Bitcoin Analyst Predicts $65,000 Surge as Cash Flows In

Bitcoin analyst predicts potential surge to 65000 as massive cash inflows hit market – Bitcoin Analyst Predicts $65,000 Surge as Massive Cash Inflows Hit Market: The crypto world is buzzing with excitement as a prominent analyst predicts a potential surge in Bitcoin’s price to $65,000. This prediction is fueled by massive cash inflows into the market, indicating a renewed interest and potential for growth.

The analyst points to a confluence of factors, including institutional adoption, rising inflation, and increasing global demand, as driving forces behind this anticipated surge.

This surge could potentially have a ripple effect across the broader cryptocurrency market, attracting new investors and further propelling the adoption of digital assets. The potential implications for the global economy and financial systems are significant, as Bitcoin’s influence continues to grow.

Bitcoin Price Prediction and Market Dynamics

The recent prediction by a Bitcoin analyst that the cryptocurrency could surge to $65,000 has sparked considerable interest and debate within the crypto community. This bold prediction suggests a significant upward trajectory for Bitcoin, potentially exceeding its previous all-time high of $69,000 reached in November 2021.

Understanding the factors driving this potential surge is crucial for investors and enthusiasts alike.

Factors Contributing to a Potential Surge

The analyst’s prediction is based on several key factors, including massive cash inflows and positive market sentiment. These factors, combined with the inherent volatility of the cryptocurrency market, could potentially propel Bitcoin to new heights.

Massive Cash Inflows

One of the primary drivers of the predicted surge is the anticipated influx of capital into the Bitcoin market. Institutional investors, such as hedge funds and corporations, are increasingly allocating a portion of their portfolios to cryptocurrencies, recognizing Bitcoin’s potential as a store of value and a hedge against inflation.

Additionally, retail investors are also showing renewed interest in Bitcoin, driven by factors like increased awareness and the growing adoption of cryptocurrencies in everyday transactions.

Positive Market Sentiment

Market sentiment plays a significant role in driving cryptocurrency prices. When investor confidence is high, and there is a general sense of optimism surrounding Bitcoin, prices tend to rise. Recent positive developments, such as the increasing adoption of Bitcoin by major corporations and the ongoing development of Bitcoin-related infrastructure, have contributed to a positive market sentiment, which could further fuel price growth.

Historical Analysis of Bitcoin Price Surges

Examining historical price surges can provide valuable insights into the factors that have driven Bitcoin’s price movements in the past. For instance, the 2017 bull run, which saw Bitcoin’s price skyrocket to nearly $20,000, was fueled by a confluence of factors, including increased media attention, growing adoption by businesses, and speculation.

However, it is crucial to note that Bitcoin’s price is highly volatile, and past performance is not necessarily indicative of future results.

Previous Surges and Contributing Factors

- The 2017 bull run was primarily driven by increased media attention, growing adoption by businesses, and speculation. The emergence of Bitcoin exchanges and the development of new cryptocurrency applications contributed to the surge.

- The 2020-2021 bull run was fueled by a combination of factors, including the global economic uncertainty caused by the COVID-19 pandemic, increased institutional investment, and the growing adoption of Bitcoin as a payment method.

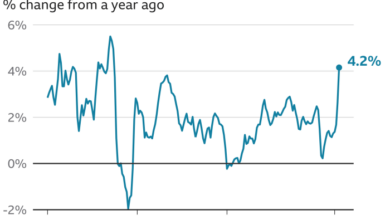

Cash Inflows and Their Impact on Bitcoin

The recent surge in Bitcoin’s price has been fueled by significant cash inflows from various sources, injecting liquidity into the market and driving its value higher. Understanding the origin and impact of these inflows is crucial for gauging the future trajectory of Bitcoin’s price.

Sources of Cash Inflows

These inflows stem from diverse sources, each contributing to the increasing demand for Bitcoin.

- Institutional Investors:Large financial institutions, such as hedge funds and investment firms, are increasingly allocating a portion of their portfolios to Bitcoin, recognizing its potential as a store of value and a hedge against inflation. For instance, in 2021, Tesla invested $1.5 billion in Bitcoin, demonstrating the growing acceptance of Bitcoin among institutional investors.

- Retail Investors:Individuals are also drawn to Bitcoin’s potential for high returns and its decentralized nature, leading to a surge in retail investment. The ease of access to cryptocurrency exchanges and the growing adoption of Bitcoin as a payment method have fueled retail participation.

- Corporations:Some corporations are integrating Bitcoin into their operations, either by accepting it as payment or by holding it as a reserve asset. For example, MicroStrategy, a business intelligence company, has invested heavily in Bitcoin, holding over 100,000 Bitcoins as of 2022.

- Government and Central Banks:While some governments and central banks remain skeptical of Bitcoin, others are exploring its potential uses. El Salvador, for instance, adopted Bitcoin as legal tender in 2021, demonstrating a growing acceptance of Bitcoin by governments.

Impact on Bitcoin Price and Market Liquidity

These cash inflows have a direct impact on Bitcoin’s price and market liquidity.

- Price Increase:Increased demand for Bitcoin, fueled by these inflows, drives its price upwards. As more buyers enter the market, they bid up the price, creating an upward pressure on Bitcoin’s value.

- Increased Liquidity:Cash inflows also increase market liquidity, making it easier for buyers and sellers to trade Bitcoin at fair prices. This is because increased liquidity provides a greater pool of funds available for transactions, reducing price volatility and facilitating smoother price discovery.

The bitcoin analyst’s prediction of a potential surge to $65,000 is fueled by massive cash inflows hitting the market. While crypto is heating up, the auto industry is also experiencing a surge of its own, as the UAW negotiates contracts with major car makers, like Ford and GM.

This news could have ripple effects on the economy, potentially influencing investor decisions and further impacting the bitcoin market.

Risks Associated with Increased Cash Inflows

While cash inflows are generally positive for Bitcoin, they also pose certain risks.

- Market Manipulation:Large inflows can be used to manipulate the market, artificially inflating the price of Bitcoin. This can lead to sudden price drops when these manipulative forces withdraw from the market.

- Price Bubbles:Excessive inflows can create a price bubble, where the price of Bitcoin rises far beyond its intrinsic value. When the bubble bursts, it can lead to significant price corrections and losses for investors.

Analysis of Bitcoin’s Technical Indicators

Technical indicators play a crucial role in analyzing Bitcoin’s price movements and can offer valuable insights into its potential future direction. By examining these indicators, we can gain a better understanding of the current market sentiment and identify potential support and resistance levels.

The news of a potential surge in Bitcoin to $65,000, driven by massive cash inflows, is exciting, but it’s important to remember that the crypto market is volatile. For those seeking a more traditional safe haven, the role of gold as a safe investment is worth considering.

Gold has historically been a hedge against inflation and economic uncertainty, providing a sense of stability during turbulent times. While Bitcoin’s future remains uncertain, the potential for a surge to $65,000 is definitely a compelling prospect for investors.

Current Technical Indicators

The current technical indicators suggest a mixed outlook for Bitcoin. While some indicators point towards a potential surge, others indicate caution.

- Relative Strength Index (RSI):The RSI currently sits at 55, suggesting that Bitcoin is in a moderately overbought territory. This indicates that the price may be due for a correction in the short term.

- Moving Average Convergence Divergence (MACD):The MACD line is crossing above the signal line, indicating a bullish crossover. This suggests that the momentum is shifting in favor of the bulls.

- Bollinger Bands:Bitcoin’s price is currently trading near the upper band of the Bollinger Bands, indicating that the price is extended and may be vulnerable to a pullback.

Trading Volume and Market Capitalization

Bitcoin’s trading volume has been increasing recently, indicating growing investor interest. This surge in volume is likely driven by the influx of institutional capital into the market. As of today, Bitcoin’s market capitalization stands at approximately $1.2 trillion, making it the largest cryptocurrency by market value.

It’s a wild ride out there in the markets! A Bitcoin analyst is predicting a surge to $65,000 as massive cash inflows hit the market, which could be fueled by the news that Canadian stocks are surging as speculation grows of a Fed rate hike pause.

With the possibility of a pause in interest rate hikes, investors are looking for new opportunities, and Bitcoin could be a prime beneficiary. It’s certainly a time to watch closely, and buckle up for what could be a volatile few weeks!

Impact of Cash Inflows on Bitcoin

The recent influx of cash into the Bitcoin market has had a significant impact on its price. As institutional investors continue to allocate a larger portion of their portfolios to Bitcoin, its price is likely to continue to rise. However, it’s important to note that the market can be volatile, and sudden price drops are not uncommon.

Summary of Key Technical Indicators, Bitcoin analyst predicts potential surge to 65000 as massive cash inflows hit market

The following table summarizes the key technical indicators and their implications for Bitcoin’s price movement:

| Indicator | Current Value | Implication |

|---|---|---|

| RSI | 55 | Moderately overbought, potential for short-term correction |

| MACD | Bullish crossover | Momentum shifting in favor of bulls |

| Bollinger Bands | Price near upper band | Price extended, vulnerable to pullback |

| Trading Volume | Increasing | Growing investor interest |

| Market Capitalization | $1.2 trillion | Largest cryptocurrency by market value |

Impact on the Crypto Market and Economy

A significant surge in Bitcoin’s price could have a profound impact on the broader cryptocurrency market and the global economy. This surge could lead to increased adoption and investment in cryptocurrencies, potentially causing a ripple effect across various sectors.

Impact on the Cryptocurrency Market

A surge in Bitcoin’s price could act as a catalyst for the entire cryptocurrency market. The increased attention and investment in Bitcoin could spill over to other cryptocurrencies, driving their prices higher. This could lead to a more vibrant and active cryptocurrency ecosystem, with greater participation from both individual investors and institutional players.

The increased liquidity and trading volume could also make it easier for projects to raise funds and develop new technologies.

Impact on the Global Economy

A surge in Bitcoin’s price could have a significant impact on the global economy, particularly on financial systems. As Bitcoin’s market capitalization grows, it could become a more influential force in global finance. This could lead to increased volatility in traditional financial markets, as investors adjust their portfolios to account for the growing influence of Bitcoin.

Governments and financial institutions would need to adapt to the changing landscape and develop new regulations to manage the risks associated with cryptocurrencies.

Implications for Investors, Businesses, and Governments

- Investors:A surge in Bitcoin’s price could create significant opportunities for investors, both short-term and long-term. However, it’s important to note that the cryptocurrency market is highly volatile, and investors need to be aware of the risks involved. A surge in Bitcoin’s price could also lead to increased adoption of other cryptocurrencies, providing investors with a wider range of investment options.

- Businesses:Businesses could benefit from the increased adoption of cryptocurrencies. They could start accepting Bitcoin as a form of payment, reducing transaction fees and expanding their customer base. Businesses could also explore the use of blockchain technology to improve efficiency and transparency in their operations.

- Governments:Governments would need to adapt to the changing landscape of finance and develop new regulations to manage the risks associated with cryptocurrencies. This could include taxation policies, consumer protection measures, and anti-money laundering regulations. Governments could also explore the potential benefits of blockchain technology, such as improved transparency and efficiency in public services.

Risk and Opportunity Assessment: Bitcoin Analyst Predicts Potential Surge To 65000 As Massive Cash Inflows Hit Market

Bitcoin’s price surge, fueled by massive cash inflows, presents a compelling investment opportunity, but it’s crucial to acknowledge the inherent risks. Understanding these risks and the potential benefits is vital for making informed investment decisions.

Volatility and Price Fluctuations

Bitcoin’s price is notoriously volatile, subject to rapid and significant fluctuations. This volatility stems from various factors, including market sentiment, regulatory changes, and adoption rates.

A surge in price can be followed by a sharp correction, potentially leading to substantial losses for investors.

For instance, in 2021, Bitcoin experienced a record-breaking surge, reaching an all-time high of over $60,000, only to subsequently decline by more than 50% within a few months. This inherent volatility poses a significant risk to investors, particularly those with short-term investment horizons.

Regulatory Uncertainty

The regulatory landscape surrounding Bitcoin is evolving rapidly, with varying regulations across different jurisdictions. This uncertainty can impact Bitcoin’s price and accessibility.

For example, China’s ban on cryptocurrency trading in 2021 led to a sharp decline in Bitcoin’s price.

While some countries are embracing Bitcoin and cryptocurrencies, others are taking a cautious approach, imposing restrictions or even outright bans. This regulatory uncertainty creates an environment of risk for investors, as it can impact the future of Bitcoin and its adoption.

Security Risks

Bitcoin transactions are secured through cryptography, but vulnerabilities remain.

Hacking incidents, such as the Mt. Gox exchange hack in 2014, have resulted in significant losses for investors.

Furthermore, the decentralized nature of Bitcoin can make it challenging to recover stolen funds. Investors must be vigilant in protecting their private keys and choosing secure platforms for storing their Bitcoin.

Opportunities Presented by a Bitcoin Surge

A surge in Bitcoin’s price can create several opportunities for investors and businesses:

- Capital Appreciation:A rising Bitcoin price can lead to substantial capital gains for investors who hold Bitcoin.

- Increased Adoption:A surge can increase awareness and adoption of Bitcoin, leading to greater demand and further price appreciation.

- New Business Opportunities:Businesses can explore opportunities to integrate Bitcoin into their operations, such as accepting Bitcoin payments or offering Bitcoin-related services.

Benefits and Drawbacks of Investing During a Surge

Investing in Bitcoin during a surge can offer potential benefits but also comes with inherent drawbacks:

- Potential for High Returns:A surge can offer the opportunity for significant returns, but the risk of a sudden correction is equally high.

- FOMO (Fear of Missing Out):The excitement surrounding a surge can lead to impulsive investment decisions driven by fear of missing out, potentially leading to losses.

- Increased Competition:As Bitcoin’s price rises, more investors and speculators enter the market, potentially increasing competition and volatility.