August: Stock Market Challenges Amid Seasonal Trends

August proves challenging for stock market amid seasonal trends – August: Stock Market Challenges Amid Seasonal Trends sets the stage for an exploration of the historical and contemporary factors that often make August a turbulent month for the stock market. While the summer months can often bring a sense of relaxation and carefree living, for investors, August can present a unique set of challenges, fueled by a confluence of seasonal patterns, economic indicators, and investor sentiment.

This month’s volatility is not a recent phenomenon, but rather a recurring trend with roots in historical events and economic realities.

From the historical perspective, August has often been a period of heightened market volatility. This can be attributed to a number of factors, including the summer “vacation effect” as traders and investors take time off, leading to reduced liquidity in the market.

Additionally, the back-to-school season can impact consumer spending patterns, influencing corporate earnings reports. These factors, combined with the ongoing release of key economic indicators, can create a volatile environment for the stock market.

August’s Historical Performance: August Proves Challenging For Stock Market Amid Seasonal Trends

August has historically been a challenging month for the stock market, often marked by volatility and a tendency for lower returns compared to other months. This trend has been observed for several decades, leading to a common saying among investors: “Sell in May and go away.”

August is often a turbulent month for the stock market, with historical trends suggesting a tendency for volatility. Understanding the forces behind these fluctuations is crucial for navigating the market successfully. This is where understanding the principles of asset valuation comes in, and that includes decoding crypto prices understanding how cryptocurrencies are valued.

By analyzing the factors that influence asset value, we can gain valuable insights into the potential direction of the market, even amidst the seasonal challenges of August.

Historical Data and Trends, August proves challenging for stock market amid seasonal trends

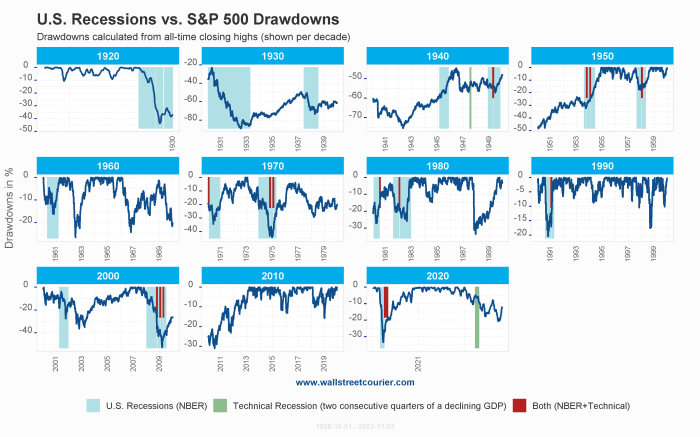

To understand the historical performance of the stock market in August, we can examine the historical data. The S&P 500 index, a widely recognized benchmark for the US stock market, has historically shown a lower average return in August compared to other months.

This trend can be attributed to various factors, including:

- Summer Vacation Season:Many investors and traders take vacations during the summer months, leading to lower trading volume and potentially increased market volatility.

- End-of-Summer Sell-Off:As summer comes to an end, some investors may sell off their positions to lock in profits or rebalance their portfolios before the start of the new fiscal year.

- Seasonal Factors:The August effect is often linked to economic factors, such as a slowdown in corporate earnings, increased uncertainty about future economic growth, and a tendency for investors to take profits after a strong first half of the year.

Notable August Events

Throughout history, various events have occurred in August that significantly impacted the stock market. These events include:

- The 1987 Black Monday:On August 19, 1987, the Dow Jones Industrial Average experienced its largest one-day decline in history, falling by 22.6%. The crash was attributed to a combination of factors, including concerns about inflation, rising interest rates, and a global trade deficit.

- The 2008 Financial Crisis:August 2008 marked a pivotal moment in the financial crisis, as the stock market experienced significant volatility and losses. The collapse of Lehman Brothers, a major investment bank, triggered a global financial panic.

- The COVID-19 Pandemic:In August 2020, the stock market experienced a sharp correction, as concerns about the resurgence of the COVID-19 pandemic and its impact on the economy grew.

Seasonal Factors

August is often a challenging month for the stock market, and several seasonal factors play a role in this trend. These factors can contribute to increased volatility and potentially lower returns.

Summer Vacations

Summer vacations can impact market activity in several ways.

- Reduced Trading Volume:Many traders and investors take time off during the summer months, leading to lower trading volumes. This can make the market more susceptible to price swings as fewer participants are actively trading.

- Limited News Flow:The summer months often see a slowdown in corporate news and economic data releases. With fewer significant events driving market sentiment, investors may be less inclined to make significant trades.

Back-to-School Season

The back-to-school season, typically starting in late August, can also affect market sentiment.

- Retail Spending:As families prepare for the new school year, retail spending often increases. This can positively impact companies in the consumer discretionary sector, potentially boosting their stock prices.

- Investor Sentiment:The back-to-school season can sometimes bring a sense of optimism and renewed activity to the market. This is because investors may anticipate a surge in economic activity as consumers spend more.

Earnings Season

August typically falls within the peak earnings season for many companies.

August has historically been a tough month for the stock market, often marked by volatility and sluggish returns. This year seems to be no different, with investors grappling with concerns about inflation and rising interest rates. While the market navigates these challenges, there’s news on the airline front with Lufthansa’s CEO asserting that discussions about a potential takeover of Portugal’s TAP are premature.

This development, along with the ongoing economic uncertainty, adds another layer of complexity to the already challenging market landscape.

- Volatility:Earnings reports can significantly impact stock prices, leading to increased market volatility. Companies that exceed expectations may see their stock prices rise, while those that fall short could experience declines.

- Investor Focus:Investors closely scrutinize earnings reports, seeking insights into a company’s financial health and future prospects. This heightened focus can contribute to market volatility.

Economic Indicators

August is a month that often sees a slowdown in economic activity, which can impact stock market performance. Investors closely monitor key economic indicators to gauge the health of the economy and anticipate potential market movements.

Key Economic Indicators

Several economic indicators are closely watched in August, providing insights into the overall economic health and potential market trends.

- Inflation:The Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) price index are key indicators of inflation. Rising inflation can lead to higher interest rates, which can dampen economic growth and negatively impact stock valuations.

- Job Market:The monthly nonfarm payrolls report, unemployment rate, and job openings data provide insights into the labor market’s strength. A strong job market is generally positive for the economy and stock market, while a weakening labor market can signal concerns about future economic growth.

- Manufacturing Activity:The Institute for Supply Management (ISM) Manufacturing Index tracks the health of the manufacturing sector. A strong manufacturing sector indicates a robust economy and potential for corporate earnings growth, which is generally positive for the stock market.

- Retail Sales:Retail sales data reflects consumer spending, a significant driver of economic growth. Strong retail sales indicate consumer confidence and a healthy economy, which can support stock market performance.

- Interest Rates:The Federal Reserve’s decisions on interest rates are closely watched by investors. Higher interest rates can make borrowing more expensive for businesses and consumers, potentially slowing economic growth and impacting stock valuations.

Impact on the Current Market Environment

The current economic landscape is characterized by persistent inflation, rising interest rates, and a potential slowdown in economic growth. The impact of these factors on the stock market is uncertain, but investors are closely monitoring economic indicators to assess the potential for a recession and adjust their investment strategies accordingly.

Comparison with Previous Augusts

Historically, August has been a volatile month for the stock market, with mixed performance. However, the current economic environment, with its unique combination of factors, presents a different context than previous Augusts. Investors are navigating a complex and uncertain landscape, requiring careful analysis of economic indicators and market trends to make informed investment decisions.

Market Sentiment and Investor Behavior

August often presents a mixed bag for the stock market, with historical data showing a tendency for lower returns. This, combined with the seasonal trends we discussed earlier, can significantly influence investor sentiment and behavior.

Investor Sentiment in August

Investor sentiment in August tends to be cautious. The summer months, often marked by vacations and reduced trading activity, can lead to a perception of lower market liquidity and volatility. This can make investors more hesitant to take on significant risks, potentially leading to a decline in trading volume and price fluctuations.

August has been a bumpy ride for the stock market, with seasonal trends contributing to the volatility. Amidst this, a surprising development has emerged in the crypto world: the Senate’s most prominent advocate for cryptocurrency, known as the “Crypto Queen,” has unveiled a far-reaching new bill focused on Bitcoin, which could have significant implications for the future of digital assets.

Whether this new bill will impact the stock market remains to be seen, but it’s definitely a development worth watching in the coming months.

Factors Influencing Investor Behavior

Several factors contribute to investor behavior in August:* Summer Vacation Season:Many investors and traders take vacations during the summer months, leading to reduced trading activity and potentially impacting market liquidity.

Earnings Season While the primary earnings season typically occurs in the first and fourth quarters, some companies release their quarterly reports in August. Positive earnings reports can boost investor confidence and potentially drive up stock prices, while negative reports can have the opposite effect.

Economic Data Releases Key economic indicators, such as inflation data, unemployment figures, and manufacturing reports, are released throughout the month. These releases can significantly influence investor sentiment and market direction, depending on the data’s strength or weakness.

Geopolitical Events Global events, such as political instability, trade tensions, or natural disasters, can also impact investor sentiment and risk appetite.

Market Volatility August is known for its potential volatility, which can make investors more cautious and prone to short-term trading strategies.

Impact on Different Sectors

August’s challenges can impact different sectors of the stock market in varying ways. The historical performance of specific sectors during August, coupled with current economic conditions and market sentiment, can provide insights into potential winners and losers.

Technology Sector

The technology sector is often sensitive to economic shifts and investor sentiment. In August, the sector could face headwinds due to potential economic uncertainties and concerns about rising interest rates. Companies heavily reliant on consumer spending, such as those in e-commerce or social media, might experience slower growth during this period.

For example, companies like Amazon and Meta could see their stock prices decline if consumer spending slows down due to economic concerns.

Conversely, companies focused on enterprise software or cloud computing could see continued growth, as businesses may continue to invest in technology to improve efficiency and productivity.

For instance, companies like Salesforce and Microsoft could benefit from increased demand for their cloud-based solutions.

Energy Sector

The energy sector can be influenced by global economic conditions, geopolitical events, and seasonal factors. In August, the sector might be affected by concerns about global demand for oil and natural gas, potentially leading to lower prices.

Companies like ExxonMobil and Chevron might face pressure on their stock prices if oil prices decline due to concerns about slowing global economic growth.

However, rising demand for energy in emerging markets and potential supply disruptions could provide support for energy prices.

For example, companies involved in renewable energy, such as solar or wind power, could see increased demand and potentially benefit from government policies supporting clean energy initiatives.

Healthcare Sector

The healthcare sector is generally considered defensive, meaning it tends to perform well during economic downturns. However, August’s challenges could impact the sector in various ways.

Pharmaceutical companies, for example, could see their stock prices decline if there are concerns about rising healthcare costs or government regulations.

On the other hand, companies focused on medical devices or healthcare technology could benefit from continued demand for their products and services.

Companies like Abbott Laboratories or Medtronic might see continued growth in their stock prices if there is an increase in demand for their medical devices and healthcare technology solutions.

Strategies for Investors

August’s notorious volatility presents unique challenges for investors. While the market’s overall direction remains uncertain, proactive strategies can help navigate these turbulent waters and protect portfolios.

Managing Risk and Protecting Portfolios

Effective risk management is crucial during periods of market volatility. A well-diversified portfolio across different asset classes can mitigate potential losses. Diversification reduces the impact of any single asset’s underperformance by spreading risk across various investments.

- Rebalance Regularly:Periodically rebalancing your portfolio ensures that your asset allocation aligns with your risk tolerance and investment goals. This involves adjusting the proportions of different asset classes to maintain the desired balance.

- Consider Defensive Sectors:In volatile markets, defensive sectors like healthcare and consumer staples tend to perform relatively well. These sectors offer essential goods and services that are less susceptible to economic downturns.

- Utilize Stop-Loss Orders:Stop-loss orders automatically sell a security when it reaches a predetermined price, limiting potential losses. This strategy can be particularly helpful in volatile markets.

Staying Informed and Adapting to Changing Market Conditions

Staying informed about market trends, economic indicators, and geopolitical events is crucial for making informed investment decisions.

- Monitor Key Economic Indicators:Pay attention to inflation data, interest rate decisions, and employment reports. These indicators provide insights into the overall health of the economy and its impact on the stock market.

- Follow Market News and Analysis:Stay updated on news and analysis from reputable sources. This helps you understand market sentiment and identify potential opportunities and risks.

- Be Prepared to Adjust Your Strategy:Market conditions can change rapidly. Be prepared to adjust your investment strategy based on new information and evolving market dynamics.