Asia Markets Rally: Evergrande Woes Eased, Fed Meeting in Focus

Asia markets rally evergrande woes eased by china stimulus fed meeting in focus – Asian markets have been on a roll recently, with major indices like the Hang Seng and Nikkei seeing significant gains. This rally comes amid a confluence of factors, including easing concerns over Evergrande’s financial woes, China’s renewed stimulus efforts, and the upcoming Federal Reserve meeting.

While the Evergrande situation continues to be a source of uncertainty, the Chinese government’s recent measures to support the real estate sector and stimulate growth have boosted investor confidence. Meanwhile, all eyes are on the Fed’s upcoming meeting, where the central bank is expected to announce its plans for interest rate hikes and inflation control.

The Fed’s decisions will undoubtedly have a ripple effect on global markets, including those in Asia.

The interplay of these factors creates a complex landscape for Asian markets. While the stimulus measures and easing of Evergrande concerns have provided a positive boost, the potential impact of rising interest rates and inflation on Asian economies remains a concern.

The coming months will be crucial for navigating this dynamic environment.

Asian Markets Rally

Asian markets have witnessed a strong rally in recent weeks, with major indices across the region registering significant gains. This surge in optimism can be attributed to a confluence of factors, including improved investor sentiment, positive economic indicators, and supportive policy announcements.

Factors Contributing to the Rally

Several factors have contributed to the recent rally in Asian markets.

- Improved Investor Sentiment:The easing of concerns over Evergrande’s financial woes, coupled with China’s stimulus measures, has boosted investor confidence. This has led to a surge in risk appetite, prompting investors to allocate more capital to Asian equities.

- Positive Economic Indicators:Recent economic data from several Asian economies has been encouraging, suggesting a stronger-than-expected recovery. This has fueled optimism about the region’s growth prospects and bolstered investor sentiment.

- Supportive Policy Announcements:Central banks in several Asian countries have maintained accommodative monetary policies, providing support for economic growth. Additionally, governments have announced stimulus measures aimed at boosting consumption and investment.

Performance of Asian Markets

The recent rally has been broad-based, with major indices across the region registering impressive gains.

Asian markets are on the rise, with Evergrande woes eased by China’s stimulus package, and the Fed meeting in focus. This positive sentiment seems to be mirrored in the US, where the housing market is rebounding with record high home prices, as seen in this article us housing market rebounds with record high home prices.

Whether this global optimism will hold, however, remains to be seen, as the Fed’s decisions and the ongoing economic uncertainty will likely influence market trends in the coming months.

- China:The Shanghai Composite Index has surged by over 10% in the past month, driven by optimism about China’s economic recovery and stimulus measures.

- Hong Kong:The Hang Seng Index has also witnessed a strong rally, gaining over 8% in recent weeks, benefiting from the easing of Evergrande concerns and the reopening of the Chinese economy.

- South Korea:The KOSPI index has risen by over 5% in the past month, supported by strong export performance and robust corporate earnings.

- India:The Nifty 50 index has gained over 4% in recent weeks, driven by positive economic indicators and expectations of continued policy support.

Notable Differences

While the overall trend in Asian markets has been positive, there have been some notable differences in performance.

- China:The Chinese market has outperformed its regional peers, driven by the country’s strong economic growth and supportive policies.

- Japan:The Japanese market has lagged behind its regional peers, with the Nikkei 225 index registering modest gains. This is attributed to the country’s slow economic recovery and concerns about rising inflation.

Evergrande Woes Eased by China Stimulus

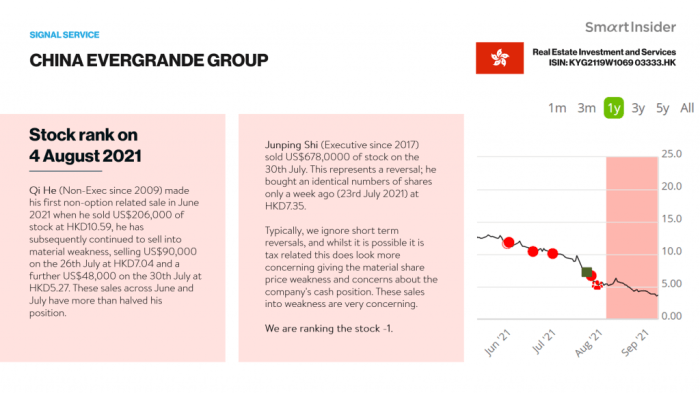

The recent developments concerning Evergrande and its impact on the Chinese economy have been a major concern for investors and analysts alike. However, the Chinese government has taken several measures to ease the situation and stimulate growth, providing some relief to the market.

Government Measures to Ease Evergrande Situation

The Chinese government has implemented a series of measures aimed at easing the Evergrande situation and stimulating growth. These measures include:

- Financial Support:The government has provided financial support to Evergrande and other struggling developers, including loans and guarantees. This is intended to help these companies meet their financial obligations and prevent a wider systemic crisis.

- Relaxed Housing Policies:The government has relaxed some of its housing policies, such as reducing down payment requirements and offering tax breaks for homebuyers. This is aimed at boosting demand in the real estate sector and supporting the economy.

- Infrastructure Spending:The government has increased infrastructure spending, which is expected to create jobs and stimulate economic activity. This includes projects such as roads, railways, and airports.

Effectiveness of the Measures and Potential Long-Term Impact

The effectiveness of these measures in easing the Evergrande situation and stimulating growth is still being debated. While the government’s interventions have provided some short-term relief, the long-term impact remains uncertain. Some analysts argue that the measures are not enough to address the underlying problems in the real estate sector, such as excessive debt and speculation.

The Asian markets are on a roll today, with Evergrande woes seemingly eased by China’s stimulus measures. All eyes are now on the Fed meeting, but I can’t help but think about my own financial goals, particularly when it comes to my mortgage.

I’m seriously considering exploring different strategies to maximize my home loan repayment, like those outlined in this great article on maximizing home loan repayment exploring the pros and cons of various approaches. Maybe I can free up some extra cash to invest in the markets, especially if the Fed delivers some good news!

They believe that the government needs to implement more structural reforms to address these issues.Others argue that the measures have been effective in stabilizing the market and preventing a wider crisis. They point to the fact that Evergrande has been able to avoid defaulting on its debt and that the Chinese economy continues to grow.The potential long-term impact of these measures on the Chinese real estate sector is also unclear.

Asian markets are rallying today, with Evergrande woes eased by China’s stimulus measures. The Fed meeting is in focus, but investors are also keeping an eye on geopolitical tensions. The ongoing conflict in the Middle East is causing a surge in hedging costs for the Israeli shekel, as seen in this recent article on israeli shekel hedging costs surge amid ongoing conflict.

This volatility adds another layer of complexity to the global market outlook, even as the focus remains on China’s economic recovery and the Fed’s next move.

Some analysts believe that the government’s interventions will lead to a more sustainable and healthy real estate market in the long run. They argue that the government is committed to preventing a housing bubble and promoting a more balanced development model.Others are concerned that the government’s measures may encourage further speculation in the real estate market, leading to another bubble in the future.

They argue that the government needs to be cautious in its interventions and focus on addressing the underlying problems in the real estate sector.Overall, the Chinese government’s measures have provided some relief to the market, but the long-term impact on the real estate sector remains uncertain.

The effectiveness of these measures will depend on how the government addresses the underlying problems in the sector and whether it can achieve a sustainable and balanced development model.

Fed Meeting in Focus: Asia Markets Rally Evergrande Woes Eased By China Stimulus Fed Meeting In Focus

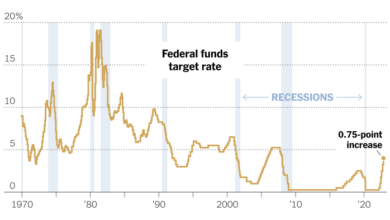

The Federal Reserve’s upcoming meeting is a significant event for global markets, particularly Asian markets. The Fed’s decisions on interest rates and inflation will have a ripple effect on economies worldwide.

Implications of Fed Decisions on Global Markets, Asia markets rally evergrande woes eased by china stimulus fed meeting in focus

The Fed’s decisions will influence global market sentiment and investment flows.

- A more hawkish stance, with aggressive interest rate hikes, could lead to a stronger dollar, making it more expensive for Asian countries to service their dollar-denominated debt. This could also attract capital outflows from Asian markets, putting downward pressure on their currencies and asset prices.

- On the other hand, a more dovish stance, with smaller rate hikes or even a pause, could provide some relief to Asian economies. A weaker dollar would make it cheaper for Asian countries to service their debt and could encourage capital inflows, supporting their currencies and markets.

Impact of Interest Rate Hikes and Inflation on Asian Economies

Rising interest rates in the US could make it more expensive for Asian businesses to borrow money, potentially slowing down economic growth. Inflation is also a concern for Asian economies, as it can erode purchasing power and lead to higher costs for businesses and consumers.

- Some Asian economies, like South Korea and Thailand, are more reliant on exports and are therefore more vulnerable to changes in global demand. A strong dollar and slower global growth could negatively impact their export sectors.

- Other Asian economies, like China and India, have large domestic markets and are less reliant on exports. However, they are still susceptible to global economic shocks, and rising interest rates and inflation could slow down their growth.

Interplay of Factors

The recent rally in Asian markets is a complex interplay of various factors, each with its own potential benefits and risks. This analysis delves into the key elements driving market sentiment, examining their individual and combined effects.

Impact of Evergrande, Stimulus, and Fed Meeting

The Evergrande situation, Chinese stimulus, and the Fed meeting are intertwined forces shaping the Asian market landscape. Understanding their individual impacts and how they interact is crucial for investors.