Apple Card News Update: Apple Parts Ways with Goldman Sachs

Apple card news update apple departure from goldman sachs in credit card venture – Apple Card News Update: Apple Parts Ways with Goldman Sachs in Credit Card Venture – The Apple Card, launched in 2019 with much fanfare, has become a popular choice for Apple enthusiasts seeking a sleek and user-friendly credit card experience.

This partnership, however, has reached its end, leaving many wondering about the future of the Apple Card and its impact on users.

This move signifies a significant shift in Apple’s financial strategy, raising questions about the reasons behind the separation and the implications for the future of the Apple Card. The decision comes amidst a changing financial landscape, where tech giants are increasingly venturing into financial services.

Apple Card’s Evolution

The Apple Card, launched in 2019, marked a significant entry of Apple into the financial services market. This venture was a strategic partnership with Goldman Sachs, a renowned financial institution, to provide a seamless and user-friendly credit card experience.

Initial Partnership and Key Features

The Apple Card’s success was rooted in the unique partnership between Apple and Goldman Sachs. Apple brought its design expertise and customer-centric approach, while Goldman Sachs provided its financial expertise and infrastructure. This collaboration resulted in a credit card that prioritized user experience and financial transparency.

At its launch, the Apple Card boasted several key features:

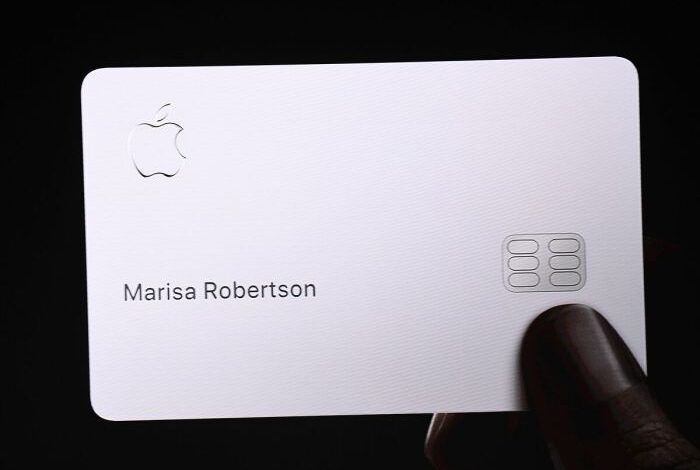

- Titanium Card Design:The Apple Card featured a minimalist titanium design, devoid of any numbers or logos, emphasizing simplicity and security.

- Apple Pay Integration:The card was seamlessly integrated with Apple Pay, enabling contactless payments through Apple devices.

- Daily Cash Rewards:The Apple Card offered a 2% cash back reward on all Apple Pay purchases and 1% on other purchases, credited daily to the user’s Apple Cash account.

- Transparency and Data Visualization:The Apple Card app provided detailed insights into spending patterns and account activity through visually appealing charts and graphs.

- Zero Fees:The Apple Card was designed with no annual fees, late fees, or foreign transaction fees.

Factors Contributing to Initial Success, Apple card news update apple departure from goldman sachs in credit card venture

The Apple Card’s initial success can be attributed to several factors:

- Apple’s Brand Recognition:Apple’s strong brand recognition and loyal customer base provided a significant advantage in launching the Apple Card. Apple users were already accustomed to the brand’s user-friendly products and services, making the transition to a financial product seamless.

- Seamless Integration with Apple Ecosystem:The Apple Card was tightly integrated with Apple’s ecosystem, offering a cohesive user experience across devices and platforms. Users could easily manage their card, track spending, and make payments through their iPhone, iPad, or Mac.

- Focus on User Experience:The Apple Card prioritized user experience through its intuitive interface, clear data visualization, and minimalist design. This approach resonated with users who valued simplicity and transparency in their financial products.

- Attractive Rewards Program:The Daily Cash rewards program, offering 2% cashback on Apple Pay purchases and 1% on other purchases, was a significant incentive for users. This program provided a tangible benefit for using the Apple Card, encouraging users to make regular purchases.

The Departure from Goldman Sachs

Apple’s decision to part ways with Goldman Sachs in their credit card venture was a significant development in the tech giant’s financial landscape. This move marked a strategic shift for Apple, signifying its ambition to gain greater control over its financial services offerings.The separation from Goldman Sachs was not a sudden decision but rather a culmination of factors that had been brewing for some time.

The partnership, while initially successful in launching Apple Card, faced challenges in navigating the complexities of the financial services industry.

Reasons for the Departure

The reasons behind Apple’s decision to end the partnership with Goldman Sachs are multifaceted, encompassing both financial and strategic considerations. * Apple’s Desire for Greater Control:Apple has always been known for its vertically integrated approach, controlling the entire ecosystem of its products and services.

This desire for control extended to its financial services ambitions. By managing its own credit card operations, Apple could directly influence the user experience, product features, and overall strategy.

Potential for Increased Profitability

The Apple Card news cycle continues to be a whirlwind, with the latest development being Apple’s departure from Goldman Sachs in their credit card venture. This shift has many wondering about the future of the Apple Card, and how it will impact users.

While we wait for the dust to settle, why not simplify your own financial life with some practical tips? Check out 10 practical life hacks to simplify your everyday routine , which might just help you manage your finances more effectively, regardless of which credit card you use.

After all, streamlining your routine can make a world of difference, especially when navigating big financial changes like this.

Building a More Robust Financial Ecosystem Apple’s move to sever ties with Goldman Sachs aligns with its broader ambition to create a comprehensive financial ecosystem. This ecosystem would encompass a range of financial products and services, including payments, lending, and investment. By establishing its own financial infrastructure, Apple could offer a more integrated and seamless experience for its users.

Timeline of Events

The decision to end the partnership with Goldman Sachs was not a sudden one. The timeline leading up to the announcement reflects a gradual shift in Apple’s financial strategy.* 2019:Apple Card is launched in partnership with Goldman Sachs.

2020-2021 Apple expands its financial services offerings, introducing Apple Pay Later and other features, signaling a growing interest in building its own financial infrastructure.

Apple’s recent decision to part ways with Goldman Sachs in their credit card venture comes at a time when Wall Street is bracing for a slow start, as outlined in this article discussing lingering concerns over interest rates. This shift in strategy for Apple Card could be seen as a response to the current economic climate, with the tech giant potentially seeking a more independent approach to its financial offerings.

2022 Apple begins to lay the groundwork for its own credit card operations, hiring key personnel and exploring partnerships with other financial institutions.

2023 Apple announces the end of its partnership with Goldman Sachs and plans to manage its own credit card operations.

The news of Apple’s departure from Goldman Sachs in their credit card venture has been making headlines, but there’s another financial story worth paying attention to: experts warn homebuyers of red flags beyond climbing interest rates. As Apple seeks a new partner for its credit card, it’s crucial to remember that the current economic climate is impacting both consumer spending and the housing market.

With these factors in play, it’ll be interesting to see how Apple navigates this shift and what the future holds for their financial services strategy.

Impact on Apple Card Users: Apple Card News Update Apple Departure From Goldman Sachs In Credit Card Venture

The shift in Apple’s credit card partnership from Goldman Sachs to Mastercard and a new issuing bank is a significant change that will undoubtedly have implications for existing Apple Card users. While Apple has assured users that the transition will be seamless, it’s essential to understand the potential impacts on various aspects of the card’s offerings.

Potential Impact on Features and Benefits

The transition to a new issuing bank could potentially impact the features and benefits of the Apple Card. While Apple has emphasized its commitment to maintaining the card’s existing features, such as daily cash back rewards and the user-friendly interface, there’s a possibility of changes down the line.

It’s crucial to monitor any adjustments made to the card’s reward structure, interest rates, or other terms and conditions.

Future of Apple Card

Apple’s departure from Goldman Sachs marks a significant turning point for the Apple Card. With its own credit card venture, Apple has the opportunity to forge a new path, leveraging its brand strength, technological prowess, and a deep understanding of its user base.

This opens up exciting possibilities for the future of the Apple Card, with potential for both enhanced user experience and strategic expansion.

Potential Partners

Apple’s search for a new partner will be a strategic decision, considering factors such as financial stability, technological compatibility, and alignment with Apple’s brand values.

- Existing Financial Institutions:Apple might choose to partner with established players like JPMorgan Chaseor Bank of America, leveraging their existing infrastructure and customer base. This would allow for a seamless transition and a wider reach.

- Emerging Fintech Companies:Alternatively, Apple could partner with a disruptive fintech company like Stripeor Affirm, which are known for their innovative financial solutions and technology-driven approach. This would allow Apple to embrace emerging trends and potentially offer more flexible and personalized credit options.

- Specialized Credit Unions:Partnering with credit unions, known for their member-centric approach and competitive rates, could offer Apple Card users unique benefits and a different financial model. This would align with Apple’s focus on user experience and could potentially appeal to a wider demographic.

Potential New Features and Enhancements

Apple’s track record of innovation suggests that the Apple Card will continue to evolve, incorporating new features and functionalities to enhance the user experience.

- Personalized Spending Insights:Leveraging Apple’s data analytics capabilities, the Apple Card could provide users with highly personalized insights into their spending patterns, helping them better manage their finances and make informed financial decisions. For instance, it could offer personalized recommendations on how to optimize spending or suggest ways to save money based on individual spending habits.

- Enhanced Security Features:Apple could further enhance the security of the Apple Card by incorporating advanced fraud detection mechanisms and biometrics authentication, leveraging its expertise in hardware and software security. This could offer users peace of mind and protect their financial data from unauthorized access.

- Integrated Financial Management:Apple could integrate the Apple Card into its existing ecosystem, offering users a seamless and unified financial management experience. This could include features like budgeting tools, bill payment options, and investment management, all accessible through the Apple Wallet app.

Strategic Direction

Apple’s strategic direction for the Apple Card will likely be guided by its desire to expand its reach in the financial services sector and cater to a wider customer base.

- Expanding Beyond Credit Cards:Apple could leverage its brand and technological capabilities to expand beyond traditional credit cards, offering a wider range of financial products and services. This could include offerings like personal loans, savings accounts, and even investment platforms, creating a comprehensive financial ecosystem for its users.

- Global Expansion:Apple could also explore global expansion for the Apple Card, extending its reach to new markets and tapping into the growing demand for digital financial services. This would require strategic partnerships with local financial institutions and adapting the product to comply with different regulatory frameworks.

- Focus on Sustainability:In line with its commitment to environmental sustainability, Apple could integrate features that promote responsible financial practices. This could include options for carbon offsetting, investments in green businesses, or partnerships with organizations promoting financial literacy and responsible spending.

Comparison with Competitors

The Apple Card stands out in the crowded credit card market with its sleek design, integration with Apple Pay, and focus on user experience. However, it’s crucial to understand how it stacks up against other popular cards, especially considering its recent shift away from Goldman Sachs.

This comparison will highlight the Apple Card’s strengths and weaknesses relative to its competitors.

Key Features and Benefits

The Apple Card offers a range of features and benefits that cater to Apple users, including:

- Daily Cash Rewards:Earn 1% daily cash back on all purchases, 2% back at Apple stores and on Apple Pay purchases, and 3% back at participating merchants.

- No Annual Fee:Unlike many premium credit cards, the Apple Card has no annual fee, making it accessible to a broader audience.

- Apple Pay Integration:Seamlessly integrates with Apple Pay for contactless payments and enhanced security.

- Titanium Card:The physical card is made of titanium, offering a unique and durable design.

- Detailed Spending Tracking:The Apple Card app provides detailed spending insights and visualizations, helping users track their finances effectively.

- Privacy Focus:Apple emphasizes privacy and data security, ensuring user information is protected.

Comparison with Popular Credit Cards

To understand the Apple Card’s competitive landscape, let’s compare it with some of the most popular credit cards in the market:

| Feature | Apple Card | Chase Sapphire Preferred® Card | Capital One Venture X Rewards Credit Card | American Express® Gold Card |

|---|---|---|---|---|

| Annual Fee | $0 | $95 | $395 | $250 |

| Welcome Bonus | None | 60,000 bonus points after spending $4,000 in the first 3 months | 75,000 bonus miles after spending $4,000 in the first 3 months | 60,000 Membership Rewards® points after spending $4,000 in the first 6 months |

| Rewards Program | Daily Cash back (1%, 2%, 3%) | Ultimate Rewards points (1 point per $1 spent, 2 points per $1 spent on travel and dining) | Miles (2 miles per $1 spent on all purchases) | Membership Rewards points (1 point per $1 spent, 2 points per $1 spent on travel and dining, 4 points per $1 spent at restaurants worldwide and at U.S. supermarkets on eligible purchases) |

| Travel Benefits | None | Travel insurance, priority pass lounge access | Global entry and TSA PreCheck statement credit, lounge access, travel insurance | Travel insurance, airport lounge access |

| Other Benefits | Apple Pay integration, titanium card design, detailed spending tracking | Redeem points for travel, merchandise, and gift cards | Redeem miles for travel, merchandise, and gift cards | Redeem points for travel, merchandise, and gift cards |

Strengths and Weaknesses

The Apple Card has several strengths that make it attractive to consumers:

- User Experience:Its integration with Apple Pay and the user-friendly app offer a seamless and intuitive experience.

- No Annual Fee:This makes it accessible to a wider audience compared to premium cards with high annual fees.

- Daily Cash Back:While the rewards rate is not the highest, the simplicity and flexibility of daily cash back appeal to many users.

- Privacy Focus:Apple’s commitment to privacy is a key differentiator for some consumers.

However, the Apple Card also has some weaknesses:

- Limited Rewards:The rewards rate is lower than some other popular cards, particularly for travel and dining.

- No Travel Benefits:Unlike many premium cards, the Apple Card lacks travel perks like airport lounge access or travel insurance.

- Limited Availability:The Apple Card is only available to U.S. residents, limiting its global reach.