Asian Shares Rally as Wall Street Hits New Highs, Inflation Cools

Asian shares rally as Wall Street hits new highs inflation cools more than expected takes center stage, and it’s a story that’s got everyone talking. Investors are feeling optimistic as inflation shows signs of easing, and this is giving a boost to both US and Asian markets.

Wall Street is riding high, with major indices reaching new milestones, while Asian markets are experiencing a welcome rally. But what’s driving this positive momentum, and what does it mean for the future? Let’s dive into the details and explore the factors behind this exciting market shift.

The recent cooling of inflation has played a major role in this positive market sentiment. This is a significant development, as it suggests that central banks may be able to ease their aggressive interest rate hikes, which had been a major concern for investors.

The tech sector, in particular, has been a beneficiary of this shift, as investors are now more willing to invest in growth stocks. But it’s not just tech that’s seeing gains. Other sectors, such as finance and consumer goods, are also performing well, fueled by a combination of factors including improving consumer confidence and a stronger economic outlook.

Asian Markets Rally: Asian Shares Rally As Wall Street Hits New Highs Inflation Cools More Than Expected

Asian stock markets have surged in recent weeks, fueled by a combination of factors, including easing inflation concerns, a weakening US dollar, and robust economic growth in the region. This positive momentum has lifted investor sentiment, leading to a strong performance across various sectors.

Performance of Asian Markets

The recent rally in Asian markets has been particularly notable in several key sectors. Technology stocks have been a standout performer, driven by strong earnings reports and optimism about the growth of the digital economy. The consumer discretionary sector has also seen significant gains, benefiting from the reopening of economies and increased consumer spending.

- The MSCI Asia Pacific Index, which tracks the performance of large and mid-cap stocks across the region, has gained over 5% in the past month.

- China’s Shanghai Composite Index has surged by over 10% during the same period, boosted by government support measures and improving economic data.

- India’s Sensex has also risen significantly, driven by strong corporate earnings and a favorable economic outlook.

Comparison to Other Global Markets

The performance of Asian markets has outpaced that of other global markets, including the US. The S&P 500, a key benchmark for US equities, has gained around 2% in the past month, lagging behind the gains seen in Asian markets.

This divergence in performance can be attributed to several factors, including the relatively stronger economic growth prospects in Asia and the easing of monetary policy in several Asian countries.

Investor Sentiment and Expectations

Investor sentiment in Asian markets has improved significantly in recent weeks, driven by the positive economic outlook and easing inflation concerns. Many analysts believe that the rally in Asian markets is likely to continue in the coming months, supported by strong corporate earnings, robust economic growth, and favorable monetary policy.

However, investors are also aware of potential risks, including rising interest rates, geopolitical tensions, and the ongoing COVID-19 pandemic.

It’s been a wild ride for the markets lately, with Asian shares rallying as Wall Street hits new highs and inflation cooling more than expected. But amidst this positive news, the banking sector continues to be a source of concern, as evidenced by the bank turmoil resulting in a 72 billion loss of deposits for First Republic.

This event serves as a reminder that the road to recovery might not be smooth sailing, and investors should remain cautious while navigating the current economic landscape.

Wall Street Hits New Highs

Wall Street indices have been surging recently, reaching new highs, fueled by a combination of factors. The cooling inflation, a positive signal for the economy, has played a significant role in boosting investor confidence. This, coupled with strong corporate earnings and a resilient job market, has led to a favorable investment environment.

The Role of Cooling Inflation

The recent decline in inflation, a key concern for investors, has been a major driver of the stock market rally. The Federal Reserve’s aggressive interest rate hikes have begun to curb price pressures, leading to a decrease in inflation. This positive development has eased investor anxieties about a potential recession and encouraged them to invest in equities.

Performance of Key Sectors

The technology sector has been a significant contributor to the recent market gains, driven by strong earnings reports and optimism about the future of artificial intelligence. The financial sector has also performed well, benefiting from rising interest rates and a healthy economy.

Consumer goods companies have seen mixed results, with some companies struggling with high inflation and supply chain disruptions, while others have benefited from strong consumer spending.

The Current Economic Landscape

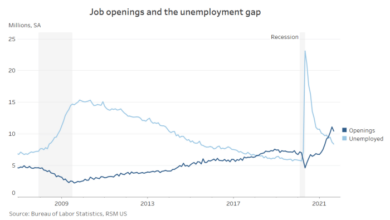

The overall economic landscape remains positive, despite some concerns about a potential recession. The job market remains strong, with unemployment rates at historically low levels. Consumer spending remains robust, supported by a strong labor market and pent-up demand. However, rising interest rates and geopolitical tensions continue to pose challenges for the economy.

It’s a strange world out there. Asian shares are rallying as Wall Street hits new highs, fueled by news that inflation is cooling more than expected. But across the globe, the situation is much more volatile. The Russian crisis deepens as Wagner leader defies Putin authority , raising concerns about the potential for wider instability.

It’s a stark reminder that even as the global economy shows signs of recovery, there are still major challenges ahead.

Inflation Cools More Than Expected

Recent data releases have shown that inflation is cooling, providing some relief for consumers and investors alike. This has sparked optimism in the markets, with Asian shares rallying and Wall Street hitting new highs.

The Impact of Cooling Inflation on Markets

The recent decline in inflation has had a positive impact on the markets. Investors are becoming more confident that the Federal Reserve may be able to ease its aggressive monetary tightening policies. This has led to a rise in stock prices, as investors anticipate a less hostile economic environment.

For example, the S&P 500 index has seen a significant increase in value since the release of the latest inflation data.

Potential Implications for Monetary Policy Decisions

The cooling inflation data has raised hopes that the Federal Reserve may be able to slow down its rate hike cycle. This would provide some relief for businesses and consumers, who have been struggling with rising interest rates. However, it is important to note that the Fed has repeatedly emphasized that it is committed to bringing inflation down to its 2% target, and that it will continue to raise rates until this goal is achieved.

It’s been a wild week in the markets, with Asian shares rallying as Wall Street hits new highs thanks to inflation cooling more than expected. But amidst the financial frenzy, a totally different kind of storm is brewing on TikTok.

The McDonald’s Grimace Shake, a bright purple concoction meant to celebrate the iconic purple character, has become a viral sensation, inspiring a bizarre trend where people pretend to die after consuming the shake. The Grimace Shake’s unexpected death-defying popularity is certainly a strange contrast to the more traditional drivers of market movement, but it’s a reminder that sometimes the most unexpected things can capture our attention and spark a viral trend.

So, while the world’s economies are in a state of flux, it seems like the only thing that can truly unite us is a good, old-fashioned viral craze.

Factors Driving the Decline in Inflation

Several factors have contributed to the recent decline in inflation. These include:

- Supply Chain Improvements:The global supply chain disruptions that plagued the economy during the pandemic have begun to ease, leading to lower prices for goods and services. For example, the cost of shipping containers has declined significantly since its peak in 2022.

- Changing Consumer Behavior:Consumers are becoming more price-sensitive, leading to a slowdown in demand for goods and services. This has put downward pressure on prices. For example, the recent decline in gasoline prices can be attributed to a decrease in demand due to rising interest rates and a shift towards more fuel-efficient vehicles.

- Government Policies:Government policies, such as the release of strategic petroleum reserves, have also helped to lower prices. This has been particularly effective in reducing the cost of gasoline.

Potential Risks and Uncertainties

While the recent decline in inflation is encouraging, it is important to acknowledge that there are still risks and uncertainties surrounding future inflation trends.

- Geopolitical Instability:The ongoing war in Ukraine and other geopolitical tensions could lead to further supply chain disruptions and higher energy prices, which would push inflation back up.

- Sticky Core Inflation:While headline inflation has cooled, core inflation, which excludes volatile food and energy prices, has remained stubbornly high. This suggests that underlying inflationary pressures are still present.

- Wage Growth:Strong wage growth could lead to higher prices as businesses pass on increased labor costs to consumers.

Impact of Inflation on Asian Markets

The recent cooling of inflation has brought a wave of optimism to Asian markets, with many investors hoping for a sustained period of economic growth. While the impact of lower inflation is likely to be positive overall, its effects will vary across different sectors and economies.

Sectors Most Likely to Benefit from Lower Inflation

Lower inflation can stimulate consumer spending, which is a major driver of economic growth in many Asian economies. Sectors that are particularly sensitive to consumer spending, such as retail, hospitality, and tourism, are likely to see a significant boost from lower inflation.

- Retail:Lower inflation will likely lead to increased consumer confidence and disposable income, boosting demand for goods and services in the retail sector. This could lead to higher sales and profits for retailers, as well as increased investment in expansion and innovation.

- Hospitality:As inflation cools, travel and leisure activities become more affordable, leading to increased demand for hospitality services. Hotels, restaurants, and travel agencies are likely to benefit from this trend, experiencing higher occupancy rates and revenue.

- Tourism:Lower inflation can make travel destinations more attractive to tourists, leading to an increase in tourism revenue. This can benefit businesses involved in tourism, such as airlines, hotels, and local businesses catering to tourists.

Long-Term Implications of Inflation for Asian Economic Growth and Market Performance

While lower inflation is generally positive for economic growth, it is important to consider the long-term implications.

- Interest Rates:Central banks in Asia may continue to raise interest rates to combat inflation, even if it cools down. This could have a negative impact on economic growth by making borrowing more expensive for businesses and consumers.

- Currency Fluctuations:Inflation can lead to currency fluctuations, which can affect the competitiveness of Asian exports. If the currencies of Asian economies appreciate too quickly, it could make their exports more expensive in global markets, potentially hurting their competitiveness.

- Investment Decisions:Lower inflation can also influence investment decisions. Businesses may be more likely to invest in expansion and innovation when inflation is low, as they can be more confident about the future value of their investments.

Key Economic Indicators for Major Asian Economies

The following table summarizes key economic indicators for major Asian economies and their projected impact on stock markets:

| Economy | Inflation Rate (2023) | GDP Growth (2023) | Projected Impact on Stock Market |

|---|---|---|---|

| China | 2.5% | 5.5% | Positive, with strong growth in consumer spending and industrial production. |

| India | 5.0% | 7.0% | Positive, with robust domestic demand and government infrastructure spending. |

| South Korea | 3.0% | 2.5% | Mixed, with potential for growth in export-oriented sectors but also concerns about global economic slowdown. |

| Japan | 1.5% | 1.0% | Cautious, with potential for moderate growth but concerns about weak consumer spending and rising energy costs. |

Investor Sentiment and Market Outlook

Investor sentiment is currently a mixed bag, reflecting a cautious optimism in the face of continued economic uncertainty. While recent data suggests that inflation may be cooling, concerns remain about the potential for recession, rising interest rates, and geopolitical instability.

Impact of Geopolitical Events and Global Uncertainty, Asian shares rally as wall street hits new highs inflation cools more than expected

Geopolitical events, particularly the ongoing war in Ukraine and heightened tensions between the US and China, continue to weigh on investor sentiment. These events create uncertainty about global supply chains, energy prices, and overall economic stability.

“The war in Ukraine has created a significant level of uncertainty for global markets, impacting energy prices, supply chains, and economic growth prospects.”

[Source

Financial Times]

Key Factors Influencing Investor Sentiment

Investors are closely watching several key factors that will shape the market outlook in the coming months:

- Interest Rates:The Federal Reserve’s aggressive interest rate hikes are a major concern for investors, as they can slow economic growth and potentially trigger a recession. The pace and extent of future rate hikes will be closely monitored.

- Inflation:While recent data suggests that inflation may be cooling, investors are still wary about the potential for persistent price pressures. The trajectory of inflation will have a significant impact on corporate earnings and consumer spending.

- Commodity Prices:Fluctuations in commodity prices, particularly energy and food, are another source of volatility. The war in Ukraine has exacerbated these fluctuations, creating uncertainty about future supply and demand.

- Corporate Earnings:Investors are closely watching corporate earnings reports to gauge the health of the economy and the potential impact of inflation on businesses. Strong earnings growth can boost investor confidence, while weak earnings can lead to market declines.