Amex Profits Fall as Higher Spending Offset by Loan Losses

Amex profits fall as higher spending offset by loan losses takes center stage, revealing a complex interplay of economic forces impacting the financial giant. While increased consumer spending fueled revenue growth, rising loan losses due to economic uncertainties ultimately dampened profits.

This scenario highlights the delicate balance between growth and risk in the current economic landscape.

The recent quarter saw Amex navigate a challenging environment, marked by persistent inflation, rising interest rates, and a potential recession looming on the horizon. These factors have significantly impacted consumer behavior and credit card usage, directly affecting Amex’s financial performance.

Amex’s Financial Performance

Amex’s recent earnings report revealed a mixed bag of results, with higher spending driving revenue growth but offset by an increase in loan losses. This complex interplay highlights the current economic environment and its impact on the financial services industry.

Impact of Higher Spending on Revenue

The increase in consumer spending is a positive sign for Amex, as it directly translates into higher transaction volumes and, consequently, increased revenue. This trend is particularly evident in the travel and entertainment sectors, where spending has rebounded significantly post-pandemic.

Amex’s cardholders are increasingly using their cards for travel, dining, and entertainment, contributing to the company’s revenue growth.

Factors Contributing to Increased Loan Losses

The rise in loan losses is a concerning trend for Amex, as it reflects the growing economic uncertainty and potential for delinquencies. Several factors contribute to this increase, including:

- Rising Interest Rates:The Federal Reserve’s aggressive interest rate hikes have increased borrowing costs, making it more challenging for consumers to manage their debt. This can lead to higher delinquency rates and ultimately, loan losses for Amex.

- Inflationary Pressures:Persistent inflation has eroded consumer purchasing power, putting pressure on household budgets. As consumers struggle to keep up with rising prices, they may find it difficult to meet their financial obligations, leading to higher loan losses.

- Economic Slowdown:The global economy is facing a potential slowdown, raising concerns about job security and income stability. This uncertainty can contribute to an increase in loan losses as consumers become more cautious with their spending and may struggle to repay their debts.

Comparison with Previous Quarters

Comparing the current quarter’s performance to previous quarters reveals a mixed trend. While revenue growth remains positive, the increase in loan losses is a significant change. In previous quarters, Amex experienced a decline in loan losses as the economy recovered from the pandemic.

However, the current quarter’s results indicate a reversal of this trend, suggesting that the economic headwinds are beginning to impact the company’s financial performance.

Segments with Significant Impact

Amex’s business is segmented into various categories, including consumer cards, business cards, and global network services. The recent performance suggests that the consumer card segment has been most impacted by the increase in loan losses. This segment is more sensitive to economic fluctuations and consumer spending patterns, making it vulnerable to the current economic challenges.

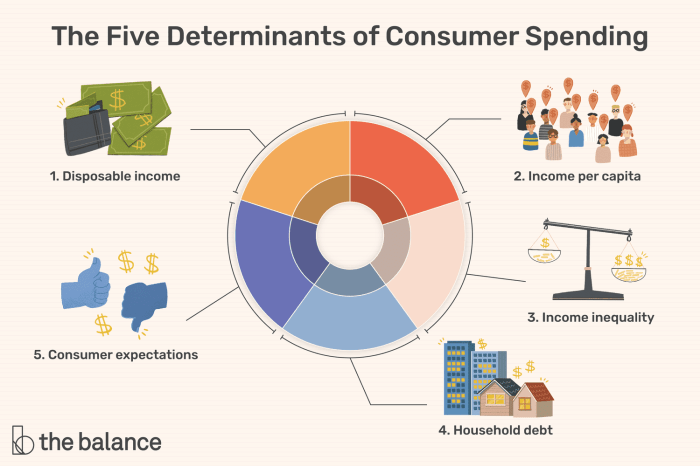

Macroeconomic Factors: Amex Profits Fall As Higher Spending Offset By Loan Losses

The recent decline in American Express’s profits, despite higher spending, is largely attributed to the current macroeconomic environment. Inflation and interest rate hikes have significantly impacted consumer spending and credit card usage, leading to increased loan losses for Amex.

It’s fascinating how Amex’s profits are being impacted by a combination of increased spending and loan losses. It’s a reminder that even in times of economic growth, businesses face challenges. This situation makes me think about the importance of protecting our data, especially with companies like Amex handling sensitive financial information.

Understanding what is a privacy policy and why is it important is crucial for everyone. It’s not just about protecting our personal details but also ensuring that companies are accountable for how they use our data. In the end, it’s about building trust and transparency in the financial world, which is essential for both businesses and consumers.

Inflation’s Impact on Consumer Spending and Credit Card Usage

Inflation has eroded consumer purchasing power, forcing many to cut back on discretionary spending. This shift in consumer behavior is evident in the decline of non-essential purchases, impacting businesses reliant on consumer spending. The rising cost of goods and services has led to a decrease in credit card usage, as consumers prioritize essential purchases and seek alternative payment methods.

Interest Rate Hikes and Loan Losses

The Federal Reserve’s aggressive interest rate hikes have increased the cost of borrowing for both consumers and businesses. This rise in borrowing costs has resulted in higher interest payments on credit card debt, leading to increased loan losses for credit card issuers like American Express.

As interest rates rise, consumers may struggle to meet their debt obligations, increasing the risk of delinquencies and defaults.

While Amex saw profits dip due to loan losses despite higher spending, it’s a reminder that economic headwinds are impacting various sectors. This trend underscores the importance of financial prudence, especially for major purchases like homes. Experts warn homebuyers of red flags beyond climbing interest rates , highlighting the need for careful consideration of market conditions and individual financial situations.

As the economy navigates these turbulent waters, it’s crucial to remain vigilant and make informed decisions, especially when it comes to significant financial commitments.

Potential Impact of the Current Economic Environment on Amex’s Future Performance

The current economic environment poses significant challenges for American Express’s future performance. Continued inflation and rising interest rates could further impact consumer spending and credit card usage, leading to increased loan losses and reduced revenue. Amex’s ability to navigate these challenges will depend on its ability to manage risk, control costs, and offer competitive products and services.

Amex may need to adjust its lending practices, explore new revenue streams, and strengthen its customer relationships to mitigate the impact of the economic downturn.

Amex’s Response to Challenges

Amex is actively tackling the challenges posed by rising loan losses, employing a multifaceted approach to mitigate risks and maintain profitability. Their strategy involves a combination of proactive measures aimed at managing credit risk and controlling expenses.

Strategies to Mitigate Loan Losses

Amex’s efforts to manage loan losses are focused on a proactive approach to risk assessment and portfolio management.

Amex’s profits took a hit this quarter, with higher spending offset by rising loan losses. It’s interesting to see how this news is playing out in the broader market, which seems to be holding its own, as you can see in these live updates on share market movement.

The Nifty is hovering around 17650, with some attention on HCL Tech and Tata Motors. It’ll be interesting to see if this trend continues, and if Amex’s dip in profits has any significant impact on the overall market.

- Enhanced Credit Underwriting:Amex has implemented stricter credit underwriting criteria to ensure that new cardholders meet more stringent eligibility requirements. This approach helps minimize the risk of extending credit to individuals who may be more likely to default.

- Targeted Marketing Campaigns:Amex is tailoring its marketing campaigns to target specific customer segments with lower risk profiles. This allows them to focus on acquiring customers who are more likely to make timely payments.

- Early Intervention Programs:Amex has established programs to proactively identify customers who may be experiencing financial difficulties. These programs offer support and assistance to help customers manage their debt and avoid default.

Cost-Cutting Measures

Amex has also implemented cost-cutting measures to optimize its operations and improve profitability.

- Streamlining Operations:Amex is streamlining its operations by automating processes and reducing administrative costs. This includes implementing technology solutions to improve efficiency and reduce manual tasks.

- Employee Optimization:Amex has taken steps to optimize its workforce by implementing headcount reductions and streamlining certain roles. This is intended to reduce labor costs and improve operational efficiency.

- Negotiating Supplier Contracts:Amex is negotiating favorable contracts with suppliers to secure lower pricing on goods and services. This helps control costs and improve profitability.

Impact on Long-Term Growth Prospects

Amex’s response to the challenges it faces is expected to have a significant impact on its long-term growth prospects.

- Improved Risk Management:Amex’s efforts to mitigate loan losses are expected to improve its risk management capabilities, which will enhance the sustainability of its business model.

- Enhanced Profitability:The cost-cutting measures implemented by Amex are expected to improve its profitability and allow it to invest in future growth opportunities.

- Stronger Brand Reputation:By demonstrating a commitment to managing risk and controlling expenses, Amex can strengthen its brand reputation and attract new customers.

Industry Outlook

Amex’s performance is a reflection of the broader credit card industry, which is currently facing a complex landscape of rising interest rates, inflation, and consumer spending patterns. Comparing Amex’s performance to other major credit card companies provides insights into the industry’s overall health and future prospects.

Comparison with Other Credit Card Companies, Amex profits fall as higher spending offset by loan losses

Amex’s performance is generally in line with other major credit card companies. For example, both Visa and Mastercard have also reported increased spending, but they have also experienced higher loan losses due to the current economic environment. However, Amex’s focus on affluent customers and premium rewards programs has helped it maintain a higher average transaction value and lower delinquency rates compared to some of its competitors.

Impact of the Current Economic Environment

The current economic environment, characterized by rising interest rates and inflation, is creating challenges for the credit card industry. Higher interest rates increase the cost of borrowing for consumers, potentially leading to reduced spending and increased delinquencies. Inflation also impacts consumer spending patterns, as individuals prioritize essential goods and services over discretionary purchases.

However, the industry also benefits from the growing adoption of digital payments and the increasing demand for travel and experiences, which drive credit card usage.

Future of the Credit Card Market

The future of the credit card market is likely to be driven by several key trends. The continued growth of e-commerce and digital payments is expected to fuel further adoption of credit cards. Furthermore, the increasing popularity of rewards programs and personalized financial services will drive competition among credit card issuers.

Emerging technologies, such as artificial intelligence (AI) and blockchain, are also expected to play a significant role in shaping the future of the credit card industry. For instance, AI-powered fraud detection systems and personalized spending recommendations are likely to become increasingly common.

Additionally, blockchain technology could potentially revolutionize the way credit card transactions are processed, offering greater security and transparency.

Investor Sentiment

Amex’s recent profit decline has sent ripples through the investor community, raising concerns about the company’s future prospects. While the company’s strong revenue growth is a positive sign, the rising loan losses are a cause for worry, leading to a mixed sentiment among investors.

Impact on Investor Confidence

The decline in Amex’s profits has undoubtedly impacted investor confidence. Investors often look at profitability as a key indicator of a company’s financial health and future growth potential. Amex’s declining profits, coupled with rising loan losses, could lead to a decrease in investor confidence, especially in the current economic climate.

Potential Impact on Amex’s Stock Price

The current situation could have a significant impact on Amex’s stock price. Investors often react to earnings reports, and a decline in profits can lead to a sell-off in the stock market. The extent of the impact will depend on various factors, including the severity of the profit decline, the company’s future outlook, and overall market conditions.

Analyst and Investor Expectations

Analysts and investors will closely monitor Amex’s performance in the coming quarters to gauge the company’s ability to navigate the current economic challenges. They will be looking for signs of improvement in loan loss provisions and continued revenue growth.

If Amex can demonstrate its resilience and ability to manage its expenses effectively, it could regain investor confidence and potentially see its stock price rebound.