US Stock Futures Dip Amidst Tesla and Netflix Slump

US stock futures point lower amidst Tesla and Netflix slump stock market news, signaling a potential downturn in the market. The recent struggles of these tech giants, Tesla and Netflix, have cast a shadow over investor sentiment, raising concerns about the broader market’s trajectory.

This decline in stock futures is a reflection of the growing uncertainty and volatility in the market, fueled by factors like inflation, rising interest rates, and the ongoing geopolitical tensions. While the market has experienced periods of volatility before, the current situation has investors on edge, prompting them to reassess their investment strategies and seek safer havens.

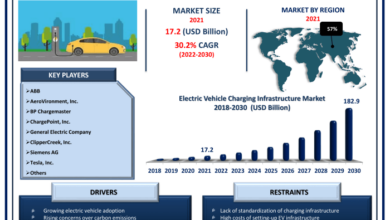

The decline in Tesla’s stock price, a company known for its innovative electric vehicles and ambitious growth plans, is attributed to a combination of factors, including production challenges, competition in the EV market, and CEO Elon Musk’s controversial acquisition of Twitter.

Netflix, on the other hand, has been grappling with declining subscriber growth and increasing competition from streaming rivals, leading to a significant drop in its stock value. The impact of these two companies’ slumps extends beyond their individual performances, as they are considered bellwethers for the tech sector and the broader market.

Their struggles have raised concerns about the overall health of the tech sector and its ability to maintain its growth momentum.

Market Overview: Us Stock Futures Point Lower Amidst Tesla And Netflix Slump Stock Market News

US stock futures are pointing lower this morning, indicating a potential decline in the stock market when trading opens. This downward trend is fueled by a combination of factors, including a recent slump in tech giants like Tesla and Netflix, as well as broader concerns about the economic outlook.

Factors Contributing to the Decline

The recent decline in US stock futures can be attributed to several key factors:

- Tech Sector Weakness:The tech sector has been a significant driver of the market’s recent performance, but recent declines in companies like Tesla and Netflix have raised concerns about the sector’s future growth. Tesla’s stock price has been volatile in recent months, influenced by factors like Elon Musk’s Twitter acquisition and concerns about competition in the electric vehicle market.

Netflix’s subscriber losses have also weighed on investor sentiment, highlighting the challenges facing streaming services in a crowded market.

- Inflation and Interest Rates:The Federal Reserve’s aggressive interest rate hikes to combat inflation continue to weigh on the market. Rising interest rates make it more expensive for companies to borrow money, which can slow down economic growth and corporate earnings. Investors are also concerned about the potential for a recession, which could further impact corporate profits.

- Geopolitical Uncertainty:The ongoing war in Ukraine and heightened geopolitical tensions are adding to market volatility. The conflict has disrupted global supply chains and fueled energy price increases, creating uncertainty about the global economic outlook.

Tesla and Netflix Slump

The recent slump in Tesla and Netflix stocks has sent ripples through the broader market, raising concerns about the health of the tech sector and the overall economic outlook. This decline has impacted investor sentiment and raised questions about the future prospects of these two tech giants.

Impact on the Market

The combined weight of Tesla and Netflix in the market, along with their influence as bellwethers of innovation and consumer trends, has amplified their impact on the broader market. Their stock price declines have contributed to a sense of unease and uncertainty among investors, leading to a broader sell-off in the tech sector and a pullback in the overall market.

Reasons for the Stock Price Decline

Several factors have contributed to the decline in Tesla and Netflix’s stock prices.

Tesla

- Elon Musk’s Twitter Acquisition:Musk’s acquisition of Twitter has raised concerns about his focus on Tesla and his ability to manage both companies effectively.

- Production Challenges:Tesla has faced production challenges in recent quarters, including supply chain disruptions and factory closures.

- Competition:The electric vehicle market is becoming increasingly competitive, with traditional automakers making significant investments in electric vehicles.

Netflix

- Slowing Subscriber Growth:Netflix has experienced slowing subscriber growth in recent quarters, raising concerns about its ability to maintain its market dominance.

- Increased Competition:Netflix faces increasing competition from streaming services such as Disney+, HBO Max, and Amazon Prime Video.

- Password Sharing:Netflix has taken steps to crack down on password sharing, which could impact its subscriber base.

Potential Long-Term Effects

The long-term effects of these slumps remain uncertain, but they could have a significant impact on the tech sector and the broader economy.

Tesla

- Impact on Electric Vehicle Adoption:Tesla’s stock price decline could impact consumer confidence in electric vehicles, potentially slowing the adoption of this technology.

- Competition in the Electric Vehicle Market:The slump could create opportunities for other electric vehicle manufacturers to gain market share.

Netflix

- Impact on Streaming Industry:Netflix’s slump could accelerate the consolidation of the streaming industry, with smaller players being acquired or forced out of the market.

- Changes in Consumer Behavior:The slump could lead to changes in consumer behavior, with more consumers opting for cheaper or bundled streaming services.

Key Market Indicators

The broader market is experiencing a downturn, with the tech-heavy Nasdaq Composite leading the decline. However, it is important to analyze the performance of other key market indicators, such as the Dow Jones Industrial Average and the S&P 500, to gain a comprehensive understanding of the market sentiment.

Performance of Key Market Indicators

The Dow Jones Industrial Average (DJIA), a measure of 30 large publicly-owned companies, closed down by 0.5%, indicating a slight decline in the value of these blue-chip stocks. The S&P 500, a broader market index tracking 500 companies, also experienced a similar dip, closing down by 0.4%.

While these losses are relatively modest, they reflect the overall negative sentiment in the market.

The US stock futures are pointing lower this morning, with Tesla and Netflix taking a beating. It seems like the market is still reeling from recent economic news, and investors are becoming more cautious. This cautiousness might be due to the fact that Costco has recently implemented stricter measures to combat unauthorized use of membership cards, a move that could impact the company’s bottom line.

It remains to be seen how this will play out in the long run, but it’s definitely something to keep an eye on as the market continues to navigate these uncertain times.

Implications for Future Market Movement

The performance of these key market indicators suggests a cautious approach among investors. The slight declines in the DJIA and S&P 500, combined with the more significant drop in the Nasdaq, indicate a potential shift in investor sentiment towards more conservative investments.

This could lead to further volatility in the market, with investors seeking safer havens in the face of economic uncertainty.

While US stock futures point lower amidst a slump in Tesla and Netflix shares, a glimmer of hope shines from across the globe. The IMF has just approved a $3 billion loan program for Pakistan, boosting economic prospects and offering a potential counterpoint to the negative sentiment in the US market.

This news, however, is unlikely to significantly impact the immediate trajectory of US stock futures, which are primarily driven by domestic factors.

Investor Sentiment

The recent slump in Tesla and Netflix shares has cast a shadow over investor sentiment, prompting concerns about the broader market outlook. Market analysts and investors are closely monitoring the situation, trying to gauge the extent of the impact and its potential implications for future market performance.

Investor Sentiment Analysis, Us stock futures point lower amidst tesla and netflix slump stock market news

Investor sentiment is a key driver of market performance. When investors are optimistic about the future, they are more likely to buy stocks, pushing prices higher. Conversely, when investors are pessimistic, they are more likely to sell stocks, leading to lower prices.There are several ways to measure investor sentiment, including:

- Investor surveys:These surveys ask investors about their current market outlook and investment plans. For example, the American Association of Individual Investors (AAII) conducts a weekly survey that asks members about their sentiment towards the stock market.

- Options market data:The options market provides insights into investor sentiment by analyzing the trading activity of put and call options. For instance, a high volume of put options purchases suggests that investors are anticipating a decline in stock prices.

- Social media sentiment:Analyzing social media posts and comments can reveal the prevailing sentiment among investors. Tools like Google Trends can be used to track the frequency of search terms related to the stock market.

Impact of Investor Sentiment on Market Performance

Investor sentiment can have a significant impact on market performance, both in the short term and the long term.

- Short-term impact:Sudden shifts in investor sentiment can lead to short-term market volatility. For example, if investors become suddenly pessimistic about the economy, they may sell their stocks, causing prices to decline.

- Long-term impact:Over time, investor sentiment can influence the long-term direction of the market. For instance, if investors are consistently optimistic about the economy and corporate earnings, they may be more likely to invest in stocks, leading to a bull market.

Opinions of Prominent Market Analysts and Investors

Prominent market analysts and investors have expressed a range of opinions about the current market situation. Some analysts remain optimistic about the long-term prospects of the stock market, citing factors such as low interest rates and strong corporate earnings. Others are more cautious, pointing to potential risks such as inflation and geopolitical uncertainty.

“The market is always looking ahead, and investors are starting to worry about the potential impact of inflation on corporate profits. This could lead to a period of market volatility in the near term.”

While US stock futures point lower amidst the Tesla and Netflix slump, it’s worth noting that the US economy kicked off the week strong. Check out the latest updates on the US economy’s performance to get a broader picture of the market landscape.

Despite the recent downturn in tech giants, the overall economic indicators suggest a potentially positive week ahead, though it remains to be seen if this will be enough to counteract the negative sentiment in the market.

[Name of Prominent Analyst]

“The current market correction is a healthy development. It provides an opportunity for investors to re-evaluate their portfolios and buy stocks at more attractive prices.”

[Name of Prominent Investor]

Potential Market Drivers

The stock market is constantly in flux, influenced by a multitude of factors that can drive prices up or down. Understanding these drivers is crucial for investors to make informed decisions.

Economic Data

Economic data releases, such as inflation reports, unemployment figures, and GDP growth, provide insights into the overall health of the economy. Strong economic data typically supports market optimism, leading to higher stock prices. Conversely, weak economic indicators can signal concerns about growth and potentially trigger market downturns.

For example, the recent rise in inflation has led to increased volatility in the market as investors grapple with the impact of rising prices on corporate profits and consumer spending.

Geopolitical Events

Geopolitical events, including wars, trade disputes, and political instability, can significantly impact market sentiment. These events often introduce uncertainty and risk aversion, leading to market declines. For example, the ongoing war in Ukraine has disrupted global supply chains and contributed to rising energy prices, impacting stock markets worldwide.

Company Earnings

Company earnings reports provide insights into the financial performance of individual companies. Strong earnings, exceeding analysts’ expectations, can boost stock prices as investors view the company as healthy and profitable. Conversely, disappointing earnings can lead to sell-offs, reflecting concerns about the company’s future prospects.

For instance, Tesla’s recent earnings report, which fell short of expectations, contributed to the company’s stock slump.

Table of Market Drivers

| Market Driver | Potential Impact |

|---|---|

| Strong Economic Data | Market Optimism, Higher Stock Prices |

| Weak Economic Data | Market Concerns, Potential Downturn |

| Positive Geopolitical Events | Increased Investor Confidence, Market Gains |

| Negative Geopolitical Events | Uncertainty, Risk Aversion, Market Declines |

| Strong Company Earnings | Increased Stock Prices, Positive Investor Sentiment |

| Weak Company Earnings | Sell-offs, Concerns about Future Prospects |

Strategies for Investors

The recent slump in Tesla and Netflix stocks, coupled with broader market uncertainty, has presented investors with a challenging landscape. Navigating this environment requires a thoughtful approach, considering various investment strategies and their potential risks and rewards.

Defensive Strategies

Defensive strategies prioritize capital preservation and income generation during periods of market volatility.

- Cash and Equivalents:Holding a significant portion of your portfolio in cash or short-term, low-risk investments like money market accounts or treasury bills provides liquidity and minimizes exposure to market fluctuations. This approach is particularly suitable for investors with a short-term investment horizon or a high risk aversion.

- High-Quality Bonds:Investing in bonds issued by financially stable companies or government entities offers relatively stable income streams and a lower risk profile compared to equities. Consider diversifying across different maturities and credit ratings to manage interest rate risk.

- Dividend-Paying Stocks:Focusing on companies with a history of consistent dividend payments can provide a steady stream of income and potential for capital appreciation. Look for companies with strong fundamentals, stable earnings, and a history of dividend increases.

Growth Strategies

Growth strategies aim to capitalize on potential market upside by investing in companies with strong growth prospects.

- Growth Stocks:Investing in companies with high earnings growth potential can offer significant returns, but also comes with higher risk. This strategy is typically suitable for investors with a long-term investment horizon and a higher risk tolerance.

- Emerging Markets:Investing in emerging markets can provide exposure to fast-growing economies and industries. However, emerging markets often carry higher risk due to political instability, economic volatility, and currency fluctuations.

- Small-Cap Stocks:Investing in small-cap companies can offer potential for significant returns, but also carries higher risk due to limited market capitalization and potential for illiquidity.

Value Strategies

Value strategies focus on identifying undervalued assets that are trading below their intrinsic worth.

- Value Stocks:These are companies that are trading at a discount to their intrinsic value, based on factors such as earnings, assets, or dividends. Value investors believe that these stocks have the potential to appreciate in value as the market recognizes their true worth.

- Distressed Securities:This strategy involves investing in companies facing financial difficulties, hoping that their business will eventually recover and their stock prices will rebound. This strategy carries significant risk and requires extensive due diligence.