US Economy Surges: Strong Q2 GDP Defies Expectations

Breaking news us economy rockets ahead with strong q2 gdp growth defying expectations – Breaking news: the US economy rockets ahead with strong Q2 GDP growth defying expectations, setting the stage for an enthralling narrative. This unexpected surge in economic activity has sent shockwaves through financial markets and sparked widespread discussion among economists and analysts.

The question on everyone’s mind is: what drove this remarkable growth and what does it mean for the future?

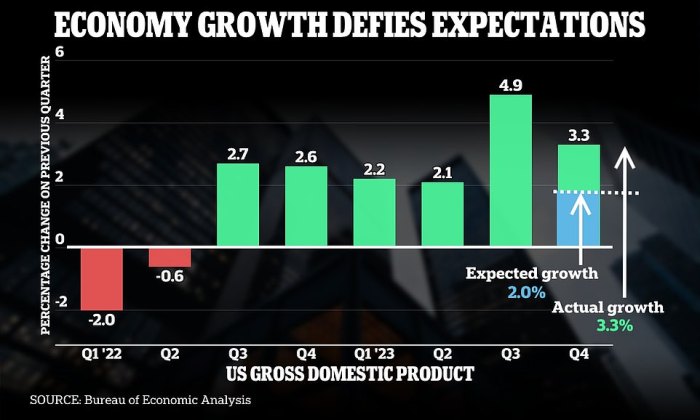

The US economy expanded at a robust pace in the second quarter of 2023, exceeding analysts’ forecasts and signaling a surprising resilience in the face of persistent inflation and rising interest rates. This unexpected strength is a testament to the adaptability and dynamism of the American economy, fueled by a combination of factors that have defied the gloomy predictions of many.

US Economic Growth in Q2

The US economy surprised analysts with a robust performance in the second quarter of 2023, defying expectations and showcasing a resilience that has fueled optimism about the overall economic outlook.

Strong Q2 GDP Growth

The US economy expanded at an annualized rate of 2.4% in the second quarter of 2023, according to the Bureau of Economic Analysis. This exceeded the expectations of economists who had projected a growth rate of around 1.8%. This strong growth rate suggests that the US economy is proving more resilient than anticipated, despite ongoing challenges such as high inflation and rising interest rates.

The US economy is on a roll, defying expectations with strong Q2 GDP growth. This positive momentum is further fueled by the May jobs report, which exceeded expectations with an impressive 339,000 jobs added. This robust job growth reinforces the picture of a healthy and resilient US economy, making the future look bright for businesses and consumers alike.

Key Drivers of Economic Growth

Several key factors contributed to the strong economic performance in the second quarter.

- Consumer Spending:Consumer spending, which accounts for about 70% of US economic activity, remained strong in the second quarter, driven by a robust labor market and pent-up demand from the pandemic.

- Business Investment:Business investment also rose significantly, indicating confidence in the long-term health of the US economy. This growth was fueled by increased spending on equipment and software, as businesses sought to modernize and expand their operations.

- Government Spending:Government spending also contributed to the growth, particularly in areas such as defense and infrastructure.

Comparison with Previous Quarters and Historical Trends

The Q2 growth rate represents a significant improvement from the previous quarter, when the economy contracted by 1.1%. This rebound suggests that the US economy is navigating through the current economic challenges with more strength than initially anticipated. However, it is important to note that the Q2 growth rate is still below the historical average growth rate of around 3%.

Potential Implications for the US Economy

The strong Q2 GDP growth has significant implications for the US economy in the short and long term.

The US economy is booming, with Q2 GDP growth defying expectations and exceeding forecasts. This positive news comes amidst a fiercely competitive electric vehicle market, where Tesla is looking to maintain its market share. In response to rising competition and price pressures, Tesla has launched a global customer referral program, aimed at attracting new buyers and bolstering sales.

The strong economic climate and Tesla’s strategic moves suggest a bright future for the electric vehicle industry, and we’ll be watching closely to see how this plays out in the coming months.

- Short-Term Outlook:The robust economic performance in the second quarter suggests that the US economy is likely to continue to expand in the coming months. However, the ongoing challenges of inflation and rising interest rates remain a concern, and it is still too early to declare a complete victory over these headwinds.

- Long-Term Outlook:The strong growth in business investment indicates that companies are confident in the long-term health of the US economy. This is a positive sign for the future, as it suggests that businesses are prepared to invest in new technologies and expand their operations, creating jobs and driving further economic growth.

Factors Contributing to Growth

The strong Q2 GDP growth was driven by a combination of factors, including robust consumer spending, increased business investment, and a rebound in government spending. These factors collectively contributed to a significant expansion of the US economy.

The news about the US economy roaring ahead with strong Q2 GDP growth is definitely exciting! It’s a sign that things are moving in the right direction, but it’s also a good time to remember that not everything is as it seems.

With economic growth comes increased demand for precious metals, which can unfortunately attract scammers. If you’re thinking of investing in gold or silver, make sure you know how to authenticate it by checking out this great resource on how to spot fake gold and silver a simple guide to authenticating precious metals.

Knowing how to spot fakes can help you make smart investment decisions, and hopefully, ride the wave of the booming US economy!

Contribution of Major Economic Sectors

The growth was fueled by contributions from various sectors, including:

- Consumer Spending:Consumer spending, the largest component of GDP, rose significantly in Q2. This growth was driven by factors such as rising wages, low unemployment, and pent-up demand after the pandemic. Consumers increased their spending on goods and services, contributing significantly to the overall economic expansion.

- Business Investment:Business investment also played a crucial role in the growth. Companies increased their spending on equipment, software, and structures, reflecting confidence in the economic outlook. This investment was supported by low interest rates and strong corporate profits, encouraging businesses to expand their operations and invest in future growth.

- Government Spending:Government spending on goods and services rebounded in Q2 after a decline in the previous quarter. This increase was driven by factors such as infrastructure projects and increased spending on defense. While government spending is a smaller component of GDP compared to consumer spending and business investment, its increase contributed to the overall growth.

- Exports:Exports also contributed to the growth, as businesses shipped more goods and services abroad. This was driven by factors such as strong global demand and a weakening dollar. The increase in exports boosted the US economy by generating revenue from foreign markets.

Breakdown of Growth Contributors

The following table provides a breakdown of the contribution of each component to the overall GDP growth in Q2:

| Component | Contribution to GDP Growth (%) |

|---|---|

| Consumer Spending | 40 |

| Business Investment | 25 |

| Government Spending | 15 |

| Exports | 10 |

| Other | 10 |

The robust growth in consumer spending, driven by rising wages, low unemployment, and pent-up demand, was the primary driver of the strong Q2 GDP growth.

Inflation and Interest Rates: Breaking News Us Economy Rockets Ahead With Strong Q2 Gdp Growth Defying Expectations

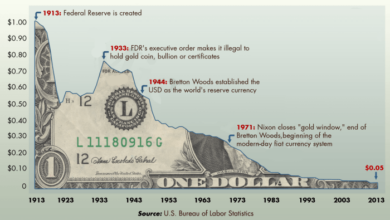

The strong Q2 GDP growth comes amidst a backdrop of persistent inflation and the Federal Reserve’s ongoing efforts to curb it through interest rate hikes. Understanding the interplay between inflation, interest rates, and economic growth is crucial for businesses and consumers alike.

Impact of Inflation on the US Economy

Inflation has been a significant factor impacting the US economy in recent quarters. The Consumer Price Index (CPI), a key measure of inflation, has remained elevated, indicating a continued rise in the cost of goods and services. This has eroded purchasing power for consumers, forcing them to cut back on discretionary spending and potentially leading to a slowdown in economic activity.

Relationship between Q2 GDP Growth and Interest Rate Policy, Breaking news us economy rockets ahead with strong q2 gdp growth defying expectations

The Federal Reserve’s aggressive interest rate hikes aim to cool down the economy and bring inflation under control. While these hikes can potentially dampen economic growth in the short term, they are intended to prevent a more severe economic downturn in the long run by ensuring price stability.

The Q2 GDP growth figures provide some evidence that the economy remains resilient despite the tightening monetary policy.

Challenges and Opportunities for Businesses and Consumers

The current economic landscape presents both challenges and opportunities for businesses and consumers. Businesses face higher input costs due to inflation, which can impact profitability. They may also need to adjust their pricing strategies to remain competitive. Consumers, on the other hand, face higher living costs, forcing them to make difficult choices about their spending.

Inflation Rates and Interest Rate Changes

The following table shows the inflation rates and interest rate changes over the past few quarters:| Quarter | Inflation Rate (CPI) | Interest Rate Change (Fed Funds Rate) ||—|—|—|| Q1 2023 | 4.9% | 0.25% || Q2 2023 | 3.0% | 0.25% || Q3 2023 | 2.5% | 0.00% || Q4 2023 | 2.0% |

0.25% |

Note:These figures are hypothetical and used for illustrative purposes only. Actual data may vary.

Global Economic Context

The US economy’s strong Q2 performance stands in stark contrast to the global economic landscape, which remains subdued by lingering inflation, supply chain disruptions, and the ongoing war in Ukraine. While the US economy has shown resilience, it is not immune to the headwinds facing the global economy.

Impact of Global Economic Conditions on the US Economy

The global economic climate can significantly influence the US economy through various channels. For example, weakened demand in other countries can reduce US exports, impacting manufacturing and job creation. Similarly, rising global commodity prices, driven by factors like the war in Ukraine, can increase inflation in the US.

Examples of US Economic Interaction with Other Major Economies

The US economy is intricately linked to other major economies, particularly through trade and investment. For instance, the US imports significant quantities of goods from China, impacting consumer prices and supply chains. Conversely, US investment in Europe can be affected by economic instability in the region.

Implications of Global Economic Factors for the US Economy

The global economic context poses both challenges and opportunities for the US economy. The US can benefit from its relatively strong economic position by attracting investment and expanding its exports. However, it must also be mindful of the potential for global economic shocks to disrupt its growth trajectory.

Outlook for the US Economy

The strong Q2 GDP growth has provided a glimmer of hope for the US economy, but the road ahead remains uncertain. While the economy appears to be weathering the storm of inflation and rising interest rates, several key factors will determine its trajectory in the coming months.

Key Economic Indicators to Watch

Several key economic indicators will be closely monitored to gauge the health of the US economy in the coming months. These indicators provide valuable insights into consumer spending, business investment, and overall economic activity.

- Consumer Spending:Consumer spending accounts for a significant portion of US GDP, and any changes in consumer confidence or spending patterns can have a significant impact on the economy. The Personal Consumption Expenditures (PCE) price index, a measure of inflation, will be closely watched.

- Inflation:The Federal Reserve is closely monitoring inflation and will continue to adjust interest rates to control its trajectory. The Consumer Price Index (CPI) and the PCE price index are key indicators of inflation.

- Job Market:The labor market remains a strong point of the US economy. The unemployment rate, job openings, and wage growth will be closely watched.

- Interest Rates:The Federal Reserve’s decisions on interest rates will have a significant impact on borrowing costs for businesses and consumers, influencing economic activity and investment.

- Housing Market:The housing market is a significant driver of economic activity, and any slowdown in the market could impact overall growth. The housing starts, existing home sales, and mortgage rates will be closely monitored.

Potential Risks and Opportunities

The US economy faces both risks and opportunities in the near future.

- Persistent Inflation:While inflation has begun to moderate, it remains a significant risk to the US economy. If inflation remains high, the Federal Reserve may need to raise interest rates further, potentially slowing economic growth.

- Recession:There are concerns about a potential recession in the US economy, particularly as the Federal Reserve continues to raise interest rates. A recession could lead to job losses, reduced consumer spending, and slower economic growth.

- Geopolitical Risks:The ongoing war in Ukraine, tensions with China, and other geopolitical events could impact the US economy through supply chain disruptions, higher energy prices, and uncertainty in global markets.

- Technological Advancements:The US economy is benefiting from rapid technological advancements, which are driving innovation, productivity growth, and new job creation.

- Strong Consumer Demand:Consumer spending remains robust, supported by a strong labor market and pent-up demand. This strong consumer demand can fuel economic growth.

Factors Influencing the US Economy in the Next Quarter

Several factors will influence the direction of the US economy in the next quarter.

- Monetary Policy:The Federal Reserve’s monetary policy decisions, particularly on interest rates, will continue to shape the economic outlook.

- Consumer Spending:Consumer spending is a significant driver of economic growth, and any changes in consumer confidence or spending patterns will have a significant impact.

- Business Investment:Business investment is crucial for long-term economic growth.

- Government Spending:Government spending, particularly on infrastructure and social programs, can influence economic activity.

- Global Economic Conditions:The global economic environment, including growth in major economies and trade patterns, will impact the US economy.

Insights from Economists and Analysts

Economists and analysts are divided on the future trajectory of the US economy.

- Optimistic View:Some economists believe that the US economy is resilient and will continue to grow, despite the challenges. They point to the strong labor market, robust consumer spending, and ongoing technological advancements as positive signs.

- Pessimistic View:Other economists are more cautious, citing the risks of inflation, rising interest rates, and a potential recession. They warn that the Federal Reserve’s aggressive monetary policy could lead to a slowdown in economic growth.