Asian Stock Markets: Fed Rate Decision Impact

Asian stock market trends amid anticipation of fed conference on interest rates – Asian stock market trends amid anticipation of the Fed conference on interest rates sets the stage for a captivating narrative, offering readers a glimpse into a world where economic forces collide with investor sentiment. The upcoming Fed decision, whether to raise rates or hold them steady, is poised to send ripples across Asian markets, impacting currency valuations, capital flows, and economic growth.

The region’s diverse economies, each with its unique monetary policies and economic structures, will react differently to the Fed’s decision, creating a complex and intriguing landscape for investors.

This analysis delves into the potential impact of the Fed’s decision on Asian stock markets, exploring current economic trends, investor sentiment, and specific sector analysis. We’ll examine key market indicators that can provide insights into market performance and explore the potential impact on different sectors, from technology to energy and consumer goods.

By understanding the intricacies of these relationships, investors can gain valuable insights into navigating the volatile waters of Asian markets.

Current Economic Trends in Asia: Asian Stock Market Trends Amid Anticipation Of Fed Conference On Interest Rates

Asia’s economic landscape is a complex tapestry of diverse growth trajectories, navigating global headwinds and navigating domestic challenges. The region is a powerhouse of global trade and investment, with major economies like China, Japan, and India contributing significantly to global GDP.

However, the recent period has witnessed a confluence of factors that are shaping the economic outlook for Asia.

Key Economic Indicators in Major Asian Economies

The performance of major Asian economies varies significantly, with some exhibiting robust growth while others face headwinds.

Asian stock markets are on edge this week, bracing for the Fed’s upcoming conference on interest rates. Investors are closely watching for any hints about the future path of monetary policy, especially in light of the recent surge in inflation.

The latest consumer price index report, which showed annual consumer price hikes accelerating to a record 3.2% rise in July , has fueled concerns about a potential acceleration in rate hikes. This uncertainty is likely to weigh heavily on investor sentiment in the coming days, impacting the trajectory of Asian markets.

- China, the world’s second-largest economy, has experienced a slowdown in recent quarters, with the impact of the “zero-COVID” policy and property sector challenges weighing on growth. However, China’s economic fundamentals remain strong, and the government is implementing policies to stimulate growth.

Asian stock markets are on edge this week, with investors closely watching the upcoming Fed conference on interest rates. The market is already feeling the ripple effects of global economic uncertainties, as evidenced by the recent stock market updates and economic trends stocks open lower amid china economic concerns positive us retail sales.

The Fed’s decision will have a significant impact on global financial markets, particularly in Asia, where economies are highly sensitive to changes in US monetary policy.

- India, on the other hand, continues to be a bright spot in the global economy, with its strong domestic demand and structural reforms driving growth. The country is expected to remain one of the fastest-growing major economies in the world.

- Japan, a developed economy with a large manufacturing sector, is facing challenges from a weak yen and rising energy prices. The country’s economic growth remains sluggish, with policymakers struggling to achieve sustainable inflation.

- South Korea, a major exporter of technology and consumer goods, is also grappling with global economic uncertainties, including supply chain disruptions and rising energy costs. The country’s economic outlook remains uncertain, with the performance of its export sector being a key factor.

Impact of Global Economic Uncertainties on Asian Markets

Global economic uncertainties are casting a shadow over Asian markets, with several factors impacting growth prospects.

The Asian stock markets are on edge, anticipating the Fed’s conference on interest rates, a decision that could significantly impact global economic growth. While investors grapple with these macro concerns, news of Peloton recalling 2.2 million bikes over injury and fall concerns adds another layer of uncertainty.

This recall, a significant blow to the company’s image and sales, highlights the importance of consumer safety and could impact the broader market sentiment. The upcoming Fed decision remains the primary focus, but this unexpected development adds a new dimension to the market’s volatility.

- Supply Chain Disruptions: The COVID-19 pandemic has caused widespread supply chain disruptions, leading to shortages of key components and raw materials. This has affected production and increased costs for businesses in Asia, impacting economic activity.

- Rising Energy Prices: The war in Ukraine and geopolitical tensions have led to a surge in energy prices, putting pressure on Asian economies that rely heavily on imported energy. This has increased inflation and reduced consumer spending, impacting economic growth.

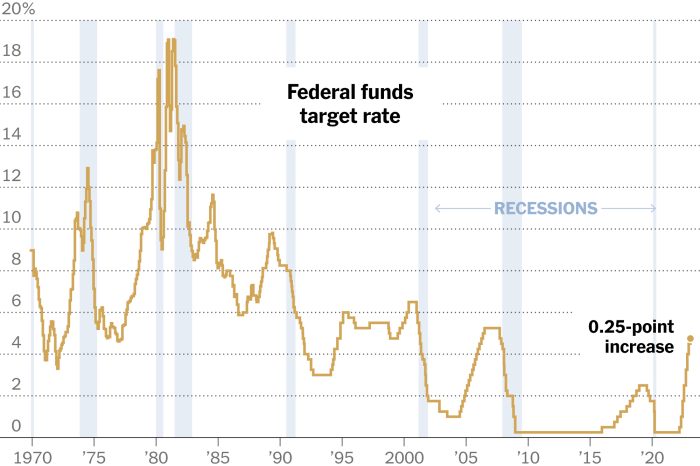

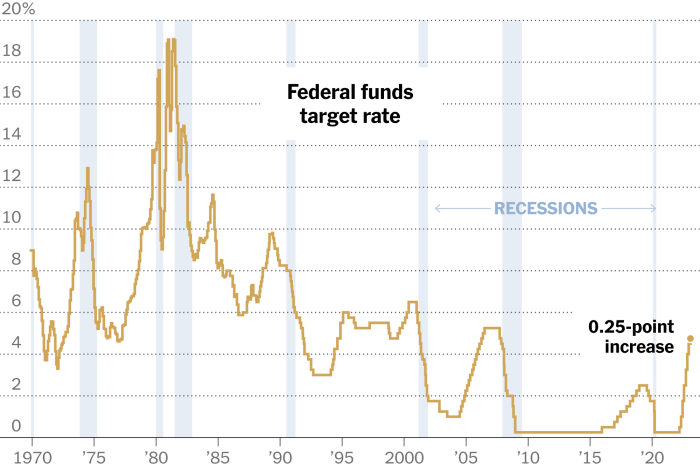

- Monetary Policy Tightening: Major central banks, including the US Federal Reserve, are tightening monetary policy to combat inflation. This has led to a rise in interest rates, which can impact investment and economic growth in Asia.

Economic Outlook for Different Asian Regions

The economic outlook for different Asian regions varies, with some regions expected to perform better than others.

- Southeast Asia: The region is expected to benefit from strong domestic demand and a growing middle class. However, rising inflation and supply chain disruptions pose risks to growth.

- South Asia: India is expected to continue to be a growth driver for the region, with its strong domestic demand and structural reforms. However, high inflation and rising energy prices pose challenges.

- Northeast Asia: China’s economic slowdown is expected to weigh on the region’s growth. Japan’s economic outlook remains uncertain, while South Korea is facing challenges from global economic uncertainties.

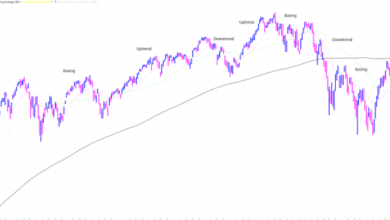

Investor Sentiment and Market Volatility

Investor sentiment towards Asian markets is currently a mixed bag, with anticipation of the Fed’s interest rate decision casting a shadow over the region’s outlook. While some investors remain optimistic about the region’s long-term growth potential, others are adopting a more cautious approach, wary of the potential impact of rising interest rates on economic activity and asset valuations.

Impact of the Fed’s Decision on Market Volatility

The Fed’s decision on interest rates will undoubtedly have a significant impact on market volatility, both in the short term and the long term. A hawkish stance, with a larger-than-expected rate hike, could trigger a sell-off in Asian markets as investors re-evaluate risk appetite and adjust their portfolios.

Conversely, a dovish stance, with a smaller rate hike or even a pause, could provide some relief and boost investor sentiment.

The potential impact of the Fed’s decision on market volatility is likely to be magnified by the current global economic uncertainty, including geopolitical tensions, supply chain disruptions, and rising inflation.

Investor Behavior and Portfolio Adjustments

Investor behavior in response to the Fed’s decision will vary depending on individual risk tolerance and investment strategies. Some investors may choose to reduce their exposure to Asian markets, particularly in sectors sensitive to interest rate changes, such as technology and consumer discretionary.

Others may see the potential for attractive entry points in undervalued assets if the market experiences a sell-off.

A key factor influencing investor behavior will be the perceived impact of the Fed’s decision on the region’s economic growth prospects. If the Fed’s actions are seen as dampening growth, investors may become more risk-averse, leading to further market volatility.

Key Market Indicators to Watch

The upcoming Fed meeting on interest rates is a significant event that will likely impact Asian stock markets. Understanding key market indicators can help investors gauge the potential impact of the Fed’s decision and make informed investment decisions.

Key Market Indicators and Their Impact, Asian stock market trends amid anticipation of fed conference on interest rates

Here are some key market indicators to watch closely:

| Indicator | Description | Potential Impact on Market Performance | Current Value/Trend |

|---|---|---|---|

| US Dollar Index (DXY) | Measures the value of the US dollar against a basket of six major currencies. | A strengthening dollar can make Asian exports more expensive, potentially hurting corporate earnings and leading to lower stock prices. Conversely, a weakening dollar can boost Asian exports and support stock prices. | Currently trading at [insert current value] and has been [insert trend: strengthening, weakening, or stable]. |

| US Treasury Yields | Reflect the interest rates on US government bonds. | Rising yields can attract capital away from emerging markets like Asia, leading to lower stock prices. Conversely, falling yields can encourage investment in Asian stocks. | The 10-year Treasury yield is currently at [insert current value] and has been [insert trend: rising, falling, or stable]. |

| Inflation Data | Measures the rate of price increases in the economy. | High inflation can prompt the Fed to raise interest rates more aggressively, potentially impacting Asian stock markets. Conversely, lower inflation may lead to a more accommodative monetary policy. | The latest inflation data for major Asian economies show [insert current inflation rates and trends for key Asian economies]. |

| Economic Growth Data | Measures the rate of change in a country’s economic output. | Strong economic growth can support corporate earnings and drive stock prices higher. Conversely, weak growth can lead to lower earnings and potentially depress stock prices. | Recent economic growth data for key Asian economies show [insert recent economic growth figures and trends for key Asian economies]. |

These indicators provide insights into the broader economic environment and investor sentiment, which can influence the performance of Asian stock markets. For example, a strengthening US dollar and rising Treasury yields might indicate a risk-off sentiment among investors, potentially leading to capital outflows from Asian markets.

Conversely, declining inflation and strong economic growth in Asia could signal a positive outlook, potentially attracting investors to the region. By monitoring these indicators, investors can gain a better understanding of market dynamics and make more informed investment decisions.