Big News Stocks Looking Up: Job Report on the Horizon

Big news stocks looking up as we wait for important jobs report – the market is holding its breath, anticipating the release of the crucial jobs report that could send shockwaves through Wall Street. This report is a major economic indicator, and its impact on the stock market is undeniable.

Investors are closely watching the numbers, hoping for signs of a healthy labor market that could fuel further stock market growth. The stakes are high, with sectors like technology, consumer discretionary, and energy all poised to react to the report’s findings.

The jobs report is expected to reveal the number of new jobs created, the unemployment rate, and average hourly earnings. These figures will provide valuable insights into the health of the economy and the direction of future interest rate hikes.

Investors are eager to see whether the report aligns with their expectations, or if it throws a curveball that could reshape the market landscape.

Market Reaction to Job Report Expectations: Big News Stocks Looking Up As We Wait For Important Jobs Report

The upcoming release of the monthly jobs report is a significant event for investors and the stock market. The report, which is compiled by the Bureau of Labor Statistics (BLS), provides insights into the health of the US economy and is closely watched by market participants.

The big news stocks are looking up, anticipating the crucial jobs report that could potentially shift the market. It’s a positive sign, especially with the broader market showing strength as tech stocks rebound, and the Dow aiming for its tenth consecutive win – check out this article for the latest on the rally.

This positive momentum could further boost the big news stocks, making this week a crucial one for investors.

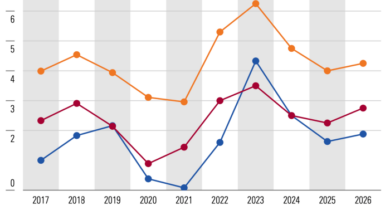

Historically, the stock market has shown a strong correlation with the job report data.

Historical Correlation Between Job Report and Stock Market

The correlation between job report data and stock market performance is a well-documented phenomenon. Generally, positive job report data, such as strong job growth and low unemployment, is associated with a positive reaction from the stock market. Conversely, weak job report data can lead to market declines.

- A strong jobs report can boost investor confidence, leading to increased investment and higher stock prices. This is because a strong job market indicates a healthy economy, which is generally seen as positive for corporate profits and economic growth.

- On the other hand, a weak jobs report can dampen investor sentiment, leading to selling pressure and lower stock prices. This is because a weak job market suggests a slowing economy, which could lead to lower corporate profits and slower economic growth.

The big news stocks are looking up, with a possible boost on the horizon as we wait for the important jobs report. However, the market is still grappling with inflation concerns and a focus on Disney’s recent shake-up, as seen in the recent attempted recovery detailed in this recent article.

It’ll be interesting to see if the jobs report can offer the reassurance needed for a sustained rally.

Current Market Sentiment and Investor Expectations

The current market sentiment leading up to the jobs report release is mixed. While some investors are optimistic about the report’s potential to show continued economic strength, others are concerned about potential signs of a slowdown.

- The recent economic data has been mixed, with some indicators showing signs of resilience while others suggest potential weakness. This uncertainty has contributed to the mixed market sentiment.

- Investors are looking for signs of continued job growth and wage growth, which would support the narrative of a strong economy. However, they are also monitoring inflation and interest rate expectations, which could impact corporate profits and economic growth.

Key Economic Indicators to Watch

Investors will be closely watching several key economic indicators in the jobs report, including:

- Nonfarm Payrolls:This is the most widely watched indicator, measuring the change in the number of jobs created in the nonfarm sector. A strong number here is generally seen as positive for the stock market.

- Unemployment Rate:This indicator measures the percentage of the labor force that is unemployed. A lower unemployment rate is generally seen as positive for the stock market.

- Average Hourly Earnings:This indicator measures the average hourly wage for all employees in the nonfarm sector. Strong wage growth can be seen as a sign of a healthy economy, which is generally positive for the stock market. However, high wage growth can also lead to concerns about inflation, which could have a negative impact on corporate profits and the stock market.

It’s a wild ride out there in the market, with big news stocks looking up as we wait for the crucial jobs report. But while the stock market is on everyone’s mind, it’s worth remembering the differences between the digital gold of Bitcoin and the programmable blockchain of Ethereum – check out this great explanation on how Ethereum is different from Bitcoin.

With the future of the economy still uncertain, it’s important to diversify your portfolio and explore the potential of these groundbreaking technologies.

Impact of Job Report on Sectors and Industries, Big news stocks looking up as we wait for important jobs report

The impact of the jobs report on specific sectors and industries can vary depending on the report’s content.

- Consumer Discretionary Sector:A strong jobs report could boost consumer confidence and spending, benefiting companies in the consumer discretionary sector, such as retailers, restaurants, and travel companies.

- Technology Sector:The technology sector is generally sensitive to economic conditions. A strong jobs report could lead to increased investment in technology companies, while a weak report could lead to a decline in investment.

- Financial Sector:The financial sector is often seen as a bellwether for the overall economy. A strong jobs report could lead to increased lending activity and higher profits for banks and other financial institutions.

Big News Stocks and Their Potential for Growth

The upcoming jobs report is a major event for the stock market, and several companies stand to benefit from positive economic news. These “big news” stocks are those most likely to be impacted by the report’s results, potentially experiencing significant price fluctuations.

Impact of Job Report on Big News Stocks

The job report is a key indicator of the health of the US economy. Strong job growth typically leads to increased consumer spending, boosting demand for goods and services. This, in turn, benefits companies across various sectors, particularly those heavily reliant on consumer spending.

Here is a list of “big news” stocks that are likely to be affected by the job report:

- Stock Name: Amazon (AMZN)

- Sector: E-commerce

- Recent Performance: Amazon’s stock has been relatively flat in recent weeks, but it has shown some upward momentum as investors anticipate a strong holiday shopping season.

- Potential Impact of Job Report: A strong jobs report could boost consumer confidence and increase spending on Amazon’s platform, leading to higher revenue and earnings for the company.

- Stock Name: Home Depot (HD)

- Sector: Home Improvement

- Recent Performance: Home Depot’s stock has performed well in recent weeks, driven by strong demand for home improvement products.

- Potential Impact of Job Report: A positive jobs report could further strengthen consumer spending on home improvement projects, benefiting Home Depot’s sales and profitability.

- Stock Name: Target (TGT)

- Sector: Retail

- Recent Performance: Target’s stock has shown some volatility in recent weeks, but it remains a popular investment among investors who believe in the company’s growth potential.

- Potential Impact of Job Report: A strong jobs report could lead to increased consumer spending on discretionary goods, which would benefit Target’s sales and earnings.

- Stock Name: Tesla (TSLA)

- Sector: Electric Vehicles

- Recent Performance: Tesla’s stock has been volatile in recent weeks, but it remains a popular investment among investors who believe in the company’s long-term growth potential.

- Potential Impact of Job Report: A strong jobs report could boost consumer confidence and lead to increased demand for electric vehicles, benefiting Tesla’s sales and earnings.

- Stock Name: Apple (AAPL)

- Sector: Technology

- Recent Performance: Apple’s stock has been relatively flat in recent weeks, but it remains a popular investment among investors who believe in the company’s strong brand and innovative products.

- Potential Impact of Job Report: A strong jobs report could lead to increased consumer spending on discretionary goods, including Apple products, benefiting the company’s sales and earnings.

Performance of Big News Stocks in Recent Weeks

The performance of these stocks in recent weeks has been mixed, reflecting the overall market sentiment and investor expectations surrounding the job report. Here is a table summarizing the recent performance of these stocks:

| Stock Name | Sector | Recent Performance | Potential Impact of Job Report |

|---|---|---|---|

| Amazon (AMZN) | E-commerce | Flat | Positive |

| Home Depot (HD) | Home Improvement | Upward | Positive |

| Target (TGT) | Retail | Volatile | Positive |

| Tesla (TSLA) | Electric Vehicles | Volatile | Positive |

| Apple (AAPL) | Technology | Flat | Positive |

Factors Influencing Stock Performance

While the jobs report is a major catalyst for market movement, it’s not the only factor determining the performance of “big news” stocks. Several other forces are at play, shaping the investment landscape and influencing stock prices.

Geopolitical Events

Geopolitical events can significantly impact stock prices, particularly for companies with international operations or exposure to specific regions. These events can create uncertainty and volatility, leading to market fluctuations. For example, a global conflict or a change in trade policies can disrupt supply chains, impact consumer confidence, and affect corporate earnings.

“Geopolitical risk is the possibility that political events, such as wars, revolutions, or changes in government policy, will negatively impact a company’s operations or investments.”

| Factor | Impact on Stock Prices | Example | Relevance to Job Report |

|---|---|---|---|

| Geopolitical Events | Increased volatility, potential for price drops or gains depending on the event’s impact | The Russia-Ukraine conflict has disrupted global energy markets and supply chains, impacting energy companies and manufacturers | Indirectly, as a strong jobs report could signal a more resilient economy, potentially mitigating the negative effects of geopolitical events |

Company-Specific News

Company-specific news, such as earnings reports, product launches, or regulatory changes, can significantly impact stock prices. Positive news can lead to increased investor confidence and higher stock prices, while negative news can result in decreased confidence and lower prices.

“Company-specific news is any event or announcement that directly affects a particular company, such as earnings reports, product launches, or regulatory changes.”

| Factor | Impact on Stock Prices | Example | Relevance to Job Report |

|---|---|---|---|

| Company-Specific News | Significant impact, both positive and negative, depending on the news | A strong earnings report from a tech giant can boost its stock price, while a product recall can lead to a decline | Indirectly, as a strong jobs report could suggest a favorable economic environment for company growth and performance |

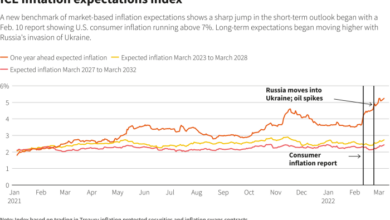

Broader Economic Trends

Broader economic trends, such as interest rates, inflation, and consumer spending, can have a significant impact on stock prices. For instance, rising interest rates can make borrowing more expensive, potentially slowing down economic growth and impacting corporate earnings.

“Broader economic trends refer to the overall health and direction of the economy, such as interest rates, inflation, and consumer spending.”

| Factor | Impact on Stock Prices | Example | Relevance to Job Report |

|---|---|---|---|

| Broader Economic Trends | Can influence investor sentiment and stock valuations | Rising inflation can lead to higher costs for companies, potentially impacting profits and stock prices | Directly, as a strong jobs report could suggest a healthy economy with low unemployment and potentially higher inflation |

Investment Strategies for Job Report Week

The weekly jobs report is a major economic indicator that can significantly impact the stock market. Investors often adjust their investment strategies based on their expectations for the report. This week, with the jobs report on the horizon, investors are closely watching for clues about the direction of the economy and how it might affect their portfolios.

Strategies for Bullish Investors

Investors who are bullish on the job report, expecting a strong report that indicates a healthy economy, might consider the following strategies:

- Buying Stocks:A strong jobs report could boost investor confidence, leading to increased demand for stocks. This could result in higher stock prices. Bullish investors might choose to buy stocks in sectors that are likely to benefit from a strong economy, such as consumer discretionary, technology, and industrials.

For example, an investor might buy shares of Amazon (AMZN) or Tesla (TSLA) if they believe these companies will perform well in a strong economy.

- Buying Call Options:Call options give the holder the right, but not the obligation, to buy a stock at a certain price (the strike price) by a certain date (the expiration date). If the stock price rises above the strike price, the call option will be profitable.

Bullish investors might buy call options on stocks they believe will rise in value after a positive jobs report. For instance, an investor might buy call options on Apple (AAPL) if they expect the company’s stock price to increase after a strong jobs report.

- Investing in Leveraged ETFs:Leveraged ETFs are designed to amplify the returns of an underlying index or asset class. For example, a 2x leveraged ETF on the S&P 500 would aim to provide twice the return of the S&P 500. Bullish investors might use leveraged ETFs to amplify their potential gains if they believe the stock market will rise following a strong jobs report.

However, it is important to note that leveraged ETFs also amplify losses, so they carry a higher level of risk.

Strategies for Bearish Investors

Investors who are bearish on the job report, expecting a weak report that indicates economic weakness, might consider the following strategies:

- Selling Stocks:A weak jobs report could dampen investor sentiment, leading to decreased demand for stocks. This could result in lower stock prices. Bearish investors might choose to sell stocks in sectors that are likely to be negatively affected by a weak economy, such as consumer staples and utilities.

For example, an investor might sell shares of Walmart (WMT) or Procter & Gamble (PG) if they believe these companies will perform poorly in a weak economy.

- Buying Put Options:Put options give the holder the right, but not the obligation, to sell a stock at a certain price (the strike price) by a certain date (the expiration date). If the stock price falls below the strike price, the put option will be profitable.

Bearish investors might buy put options on stocks they believe will fall in value after a negative jobs report. For instance, an investor might buy put options on Netflix (NFLX) if they expect the company’s stock price to decline after a weak jobs report.

- Short Selling:Short selling involves borrowing shares of a stock and immediately selling them in the market. The hope is that the stock price will decline, allowing the short seller to buy back the shares at a lower price and pocket the difference.

Bearish investors might short sell stocks they believe will decline after a weak jobs report. However, short selling is a high-risk strategy that can result in significant losses if the stock price rises instead of falls.

Risks and Rewards of Each Strategy

It is crucial to understand the risks and rewards associated with each investment strategy before making any decisions.

- Bullish Strategies:

- Reward:Potential for high gains if the jobs report is strong and the market reacts positively.

- Risk:Potential for losses if the jobs report is weak or the market reacts negatively.

- Bearish Strategies:

- Reward:Potential for high gains if the jobs report is weak and the market reacts negatively.

- Risk:Potential for significant losses if the jobs report is strong or the market reacts positively.

Specific Examples of Investment Strategies

- Buying or Selling Options:Investors might buy call options on stocks in sectors expected to benefit from a strong economy, such as technology or industrials, or buy put options on stocks in sectors expected to be negatively affected by a weak economy, such as consumer staples or utilities.

- Using Leveraged ETFs:Investors might use leveraged ETFs to amplify their potential gains if they believe the market will move in a particular direction. However, it is important to remember that leveraged ETFs also amplify losses.

- Investing in Specific Sectors:Investors might choose to invest in sectors that they believe will perform well or poorly based on the jobs report. For example, an investor might invest in the healthcare sector if they believe it will be relatively resilient to economic downturns or in the energy sector if they believe it will benefit from increased economic activity.