Bitcoin Risks: Government Bans & Quantum Computing Explained

Bitcoin risks government ban and quantum computing explained – Bitcoin Risks: Government Bans & Quantum Computing Explained – these are just two of the many challenges facing the world’s most popular cryptocurrency. While Bitcoin’s decentralized nature offers a unique appeal, it also makes it vulnerable to government intervention and the potential threat of quantum computing.

As we delve deeper into these risks, we’ll uncover the complexities of Bitcoin’s future in a world rapidly evolving with technology.

From historical instances of government regulation to the potential impact of quantum computers on Bitcoin’s encryption, this exploration aims to provide a comprehensive understanding of the challenges and opportunities surrounding Bitcoin’s future. We’ll examine the potential motivations behind government bans, the timeline for quantum computing development, and the strategies being implemented to mitigate these threats.

We’ll also consider how Bitcoin’s decentralized nature might influence global economies and the future of finance.

Bitcoin and Government Regulation

The relationship between Bitcoin and governments is complex and evolving. While Bitcoin advocates often tout its decentralized nature as a shield against government interference, the reality is that governments have historically played a significant role in shaping the cryptocurrency landscape.

While the world grapples with the potential impact of quantum computing on Bitcoin’s security and the possibility of government bans, other tech advancements are forging ahead. A major development in the electric vehicle sector is the partnership between GM and Samsung SDI to build a $3 billion battery plant in Indiana, a move that could significantly accelerate the adoption of EVs.

This is just one example of how technology is evolving rapidly, and it’s important to stay informed about the latest trends, even as we ponder the future of Bitcoin and its vulnerabilities.

Understanding the motivations behind government actions and the potential impact of regulation on Bitcoin is crucial for anyone invested in this volatile market.

Historical Instances of Government Interventions in Cryptocurrency Markets

Governments have taken various approaches to regulate cryptocurrencies, ranging from outright bans to more lenient frameworks. Here are some notable examples:

- China:In 2017, China banned initial coin offerings (ICOs) and closed down cryptocurrency exchanges, effectively pushing Bitcoin trading underground. This move was largely driven by concerns about financial instability and the potential for money laundering.

- India:India has had a complex relationship with Bitcoin, with the government initially taking a cautious stance and even considering a complete ban. However, in 2022, India legalized cryptocurrencies as assets but imposed strict regulations on trading and taxation.

- United States:The U.S. government has adopted a more nuanced approach, with various agencies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) working to define regulatory frameworks for different aspects of the crypto market.

Motivations for a Government to Ban Bitcoin

Governments may choose to ban Bitcoin for a variety of reasons, including:

- Economic Concerns:Bitcoin’s volatility and potential for speculation can pose risks to financial stability. Governments may worry that widespread adoption could lead to destabilizing fluctuations in the value of national currencies.

- Political Considerations:Some governments may see Bitcoin as a threat to their control over monetary policy. The decentralized nature of Bitcoin undermines the power of central banks to manage inflation and control the money supply.

- Social Impacts:Concerns about the potential for money laundering, terrorist financing, and other illicit activities associated with anonymous transactions can also drive government bans.

Regulatory Approaches of Different Countries

Countries have adopted diverse approaches to regulating Bitcoin, reflecting their unique economic, political, and social contexts:

- Banning:Some countries, like China, have implemented outright bans on Bitcoin trading and related activities. This approach seeks to eliminate the cryptocurrency market within their borders.

- Regulation:Other countries, like the U.S., have chosen to regulate Bitcoin through specific frameworks that define its legal status and impose certain requirements on exchanges and businesses involved in cryptocurrency transactions.

- Ambiguity:Some countries have adopted a more ambiguous approach, neither explicitly banning nor fully regulating Bitcoin. This approach can create uncertainty for businesses and individuals operating in the cryptocurrency space.

Government Actions that Could Impact Bitcoin’s Value or Adoption, Bitcoin risks government ban and quantum computing explained

Governments have a range of tools at their disposal to influence Bitcoin’s value and adoption:

- Taxation:Governments can impose taxes on Bitcoin transactions or profits, making it less attractive for investors.

- Regulation of Exchanges:Stricter regulations on cryptocurrency exchanges can limit access to Bitcoin and reduce its liquidity.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Rules:Governments can require cryptocurrency businesses to comply with AML and KYC regulations, making it more difficult for individuals to operate anonymously.

- Central Bank Digital Currencies (CBDCs):The development of CBDCs could potentially compete with Bitcoin and impact its adoption.

The Impact of Quantum Computing on Bitcoin: Bitcoin Risks Government Ban And Quantum Computing Explained

Quantum computing, a revolutionary technology with the potential to solve problems intractable for classical computers, has emerged as a significant threat to Bitcoin’s cryptographic security. While Bitcoin’s current encryption algorithms are considered robust against traditional computers, they may be vulnerable to the power of quantum computers.

While the future of Bitcoin faces uncertainties like government bans and the potential impact of quantum computing, the recent economic news paints a brighter picture. The U.S. economy added a surprising 253,000 jobs in April, with the unemployment rate dropping to 3.4% according to this report.

This robust growth could offer some stability in the face of potential regulatory challenges for cryptocurrencies, but it remains to be seen how these factors will ultimately play out.

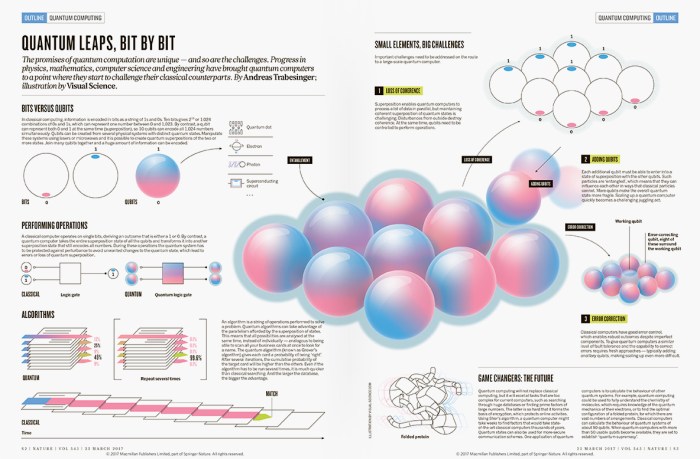

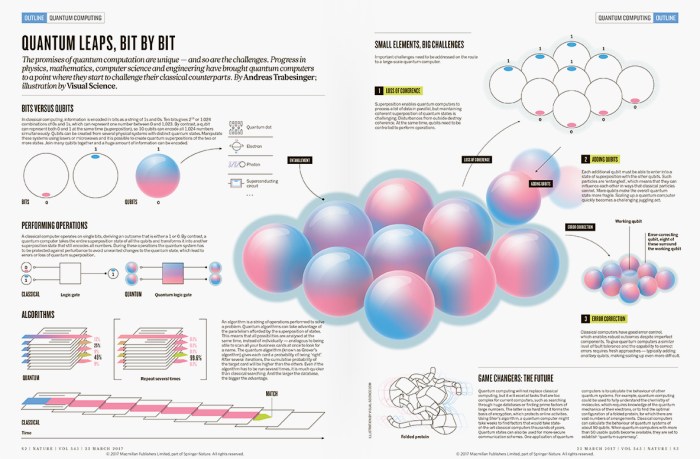

The Fundamentals of Quantum Computing

Quantum computers harness the principles of quantum mechanics to perform calculations in ways that are fundamentally different from traditional computers. While traditional computers use bits, which can represent either a 0 or a 1, quantum computers use qubits. Qubits can represent a 0, a 1, or a superposition of both states simultaneously.

Bitcoin’s future is uncertain, with government bans and the threat of quantum computing looming. But even with these potential risks, it’s important to remember that financial security is paramount. If you’re experiencing missing deposits, like some Wells Fargo customers have reported, it’s crucial to take action.

Check out this guide on how to address the issue and protect your finances , and then consider how these strategies might apply to your own crypto investments. Understanding your financial vulnerabilities is the first step to building a more secure future, whether you’re dealing with traditional banking or the world of cryptocurrencies.

This superposition allows quantum computers to explore multiple possibilities concurrently, significantly accelerating computation for certain types of problems.

Potential Threats to Bitcoin’s Cryptographic Security

Quantum computers pose a significant threat to Bitcoin’s cryptographic security by potentially breaking the elliptic curve cryptography (ECC) algorithms used to secure Bitcoin transactions. ECC relies on the difficulty of factoring large numbers, a problem that becomes significantly easier for quantum computers.

The Timeline for the Development of Quantum Computers

The development of quantum computers capable of breaking Bitcoin’s encryption is still in its early stages. Experts predict that a quantum computer with sufficient power to crack Bitcoin’s cryptography could be developed within the next 10-20 years. However, the exact timeline remains uncertain and subject to rapid advancements in the field.

Countermeasures and Adaptations to Mitigate Quantum Threats

Bitcoin developers are actively researching and implementing countermeasures to mitigate quantum threats. Some of the potential solutions include:

- Post-quantum cryptography (PQC):PQC algorithms are designed to be resistant to attacks from both classical and quantum computers. Bitcoin developers are exploring the integration of PQC algorithms into the Bitcoin network.

- Quantum-resistant hash functions:Hash functions play a crucial role in Bitcoin’s security. Developers are investigating quantum-resistant hash functions that are less susceptible to quantum attacks.

- Hybrid cryptography:Combining ECC with PQC algorithms can provide a more robust security solution. This approach utilizes the strengths of both types of cryptography to create a more resilient system.

The Future of Bitcoin in a World with Quantum Computing

Quantum computing is a rapidly developing field with the potential to revolutionize many industries, including finance. One area where quantum computing could have a significant impact is on the security of cryptocurrencies like Bitcoin. While quantum computers offer exciting opportunities, they also pose potential threats to Bitcoin’s underlying cryptography.

The Impact of Quantum Computing on Bitcoin

Quantum computers have the potential to break the cryptographic algorithms used to secure Bitcoin transactions. This could lead to a number of problems, including:* Compromised private keys:Quantum computers could potentially be used to crack the cryptographic algorithms used to generate private keys.

This could allow attackers to steal Bitcoin from wallets.

Double-spending attacks Quantum computers could also be used to carry out double-spending attacks. This would involve creating multiple transactions with the same Bitcoin, allowing an attacker to spend the same coins twice.

Centralization of control If quantum computers become powerful enough to break Bitcoin’s cryptography, it could lead to a centralization of control over the network. This is because only those with access to powerful quantum computers would be able to control the network.These risks highlight the need for the Bitcoin community to develop quantum-resistant solutions.

Bitcoin’s Role in a Globalized Economy

Bitcoin, a decentralized digital currency, has the potential to revolutionize global finance. Its unique characteristics, such as its borderless nature and resistance to censorship, offer both opportunities and challenges for the globalized economy.

Bitcoin’s Decentralized Nature in a Globalized Economy

Bitcoin’s decentralized nature, meaning it is not controlled by any single entity, offers several potential benefits in a globalized economy. It allows for peer-to-peer transactions, eliminating the need for intermediaries like banks. This can reduce transaction costs and increase efficiency, especially for cross-border payments.

- Financial Inclusion:Bitcoin can provide financial services to individuals and businesses in countries with limited access to traditional banking systems.

- Reduced Transaction Costs:By eliminating intermediaries, Bitcoin can reduce the fees associated with international transfers.

- Transparency and Security:Bitcoin’s blockchain technology allows for transparent and secure transactions, enhancing trust in the financial system.

However, Bitcoin’s decentralized nature also presents challenges.

- Lack of Regulation:The absence of central oversight can lead to volatility and potential risks for investors.

- Security Concerns:Bitcoin’s decentralized nature can make it vulnerable to hacking and fraud.

- Limited Adoption:While Bitcoin has gained traction, its widespread adoption remains a challenge due to its complexity and lack of regulatory clarity.

Bitcoin’s Volatility and Lack of Regulation

Bitcoin’s volatility is a significant concern for its role in the globalized economy. Its price can fluctuate dramatically, making it risky for businesses and individuals to use as a medium of exchange or store of value. This volatility is partly due to the lack of regulation, which can lead to speculation and market manipulation.

“Bitcoin’s price volatility can make it difficult for businesses to price goods and services, and for individuals to plan their finances.”

However, some argue that Bitcoin’s volatility is a temporary phenomenon and that as it matures, its price will stabilize. Additionally, its volatility can also be seen as an opportunity for investors seeking high returns.

Impact of Bitcoin on Cross-Border Transactions, Remittances, and International Trade

Bitcoin has the potential to revolutionize cross-border transactions, remittances, and international trade. Its borderless nature allows for fast and efficient transfers, bypassing traditional banking systems and their associated fees.

- Reduced Remittance Costs:Bitcoin can significantly reduce the cost of sending money across borders, benefiting migrant workers and their families.

- Faster Transactions:Bitcoin transactions are typically processed faster than traditional bank transfers, improving efficiency in international trade.

- Increased Accessibility:Bitcoin can provide access to financial services for individuals and businesses in countries with limited banking infrastructure.

However, challenges remain in terms of regulatory uncertainty and scalability.

Comparison of Bitcoin and Traditional Financial Systems

The following table compares and contrasts the advantages and disadvantages of Bitcoin and traditional financial systems in a global context: