American Express CEO Shares Warren Buffetts Investing Magic

American express ceo shares insights on warren buffetts investing magic – American Express CEO shares insights on Warren Buffett’s investing magic sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The CEO, a seasoned investor in his own right, provides a unique perspective on Buffett’s investment philosophy, revealing the secrets behind the Oracle of Omaha’s remarkable success.

This isn’t just a rehash of well-worn Buffett quotes; it’s a deep dive into the practical application of his principles, highlighting how they can be adapted to today’s market.

The discussion delves into the core elements of Buffett’s investment strategy, including his unwavering focus on intrinsic value, his disciplined approach to risk management, and his commitment to long-term thinking. We’ll explore how these principles have guided Buffett’s investment decisions over decades, and how they can be applied by investors of all levels.

This isn’t just about making money; it’s about developing a sound investment mindset that can weather any market storm.

American Express CEO’s Perspective on Warren Buffett’s Investment Philosophy: American Express Ceo Shares Insights On Warren Buffetts Investing Magic

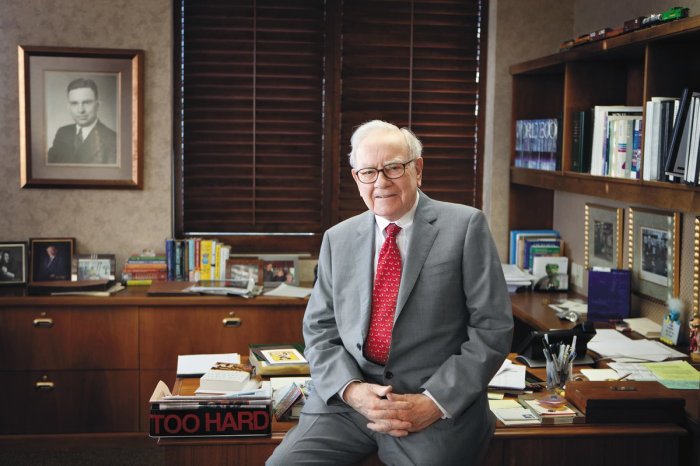

American Express CEO, Stephen Squeri, has often spoken about his admiration for Warren Buffett and his investment philosophy. He believes that Buffett’s approach to value investing is timeless and highly relevant in today’s volatile markets. Squeri sees Buffett’s success as a testament to the power of long-term thinking and disciplined investing.

Key Principles of Buffett’s Investment Philosophy

Squeri highlights several key principles of Buffett’s investment philosophy that have resonated with him. These principles emphasize the importance of understanding a company’s intrinsic value, focusing on long-term growth, and maintaining a disciplined approach to investing.

- Focus on Intrinsic Value:Buffett believes in identifying companies with strong fundamentals and a track record of profitability. He emphasizes the importance of understanding a company’s true worth, independent of its market price. He seeks companies with a strong competitive advantage, known as a “moat,” that protects them from competition and allows them to generate consistent profits over the long term.

- Long-Term Perspective:Buffett is known for his long-term investment horizon. He doesn’t focus on short-term market fluctuations and instead seeks companies with the potential for sustainable growth over many years. This long-term perspective allows him to weather market storms and benefit from the compounding power of returns.

- Discipline and Patience:Buffett’s investment philosophy emphasizes discipline and patience. He avoids impulsive decisions and only invests in companies he fully understands and believes in. He is willing to wait for the right opportunities and doesn’t chase short-term gains. This disciplined approach allows him to make calculated decisions and avoid costly mistakes.

Key Elements of Warren Buffett’s Investment Strategy

Warren Buffett, widely regarded as one of the most successful investors of all time, has built his fortune and reputation on a carefully crafted investment philosophy. His approach, often described as value investing, is characterized by a set of core principles that guide his investment decisions and have consistently delivered impressive returns over decades.

Focus on Value Investing

Value investing, the cornerstone of Buffett’s strategy, emphasizes buying undervalued assets with the potential for future growth. Buffett seeks companies with strong fundamentals, solid financial performance, and a sustainable competitive advantage. He believes that by identifying companies with intrinsic value that is not fully reflected in their market price, he can capitalize on the potential for appreciation as the market recognizes the true value of the investment.

Long-Term Perspective

Buffett’s investment philosophy is firmly rooted in a long-term perspective. He is not driven by short-term market fluctuations or the pursuit of quick profits. Instead, he focuses on investing in companies that he believes will be successful over the long haul, often holding onto these investments for years, even decades.

The American Express CEO’s insights on Warren Buffett’s investing magic are fascinating, especially considering the recent economic news. The US economy added a surprising 253,000 jobs in April, with the unemployment rate dropping to 3.4%, according to this report.

This positive economic data might even make Buffett’s investment strategies seem even more valuable, as he often seeks out companies with strong fundamentals and a solid track record of growth.

This long-term approach allows him to weather market volatility and capitalize on the compounding effect of returns over time.

Focus on Quality Businesses

Buffett’s investment strategy prioritizes investing in companies with strong management teams, a proven track record of profitability, and a sustainable competitive advantage. He believes that by investing in high-quality businesses with a solid foundation, he can reduce risk and increase the likelihood of long-term success.

Margin of Safety

Buffett employs a margin of safety in his investment decisions. This involves buying assets at a price significantly below their intrinsic value, creating a buffer against potential downside risks. This approach allows him to protect his investments from market volatility and ensures that he is purchasing assets at a price that offers a significant potential for upside growth.

It’s fascinating to hear the American Express CEO’s take on Warren Buffett’s investing philosophy, especially in light of the recent federal reserve report on SVB’s collapse, which highlights mismanagement and supervisory failures. It’s a stark reminder that even with the best strategies, risks are inherent in any investment, and sometimes even the most experienced investors can be caught off guard.

But, as the CEO pointed out, Buffett’s long-term approach, focused on value and patience, can help weather even the most turbulent markets.

Discipline and Patience

Buffett’s investment strategy emphasizes discipline and patience. He is not afraid to wait for the right opportunity and is willing to hold onto investments for extended periods, even if the market experiences short-term fluctuations. This disciplined and patient approach allows him to avoid emotional decision-making and stay focused on his long-term goals.

Examples of Buffett’s Investment Principles in Action

One of Buffett’s most notable investments was in Coca-Cola, a company he began buying shares of in 1988. He recognized the company’s strong brand, global reach, and consistent profitability, and believed that these factors would lead to long-term success. His investment in Coca-Cola has proven to be highly successful, as the company has continued to grow its earnings and dividend payments over the years.Another example is Buffett’s investment in Apple, a company he began buying shares of in 2016.

He recognized the company’s strong brand, innovative products, and loyal customer base, and believed that these factors would lead to continued growth and profitability. His investment in Apple has also proven to be highly successful, as the company has continued to grow its earnings and dividend payments over the years.

Importance of Long-Term Thinking and Patience

Buffett’s success as an investor is a testament to the importance of long-term thinking and patience. He is not driven by short-term market fluctuations or the pursuit of quick profits. Instead, he focuses on investing in companies that he believes will be successful over the long haul, often holding onto these investments for years, even decades.

This long-term approach allows him to weather market volatility and capitalize on the compounding effect of returns over time.

The Role of Intrinsic Value in Buffett’s Investment Decisions

Warren Buffett’s investment philosophy revolves around the concept of intrinsic value, which he defines as the present value of all future cash flows a company is expected to generate. This approach emphasizes the long-term potential of a business and its ability to generate profits over time, rather than focusing on short-term market fluctuations.

Intrinsic Value as a Guiding Principle, American express ceo shares insights on warren buffetts investing magic

Buffett believes that the market price of a stock can deviate from its intrinsic value in the short term due to market sentiment, investor behavior, or other external factors. However, he contends that over the long term, the intrinsic value of a company will ultimately determine its true worth.

This principle guides his investment decisions, leading him to invest in companies that he believes are undervalued by the market and have the potential to generate significant future cash flows.

Examples of Companies Invested in Based on Intrinsic Value

Buffett’s investment portfolio is filled with examples of companies he has acquired or invested in based on their intrinsic value. Some notable examples include:

- Coca-Cola:Buffett recognized the enduring value of Coca-Cola’s brand and its ability to generate consistent cash flows from its global distribution network and loyal customer base. He first invested in the company in 1988, and his stake has grown significantly over the years, demonstrating the long-term potential of his investment strategy.

- American Express:Buffett recognized the value of American Express’s premium brand and its ability to generate significant revenue from its affluent customer base. He first invested in the company in 1964, and his investment has yielded significant returns over the years.

- Apple:Buffett invested in Apple in 2016, recognizing the company’s strong brand, innovative products, and ability to generate significant cash flows from its loyal customer base. His investment has been a successful one, demonstrating his ability to identify companies with long-term potential.

Understanding a Company’s Underlying Business and Future Potential

To determine the intrinsic value of a company, Buffett emphasizes the importance of understanding its underlying business and its future potential. He focuses on:

- The company’s competitive advantage:Buffett seeks companies with a sustainable competitive advantage, such as a strong brand, a unique product or service, or a cost advantage. These factors enable companies to generate higher profits and outperform their competitors over the long term.

- The company’s management team:Buffett believes that a competent and ethical management team is crucial to a company’s long-term success. He seeks companies with managers who are committed to maximizing shareholder value and have a proven track record of success.

- The company’s financial strength:Buffett analyzes a company’s financial statements to assess its profitability, cash flow generation, and debt levels. He prefers companies with strong financial fundamentals, which indicate a solid foundation for future growth.

“The most important thing is to have a long-term outlook. We don’t look at what the market is doing today or tomorrow. We look at what the company is going to do over the next five, ten, or twenty years.”

Warren Buffett

Buffett’s Approach to Risk Management

Warren Buffett’s investment philosophy is built on a foundation of careful risk management. He believes that preserving capital is paramount, and that taking calculated risks is essential for long-term success. This approach has shaped his investment decisions and earned him a reputation as a shrewd and disciplined investor.

The Importance of Diversification

Diversification is a key element of Buffett’s risk management strategy. He avoids concentrating his investments in a single sector or industry, spreading his bets across a wide range of businesses. This helps to mitigate the impact of any single investment going sour.

The American Express CEO’s insights on Warren Buffett’s investing magic are fascinating, especially when considering the long-term vision required for such strategies. It’s a reminder that success often comes from a focus on the bigger picture, just like the potential for value creation in the world of blockchain through strategic mergers and acquisitions, as explored in this article on Gavin Wood’s chain mergers and acquisitions.

Ultimately, both approaches highlight the importance of strategic foresight and understanding the potential for long-term growth.

- Buffett has consistently advocated for a diversified portfolio, believing that it reduces overall risk and improves the chances of long-term success.

- He has often stated that “putting all your eggs in one basket and then watching that basket” is a risky approach.

Focusing on Investments with a Strong Track Record

Buffett prioritizes investments in companies with a proven track record of profitability and strong management teams. He believes that focusing on companies with a history of success reduces the risk of investing in businesses that may be struggling or have uncertain futures.

- He prefers to invest in companies that have a long history of generating consistent returns and that are well-positioned to continue doing so in the future.

- He avoids investing in companies that are heavily reliant on debt or that operate in industries with high levels of competition or regulatory uncertainty.

Examples of Buffett’s Risk Management

Buffett has a history of managing risk effectively throughout his career. He has consistently avoided investing in speculative assets, such as derivatives or complex financial instruments, preferring to focus on investments that he understands and can evaluate thoroughly.

- During the 2008 financial crisis, Buffett’s portfolio remained relatively unscathed, as he had avoided investing in the subprime mortgage market, which was at the heart of the crisis.

- His investment in Coca-Cola, a company with a strong brand, a loyal customer base, and a long history of profitability, has been a cornerstone of his portfolio for decades, demonstrating his commitment to investing in companies with a proven track record.

Lessons for Investors from Warren Buffett’s Success

Warren Buffett, the legendary investor, has consistently outperformed the market over decades. His success can be attributed to a disciplined and patient approach to investing, focusing on long-term value creation. By understanding the principles that have guided his investment decisions, investors can learn valuable lessons to improve their own portfolio performance.

The Importance of Discipline and Patience

Buffett’s success is not just about luck; it’s about a disciplined and patient approach to investing. He believes in holding onto quality businesses for the long term, even when market sentiment fluctuates. He avoids chasing short-term gains and instead focuses on building a portfolio of companies that have a strong track record of profitability and growth potential.

This disciplined approach allows him to ride out market volatility and reap the rewards of long-term compounding.

The Value of a Long-Term Perspective

Buffett’s investment philosophy emphasizes the importance of a long-term perspective. He doesn’t get caught up in short-term market fluctuations, instead, he looks at companies with a long-term lens, considering their future growth potential and competitive advantages. This long-term perspective allows him to make investment decisions that are not influenced by market noise.

Actionable Steps for Investors

- Focus on Value Investing:Buffett emphasizes the importance of intrinsic value. This means investing in companies that are undervalued by the market, and have strong fundamentals such as profitability, strong cash flow, and a sustainable competitive advantage. Investors can identify such companies by analyzing their financial statements, understanding their business model, and assessing their management team’s quality.

- Develop a Long-Term Investment Plan:Creating a well-defined investment plan helps investors stay disciplined and avoid impulsive decisions. This plan should Artikel their investment goals, risk tolerance, and asset allocation strategy. It’s crucial to stick to the plan, even when the market is volatile.

- Invest in Companies You Understand:Buffett advises investors to invest in companies they understand. By understanding the business model, competitive landscape, and management team, investors can make more informed investment decisions and avoid investing in companies they don’t fully comprehend.

- Practice Patience:Patience is key to successful investing. Don’t expect quick gains or get swayed by market sentiment. Buffett emphasizes the importance of holding onto quality businesses for the long term, even when the market is down. This patience allows investors to ride out market fluctuations and benefit from long-term compounding.

- Avoid Excessive Trading:Buffett discourages excessive trading, believing that it can lead to higher transaction costs and lower returns. Instead, he encourages investors to focus on identifying high-quality companies and holding them for the long term.

- Seek Continuous Learning:The investment landscape is constantly evolving. Buffett emphasizes the importance of continuous learning, staying updated on market trends, and seeking out new investment opportunities. Investors can achieve this by reading industry publications, attending investment conferences, and engaging in online forums.

Buffett’s Investment Style in the Context of the Current Market

Warren Buffett’s investment philosophy, built on value investing and long-term thinking, has stood the test of time. But how relevant is his style in today’s fast-paced, volatile market? The current market environment presents both challenges and opportunities, and understanding how to adapt Buffett’s principles to navigate these complexities is crucial for investors.

Challenges and Opportunities in the Current Market

The current market is characterized by rapid technological advancements, geopolitical uncertainties, and shifting economic conditions. This creates a dynamic landscape where traditional valuation metrics might not always hold true, and short-term market fluctuations can be amplified.

- Rapid Technological Advancements:The rise of disruptive technologies like artificial intelligence and automation is reshaping industries and creating new investment opportunities. However, it also presents challenges in accurately assessing the long-term value of companies in rapidly evolving sectors.

- Geopolitical Uncertainties:Global events like trade wars, political instability, and pandemics can create market volatility and affect investment decisions. Navigating these uncertainties requires a cautious approach and a focus on companies with strong fundamentals and resilience.

- Shifting Economic Conditions:Interest rate changes, inflation, and economic growth rates can impact investment returns. Understanding the macroeconomic environment and its potential impact on individual companies is essential for making informed investment choices.

Adapting Buffett’s Principles to the Current Market

Despite the challenges, Buffett’s principles remain relevant in today’s market. His focus on intrinsic value, long-term thinking, and risk management can be adapted to navigate the current complexities.

- Focus on Intrinsic Value:While traditional valuation metrics might need adjustments, the principle of intrinsic value remains central. Investors should analyze a company’s underlying business, its competitive advantages, and its long-term growth potential to determine its true worth.

- Long-Term Perspective:Short-term market fluctuations can be distracting. Buffett emphasizes a long-term perspective, focusing on companies with sustainable business models and a track record of delivering value over time. This approach helps investors weather market volatility and ride out short-term downturns.

- Risk Management:Buffett advocates for a cautious approach to risk management. This includes understanding the risks associated with individual investments and diversifying the portfolio to mitigate potential losses. In the current market, it’s even more crucial to assess the potential impact of emerging technologies, geopolitical events, and economic uncertainties on individual investments.

- Circle of Competence:Buffett emphasizes investing in companies within one’s “circle of competence.” This means understanding the business model, industry dynamics, and competitive landscape of the companies in which you invest. In today’s complex market, it’s even more important to focus on areas where you have expertise and avoid investments that are beyond your understanding.

Examples of Buffett’s Principles in Action

Buffett’s investment in Apple, a company that has benefited significantly from technological advancements, demonstrates the adaptability of his principles. Despite being a tech company, Apple’s strong brand, loyal customer base, and recurring revenue streams align with Buffett’s focus on intrinsic value and long-term growth.