Fed Decision Impacts Tech Earnings: Markets React, Latest Stock News

Fed decision impact tech earnings markets react latest stock news – The Fed’s recent interest rate decision has sent shockwaves through the tech sector, impacting earnings reports and triggering significant market reactions. This ripple effect has left investors grappling with the latest stock news and trying to decipher the implications for their portfolios.

The Fed’s decision, driven by concerns about inflation and economic growth, has created a volatile environment for tech companies. Investors are closely analyzing earnings reports to gauge how these companies are navigating the new interest rate landscape and the potential impact on future profitability.

The Fed’s Decision and its Potential Impact

The Federal Reserve’s latest interest rate decision has sent ripples through the financial markets, particularly impacting the tech sector. The Fed’s decision to raise interest rates by a quarter percentage point, while seemingly modest, has significant implications for the tech industry, which is known for its high growth potential and reliance on borrowed capital.

The Fed’s Rationale and its Impact on Economic Growth

The Fed’s decision to raise interest rates is driven by its ongoing efforts to combat inflation. By increasing borrowing costs, the Fed aims to cool down the economy and curb consumer spending, ultimately leading to a decrease in price pressures.

However, this strategy comes with potential drawbacks. Higher interest rates can stifle economic growth, particularly for sectors like technology, which rely heavily on investment and expansion.

The Current Interest Rate Environment and Market Volatility

The current interest rate environment is a stark contrast to the ultra-low rates seen in recent years. This shift has increased market volatility, as investors grapple with the implications of higher borrowing costs. Tech stocks, which were once seen as safe havens during periods of economic uncertainty, have become more vulnerable to market fluctuations.

The tech sector’s valuation is often tied to future growth expectations, and higher interest rates can make those expectations less certain, leading to price corrections.

The Fed’s decision has sent shockwaves through the tech earnings market, with investors closely watching how the latest stock news unfolds. Amidst this volatility, it’s easy to feel overwhelmed, but remember, even small changes can make a big difference.

Check out these 10 practical life hacks to simplify your everyday routine to regain a sense of control. By simplifying your own life, you can better navigate the complexities of the market and make informed decisions based on the latest stock news and tech earnings reports.

The Impact on Tech Earnings

The rising interest rate environment is likely to impact tech companies’ earnings in several ways. Firstly, it can make it more expensive for tech firms to raise capital, slowing down their expansion plans and potentially impacting revenue growth. Secondly, higher interest rates can lead to increased borrowing costs for tech companies, putting pressure on their profitability.

Lastly, a slowdown in economic growth can reduce consumer spending on tech products and services, impacting demand and ultimately affecting earnings.

Examples of Market Reactions

The recent Fed decision has already had a noticeable impact on the tech sector. For instance, the Nasdaq Composite Index, which is heavily weighted towards tech stocks, experienced a decline following the Fed’s announcement. This suggests that investors are anticipating potential headwinds for the tech sector in the coming months.

Potential Strategies for Investors

The recent Fed decision and its impact on the tech sector have created a complex landscape for investors. While some see potential for growth, others are concerned about the potential for a downturn. Navigating this environment requires a thoughtful approach that considers both risks and rewards.

Assessing Risk and Reward, Fed decision impact tech earnings markets react latest stock news

Investors should carefully assess the risk and reward associated with investing in the tech sector. The tech sector is known for its high growth potential, but it also carries a higher degree of volatility. Recent market developments have highlighted this volatility, making it crucial to have a clear understanding of the potential risks and rewards before making any investment decisions.

“The tech sector is a double-edged sword: it offers the potential for significant returns, but also comes with a high degree of volatility.”

Portfolio Diversification

Diversifying your portfolio across different asset classes and sectors can help mitigate risk. By spreading your investments across a variety of assets, you reduce your exposure to any single sector or asset class. This strategy can help to smooth out returns and reduce overall portfolio volatility.

- Consider investing in a mix of stocks, bonds, real estate, and other assets to diversify your portfolio.

- Allocate a portion of your portfolio to sectors that are less correlated with the tech sector, such as healthcare, consumer staples, or energy.

Long-Term Investing

The tech sector is known for its long-term growth potential. Investors with a long-term horizon may consider staying invested in the sector, even during periods of market volatility. This strategy allows investors to ride out short-term fluctuations and benefit from the long-term growth potential of the sector.

“The tech sector has a long history of innovation and growth, making it a potentially attractive investment for long-term investors.”

The Fed’s decision to raise interest rates sent shockwaves through the tech sector, with earnings reports reflecting the uncertainty. Meanwhile, the global food supply chain faces new challenges as Ukraine’s grain exports are in peril amidst Russian attacks, forcing the shipping industry to brace for difficult times.

This geopolitical turmoil adds another layer of complexity to the already volatile market, making it difficult to predict how investors will react in the coming weeks.

Active Portfolio Management

Actively managing your portfolio involves monitoring market developments and adjusting your investment strategy accordingly. This approach can help you capitalize on opportunities and mitigate risks.

- Regularly review your portfolio and make adjustments based on market conditions and your investment goals.

- Consider rebalancing your portfolio periodically to maintain your desired asset allocation.

Impact on Different Segments of the Tech Industry: Fed Decision Impact Tech Earnings Markets React Latest Stock News

The Fed’s decision to raise interest rates will have a significant impact on different segments of the tech industry, with some sectors potentially facing greater challenges than others. Understanding the potential effects on each segment is crucial for investors looking to navigate the evolving market landscape.

Software

Software companies, particularly those focused on enterprise solutions, may experience some short-term challenges as businesses tighten their belts in response to higher borrowing costs. However, the long-term growth potential of the software sector remains strong. The increasing adoption of cloud computing, artificial intelligence, and other emerging technologies will continue to drive demand for software solutions.

- Opportunities:The rising demand for cloud-based software and services, along with the ongoing digital transformation initiatives across various industries, presents significant opportunities for software companies.

- Challenges:Increased competition, potential for reduced IT budgets in certain sectors, and the need to adapt to changing customer demands are some of the challenges software companies may face.

Examples of software companies with strong growth potential include:

- Salesforce:A leading provider of cloud-based customer relationship management (CRM) solutions, Salesforce is well-positioned to benefit from the growing demand for cloud services and the increasing focus on customer experience.

- Microsoft:With its diverse portfolio of software products, including Azure cloud computing platform, Microsoft is expected to maintain its dominance in the software industry.

Hardware

The hardware segment of the tech industry, which includes companies that manufacture computers, smartphones, and other electronic devices, is likely to be more sensitive to rising interest rates. Consumers may delay purchases of expensive electronics due to concerns about affordability.

- Opportunities:The demand for high-performance computing devices, such as gaming PCs and laptops, may remain strong. Additionally, the growth of the Internet of Things (IoT) and the increasing adoption of 5G technology could drive demand for hardware components.

- Challenges:The rising cost of raw materials and components, along with potential supply chain disruptions, could pose challenges for hardware manufacturers. Moreover, the increasing popularity of subscription-based services, such as streaming platforms, may impact the demand for certain hardware products.

Examples of hardware companies that may face significant challenges include:

- Apple:While Apple’s iPhone remains a popular product, the company may face some pressure on sales if consumers become more price-sensitive.

- Dell Technologies:Dell, a major manufacturer of personal computers and servers, could experience a slowdown in demand if businesses reduce their IT spending.

E-commerce

E-commerce companies, which rely heavily on consumer spending, are likely to face some challenges as rising interest rates and inflation put pressure on household budgets. However, the long-term growth prospects for e-commerce remain strong, driven by the increasing popularity of online shopping and the continued expansion of digital marketplaces.

The Fed’s decision to raise rates sent shockwaves through the tech sector, impacting earnings and triggering market reactions. While investors grapple with these developments, it’s crucial to understand the broader economic landscape, especially the impact of inflation. Check out the inflation guide tips to understand and manage rising prices for valuable insights and strategies to navigate these challenging times.

As we digest the latest stock news, keeping inflation in mind will be key to making informed investment decisions.

- Opportunities:The growing adoption of mobile commerce, the rise of social commerce, and the increasing demand for personalized shopping experiences offer significant opportunities for e-commerce companies.

- Challenges:Rising competition, increased shipping costs, and the need to adapt to evolving consumer preferences are some of the challenges facing e-commerce businesses.

Examples of e-commerce companies with strong growth potential include:

- Amazon:With its vast online marketplace and its growing presence in cloud computing, Amazon is well-positioned to benefit from the continued growth of e-commerce.

- Shopify:Shopify provides a platform for businesses to create and manage online stores, enabling them to reach a wider customer base. The company is expected to benefit from the increasing popularity of online shopping and the growth of small and medium-sized businesses.

Historical Perspective

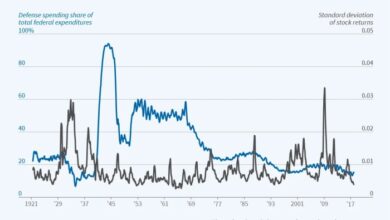

The current situation, with the Fed raising interest rates to combat inflation, is not unprecedented in the tech sector. History offers valuable insights into how previous Fed decisions have impacted the tech industry and the broader market. By examining these historical trends, we can gain a better understanding of the potential long-term implications of the current Fed’s actions.

Impact of Previous Fed Decisions on Tech

Examining past Fed decisions and their effects on the tech sector reveals a pattern of cyclical growth and contraction. For example, the dot-com bubble of the late 1990s, fueled by easy monetary policy, saw rapid growth in tech companies. However, when the Fed tightened monetary policy in 2000, the bubble burst, leading to a significant downturn in the tech sector.

This historical pattern underscores the importance of the Fed’s decisions in shaping the tech landscape. While the current situation is unique, past experiences provide a framework for understanding the potential consequences of the Fed’s actions.

Expert Opinions and Analysis

The Fed’s decision to raise interest rates has sparked a flurry of opinions and analysis from prominent economists and market analysts, with diverse perspectives on its implications for the tech sector. While some experts remain cautiously optimistic about the long-term growth potential of the tech industry, others express concerns about the impact of rising interest rates on valuations and investment appetite.

Views on the Fed’s Decision and its Impact on the Tech Sector

The Fed’s decision to raise interest rates has been met with mixed reactions from experts. Some believe that the move is necessary to curb inflation and stabilize the economy, while others argue that it could stifle economic growth and lead to a recession.

The impact on the tech sector is particularly uncertain, as the industry is highly sensitive to interest rate changes.

“The Fed’s decision to raise interest rates is a double-edged sword for the tech sector. While it may help to curb inflation, it could also slow down economic growth and make it more expensive for tech companies to borrow money.”

[Name of Economist], [Source]

- Positive Views:Some experts believe that the Fed’s decision could actually benefit the tech sector in the long run by creating a more stable economic environment. They argue that higher interest rates could lead to a more rational valuation of tech companies and encourage investment in companies with strong fundamentals.

- Negative Views:Other experts are more pessimistic, arguing that higher interest rates will make it more expensive for tech companies to borrow money and could lead to a slowdown in investment and innovation. They also worry that rising interest rates could lead to a decline in consumer spending, which could hurt tech companies that rely on consumer demand.

Perspectives on the Future of the Tech Market

The future of the tech market remains uncertain, with experts holding diverse perspectives. Some believe that the sector will continue to grow at a healthy pace, driven by innovation and increasing demand for technology. Others are more cautious, citing concerns about the impact of rising interest rates, geopolitical tensions, and the potential for a recession.

- Growth Potential:Some experts point to the continued growth of cloud computing, artificial intelligence, and other emerging technologies as evidence that the tech sector has a bright future. They argue that these technologies have the potential to transform industries and create new opportunities for growth.

- Cautious Outlook:Other experts are more cautious, citing concerns about the impact of rising interest rates on tech valuations and investment appetite. They also point to the potential for a slowdown in economic growth and a decline in consumer spending, which could hurt the tech sector.

Areas of Disagreement Among Experts

Despite the general consensus that the Fed’s decision will have a significant impact on the tech sector, there are areas of disagreement among experts. These disagreements stem from different interpretations of economic data, the potential impact of interest rate changes on various segments of the tech industry, and the likelihood of a recession.

- Impact on Valuations:Some experts believe that higher interest rates will lead to a significant decline in tech valuations, as investors demand higher returns. Others argue that the impact on valuations will be less severe, as the tech sector is still considered a growth industry with strong long-term prospects.

- Investment Appetite:Some experts believe that higher interest rates will lead to a decline in investment appetite in the tech sector, as investors shift their focus to more traditional investments. Others argue that the impact on investment appetite will be limited, as the tech sector remains attractive to investors seeking growth and innovation.

- Recession Risk:Some experts believe that the Fed’s decision could increase the risk of a recession, as higher interest rates could slow down economic growth and lead to a decline in consumer spending. Others argue that the risk of a recession is low, as the economy is still relatively strong and the labor market remains robust.