Amazon Stock Falls Despite Strong Revenue as Cloud Growth Slows

Amazons stock falls despite strong revenue as cloud growth slows – Amazon’s stock falls despite strong revenue as cloud growth slows, a surprising turn of events for the tech giant. While Amazon reported impressive revenue growth, driven by its e-commerce business and advertising, investors were concerned about the slowing growth of Amazon Web Services (AWS), the company’s cloud computing arm.

This slowdown, a departure from the rapid growth AWS has historically enjoyed, raised questions about the future of Amazon’s profitability and overall growth potential.

The market’s reaction highlights the increasing importance of AWS to Amazon’s overall financial performance. Investors are closely watching the cloud computing sector, which is becoming increasingly competitive, with players like Microsoft Azure and Google Cloud gaining market share. The slowing growth of AWS suggests that Amazon may need to find new ways to differentiate its cloud services and maintain its competitive edge.

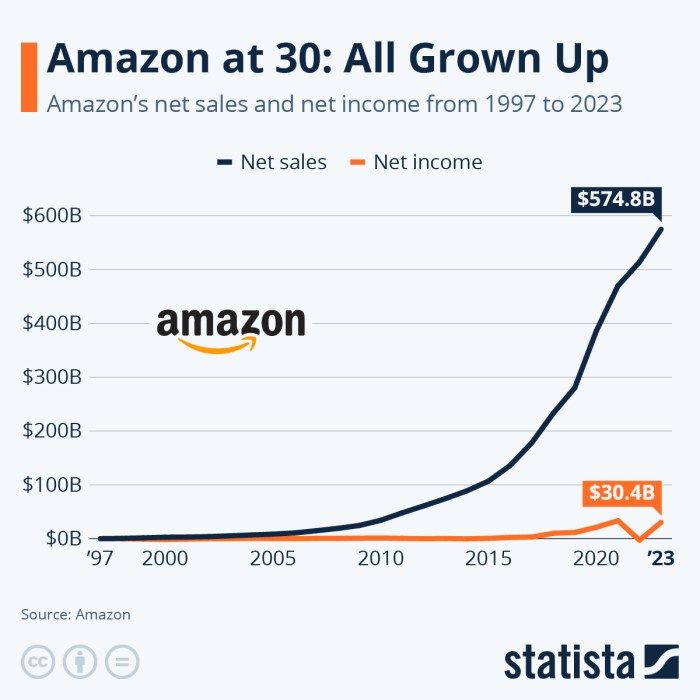

Amazon’s Revenue Performance

Amazon’s recent stock decline, despite reporting strong revenue, highlights the complexities of the tech giant’s business model and the evolving market dynamics. While revenue growth remains impressive, investors are increasingly focused on profitability and the long-term sustainability of Amazon’s various business segments.

Revenue Drivers in the Recent Quarter, Amazons stock falls despite strong revenue as cloud growth slows

Amazon’s strong revenue performance in the recent quarter was driven by a combination of factors, including:

- Growth in Amazon Web Services (AWS):AWS, Amazon’s cloud computing platform, continues to be a significant revenue driver. The segment reported double-digit revenue growth, reflecting the increasing adoption of cloud services across various industries.

- E-commerce Sales:Amazon’s core e-commerce business also saw solid growth, driven by increased online shopping activity, particularly in the North American market.

- Advertising Revenue:Amazon’s advertising business continues to expand, benefiting from the company’s vast customer base and targeted advertising capabilities.

Revenue Growth Across Segments

Amazon’s revenue growth varied across its different business segments:

- E-commerce:Amazon’s North America e-commerce business experienced robust growth, driven by increased consumer spending and the shift towards online shopping.

- AWS:AWS continues to be a key revenue driver for Amazon, with strong growth fueled by the increasing adoption of cloud services.

- Advertising:Amazon’s advertising business saw significant growth, benefiting from the company’s vast customer base and targeted advertising capabilities.

- Subscription Services:Amazon Prime memberships continue to grow, contributing to revenue growth in the subscription services segment.

Impact of Inflation and Consumer Spending

Inflation and consumer spending have had a mixed impact on Amazon’s revenue:

- Increased Costs:Rising inflation has led to higher costs for Amazon, impacting its profitability.

- Shifting Consumer Behavior:Consumers are increasingly price-sensitive in the current economic environment, potentially impacting Amazon’s sales volume.

- Focus on Value:Amazon has been focusing on providing value to consumers through competitive pricing and promotions, which could help maintain revenue growth.

Slowing Cloud Growth

Amazon’s recent stock decline, despite robust revenue, highlights the impact of slowing growth in its cloud computing division, Amazon Web Services (AWS). While AWS remains a significant revenue generator for Amazon, its growth rate has slowed, raising concerns among investors about the company’s future prospects.

Factors Contributing to AWS’s Slowing Growth

The slowdown in AWS growth can be attributed to a confluence of factors:

- Increased Competition:AWS faces stiff competition from Microsoft Azure and Google Cloud Platform, which are aggressively expanding their market share. These competitors are offering competitive pricing, innovative services, and tailored solutions, putting pressure on AWS to maintain its dominance.

- Economic Uncertainty:The global economic slowdown and rising inflation have led businesses to become more cautious about their IT spending, impacting cloud adoption rates. Companies are prioritizing cost optimization and may be delaying or reducing cloud investments.

- Maturity of the Cloud Market:The cloud computing market is maturing, with a growing number of enterprises already adopting cloud services. As the market reaches saturation, it becomes more challenging for AWS to sustain its high growth rates.

- Shifting Customer Priorities:Businesses are increasingly focusing on cost optimization and efficiency, leading them to explore alternative cloud providers or hybrid cloud solutions. This shift in priorities can impact AWS’s revenue growth.

Comparison with Historical Performance and Competitors

AWS’s growth rate has slowed considerably compared to its historical performance. In 2022, AWS revenue grew by 29%, a significant decline from the 40% growth rate it achieved in 2021. This slowdown is in line with the overall cloud computing market, which is experiencing a moderation in growth.

Amazon’s stock took a hit despite strong revenue, highlighting the impact of slowing cloud growth. This is a trend we’re seeing across the tech sector, with even established players like genesis crypto lending filing for bankruptcy protection struggling in the current economic climate.

While Amazon’s core retail business remains robust, investors are clearly concerned about the future of its cloud division, AWS, which has been a key driver of growth in recent years.

AWS remains the market leader in cloud computing, with a market share of around 33%. However, its competitors are gaining ground. Microsoft Azure has a market share of around 22%, while Google Cloud Platform holds about 10%. The competitive landscape is becoming increasingly intense, putting pressure on AWS to innovate and maintain its leadership position.

Challenges and Opportunities for AWS

AWS faces several challenges in the future:

- Maintaining Competitive Advantage:AWS needs to continue innovating and offering competitive pricing to stay ahead of its rivals. This includes developing new services, enhancing existing offerings, and providing tailored solutions to meet specific customer needs.

- Addressing Security Concerns:Cloud security is a critical concern for businesses, and AWS needs to address these concerns effectively. This involves investing in robust security measures, complying with industry regulations, and providing transparent security practices.

- Expanding into New Markets:AWS has an opportunity to expand its reach into emerging markets, such as developing countries and industries with high growth potential. This requires tailoring its offerings to local needs and building strong partnerships.

Impact on Amazon’s Financial Performance

The slowdown in AWS growth has a significant impact on Amazon’s overall financial performance. AWS is a major revenue driver for the company, and its slower growth rate is putting pressure on Amazon’s profitability. While Amazon’s revenue continues to grow, the company’s operating margins have been declining in recent quarters, primarily due to the slowdown in AWS growth.

Amazon is facing increased competition and economic uncertainty, which are impacting its ability to maintain high profit margins.

Amazon’s stock took a tumble despite reporting strong revenue, highlighting the growing concern about slowing cloud growth. This downturn mirrors the broader market trend, with investors seeking out more resilient investments. It’s interesting to see how this contrasts with the burgeoning world of cryptocurrencies, particularly the difference between Bitcoin and Ethereum, as outlined in this article: how ethereum is different from bitcoin.

While Amazon grapples with cloud growth, Ethereum’s smart contract capabilities and potential for decentralized applications are attracting significant attention. It remains to be seen whether the tech giant can regain its footing, but the shift in investor sentiment toward alternative technologies is undeniable.

“The slowdown in AWS growth is a major concern for Amazon investors, as it represents a significant portion of the company’s revenue and profitability. While Amazon is still a dominant player in the cloud computing market, it faces challenges from competitors and a maturing market.”

Financial Analyst

Amazon’s stock took a hit despite impressive revenue, a clear sign that investors are worried about the slowing growth of its cloud computing business. It’s a reminder that even giants like Amazon are susceptible to market shifts, and it highlights the importance of having a solid financial strategy, especially when it comes to managing debt.

For tips and strategies on how to navigate your own financial landscape, check out this excellent resource on credit debt management tips strategies examples. While Amazon’s cloud growth may be slowing, it’s important to remember that a well-managed financial plan can help you weather any storm.

Stock Market Reaction

Amazon’s stock took a significant hit following the release of its earnings report, despite reporting strong revenue growth. This negative reaction highlights the market’s focus on the company’s slowing cloud growth and its implications for future profitability.

Amazon’s Stock Performance Compared to Peers

Investors are increasingly concerned about the slowing growth of Amazon Web Services (AWS), which has been a key driver of Amazon’s profitability. The company’s stock performance has lagged behind its peers in the technology sector, such as Microsoft and Alphabet, which have shown more resilience in their cloud businesses.

This comparison highlights the market’s sensitivity to the performance of AWS and its impact on Amazon’s overall financial health.

Investor Sentiment and Amazon’s Stock Price

Investor sentiment towards Amazon has shifted significantly in recent months. While the company continues to generate strong revenue, concerns about slowing cloud growth and the company’s profitability have led to a decline in investor confidence. This decline in sentiment has contributed to the recent drop in Amazon’s stock price, as investors adjust their expectations for the company’s future growth prospects.

Market Expectations for Amazon’s Future Growth

The market is now looking for evidence that Amazon can regain its growth momentum. Investors are closely watching the company’s efforts to diversify its revenue streams and improve profitability. The market is also monitoring the competitive landscape in the cloud computing market, as Microsoft and Google continue to challenge AWS’s dominance.

Amazon’s Strategic Initiatives: Amazons Stock Falls Despite Strong Revenue As Cloud Growth Slows

Amazon is aggressively pursuing a range of strategic initiatives to navigate the evolving market landscape and drive growth. These initiatives encompass a variety of areas, including cost optimization, expansion into new markets, and leveraging its technological prowess to create new revenue streams.

Cost Optimization Measures

Amazon has embarked on a significant cost-cutting campaign to enhance profitability. The company is streamlining operations, reducing workforce size, and exploring ways to improve efficiency in its supply chain.

- Layoffs and Workforce Reduction:Amazon has announced significant layoffs across various departments, aiming to reduce operating costs and streamline its workforce. This includes cutting roles in its retail, cloud computing, and advertising divisions.

- Supply Chain Optimization:Amazon is actively optimizing its supply chain by investing in automation and robotics. This includes using robots in its warehouses and optimizing delivery routes to minimize transportation costs.

- Reducing Real Estate Footprint:Amazon is reducing its real estate footprint by closing some of its physical stores and renegotiating leases to lower overhead costs. This is particularly evident in its grocery store division, where some locations have been closed.

Amazon’s cost-cutting measures have had a mixed impact. While these initiatives have helped to improve profitability in the short term, they have also led to concerns about potential job losses and a decline in customer service.

Expanding into New Markets

Amazon continues to expand its reach into new markets, seeking to capitalize on emerging growth opportunities. This includes entering new geographic regions and diversifying its product and service offerings.

- Geographic Expansion:Amazon is actively expanding its operations into new countries, including emerging markets in Asia and Africa. This expansion allows the company to tap into new customer bases and capture market share in these regions.

- New Product and Service Offerings:Amazon is introducing new product and service offerings to diversify its revenue streams. This includes expanding into areas such as healthcare, advertising, and financial services. For example, Amazon’s foray into healthcare includes offering telehealth services and pharmacy services.

Amazon’s expansion into new markets is a key strategic initiative that could significantly impact its business model and competitive landscape. The company’s ability to adapt to local market dynamics and leverage its existing infrastructure will be crucial to its success in these new ventures.

Innovation and New Product Launches

Amazon is committed to innovation and continuously introduces new products and services to enhance customer experience and drive revenue growth.

- Amazon Go Stores:Amazon’s innovative Go stores offer a seamless shopping experience, allowing customers to simply grab items and leave without needing to checkout. This technology utilizes computer vision and sensors to track customer purchases, providing a frictionless shopping experience.

- Amazon Prime Air:Amazon is investing in drone delivery technology, aiming to revolutionize delivery services by providing faster and more efficient delivery options. This initiative is still in its early stages, but it has the potential to significantly disrupt the logistics industry.

- Amazon Web Services (AWS):AWS is Amazon’s cloud computing platform, offering a wide range of services to businesses. AWS has become a major revenue generator for Amazon and is a key driver of the company’s growth. Amazon continues to invest heavily in developing new features and services for AWS, aiming to maintain its leadership position in the cloud computing market.

Amazon’s focus on innovation and new product launches is crucial for its long-term success. The company’s ability to develop and introduce cutting-edge products and services will be essential for maintaining its competitive advantage in the rapidly evolving tech industry.

Industry Outlook

The recent decline in Amazon’s stock price, despite strong revenue, reflects a broader shift in the tech landscape. The e-commerce and cloud computing industries, which have been key drivers of Amazon’s growth, are facing new challenges and opportunities. Understanding these industry dynamics is crucial for evaluating Amazon’s future prospects.

E-commerce Industry Landscape

The e-commerce industry is characterized by intense competition, rapid innovation, and evolving consumer preferences. Key trends shaping the future of this industry include:

- Growth of Mobile Commerce:Smartphones and tablets are increasingly becoming the primary devices for online shopping, leading to a shift in user experience and marketing strategies.

- Rise of Social Commerce:Social media platforms are becoming integrated with shopping experiences, enabling users to discover and purchase products directly within their social networks.

- Personalization and Customization:Consumers are demanding personalized recommendations and customized products, pushing retailers to leverage data analytics and artificial intelligence.

- Focus on Sustainability:Consumers are increasingly conscious of environmental impact, leading to a growing demand for sustainable and ethical products and practices.

Cloud Computing Industry Landscape

The cloud computing market is experiencing robust growth, driven by the increasing adoption of cloud services by businesses of all sizes. Key trends shaping the future of this industry include:

- Shift to Multi-Cloud Strategies:Organizations are adopting a multi-cloud approach, utilizing services from multiple cloud providers to optimize cost, performance, and flexibility.

- Edge Computing:The emergence of edge computing, where data is processed closer to the source, is enabling faster response times and lower latency for applications.

- Growth of Cloud-Native Technologies:Cloud-native technologies, such as containers and microservices, are facilitating the development and deployment of applications in the cloud.

- Increased Focus on Security and Compliance:As organizations move sensitive data to the cloud, security and compliance concerns are becoming increasingly important.

Amazon’s Competitive Landscape

Amazon faces stiff competition in both the e-commerce and cloud computing industries. In e-commerce, it competes with major players like Walmart, Target, and Alibaba, as well as numerous smaller online retailers. In cloud computing, it competes with Microsoft Azure, Google Cloud Platform, and other cloud providers.

Challenges and Opportunities for Amazon

Amazon faces a number of challenges in the long term, including:

- Maintaining Growth in a Mature Market:The e-commerce market is becoming increasingly saturated, making it difficult for Amazon to sustain its high growth rates.

- Regulatory Scrutiny:Amazon has faced increasing scrutiny from regulators regarding its anti-competitive practices and data privacy policies.

- Competition from Emerging Players:New players are emerging in both e-commerce and cloud computing, challenging Amazon’s dominance in these markets.

Despite these challenges, Amazon has several opportunities for growth:

- Expanding into New Markets:Amazon can continue to expand into new markets, such as healthcare and advertising, leveraging its existing infrastructure and expertise.

- Developing New Technologies:Amazon can continue to invest in new technologies, such as artificial intelligence and robotics, to enhance its offerings and create new opportunities.

- Strengthening its Customer Relationships:Amazon can focus on building stronger relationships with its customers by providing personalized experiences and excellent customer service.