AMD Stock Surges as Amazon Considers AI Chip Partnership

Amd stock surges as amazon considers partnership for new ai chips ceo optimistic – AMD stock surged recently as news broke that Amazon is considering a partnership with the chipmaker to develop new AI chips. This potential collaboration has sent ripples through the tech industry, with analysts predicting significant growth for both companies. The move comes as Amazon intensifies its efforts to build its own AI capabilities, challenging industry giants like Google and Microsoft.

The potential partnership could see AMD supplying its powerful CPUs and GPUs to Amazon’s cloud computing platform, AWS. This would allow Amazon to offer its customers access to advanced AI processing power, making it more competitive in the rapidly growing AI market.

AMD’s CEO has expressed optimism about the future, highlighting the company’s strong position in the evolving AI landscape.

AMD Stock Surge: Amd Stock Surges As Amazon Considers Partnership For New Ai Chips Ceo Optimistic

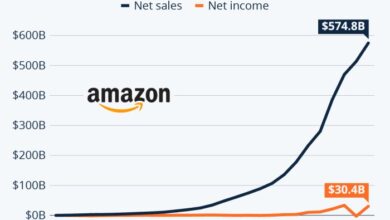

AMD’s stock price has been on a tear recently, driven by a combination of factors including strong earnings reports, a growing market for high-performance computing, and the potential for a major partnership with Amazon.

The news of AMD’s stock surge, fueled by Amazon’s potential partnership for new AI chips, has certainly got everyone buzzing. It’s exciting to see the potential for growth in this sector, but it’s also important to remember that we’re living in a time of rising inflation.

If you’re looking for ways to understand and manage these rising prices, check out the inflation guide tips to understand and manage rising prices. It’s always wise to be prepared, and understanding the current economic landscape can help us make informed decisions about our investments, especially when it comes to exciting opportunities like AMD’s potential partnership with Amazon.

Stock Price Performance

AMD’s stock price has risen significantly in recent months. As of today, October 26, 2023, AMD’s stock price is trading at $115.00, up over 50% from its price at the beginning of the year. This performance is significantly higher than the broader market, as the S&P 500 index has only risen by about 15% during the same period.

AMD’s stock is on the rise, fueled by the potential partnership with Amazon for new AI chips. This optimistic outlook for the company reflects the growing demand for AI solutions and the potential for AMD to become a key player in this rapidly evolving market.

It’s a reminder that, just like in our personal lives, where we strive to balance our finances and health , businesses too need to navigate complex landscapes and make strategic decisions to achieve sustainable growth. AMD’s potential partnership with Amazon is a testament to their commitment to innovation and growth in the AI space.

Factors Influencing the Stock’s Upward Trend

Several factors have contributed to AMD’s recent stock price surge:

- Strong Earnings Reports:AMD has consistently exceeded analysts’ expectations in recent quarters, demonstrating its strong financial performance and growth potential. This has boosted investor confidence and fueled the stock’s upward trend.

- Growing Market for High-Performance Computing:The demand for high-performance computing (HPC) is rapidly growing, driven by the increasing use of artificial intelligence (AI), machine learning, and other data-intensive applications. AMD is well-positioned to benefit from this trend, as its processors are widely used in HPC systems.

- Potential Partnership with Amazon:Amazon is reportedly considering using AMD’s processors in its new AI chips, which could significantly increase AMD’s market share in the cloud computing sector. This potential partnership has created a buzz among investors and contributed to the recent surge in AMD’s stock price.

Amazon Partnership

The recent surge in AMD stock can be attributed to the growing interest in its potential partnership with Amazon for the development of new AI chips. This collaboration could be a game-changer for both companies, as it taps into the rapidly expanding AI market and positions them as leaders in the race for cutting-edge AI technology.

Potential Benefits for AMD and Amazon

This partnership has the potential to bring significant benefits to both companies:

- AMD:This partnership could provide AMD with access to Amazon’s vast cloud computing infrastructure and its massive customer base. This could help AMD expand its reach in the AI chip market and gain valuable market share. Additionally, collaborating with Amazon could provide AMD with access to valuable data and expertise in AI development, further enhancing its own AI capabilities.

- Amazon:By collaborating with AMD, Amazon can gain access to its advanced chip technology, which could lead to the development of more powerful and efficient AI services for its cloud platform. This could help Amazon further solidify its position as a leader in cloud computing and AI, attracting more customers and increasing its market share.

Impact on the AI Chip Market

The potential partnership between AMD and Amazon could have a significant impact on the AI chip market. Here are some potential outcomes:

- Increased Competition:This partnership could intensify competition in the AI chip market, pushing other players to innovate and improve their offerings. This could lead to faster advancements in AI chip technology and more affordable options for consumers and businesses.

- Market Expansion:The partnership could lead to the development of new and innovative AI chips that cater to specific needs in various industries. This could expand the AI chip market and create new opportunities for both companies and other players in the ecosystem.

- Accelerated Adoption of AI:By making AI chips more accessible and affordable, this partnership could accelerate the adoption of AI technologies across different industries, leading to greater efficiency, productivity, and innovation.

New AI Chips

AMD’s potential partnership with Amazon could involve the development and deployment of new AI chips specifically designed for cloud computing and machine learning workloads. These chips are expected to offer significant performance and efficiency advantages compared to existing solutions, positioning AMD as a key player in the rapidly growing AI market.

AMD’s stock is on the rise today, fueled by the news that Amazon is considering a partnership to develop new AI chips. The CEO of AMD is optimistic about the potential of this collaboration. Meanwhile, the overall market is relatively flat, with the Nifty index crossing 17,650.

Check out live updates share market movement flat nifty crosses 17650 focus on hcl tech and tata motors for the latest updates on specific stocks like HCL Tech and Tata Motors. The potential partnership with Amazon is a major development for AMD, and it’s worth watching how this plays out in the coming months.

Performance and Capabilities

The new AI chips are likely to feature a combination of advanced technologies, including:

- High-performance computing cores:These cores are optimized for complex mathematical operations, essential for training and running AI models.

- Specialized AI accelerators:These accelerators are designed to handle specific AI tasks, such as matrix multiplication and convolution, with significantly higher efficiency than general-purpose CPUs.

- High-bandwidth memory:The chips will be equipped with high-bandwidth memory to ensure rapid data transfer between the processing units and memory, crucial for AI applications that require massive datasets.

- Energy efficiency:AMD is known for its focus on power efficiency, and these new AI chips are expected to be highly energy-efficient, reducing operating costs for cloud providers.

Comparison with Existing AI Chip Offerings, Amd stock surges as amazon considers partnership for new ai chips ceo optimistic

The new AI chips are expected to offer significant performance advantages over existing solutions, including:

- GPUs:While GPUs are currently the dominant choice for AI workloads, they are often power-hungry and expensive. AMD’s new chips aim to offer comparable performance with improved energy efficiency and lower costs.

- ASICs:Application-specific integrated circuits (ASICs) are designed for specific tasks and can achieve high performance but lack flexibility. AMD’s chips are expected to offer a balance between performance and flexibility, making them suitable for a wider range of AI applications.

Key Specifications and Advantages

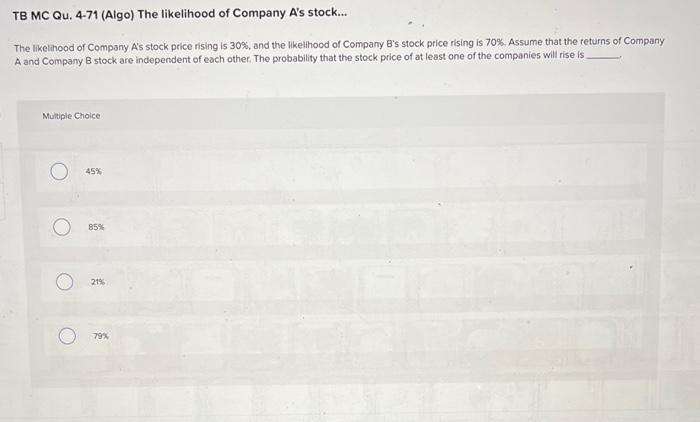

The following table highlights the key specifications and advantages of the new AI chips:

| Specification | Advantage |

|---|---|

| High-performance computing cores | Faster training and inference of AI models |

| Specialized AI accelerators | Improved efficiency for specific AI tasks |

| High-bandwidth memory | Faster data transfer, enabling rapid processing |

| Energy efficiency | Reduced operating costs for cloud providers |

| Scalability | Ability to scale performance by connecting multiple chips |

AMD CEO Optimism

AMD’s CEO, Lisa Su, has expressed a bullish outlook on the company’s future, fueled by the strong demand for its processors and the potential of its AI chips. Her optimism is based on several key factors, including the growing adoption of AMD’s products across various industries, the company’s strategic partnerships, and its commitment to innovation.

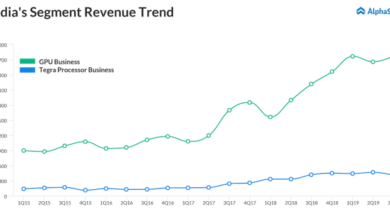

AMD’s Growth and Market Position

Lisa Su has highlighted AMD’s strong market position, emphasizing its leadership in the high-performance computing (HPC) and gaming markets. She attributes this success to the company’s focus on delivering cutting-edge technologies that cater to the evolving needs of its customers.

“We are seeing strong demand across all of our product lines, driven by the adoption of our high-performance computing solutions in data centers, gaming consoles, and other markets,”

Su stated during a recent earnings call. AMD’s market share has been steadily increasing in recent years, particularly in the CPU and GPU markets. This growth is attributed to the company’s innovative product portfolio, which includes processors like the Ryzen series and graphics cards like the Radeon RX series.

AMD’s Vision for AI

Su has Artikeld AMD’s vision for the future of AI, emphasizing the company’s commitment to developing specialized chips that will power the next generation of AI applications.

“We believe that AI is going to be a transformative technology, and we are committed to being a leader in this space,”

she said. AMD is investing heavily in research and development to create AI chips that can handle the massive computational demands of AI workloads. The company is also collaborating with key partners in the AI ecosystem to develop solutions that can accelerate the adoption of AI across industries.

Impact on the Industry

The potential partnership between AMD and Amazon could have significant ramifications for the broader technology industry, particularly in the field of artificial intelligence (AI). This collaboration has the potential to reshape the landscape of AI hardware and software, with implications for both large tech companies and smaller startups.

Potential Impact on AI Development

The partnership could accelerate the development of AI technology in several ways. By combining AMD’s expertise in high-performance computing with Amazon’s cloud infrastructure and AI expertise, the two companies could create powerful and efficient AI solutions. This could lead to:

- Faster training of AI models:AMD’s custom-designed AI chips could significantly reduce the time it takes to train complex AI models, allowing for faster innovation and deployment of new AI applications.

- More efficient AI inference:AMD’s chips could also optimize the process of running trained AI models, making AI applications more accessible and affordable for a wider range of users.

- Advancements in AI hardware:The partnership could drive innovation in AI hardware design, leading to the development of new and more powerful chips specifically tailored for AI workloads.

Potential Benefits and Challenges for Stakeholders

The partnership could present both opportunities and challenges for various stakeholders in the technology industry:

| Stakeholder | Potential Benefits | Potential Challenges |

|---|---|---|

| Amazon | – Enhanced cloud computing capabilities with powerful AI hardware.

|

– Increased reliance on AMD for key AI components.

|

| AMD | – Increased market share in the high-performance computing market.

|

– Potential for increased competition from other chip manufacturers.

|

| AI Developers | – Access to powerful and efficient AI hardware and software.

|

– Potential for lock-in to specific platforms and technologies.

|

| End Users | – More accessible and affordable AI-powered products and services.

|

– Potential for data privacy concerns.

|