Bitcoin Surges to 18-Month High Amidst Risk Appetite and Powells Remarks

Bitcoin surges to 18 month high amidst risk appetite and powells remarks – Bitcoin Surges to 18-Month High Amidst Risk Appetite and Powell’s Remarks: The cryptocurrency market is experiencing a surge in volatility, with Bitcoin recently reaching its highest point in 18 months. This surge is fueled by a combination of factors, including a renewed appetite for risk in financial markets and recent comments from Federal Reserve Chair Jerome Powell.

The recent rise in Bitcoin’s price can be attributed to a confluence of events, including a shift in market sentiment, growing institutional interest, and a perception that the cryptocurrency could be a hedge against inflation. The market is cautiously optimistic about the future of cryptocurrencies, particularly as Bitcoin continues to establish itself as a leading digital asset.

Bitcoin’s Surge

Bitcoin, the world’s largest cryptocurrency, has recently experienced a significant price surge, reaching its highest level in 18 months. This rally has sparked renewed interest in the digital asset and has raised questions about the factors driving its upward momentum.

Market Sentiment and Risk Appetite

The recent surge in Bitcoin’s price can be attributed, in part, to the prevailing market sentiment and increasing risk appetite among investors. This optimism is fueled by a combination of factors, including the recent decline in inflation, positive economic indicators, and a perceived shift in sentiment towards riskier assets.

Broader Economic Trends

Bitcoin’s price is often influenced by broader economic trends. The recent surge in Bitcoin’s price can be linked to a number of factors, including:

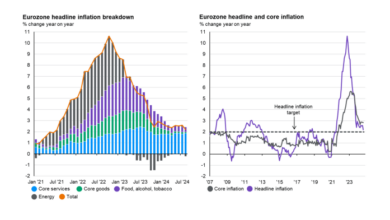

- Declining Inflation:As inflation rates have started to decline, investors have become more optimistic about the economic outlook, leading to a shift towards riskier assets like Bitcoin.

- Positive Economic Indicators:Positive economic indicators, such as a strong job market and resilient consumer spending, have also contributed to the overall market optimism.

- Shifting Sentiment towards Riskier Assets:Investors are increasingly willing to take on more risk as the economic outlook improves, leading to a surge in demand for riskier assets, including Bitcoin.

Historical Perspective on Bitcoin’s Price Fluctuations

Bitcoin’s price has been known for its volatility. It has experienced significant price swings throughout its history, with periods of rapid growth followed by sharp declines. The current surge in Bitcoin’s price is not unprecedented. In the past, Bitcoin has experienced similar rallies, driven by various factors, including market sentiment, regulatory changes, and technological advancements.

Comparison to Previous Highs

The current surge in Bitcoin’s price has pushed it to its highest level in 18 months. While this is a significant milestone, it is important to note that Bitcoin’s price has reached even higher levels in the past. The current surge can be compared to previous highs, such as the all-time high of over $68,000 reached in November 2021.

“The current surge in Bitcoin’s price is a reminder of the volatility and potential for both gains and losses in the cryptocurrency market.”

Bitcoin’s surge to an 18-month high is fueled by a combination of risk appetite and Powell’s dovish remarks. While the crypto market celebrates, the oil market faces uncertainty amid the Fed’s rate hikes and tightening supply, as explored in this recent article oil market faces uncertainty amid fed rate hike and tightening supply.

It’s interesting to see how these two markets, seemingly disparate, are intertwined by the global economic landscape and central bank decisions.

[Source]

Bitcoin’s recent surge to an 18-month high, fueled by risk appetite and Powell’s comments, seems to be mirroring the broader market’s response to shifting inflation signals. As the market grapples with the latest economic data, investors are looking for clues about the Fed’s future course of action, leading to volatility in both stocks and cryptocurrencies.

For a deeper dive into the stock market’s reaction to these evolving inflation signals, check out this insightful analysis: stock market reacts to shifting inflation signals insights from latest market movements. Ultimately, Bitcoin’s trajectory remains intertwined with the overall macroeconomic environment, making it crucial to stay informed about the latest market movements.

Risk Appetite and Bitcoin’s Correlation: Bitcoin Surges To 18 Month High Amidst Risk Appetite And Powells Remarks

Bitcoin, often perceived as a risky asset, has a strong correlation with broader market sentiment, particularly risk appetite. When investors feel optimistic about the overall economy and financial markets, they tend to allocate more capital to assets perceived as riskier, including Bitcoin.

Conversely, during periods of uncertainty or heightened risk aversion, investors often seek safer havens like bonds or gold, leading to a decline in Bitcoin’s price.

Powell’s Remarks and Risk Appetite

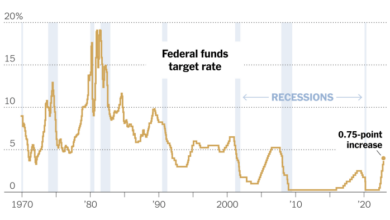

The recent surge in Bitcoin’s price can be partly attributed to a shift in risk appetite following comments from Federal Reserve Chair Jerome Powell. Powell’s remarks, signaling a potential pause in interest rate hikes, have calmed fears about aggressive monetary tightening and boosted investor confidence.

This shift in sentiment has encouraged investors to embrace riskier assets, including Bitcoin.

Impact of Future Economic Developments on Bitcoin’s Price

Future economic developments will undoubtedly play a crucial role in shaping Bitcoin’s price trajectory.

Interest Rate Hikes

Continued interest rate hikes by central banks could negatively impact Bitcoin’s price. Higher interest rates increase the opportunity cost of holding Bitcoin, as investors can earn higher returns on risk-free assets like bonds. This could lead to a decline in demand for Bitcoin.

Bitcoin’s surge to an 18-month high, fueled by risk appetite and Powell’s recent remarks, could be further bolstered by a growing sense of optimism among consumers. A recent University of Michigan survey revealed a surge in consumer sentiment, driven by slowing inflation.

This positive outlook could translate into increased spending, potentially boosting demand for risk assets like Bitcoin.

Inflation

Inflation remains a key factor influencing Bitcoin’s price. Bitcoin has been touted as a hedge against inflation, as its supply is limited and its value can potentially rise during periods of high inflation. However, the correlation between Bitcoin and inflation is not always straightforward and depends on various factors, including investor sentiment and macroeconomic conditions.

Economic Growth

Strong economic growth can boost risk appetite and support Bitcoin’s price. A robust economy typically encourages investors to allocate more capital to riskier assets, including cryptocurrencies. Conversely, economic slowdowns or recessions can lead to increased risk aversion and a decline in Bitcoin’s price.

Powell’s Remarks and Their Implications

The recent surge in Bitcoin’s price has coincided with Federal Reserve Chair Jerome Powell’s comments on monetary policy and inflation. Powell’s remarks have sparked a wave of speculation about their potential impact on the cryptocurrency market, particularly Bitcoin.

Potential Impact on Bitcoin’s Price, Bitcoin surges to 18 month high amidst risk appetite and powells remarks

Powell’s remarks have raised hopes among some investors that the Fed may be nearing the end of its interest rate hiking cycle. This potential shift in monetary policy could lead to a decrease in the cost of borrowing, potentially boosting investor appetite for riskier assets like Bitcoin.

Additionally, Powell’s comments on inflation have fueled speculation about the future trajectory of the dollar, with some investors viewing Bitcoin as a potential hedge against inflation.

Influence on Investor Sentiment

Powell’s statements regarding monetary policy and inflation have a significant influence on investor sentiment towards Bitcoin. Investors closely monitor the Fed’s actions and pronouncements as they can impact the broader economic landscape and, in turn, influence asset prices. If Powell’s remarks suggest a more dovish stance from the Fed, it could boost investor confidence and encourage them to allocate more capital to risk assets like Bitcoin.

Conversely, hawkish statements from Powell could lead to a decline in investor confidence and a potential sell-off in Bitcoin.

Short-Term and Long-Term Implications

Powell’s remarks have the potential to influence the cryptocurrency market both in the short and long term. In the short term, investors may react to his comments by buying or selling Bitcoin, leading to price volatility. However, the long-term impact of Powell’s remarks is less clear and depends on various factors, including the Fed’s ultimate policy decisions, the broader economic environment, and the adoption of Bitcoin as a mainstream asset.

Bitcoin’s Future Prospects

The recent surge in Bitcoin’s price, reaching an 18-month high, has sparked renewed interest in its future prospects. While the current bullish sentiment is fueled by factors like increased risk appetite and positive remarks from Federal Reserve Chair Jerome Powell, it’s crucial to consider the long-term factors that could drive Bitcoin’s price trajectory.

Factors Driving Bitcoin’s Price Higher

Several factors could contribute to Bitcoin’s price appreciation in the coming months and years.

- Increased Institutional Adoption:More traditional financial institutions are exploring and adopting Bitcoin as an asset class. This growing institutional interest brings greater liquidity and stability to the market, attracting more investors.

- Growing Global Demand:As awareness and understanding of Bitcoin increase, demand for it as a store of value and a means of payment is likely to rise in emerging markets and developing economies, where traditional financial systems may be less robust.

- Scarcity and Deflationary Nature:Bitcoin’s limited supply of 21 million coins acts as a built-in deflationary mechanism, potentially making it a hedge against inflation in a world of increasing money printing.

- Technological Advancements:The Bitcoin network continues to evolve with improvements in scalability, transaction speed, and security, making it more attractive for both individuals and businesses.

- Macroeconomic Uncertainty:Global economic instability and geopolitical tensions can drive investors towards safe-haven assets like Bitcoin, seeking protection from market volatility.

Challenges and Risks Facing Bitcoin

Despite the bullish outlook, Bitcoin faces several challenges and risks that could impact its price.

- Regulatory Uncertainty:Governments worldwide are still grappling with how to regulate cryptocurrencies, and unclear regulations can create uncertainty for investors and businesses.

- Market Volatility:Bitcoin’s price is notoriously volatile, subject to rapid swings based on news, sentiment, and market speculation. This volatility can deter some investors, especially those seeking more stable investments.

- Energy Consumption:Bitcoin’s Proof-of-Work (PoW) consensus mechanism requires significant energy consumption, raising concerns about its environmental impact and sustainability.

- Competition:The cryptocurrency market is highly competitive, with numerous alternative cryptocurrencies vying for investor attention and market share.

- Security Risks:Cryptocurrency exchanges and wallets are potential targets for hackers, and security breaches can result in losses for investors.

Bitcoin’s Performance Against Other Asset Classes

To understand Bitcoin’s potential, it’s helpful to compare its performance against other major asset classes: