Saudi Arabia Extends Oil Cuts, Sparking Price Surge

Saudi arabia extends oil production cut sparking price surge and market speculations – Saudi Arabia Extends Oil Cuts, Sparking Price Surge and Market Speculations: The recent decision by Saudi Arabia to extend its oil production cuts has sent shockwaves through the global energy market, triggering a surge in oil prices and igniting a wave of market speculation.

This move, driven by a complex interplay of economic and geopolitical factors, has far-reaching implications for global energy markets, economies, and the transition to renewable energy sources.

The decision to extend the cuts comes as global oil demand is expected to remain strong, particularly from emerging economies, while the global supply remains constrained. This creates a delicate balance between meeting demand and maintaining price stability, placing Saudi Arabia, as the world’s largest oil exporter, in a pivotal position.

The implications of this decision extend beyond oil prices, influencing the geopolitical landscape and the future of energy policy.

Saudi Arabia’s Decision to Extend Oil Production Cuts

Saudi Arabia’s recent decision to extend its oil production cuts has sent shockwaves through the global energy market, sparking concerns about potential price increases and geopolitical implications. This move, which aims to further stabilize the market and support oil prices, comes at a time when global energy demand is on the rise, and supply remains tight.

Rationale Behind the Extended Cuts

The extension of the production cuts reflects Saudi Arabia’s strategic objectives of maintaining oil market stability and ensuring price stability. By reducing production, Saudi Arabia seeks to control the supply of crude oil, thereby influencing prices and safeguarding its revenue stream.

The decision is driven by a combination of factors:

- High oil prices:The recent surge in oil prices, fueled by strong demand and supply constraints, has benefited Saudi Arabia, a major oil producer. By extending the cuts, Saudi Arabia aims to sustain these high prices, further bolstering its economic prospects.

- Geopolitical tensions:The ongoing war in Ukraine and geopolitical uncertainties in the Middle East have created volatility in the global oil market. Saudi Arabia’s decision to extend cuts can be seen as a measure to mitigate these risks and maintain stability in the market.

- Global demand recovery:Despite economic headwinds, global oil demand is expected to continue its recovery in the coming years. Saudi Arabia’s move to extend cuts could be a preemptive measure to address potential supply shortages and maintain its market dominance.

Economic and Geopolitical Implications

The extension of the oil production cuts is likely to have significant economic and geopolitical implications:

- Price volatility:The cuts could lead to further price volatility in the oil market, potentially pushing prices even higher. This could exacerbate inflation and strain consumers’ budgets globally.

- Impact on consuming nations:Countries heavily reliant on imported oil could face higher energy costs, potentially affecting their economic growth and consumer spending. The rising oil prices could also put pressure on governments to implement fuel subsidies, which could strain public finances.

- Geopolitical tensions:The decision could further strain relations between oil-producing and oil-consuming nations. Some countries may view the cuts as a move by Saudi Arabia to exert its influence on the global energy market, potentially leading to increased geopolitical tensions.

- Alternative energy sources:The high oil prices could accelerate the transition to renewable energy sources, as countries seek to reduce their dependence on fossil fuels. This could have long-term implications for the global energy landscape.

Details of the Extended Cuts

The extended oil production cuts involve a reduction of 1.1 million barrels per day (bpd) from October 2023 to the end of December 2023. This extension comes on top of the existing cuts, which were originally scheduled to end in September 2023.

The cuts are expected to impact global oil supply significantly, potentially leading to higher oil prices in the coming months.

Impact on Global Oil Prices

The decision by Saudi Arabia to extend its oil production cuts has sent shockwaves through the global energy market, leading to a surge in oil prices. This move, coupled with the ongoing geopolitical tensions and global economic uncertainty, has created a complex and volatile landscape for oil prices.

The news of Saudi Arabia extending its oil production cuts has sent shockwaves through the markets, driving prices higher and sparking intense speculation about the future of energy. It’s a reminder of the delicate balance of power in the global energy landscape, a landscape that’s been shaped by figures like Kevin Mitnick, the legendary computer hacker who sadly passed away at 59, leaving behind a legacy that continues to influence cybersecurity today.

You can read more about his life and impact here. As the oil markets grapple with the implications of Saudi Arabia’s move, it’s clear that the energy sector is constantly evolving, demanding innovative solutions and strategies to navigate the complexities of the digital age.

Immediate Impact on Oil Prices

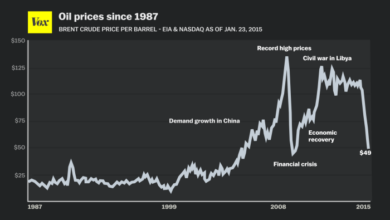

The immediate impact of the production cuts has been a sharp increase in oil prices. The benchmark Brent crude oil price has risen by over 10% since the announcement, reaching its highest level in several months. This price surge is a direct consequence of the reduced supply of oil, which has tightened the market and increased the cost of energy for consumers and businesses worldwide.

Market Speculations and Reactions

Saudi Arabia’s decision to extend oil production cuts has sparked widespread market speculation and reactions, influencing global energy markets and the broader economy. This move has fueled uncertainty and raised questions about the future trajectory of oil prices and the potential impact on global energy security.

Speculations Surrounding the Decision

The decision to extend oil production cuts has generated diverse market speculations. Some analysts believe this move is a strategic play by Saudi Arabia to maintain high oil prices and bolster its revenue. Others suggest that it is a calculated response to global economic uncertainties and geopolitical tensions, aiming to stabilize the market and ensure supply security.

The extended cuts are also seen as a potential catalyst for further price increases, potentially leading to inflation and economic strain.

Saudi Arabia’s decision to extend oil production cuts has sent shockwaves through the global market, triggering a surge in prices and sparking intense speculation. It’s a move that echoes the unexpected shakeup at Alibaba, where CEO Zhang was replaced in a move that caught many by surprise, as seen in this article.

This kind of volatility, both in the energy sector and in the tech world, highlights the unpredictable nature of global markets and the need for constant vigilance.

Reactions of Key Stakeholders

The decision has elicited varied reactions from major oil producers, consumers, and industry stakeholders.

- Oil Producers:Some oil producers, particularly those aligned with Saudi Arabia’s stance, have expressed support for the extended cuts. They believe it is necessary to maintain market stability and prevent a price crash. However, other producers, particularly those facing production challenges or seeking to increase market share, have voiced concerns about the impact on their own output and revenues.

- Oil Consumers:Oil-consuming nations have expressed mixed reactions. Some countries, particularly those heavily reliant on oil imports, have expressed concerns about the potential for higher prices and economic hardship. Others, however, view the cuts as a necessary step to ensure energy security and mitigate potential supply disruptions.

- Industry Stakeholders:Industry stakeholders, including oil companies, traders, and investors, have responded to the decision with caution. While some anticipate potential gains from higher prices, others are concerned about the potential for market volatility and uncertainty. The decision has also triggered a wave of investment activity in the energy sector, as investors seek to capitalize on the anticipated price increases.

Saudi Arabia’s decision to extend oil production cuts has sent shockwaves through the market, leading to a surge in prices and a flurry of speculation. While the energy sector grapples with this news, the cryptocurrency market is displaying a different kind of resilience.

Despite a slight dip in Bitcoin, Ethereum is showing gains, indicating that investor confidence remains positive, as highlighted in this recent market update cryptocurrency market update bitcoin slips ether inches up as investor confidence remains positive. This divergence in market sentiment suggests that investors are looking for alternative assets to hedge against the uncertainty caused by the oil price fluctuations.

Potential Impact on Global Energy Markets

The extended oil production cuts are expected to have significant implications for global energy markets.

- Price Volatility:The decision is likely to contribute to increased price volatility in the short term. As market participants adjust to the new supply dynamics, prices could fluctuate significantly, creating uncertainty for consumers and businesses.

- Inflationary Pressures:The potential for higher oil prices could exacerbate inflationary pressures globally. Increased energy costs can ripple through the economy, impacting transportation, manufacturing, and consumer spending.

- Energy Security Concerns:The decision raises concerns about energy security, particularly for oil-importing nations. The potential for supply disruptions or price spikes could create vulnerabilities and necessitate strategic adjustments to energy policies.

- Alternative Energy Investments:The extended cuts could accelerate investments in alternative energy sources, such as renewable energy and electric vehicles. As oil prices rise, the economic viability of these alternatives becomes more attractive, potentially leading to a shift in energy consumption patterns.

Potential Consequences for the Global Economy: Saudi Arabia Extends Oil Production Cut Sparking Price Surge And Market Speculations

The decision by Saudi Arabia to extend its oil production cuts has sent shockwaves through the global economy. While the move aims to stabilize oil prices and ensure energy security, it also carries the potential for significant economic consequences. Higher oil prices can have a ripple effect across various sectors, impacting inflation, economic growth, and consumer spending.

Impact on Inflation

Higher oil prices contribute to inflation by increasing the cost of production and transportation. This impact is felt across the entire supply chain, as businesses pass on increased costs to consumers. For instance, the price of gasoline, a key component of transportation, rises directly with oil prices, affecting the cost of goods and services.

This can lead to a vicious cycle of rising prices and reduced consumer spending, potentially hindering economic growth.

Impact on Economic Growth

Higher oil prices can also stifle economic growth by dampening consumer and business spending. Consumers may choose to cut back on discretionary spending, leading to a decrease in demand for goods and services. Businesses may also face challenges in maintaining profitability as their input costs rise.

This can result in reduced investment, job creation, and overall economic activity. For example, the global financial crisis of 2008 was partly triggered by high oil prices, which contributed to a decline in economic activity.

Impact on Different Sectors

- Transportation:The transportation sector is directly impacted by higher oil prices, as fuel costs represent a significant portion of their operational expenses. This can lead to higher transportation costs for businesses, impacting the cost of goods and services. For consumers, higher fuel prices can reduce discretionary spending on travel and leisure activities.

- Manufacturing:The manufacturing sector relies heavily on energy for production, and higher oil prices can increase input costs. This can make it more challenging for manufacturers to compete in global markets, potentially leading to job losses and reduced investment.

- Consumer Spending:Higher oil prices can lead to a decline in consumer spending, as consumers have less disposable income after paying for higher fuel and transportation costs. This can negatively impact retail sales, tourism, and other sectors that rely on consumer spending.

Potential Consequences Across Regions and Countries

| Region/Country | Potential Consequences |

|---|---|

| Developed Economies (e.g., US, EU) | Higher inflation, slower economic growth, reduced consumer spending, potential for social unrest. |

| Emerging Markets (e.g., China, India) | Increased import costs, higher inflation, slower economic growth, potential for social unrest. |

| Oil-Exporting Countries (e.g., Saudi Arabia, Russia) | Increased revenue, potential for economic growth, but also potential for inflation and social unrest if oil prices rise too quickly. |

Implications for Energy Policy and Sustainability

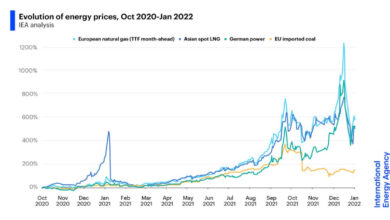

The Saudi Arabian decision to extend oil production cuts has significant implications for global energy policy and the transition to renewable energy sources. The move is likely to exacerbate the ongoing energy crisis, potentially pushing up oil prices and impacting the adoption of cleaner energy alternatives.

Impact on Renewable Energy Adoption

The oil price surge driven by Saudi Arabia’s decision could accelerate the adoption of renewable energy technologies. Higher oil prices make renewable energy sources, such as solar and wind power, more economically competitive. This is because the cost of renewable energy technologies has been steadily decreasing, while fossil fuel prices remain volatile.

For instance, the levelized cost of electricity (LCOE) for solar and wind power has fallen significantly in recent years, making them increasingly attractive compared to fossil fuels. As oil prices rise, the gap between the cost of renewable energy and fossil fuels widens, making renewable energy a more compelling investment option.

Potential for Increased Investment in Renewable Energy Infrastructure and Research, Saudi arabia extends oil production cut sparking price surge and market speculations

The oil production cuts and the resulting oil price surge could also trigger increased investment in renewable energy infrastructure and research. Governments and private investors may be motivated to accelerate the development and deployment of renewable energy technologies to reduce their dependence on fossil fuels and mitigate the impact of volatile oil prices.

For example, the International Energy Agency (IEA) has projected that global investment in renewable energy will need to increase significantly in the coming years to achieve the goals of the Paris Agreement on climate change. The current oil price situation could provide the impetus for such investments.