-Term Speculation:Options trading, particularly short-term options strategies, can lead to increased speculation and short-term price fluctuations. This can create a snowball effect, driving prices higher as more investors jump on the bandwagon.

- Positive Feedback Loop:As options prices rise, market makers are forced to buy the underlying stock to hedge their positions. This buying pressure pushes up stock prices, further increasing the demand for call options, and creating a positive feedback loop.

Historical Examples of Market Rallies Driven by Bullish Options Trading

Throughout history, there have been numerous instances where bullish options trading activity has played a significant role in driving market rallies.

- The 2017-2018 Tech Boom:The rise of technology companies like Amazon and Apple was fueled by significant bullish options trading activity. This activity, coupled with strong earnings growth, propelled the NASDAQ index to record highs.

- The 2020-2021 Meme Stock Mania:The frenzy surrounding meme stocks like GameStop and AMC was characterized by heavy options trading, particularly call options. This activity, fueled by retail investors and social media hype, drove up prices significantly.

- The 2023 AI Boom:The recent surge in AI-related stocks, such as Nvidia and Microsoft, has been accompanied by significant bullish options trading activity. This activity, driven by investor optimism about the potential of AI, has contributed to the rally in the technology sector.

Risks and Considerations

Bullish options trading, while potentially lucrative, comes with inherent risks that investors must understand and manage. These risks stem from the unique characteristics of options contracts, including their limited lifespan and potential for unlimited losses.

Time Decay

Options contracts have a limited lifespan, and their value decreases over time, a phenomenon known as time decay or theta. As the expiration date approaches, the value of the option erodes, regardless of the underlying asset’s price movement. This is because the potential for the underlying asset to move in the desired direction diminishes as time passes.

For example, an option with a long time to expiration will have a higher time value than an option with a shorter time to expiration, assuming all other factors are equal.

The rate of time decay accelerates as the expiration date nears. This means that the value of an option will decay more rapidly in the final days leading up to expiration. Investors must consider the time value of their options when making trading decisions, as it can significantly impact their profitability.

Unlimited Loss Potential

Unlike buying stocks, where the maximum loss is limited to the purchase price, options trading carries the potential for unlimited losses. This is because the price of an option can theoretically rise indefinitely.

For example, if an investor buys a call option on a stock that is trading at $100, and the stock price rises to $200, the option will be worth significantly more than the initial purchase price. However, if the stock price falls to $0, the option will expire worthless, and the investor will lose the entire premium paid for the option.

This unlimited loss potential arises from the leverage inherent in options trading. Investors can control a larger position in the underlying asset with a smaller capital outlay compared to buying shares directly. While this leverage can amplify gains, it can also magnify losses.

Impact on Market Liquidity and Price Stability

Options trading can have a significant impact on market liquidity and price stability.

For example, the increased use of options contracts can lead to increased volatility in the underlying asset. This is because options traders can create demand for the underlying asset that is not based on its fundamental value.

Options trading can also lead to market manipulation. This occurs when traders use options to artificially inflate or deflate the price of an underlying asset. This manipulation can harm other market participants and undermine the integrity of the market.

Guidance for Investors

Investors considering bullish options strategies should carefully consider the following:

- Understand the risks involved: Investors should fully understand the risks associated with options trading, including time decay, unlimited loss potential, and market manipulation. They should only invest money that they can afford to lose.

- Develop a trading plan: Investors should have a clear trading plan that Artikels their investment objectives, risk tolerance, and exit strategies. This plan should be based on thorough research and analysis of the underlying asset.

- Use appropriate risk management techniques: Investors should use appropriate risk management techniques, such as stop-loss orders, to limit their potential losses. They should also diversify their portfolio to reduce overall risk.

- Consider the time value of options: Investors should carefully consider the time value of options when making trading decisions. They should avoid buying options with a short time to expiration, as these options are more susceptible to time decay.

- Monitor their positions closely: Investors should monitor their options positions closely and be prepared to adjust their strategies as needed. This includes being aware of market conditions and the potential for changes in the underlying asset’s price.

Alternative Perspectives

While the relationship between bullish options trading and market rallies is often observed, it’s crucial to consider alternative viewpoints and potential criticisms. Not all market participants agree that options trading solely fuels market rallies, and other factors contribute to the complex interplay between market sentiment, options trading, and market dynamics.

The Role of Other Market Participants

It’s important to acknowledge that options trading isn’t the sole driver of market rallies. Other market participants, including institutional investors, hedge funds, and individual investors, play significant roles. For instance, institutional investors often drive large-scale buying and selling activities, influencing market direction.

Hedge funds employ sophisticated strategies that can impact market trends, and individual investors contribute to market sentiment through their trading decisions.

The Impact of Macroeconomic Factors

Macroeconomic factors, such as interest rates, inflation, and economic growth, also exert considerable influence on market sentiment and direction. For example, a decrease in interest rates can stimulate economic activity and lead to stock market gains, while rising inflation can create uncertainty and potentially dampen market sentiment.

Therefore, while options trading can amplify market movements, it’s not the sole determinant of market trends.

The Limitations of FOMO

While FOMO can contribute to market rallies, it’s important to acknowledge its limitations. FOMO-driven buying can create bubbles in specific sectors or assets, leading to excessive price appreciation and subsequent corrections. Market participants who chase returns solely based on FOMO may end up buying at inflated prices, increasing their risk of losses.

Furthermore, FOMO is a temporary phenomenon, and its influence on market sentiment can wane as other factors come into play.

The Potential for Market Manipulation

Some critics argue that options trading can be used for market manipulation. For example, large-scale options purchases can artificially inflate the price of an underlying asset, creating a self-fulfilling prophecy. However, regulatory bodies closely monitor market activity and have mechanisms to address potential manipulation.

Furthermore, the sheer volume and complexity of market activity make it challenging for any single entity to exert significant control over market direction.