Consumer Confidence and Stock Market Surge Fuel Economic Optimism

Consumer confidence and stock market surge fuel economic optimism, painting a picture of a thriving economy. When consumers feel secure about their financial future, they are more likely to spend, driving demand for goods and services. This increased spending, in turn, stimulates economic growth and creates a positive feedback loop.

Simultaneously, a surging stock market reflects investor confidence in the future of the economy, further bolstering optimism.

The interplay between consumer confidence and stock market performance is a complex and dynamic phenomenon. Several factors contribute to this optimistic outlook, including strong employment data, low inflation rates, and favorable interest rates. However, it is essential to recognize that economic optimism can be cyclical and susceptible to shifts in sentiment.

Understanding the factors driving these trends is crucial for businesses and investors seeking to navigate the market effectively.

Consumer Confidence

Consumer confidence, a measure of how optimistic consumers are about the economy, plays a crucial role in driving economic growth. It reflects the overall sentiment of consumers about their financial situation, job security, and the future outlook of the economy.

It’s exciting to see consumer confidence and the stock market surging, fueling a wave of economic optimism. This positive sentiment is also reflected in the tech industry, as evidenced by the recent news that daniel baldwin joins ishook 202879.

This move signals a commitment to innovation and growth, further reinforcing the belief that the economy is on a strong trajectory.

Relationship Between Consumer Confidence and Economic Growth

Consumer confidence has a direct impact on spending patterns and investment decisions, which are key drivers of economic growth. When consumers are confident about the economy, they tend to spend more, leading to increased demand for goods and services. This, in turn, stimulates businesses to invest and expand, creating new jobs and boosting economic activity.

Conversely, when consumer confidence is low, consumers tend to save more and spend less, leading to a slowdown in economic growth.

Key Indicators of Consumer Confidence

Several key indicators are used to measure consumer confidence. These indicators provide insights into consumer sentiment and help economists track the health of the economy.

- The Conference Board Consumer Confidence Index:This index is a widely followed indicator that measures consumer sentiment based on their views on current economic conditions, future expectations, and job prospects. It is compiled from a monthly survey of 5,000 households across the United States.

- The University of Michigan Consumer Sentiment Index:This index measures consumer sentiment based on their views on personal finances, business conditions, and buying plans. It is based on a monthly survey of 500 households across the United States.

- The Consumer Confidence Survey by the Federal Reserve Bank of New York:This survey measures consumer confidence based on their views on current economic conditions, future expectations, and job prospects. It is based on a monthly survey of 1,000 households across the United States.

Influence of Consumer Confidence on Spending Patterns and Investment Decisions

Consumer confidence plays a significant role in influencing spending patterns and investment decisions. When consumers are confident about the economy, they are more likely to:

- Make large purchases:This includes items such as cars, homes, and appliances. These purchases contribute significantly to economic growth as they generate demand in various sectors.

- Spend more on discretionary items:This includes items such as entertainment, travel, and dining out. These purchases contribute to the overall health of the economy by boosting consumer spending and creating jobs in related industries.

- Invest in the stock market:When consumers are confident about the economy, they are more likely to invest their savings in the stock market. This can lead to increased stock prices and stimulate economic growth.

Conversely, when consumer confidence is low, consumers are more likely to:

- Delay major purchases:This can lead to a slowdown in economic growth as it reduces demand for goods and services.

- Cut back on discretionary spending:This can lead to job losses in industries that rely on discretionary spending, such as entertainment and travel.

- Withdraw from the stock market:This can lead to a decline in stock prices and further dampen economic growth.

Stock Market Surge

A surge in the stock market is often viewed as a positive indicator of economic health, reflecting investor optimism and confidence in the future. When the stock market rises, it suggests that investors believe companies will perform well, leading to increased profits and higher valuations.

This upward trend can be fueled by various factors, including strong economic growth, favorable corporate earnings, and low interest rates.

The Correlation Between Stock Market Performance and Economic Sentiment

The stock market is a leading indicator of economic activity. Investors base their investment decisions on their perceptions of the future economy. When economic sentiment is positive, investors are more likely to buy stocks, driving prices higher. Conversely, when economic sentiment is negative, investors tend to sell stocks, leading to a decline in prices.

The recent surge in consumer confidence and the stock market’s bullish performance are painting a rosy picture for the global economy. This optimism is fueled by a number of factors, including a strong job market and a rebound in consumer spending.

However, even in this positive environment, unexpected events can shake things up. A case in point is the recent alibaba leadership overhaul ceo zhang replaced in unexpected move , which has sent shockwaves through the tech sector. While the long-term impact of this change remains to be seen, it serves as a reminder that even in times of economic growth, there can be volatility and uncertainty.

Recent Stock Market Surges and Their Potential Drivers

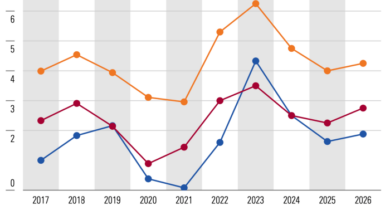

The stock market has experienced several significant surges in recent years, often driven by specific events or economic trends.

- The Post-COVID Recovery Rally (2020-2021):After the initial shock of the COVID-19 pandemic, the stock market experienced a sharp rebound, driven by government stimulus measures, low interest rates, and pent-up consumer demand.

- The Tech Boom (2020-2021):The rise of technology companies and their rapid growth during the pandemic fueled a surge in the tech sector, leading to significant gains in the stock market.

- The Post-Election Rally (2020):Following the 2020 US presidential election, the stock market experienced a rally, driven by investor optimism about potential policy changes and economic growth.

The Role of Investor Confidence and Expectations in Fueling Stock Market Rallies

Investor confidence plays a crucial role in driving stock market rallies. When investors are optimistic about the future economy and corporate profits, they are more likely to invest in stocks, pushing prices higher. Conversely, when investor confidence is low, they may sell stocks, leading to a decline in prices.

“Investor sentiment is a powerful force that can influence the stock market. When investors are optimistic, they are more likely to buy stocks, which can drive prices higher. Conversely, when investors are pessimistic, they are more likely to sell stocks, which can drive prices lower.”

The recent surge in consumer confidence and the stock market is a clear sign of economic optimism. One of the key drivers of this positive trend is the rapid advancement of artificial intelligence (AI), and NVIDIA is at the forefront of this revolution.

Their latest AI supercomputers and services, as detailed in this article nvidia unleashes ai supercomputers and services propelling stock surge to new heights , are not only pushing the boundaries of AI but also fueling a surge in their own stock price, further contributing to the overall market optimism.

Investopedia

Fueling Economic Optimism

A surge in consumer confidence and stock market performance often signals a healthy economic climate. These indicators, intertwined and mutually reinforcing, paint a picture of a thriving economy, characterized by strong consumer spending, robust corporate earnings, and investor confidence.

Key Economic Indicators

The interplay of various economic indicators provides valuable insights into the overall health of the economy and influences consumer and investor sentiment.

- Employment Data:A strong labor market, characterized by low unemployment rates and robust job creation, instills confidence in consumers. When people feel secure in their jobs, they are more likely to spend money, boosting economic activity.

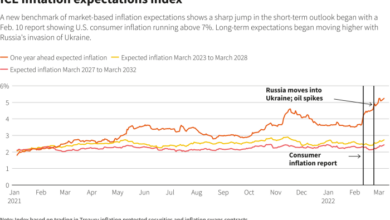

- Inflation Rates:Stable and moderate inflation rates, generally around 2-3%, are seen as healthy for the economy. High inflation erodes purchasing power and can lead to uncertainty, dampening consumer confidence. Conversely, low inflation, while beneficial for consumers, can indicate weak demand and potentially slow economic growth.

- Interest Rates:Low interest rates encourage borrowing and spending, while high interest rates can make borrowing more expensive and discourage investment. The Federal Reserve (Fed) carefully monitors and adjusts interest rates to stimulate or curb economic activity. When interest rates are low, consumers are more likely to take out loans for purchases, boosting consumer spending and contributing to a positive economic outlook.

Impact of Economic Policies

Government policies play a significant role in shaping economic conditions and influencing consumer confidence and stock market sentiment.

- Fiscal Policy:Government spending and tax policies can directly impact economic activity. Expansionary fiscal policies, such as increased government spending or tax cuts, can stimulate demand and boost economic growth, leading to increased consumer confidence and a positive stock market reaction.

Conversely, contractionary fiscal policies, such as reduced government spending or tax increases, can dampen economic activity, potentially leading to decreased consumer confidence and stock market volatility.

- Monetary Policy:The Fed’s actions, such as adjusting interest rates and controlling the money supply, can influence borrowing costs, inflation, and economic growth. Lower interest rates can stimulate borrowing and investment, leading to increased economic activity and potentially higher stock prices. However, overly loose monetary policy can lead to inflation and asset bubbles, potentially resulting in market instability and a decrease in consumer confidence.

The Interplay of Confidence and Market Dynamics: Consumer Confidence And Stock Market Surge Fuel Economic Optimism

Consumer confidence and stock market performance are inextricably linked, creating a dynamic feedback loop that shapes economic sentiment. This interplay is characterized by a cyclical nature, where confidence influences market volatility, and market fluctuations, in turn, impact consumer sentiment.

The Cyclical Nature of Confidence and Market Volatility

Consumer confidence is a powerful indicator of economic health, reflecting consumer spending patterns and overall optimism about the future. When confidence is high, consumers are more likely to spend, leading to increased demand for goods and services, which in turn boosts corporate profits and stock prices.

Conversely, low consumer confidence can lead to reduced spending, impacting economic growth and causing stock market declines.This cyclical relationship is evident in historical data. For example, during periods of economic expansion, consumer confidence tends to rise, leading to increased stock market valuations.

Conversely, during recessions, consumer confidence often plummets, driving stock prices down.

A Hypothetical Scenario of Sentiment Shift and Market Behavior

Imagine a scenario where a new technological innovation emerges, promising significant productivity gains and economic growth. This positive news boosts consumer confidence, leading to increased spending and investment. This surge in demand stimulates corporate growth and profits, driving stock prices higher.As stock market valuations rise, investors become more optimistic about the future, further fueling consumer confidence and creating a positive feedback loop.

This scenario highlights how a shift in consumer sentiment can have a profound impact on stock market behavior, driving sustained growth and economic prosperity.

Risks and Opportunities Associated with Sustained Economic Optimism, Consumer confidence and stock market surge fuel economic optimism

While sustained economic optimism can lead to positive outcomes, it also carries inherent risks.

- Overvaluation:A prolonged period of optimism can lead to asset bubbles, where prices become inflated and unsustainable. This can create a vulnerability to sudden market corrections when confidence wanes.

- Inflationary Pressures:Increased consumer spending and investment can lead to higher demand for goods and services, potentially pushing up prices and eroding purchasing power.

- Policy Uncertainty:Policy changes, such as interest rate hikes or tax increases, can disrupt economic momentum and dampen consumer confidence, leading to market volatility.

However, sustained economic optimism also presents opportunities:

- Investment Growth:High confidence encourages businesses to invest in expansion, leading to job creation and economic growth.

- Innovation and Productivity:A positive economic climate fosters innovation and productivity improvements, leading to long-term economic gains.

- Consumer Spending:Increased consumer spending fuels economic growth and supports business expansion.

Implications for Businesses and Investors

A surge in consumer confidence and a buoyant stock market create a fertile ground for businesses to thrive and investors to reap rewards. This positive economic environment presents opportunities for both sectors to capitalize on the prevailing optimism and navigate the market dynamics effectively.

Business Strategies in a Positive Economic Climate

Understanding the impact of consumer confidence and stock market gains on different business sectors is crucial for formulating effective strategies. The following table provides insights into the potential implications and strategic considerations for various sectors:

| Business Sector | Impact of Consumer Confidence | Impact of Stock Market Surge | Strategic Considerations |

|---|---|---|---|

| Consumer Discretionary | Increased spending on non-essential goods and services | Higher valuations and increased access to capital | Expand product offerings, invest in marketing, and focus on customer experience |

| Retail | Higher sales volumes and increased foot traffic | Improved financial performance and potential for expansion | Optimize inventory management, enhance online presence, and invest in customer loyalty programs |

| Travel and Hospitality | Booming demand for travel and leisure activities | Increased investment in infrastructure and new ventures | Expand operations, offer competitive pricing, and focus on sustainable tourism practices |

| Technology | Increased demand for innovative products and services | Attractive investment opportunities and mergers and acquisitions | Invest in research and development, expand into new markets, and focus on cybersecurity |

Investor Strategies in an Optimistic Market

Investors can leverage the positive economic climate to maximize their returns and mitigate risks. Here are some key strategies for navigating an optimistic market:

“In a bull market, it’s easy to make money. The real challenge is to make money in a bear market.”

Warren Buffett

- Diversify Investments:Spreading investments across different asset classes, sectors, and geographies helps mitigate risk and enhance returns.

- Focus on Value Stocks:Identify companies with strong fundamentals, undervalued by the market, and poised for growth.

- Consider Long-Term Investments:Avoid short-term speculation and focus on long-term growth opportunities.

- Monitor Market Sentiment:Stay informed about market trends and economic indicators to adjust investment strategies accordingly.