ADM Faces Turbulence: CFO Probe, Profit Cut Spark 12% Share Drop

Adm faces turbulence cfo investigation and profit forecast trim spark 12 share drop – ADM Faces Turbulence: CFO Probe, Profit Cut Spark 12% Share Drop sets the stage for a dramatic story in the world of finance. This agricultural giant, known for its vast reach in food processing and trading, has been thrown into a whirlwind of uncertainty.

The news of a CFO investigation, coupled with a profit forecast trim, sent shockwaves through the market, leading to a staggering 12% share drop. This sudden decline raises crucial questions about the company’s financial stability, its future direction, and the impact on investors.

The investigation into the CFO’s activities is the most pressing concern. It throws a spotlight on potential misconduct and raises doubts about the integrity of ADM’s financial reporting. The profit forecast trim, a stark indicator of the company’s current financial struggles, further fuels these concerns.

These developments have left investors reeling, scrambling to understand the implications for their portfolios. This situation begs the question: will ADM be able to weather this storm and emerge stronger, or will it be a harbinger of a more challenging future?

Company Performance and Financial Situation

The recent turbulence surrounding ADM, including the CFO investigation and the profit forecast trim, has significantly impacted the company’s share price, causing a 12% drop. This situation raises concerns about ADM’s financial stability and overall outlook. It’s crucial to understand the implications of these events and their potential impact on the company’s future performance.

ADM’s recent turbulence, with a CFO investigation and a profit forecast trim sparking a 12% share drop, highlights the volatility in the market. However, amidst this, there’s a glimmer of optimism for the broader economy. The IMF predicts resilient economic growth for India in FY23, as reported by The Venom Blog , which could potentially buoy sentiment and offer a counterbalance to the negative news surrounding ADM.

It remains to be seen how this broader economic trend will impact ADM’s long-term prospects.

CFO Investigation and its Impact on Financial Stability

The investigation into the CFO’s actions, while still ongoing, casts a shadow of uncertainty over ADM’s financial stability. This uncertainty can affect investor confidence, potentially leading to decreased investment and a decline in the company’s share price. The investigation could also reveal potential financial irregularities, which could lead to regulatory scrutiny and penalties, further impacting the company’s financial health.

ADM’s turbulent week, marked by a CFO investigation and a profit forecast trim that sparked a 12% share drop, highlights the fragility of global markets. It’s a stark reminder that even seemingly stable companies can be vulnerable to unexpected shocks.

The ongoing Russian crisis, deepened by Wagner leader’s defiance of Putin’s authority , further amplifies the uncertainty surrounding the global economic landscape. This volatile environment could potentially lead to further market corrections and investor anxiety, making it crucial for companies like ADM to navigate these challenges with transparency and decisive action.

Profit Forecast Trim and its Implications on Financial Outlook

The decision to trim the profit forecast reflects the company’s cautious outlook on future earnings. This could be due to several factors, such as rising input costs, global economic uncertainty, or potential disruptions in supply chains. A lower profit forecast indicates that the company anticipates lower revenue and earnings in the future, which could negatively affect investor sentiment and the company’s overall financial performance.

Factors Contributing to the 12% Share Drop

The 12% drop in ADM’s share price is likely a result of a combination of factors:

- CFO Investigation:The uncertainty surrounding the investigation and its potential implications for the company’s financial health has eroded investor confidence, leading to selling pressure on the stock.

- Profit Forecast Trim:The revised profit forecast signals lower expected earnings, indicating potential challenges in the company’s future performance. This has further dampened investor enthusiasm, contributing to the share price decline.

- Global Economic Uncertainty:The current global economic climate, characterized by inflation, supply chain disruptions, and geopolitical tensions, has created a challenging environment for businesses, including ADM. This uncertainty has likely influenced investor decisions, leading to a sell-off in the stock market, including ADM.

Market Reaction and Investor Sentiment

The news of ADM’s CFO investigation and profit forecast trim sent shockwaves through the market, leading to a significant drop in the company’s stock price and increased trading volume. Investors reacted swiftly, reflecting their concerns about the potential implications of these events on the company’s future performance and financial stability.

Investor Concerns

The CFO investigation raised immediate concerns among investors regarding potential financial misconduct or irregularities within the company. This uncertainty surrounding the financial health of ADM prompted a sell-off, as investors sought to reduce their exposure to a company facing such scrutiny.

The profit forecast trim further fueled these concerns, as it indicated a potential slowdown in ADM’s growth trajectory, raising questions about the company’s ability to meet its financial targets.

ADM’s stock took a tumble today, dropping 12% after news of a CFO investigation and a profit forecast trim. It seems like the market is nervous about the company’s future. Adding to the overall sense of uncertainty, breaking news Tesla issues warning on model 3 tax credit eligibility has thrown a wrench into the automotive industry.

This news, combined with ADM’s current challenges, might make investors even more cautious in the coming weeks.

Analyst Sentiment

Financial analysts and industry experts have expressed a range of opinions regarding ADM’s future prospects. Some analysts remain optimistic, highlighting the company’s strong market position, diversified portfolio, and long-term growth potential. Others are more cautious, citing the ongoing investigation and the potential for further negative news to emerge.

“The investigation into the CFO is a major concern, but it’s too early to tell what the ultimate impact will be on ADM’s business,” said [Name of Analyst], an analyst at [Name of Investment Firm]. “We will be closely monitoring the situation and adjusting our investment recommendations accordingly.”

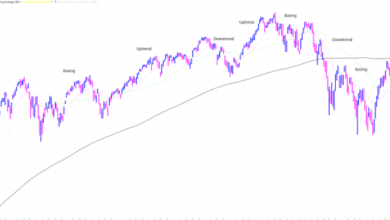

Market Volatility

The news of the investigation and profit forecast trim caused significant volatility in ADM’s stock price. The company’s shares experienced a sharp decline on the day the news was released, with trading volume significantly exceeding the average. This heightened volatility reflects the market’s uncertainty about the future direction of the company and its ability to navigate these challenges.

Impact on ADM’s Operations and Strategies

The current situation surrounding ADM’s CFO investigation and profit forecast trim has the potential to significantly impact the company’s internal operations, decision-making processes, and strategic initiatives. While it’s difficult to predict the exact ramifications, we can analyze the potential disruptions and adjustments ADM might need to make to navigate these challenges.

CFO Investigation’s Impact on Internal Operations

The CFO investigation could disrupt ADM’s internal operations in several ways. Firstly, it could lead to a temporary slowdown in decision-making, particularly regarding financial matters, as the investigation unfolds. Secondly, the investigation might divert the attention and resources of key personnel, potentially affecting the efficiency of other operational processes.

Thirdly, the uncertainty surrounding the investigation could create a climate of anxiety and distrust within the organization, impacting employee morale and productivity.

Profit Forecast Trim’s Impact on Investment Plans

The profit forecast trim could force ADM to re-evaluate its investment plans and strategic initiatives. The company might need to prioritize projects with higher returns and delay or cancel those with less immediate benefits. For instance, ADM might reconsider expansion plans or new product launches, focusing instead on cost-cutting measures and operational efficiencies.

Potential Adjustments in Operations and Strategies, Adm faces turbulence cfo investigation and profit forecast trim spark 12 share drop

To address the current challenges, ADM might need to make several adjustments in its operations and strategies. This could involve:

- Enhanced Financial Controls:Implementing stricter financial controls and oversight to mitigate future risks and enhance transparency. This could involve strengthening internal audit processes, implementing new risk management frameworks, and increasing the independence of the finance department.

- Cost Optimization:Taking measures to optimize costs across the entire organization. This could include streamlining processes, renegotiating contracts, and exploring opportunities for automation.

- Focus on Core Businesses:Prioritizing resources and investments in core business areas with higher profitability and growth potential. This could involve divesting non-core assets or reducing exposure to volatile markets.

- Improved Communication:Maintaining open and transparent communication with stakeholders, including investors, employees, and customers. This can help build trust and confidence, mitigating the negative impact of the current situation.

Potential Long-Term Implications for ADM: Adm Faces Turbulence Cfo Investigation And Profit Forecast Trim Spark 12 Share Drop

The recent turbulence surrounding ADM’s CFO investigation and profit forecast trim has raised significant questions about the company’s future trajectory. While the immediate impact on the stock price is evident, the long-term implications are far more complex and require a deeper analysis of potential scenarios and the underlying factors that could shape ADM’s destiny.

Potential Scenarios for ADM’s Future

To understand the potential long-term implications, it’s essential to consider different scenarios based on the outcomes of the CFO investigation and the profit forecast. The following table Artikels three potential scenarios and their potential impact on ADM’s future:

| Scenario | CFO Investigation Outcome | Profit Forecast | Potential Impact on ADM |

|---|---|---|---|

| Scenario 1: Positive | Investigation concludes with no wrongdoing or minor issues resolved quickly | Forecast revised upwards or remains stable | Strong investor confidence, potential for growth, improved market perception, and a return to pre-turbulence performance levels. |

| Scenario 2: Neutral | Investigation reveals some irregularities, but no significant impact on financial performance | Forecast remains unchanged or experiences a minor downward revision | Mixed investor sentiment, potential for a temporary dip in stock price, and a focus on regaining investor trust. |

| Scenario 3: Negative | Investigation reveals significant wrongdoing, leading to legal consequences and financial penalties | Forecast revised significantly downwards | Erosion of investor confidence, potential for a significant drop in stock price, reputational damage, and potential for regulatory scrutiny. |

Key Risks and Opportunities for ADM

The current situation presents both risks and opportunities for ADM in the coming months and years.

Risks

- Reputational Damage:The ongoing investigation and the profit forecast trim could damage ADM’s reputation, leading to decreased consumer trust and potential boycotts. This could particularly impact the company’s consumer-facing brands, such as its oat milk and plant-based protein products.

- Financial Instability:Depending on the outcome of the investigation, ADM could face significant financial penalties, legal fees, and potential shareholder lawsuits. This could strain the company’s financial resources and hinder its ability to invest in growth initiatives.

- Loss of Talent:The uncertainty surrounding the investigation could lead to key employees leaving the company, impacting ADM’s operational efficiency and ability to attract and retain top talent.

- Regulatory Scrutiny:The investigation could trigger increased regulatory scrutiny of ADM’s business practices, leading to more stringent compliance requirements and potential penalties.

- Increased Competition:The current situation could embolden competitors to aggressively target ADM’s market share, particularly in the rapidly growing plant-based food and beverage market.

Opportunities

- Focus on Transparency and Governance:The investigation presents an opportunity for ADM to demonstrate its commitment to transparency and good governance by proactively addressing the issues and implementing stricter internal controls.

- Investment in Sustainability:The increasing demand for sustainable and ethical food production presents an opportunity for ADM to invest in its sustainability initiatives, enhancing its brand image and attracting environmentally conscious consumers.

- Innovation and Product Development:ADM can leverage its research and development capabilities to develop new and innovative products that meet the evolving consumer preferences and dietary needs.

- Strategic Acquisitions:The current situation could present opportunities for ADM to acquire smaller, innovative companies with complementary products or technologies, expanding its portfolio and market reach.

- Stronger Relationships with Stakeholders:ADM can use this situation to strengthen its relationships with stakeholders, including investors, customers, suppliers, and employees, by demonstrating its commitment to ethical business practices and responsible growth.

Potential Milestones and Events

The future trajectory of ADM will be shaped by a series of potential milestones and events over the coming months and years.

- Completion of the CFO Investigation:The timeline for the investigation is currently unknown, but its conclusion will be a key milestone, determining the extent of the impact on ADM’s financial performance and reputation.

- Announcement of New CFO:The appointment of a new CFO will signal ADM’s commitment to addressing the issues raised by the investigation and restoring investor confidence.

- Revised Profit Forecast:The release of a revised profit forecast will provide investors with a clearer picture of ADM’s financial outlook and potential for growth in the coming years.

- Implementation of New Governance Practices:ADM’s commitment to implementing new governance practices, including stricter internal controls and enhanced transparency, will be crucial in regaining investor trust and ensuring long-term stability.

- Response to Competition:ADM’s response to the intensified competition in the food and beverage market, particularly in the plant-based sector, will be critical in maintaining its market share and securing future growth.

- Impact of Global Economic Conditions:The global economic landscape, including factors such as inflation, supply chain disruptions, and geopolitical tensions, will also play a significant role in shaping ADM’s future.